Starbucks, Burger King overhaul China strategies

Starbucks and Burger King look towards a fresh approach to their business in China, in a bid to stay afloat in an increasingly competitive market.

(By Caixin journalists Feng Yiming and Ding Yi)

Starbucks Corp. and Burger King Corp. are rethinking their China strategies as they work to stay relevant in the country’s increasingly saturated and competitive food and beverage market.

In early 2024, Starbucks floated the idea of seeking new strategic investors for its China business. The move came after two straight quarters of declining revenue and same-store sales in the market. The process stalled that August when then CEO Laxman Narasimhan was ousted. His successor, Brian Niccol, turned his focus back to the US and hit pause on China, previously saying he needed to “spend time there to better understand” the local market.

Talks restarted this February, with Starbucks reportedly meeting the likes of China Resources Holdings Co. Ltd., KKR & Co. Inc. and FountainVest Partners Co. Ltd. In June, the coffee giant launched a full roadshow. Among the more than 20 parties were Hillhouse Capital Group, Carlyle Group Inc. and food delivery titan Meituan’s investment arm.

Starbucks took full ownership of its China business in 2017 after years of operating through joint ventures (JVs) — a shift that underscored its long-term commitment to the market.

Starbucks moved a step closer to securing a new partner in September, when it shortlisted four private equity bidders for a stake in its China business, sources told Caixin. The finalists include Boyu Capital, Carlyle, HongShan Capital Group, and a consortium formed by Primavera Capital Group and EQT Partners. A decision could come as soon as October, the sources said.

CEO Niccol emphasised during a July earnings call that the search for a partner is aimed at improving operational efficiency, not simply raising capital. He stressed that Starbucks intends to retain a “meaningful stake” of its China business.

Starbucks took full ownership of its China business in 2017 after years of operating through joint ventures (JVs) — a shift that underscored its long-term commitment to the market. By 2018, China had become the company’s second largest market after the US.

While the exact size of the stake on offer remains unclear, He Xiaoqing, Greater China president of consulting firm Kearney, said Starbucks is likely to maintain a “controlling stake” in its China business. The plan is to let the strategic partner assist with the brand’s localisation efforts.

Burger King’s parent company, Restaurant Brands International Inc. (RBI), is also reshaping its China operations. In February, it acquired stakes from former franchisees TFI Asia Holdings BV and Pangaea Two Acquisition Holdings XXIII for a combined US$158 million.

An RBI representative told Caixin that the move was designed to regain full control over Burger King’s future direction in China and that it is seeking a new partner with deep roots in the local market and outstanding operational capabilities.

Starbucks dethroned

Starbucks has positioned itself as a premium coffee brand in China since entering the market in 1999. The strategy targeted an emerging urban middle class and white-collar professionals, many of whom see its stores in first- and second-tier Chinese cities as places to work and socialise.

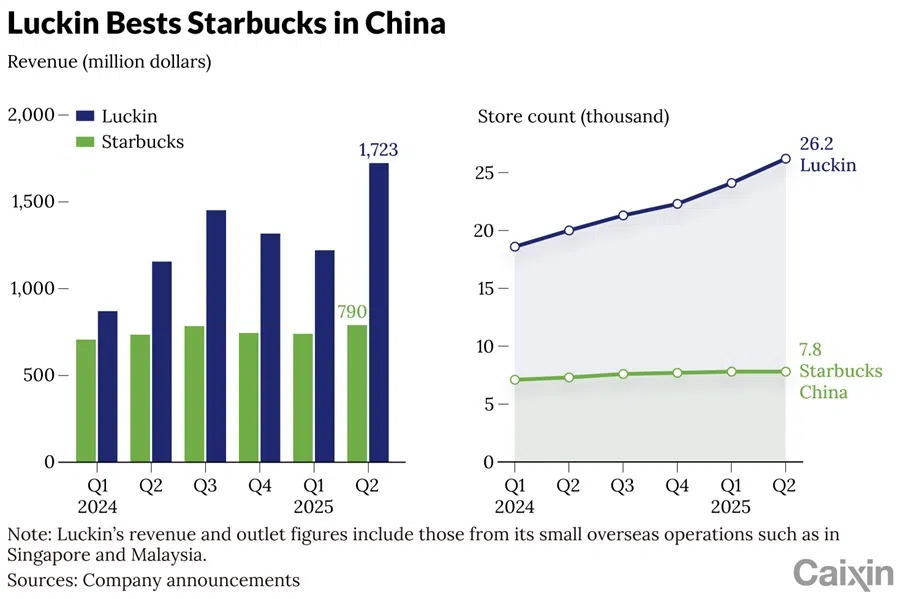

As of the end of June, Starbucks operated nearly 8,000 stores in China and generated US$790 million in second-quarter revenue from the market — nearly 40% of all international revenue outside North America. But even with a wide footprint, its market share is shrinking.

According to Zheshang Securities Co. Ltd., Starbucks’ share of the Chinese coffee market fell from 5.6% in 2022 to 4.2% in 2024, slipping from the second to the third largest player. It was overtaken by local upstart Cotti Coffee, while market leader Luckin Coffee Inc. extended its lead with an 11% share.

Luckin’s dominance stems from its low-price, subsidy-driven strategy. In June 2023, it mirrored Cotti’s popular 9.9 RMB coupon campaign — and extended the offer for at least two more years.

Starbucks has recently stepped up its own co-branding efforts in China, but its ability to respond quickly to market changes may depend on how effectively it streamlines local decision-making. — He Xiaoqing, Greater China President, Kearney

As of the end of June, Luckin operated more than 26,000 stores in China. Its second-quarter revenue, which includes those from its small overseas operations including Singapore and Malaysia, reached US$1.72 billion.

Luckin also leaned into co-branding. It partnered with Chinese liquor-maker Kweichow Moutai in 2023. Their “jiangxiang-flavoured latte,” infused with the savoury notes of Moutai’s baijiu, sparked a buying frenzy: more than 5 million cups were sold on the launch day.

Starbucks has recently stepped up its own co-branding efforts in China, but its ability to respond quickly to market changes may depend on how effectively it streamlines local decision-making, said Kearney’s He.

Burger King’s challenges mount

Burger King entered the Chinese market in 2005, initially focusing on company-run stores. That changed in 2012, when TFI became the franchisee of its China business.

In 2017, TFI filed for a US listing. Its IPO prospectus showed that it and Pangaea held a combined 72.5% stake in Burger King China via a JV, with RBI holding the remainder. However, RBI retained the right to terminate TFI’s franchise right if store expansion targets were not met.

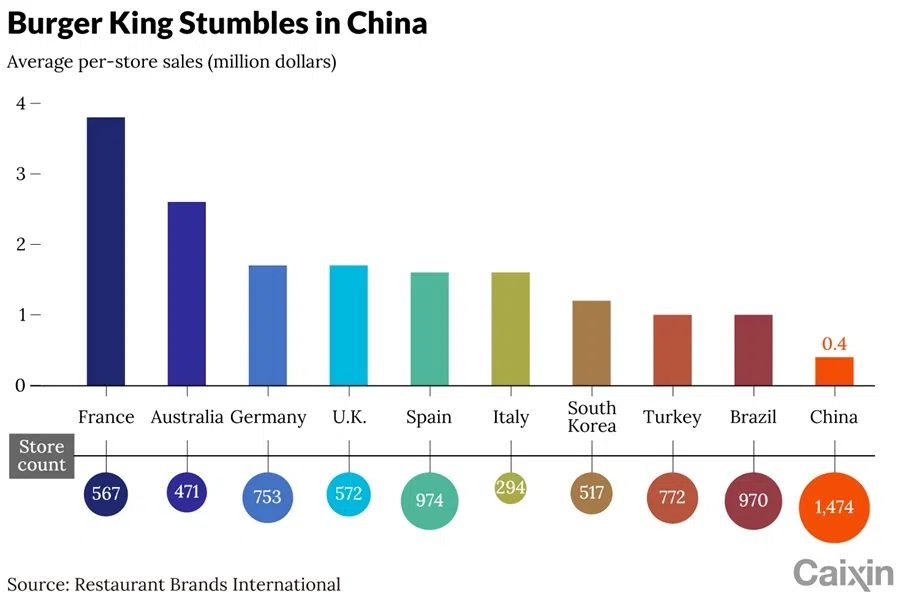

Burger King China reached over 1,000 outlets in 2018 and announced plans to double that within three years. But as of the end of 2024, the chain operated just 1,474 stores — far behind KFC China’s more than 12,000 and McDonald’s more than 7,000.

... Burger King China suffered from numerous management problems, with even basic issues such as store decoration and food safety failing to meet standards.

Despite having more outlets in China than in any of its other international markets, Burger King’s China operations rank eighth globally by revenue. In 2024, the chain generated about US$700 million in the country, with the lowest average per-store sales among its top ten international markets, according to RBI.

Several former franchisees told Caixin that under TFI’s leadership, Burger King China suffered from numerous management problems, with even basic issues such as store decoration and food safety failing to meet standards. Many franchisees took years to break-even.

Supplier problems added to the frustration. “Sometimes, the ingredients we purchased were not fresh and even rotten. I repeatedly sent emails to the headquarters to give feedback about the quality problems with ingredients like tomatoes, lettuce and chocolate sauce,” one franchisee said.

Burger King has long leaned on its “grilling” concept as a perceived healthier alternative to McDonald’s’ “frying.” But this distinction has weakened in China, said Nash Feng, China vice president of consulting firm RIES.

“Today, most Chinese consumers see Burger King as just another beef burger brand, rather than a healthier alternative to McDonald’s,” Feng said. “This is Burger King China’s biggest strategic problem.”

This article was first published by Caixin Global as “In Depth: Starbucks, Burger King Overhaul China Strategies”. Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)