Tesla’s Chinese rival BYD hits accelerator on smart driving

Despite trailing in smart driving technologies, China’s BYD is planning substantial investment in artificial intelligence and autonomous driving to compete with Tesla, Huawei and XPeng.

(By Caixin journalists Limin, Zhai Shaohui and Ding Yi)

Once mocked by electric car billionaire Elon Musk, BYD Co. Ltd. has become the chief global competitor to his Tesla Inc., thanks in part to its nous in developing automotive power cells that Musk’s company needs.

Now the Chinese electric vehicle (EV) maker faces a new challenge — matching the buzz that Musk has been able to generate with driver assistance technology, or “smart driving”, which is becoming an important selling point in a saturated industry.

BYD began life in 1995 in the southern Chinese electronics boomtown of Shenzhen as a handset and laptop-battery maker. It pivoted into car manufacturing in 2003 when it acquired a small Chinese automaker from Xi’an, and then ventured into new-energy vehicles (NEVs) five years later with the launch of a plug-in hybrid called the F3DM, initially targeting government agencies and businesses.

In 2010, the Shenzhen-based company brought to market its first pure electric car, the e6. Both models, which were sold at a premium, failed to woo local consumers at the time.

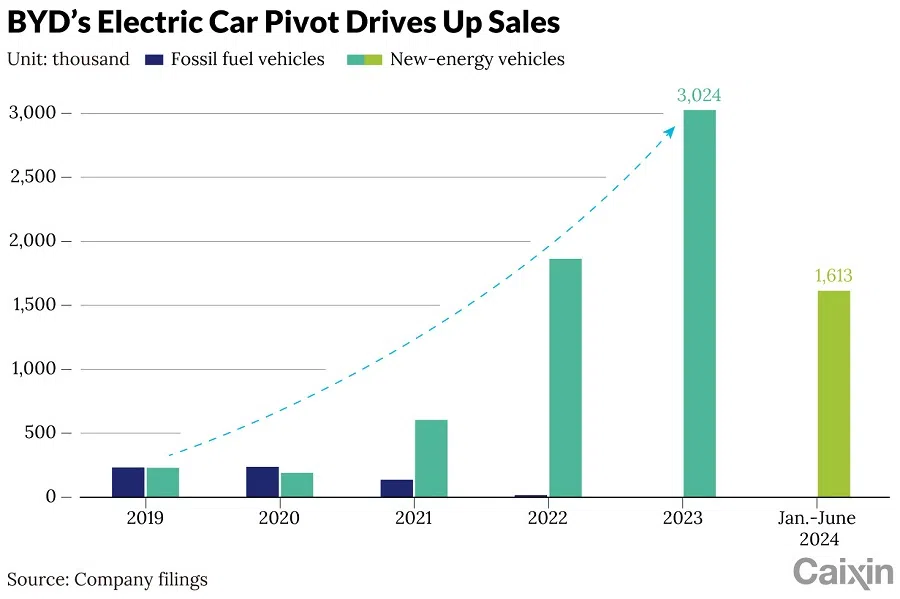

A major turning point came in 2021, when sales of BYD NEVs surged more than three-fold to beat gas-powered cars for the first time — and by a huge margin. BYD sold 603,783 NEVs that year, accounting for more than 80% of its total auto sales. That helped drive the company’s decision the next year to cease producing vehicles that run on gasoline. Record sales of more than 3 million NEVs in 2023 bore out the decision, with the year’s fourth quarter seeing the company nab the crown from Tesla as the world’s largest manufacturer of fully-electric cars.

[BYD’s] ability to design and produce the NEV component has been a key factor in its ability to carry out periodic price-cutting campaigns...

Battery advantage

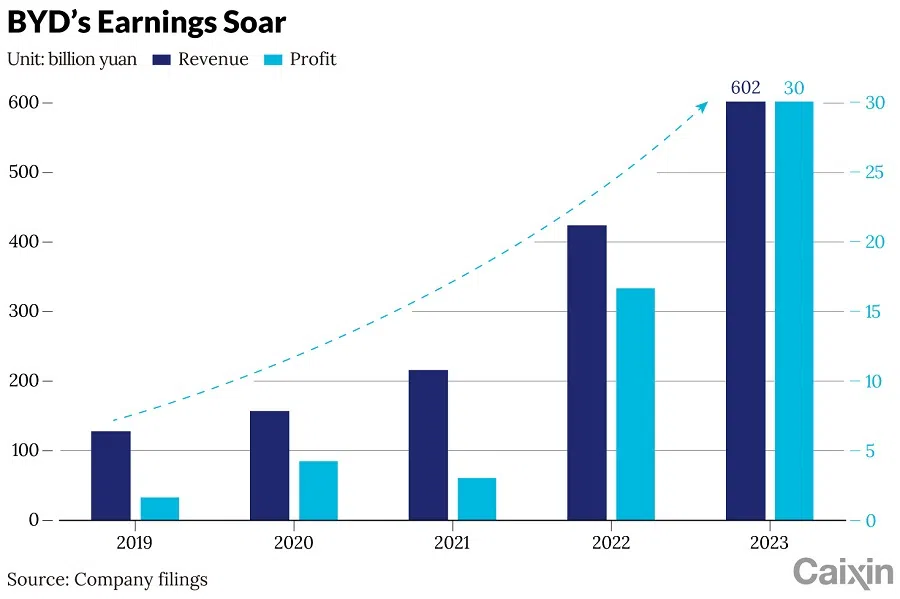

BYD’s battery chops have been crucial to its rise as a world leading NEV-maker — in part because control of its supply chain has allowed the firm to undercut competitors on price.

The company’s ability to design and produce the NEV component has been a key factor in its ability to carry out periodic price-cutting campaigns that have put many of its rivals — which must pay to source batteries externally — and those selling gasoline models on edge.

BYD has been focusing its research efforts on lithium iron phosphate (LFP) batteries. It says it achieved a major technological milestone in March 2020 with the launch of the “blade battery”, which it said are safer and cheaper than conventional cells because they do not use expensive, tricky-to-source cobalt.

To better compete with BYD, some battery companies, including industry leader Contemporary Amperex Technology Co. Ltd., have raced to launch their own LFP batteries to match the blade, laying an important foundation for NEVs to be adopted more widely, a battery industry insider told Caixin.

In the first half of this year, 69.3% of the total power batteries sold in China were LFP batteries slated for use in NEVs, the equivalent of some 141 gigawatt-hours, according to data from the China Automotive Battery Innovation Alliance (CABIA).

BYD was China’s second largest manufacturer of such batteries by installed capacity during the period, with a market share of 35.8%, closing in on CATL, which controlled 37.2% of the market, according to the CABIA.

Catching up in smart driving

Despite once dismissing autonomous driving as a fad driven by capital, BYD chair and CEO Wang Chuanfu appears to have climbed on the bandwagon.

During a shareholder meeting on 6 June, he said that BYD would invest significantly in smart driving as artificial intelligence (AI) technology advances and revealed that the company has built a team of around 4,000 people delving into advanced assisted driving technology.

The remarks came after BYD in January unveiled a broader plan to shift toward smart cars, as part of a US$14 billion bet on intelligent driving widely seen as an attempt to square up to Tesla, which has captured consumer attention, and courted infamy, with its rollout of driver assistance tech onto public roads.

BYD’s plan centres its proprietary smart car architecture called Xuanji, which enables a vehicle to automatically adjust its moving status based on information gathered inside and outside the car, processed by what the company calls “the brain” and “the nervous system”.

The plan also included an AI-powered multimodal model specially designed for smart cars. Yet, industry analysts say BYD lags behind rivals like Tesla, software giant Huawei Technologies Co. Ltd. and EV upstart XPeng Inc. in smart driving technology development.

Tesla has obtained a license from the Shanghai government, which might allow the US carmaker to test its Full Self-Driving (FSD) system in the Chinese financial hub, Caixin reported last month, citing a source close to the city’s policymaking department. The move could help Tesla get an edge in the Chinese market as the government throws its weight behind autonomous cars.

Shipments from Tesla’s factory in Shanghai fell 24.2% year-on-year in June to 71,007 units...

But Musk’s FSD push could be a distraction from the company’s broader woes in the country, where sales have slumped amid a local price war. Shipments from Tesla’s factory in Shanghai fell 24.2% year-on-year in June to 71,007 units, according to data from the China Passenger Car Association. By comparison, BYD’s shipments rose 35.2% to 340,211 units in the same period.

In May, XPeng CEO He Xiaopeng claimed his company would achieve a Level 4 autonomous driving experience in China by 2025, with plans to recruit 4,000 professionals this year to focus on self-driving technology development.

The Chinese government categorises autonomous driving technology into six levels, from zero for fully manual to five for fully autonomous, similar to the standards set by US-based SAE International.

Level 3 technology, known as “conditional” driving automation, allows a vehicle to drive itself only in certain conditions, as long as human drivers can take control in the event of an emergency. Level 4 technology allows a car to run almost entirely without human intervention in most cases. Level 1 and Level 2 both belong to assisted driving categories.

BYD said that it is the auto brand in China that has the most cars equipped with Level 2 assisted driving technology.

This article was first published by Caixin Global as “In Depth: Tesla’s Chinese Rival Hits Accelerator on Smart Driving”. Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.