Has the US crushed China's hopes for self-sufficiency in the chip industry?

After the US signed into law the CHIPS and Science Act in August to strengthen its global competitiveness in science and technology, it again imposed some of the harshest chip export bans on China in October, forcing the world's chip manufacturers to choose sides.

The US's attempt at choking off China's access to chips is indeed a heavy-handed one. It not only imposed additional export restrictions on chips and chip manufacturing equipment to China, but also banned "US persons" from working at Chinese chip companies.

While the effect of these restrictions is still unknown, they appear extremely severe.

How strict and extensive are the sanctions?

The US's Bureau of Industry and Security said in a statement released on 7 October that these new measures were aimed at restricting China's ability to "purchase and manufacture certain high-end chips used in military applications". However, the implications of these restrictions extend beyond military technology.

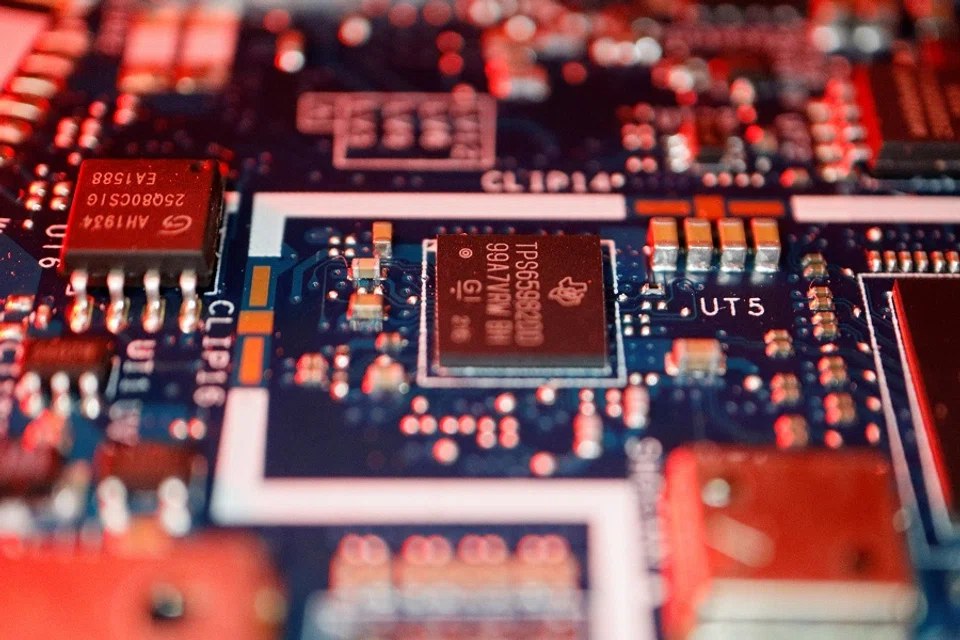

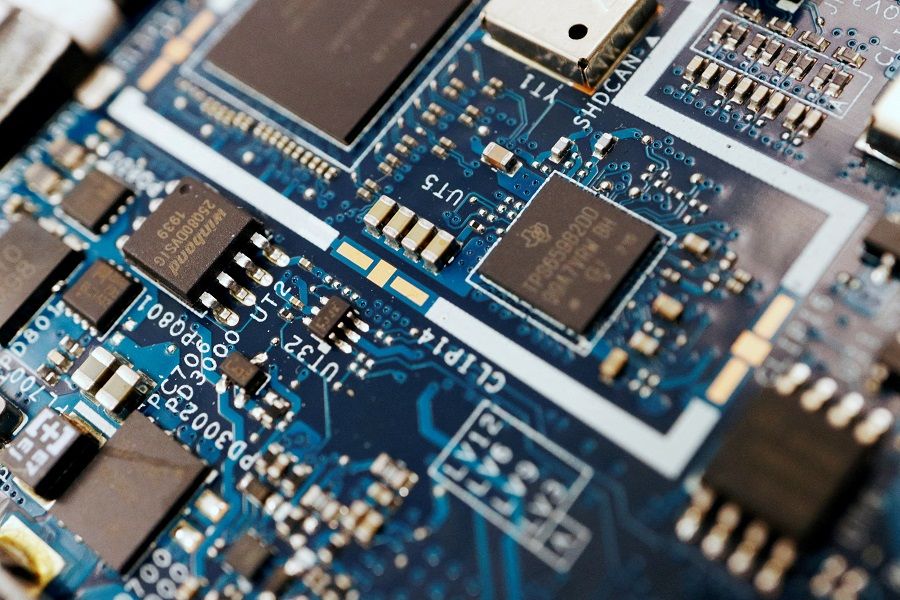

Whether it is the mobile phone or computer you're using now to read this article, the air conditioner, television or washing machine you use at home, or the subway trains and traffic lights you see on the streets, all of them require chips to function - albeit lower-end ones.

Meanwhile, advanced chips with more computing power or storage capacity are required to perform very complex functions. An excellent software design cannot be put to use if it does not have the support of advanced chip hardware. Thus, restricting access to advanced chips essentially restricts the development of cutting-edge technology.

So, just how severe are the US's new restrictions?

... the new rules have expanded the scope of restrictions from just the most advanced technology to the level of technology that is most widely used and has the most market value.

Firstly, the new controls have been expanded to include advanced chips and their manufacturing equipment from 14 nanometres (nm) and below, instead of the earlier 10 nm and below (the smaller the dimension, the more advanced they are).

Statistics show that the sale of 14 nm chips accounted for 65% of the entire semiconductor market in the first half of 2019. At present, Semiconductor Manufacturing International Corporation (SMIC) is the only Chinese firm that has mastered the manufacturing process and mass-produce the 14 nm chip.

As such, the new rules have expanded the scope of restrictions from just the most advanced technology to the level of technology that is most widely used and has the most market value.

In fact, the former Trump administration had imposed similar bans in 2020 on Huawei and some of its subsidiaries and affiliates. However, this time all Chinese and Chinese-funded enterprises, as well as enterprises with factories in China, are targeted.

As China is one of the world's largest importers of chips and where many foreign enterprises have chosen to set up factories, these restrictions have also affected chip manufacturers.

US enterprises with offices or technical staff in China such as KLA Corporation, Applied Materials Inc and Lam Research Corporation have asked employees to stop serving Chinese clients as they consider withdrawing from the Chinese semiconductor industry.

Non-US enterprises with offices in China such as Samsung and SK Hynix are also affected by these restrictions because they use US technology and equipment. However, the US granted them a one-year exemption from these export control measures, allowing US chip equipment suppliers to continue supplying these companies in the meantime. The same rule also applies to Taiwan Semiconductor Manufacturing Company, which also has a factory in mainland China.

Dutch semiconductor equipment manufacturer ASML Holding NV said that these export control measures have a "fairly limited" direct impact on them because they are exposed to "limited US technology". While ASML is unable to export its most advanced EUV lithography machines to China, it can still export slightly older technology. However, Bloomberg reported that ASML has already told its employees in the US to stop its services to customers in China.

Making a choice

Can China rely on domestic technology to develop its own chips since chips and chipmaking equipment are not available from external sources?

The US, which is determined to contain China's chip development, has also considered this aspect. Its new law now stipulates that US persons can only support the development or production of certain chips in China if they have a licence to do so. And "US persons" does not only include US citizens but also permanent residents, foreigners living in the US, and US companies.

This heavy-handed move took the industry by surprise, trapping senior executives and technical experts who work in the Chinese semiconductor industry between a rock and a hard place.

According to a research by The Wall Street Journal, combing through the announcements and information that are available on companies' websites, at least 43 senior executives of 16 public-listed Chinese semiconductor companies are US citizens. Most of them had previously worked for US chipmaking companies or semiconductor manufacturing equipment enterprises in Silicon Valley.

Among them, Gerald Yin, founder and CEO of Advanced Micro-Fabrication Equipment (AMEC), one of China's largest chipmaking equipment vendors, along with its six other senior executives and key researchers, are US citizens.

... many senior executives at Chinese companies might be forced to decide between their jobs and their US citizenship or permanent residency.

The Wall Street Journal also quoted Dane Chamorro, business consulting firm Control Risks's head of global risk analysis and business intelligence practice in the Americas, saying that restricting Chinese companies' access to US talent delivers a direct blow to China's attempt to move up the technology chain.

As the new restrictions require all US persons to apply for a licence to continue working in Chinese advanced chip development, Chamorro pointed out that many senior executives at Chinese companies might be forced to decide between their jobs and their US citizenship or permanent residency.

Simply put, the expanded talent restrictions will crush China's quest for chip self-sufficiency.

Reactions from China's semiconductor industry

Chinese foreign ministry spokesperson Mao Ning responded on 8 October that the US's export controls would "hinder international sci-tech exchange and trade cooperation, and deal a blow to global industrial and supply chains and world economic recovery".

She added, "By politicising tech and trade issues and using them as a tool and weapon, the US cannot hold back China's development but will only hurt and isolate itself when its action backfires."

Chinese enterprises also spoke up against the harsh restrictions.

The China Semiconductor Industry Association on 13 October said that such unilateral measures would not only further harm the global supply chain of the semiconductor industry, but also "create an atmosphere of uncertainty, which will negatively affect the trust, goodwill, and spirit of cooperation that the players of the global semiconductor industry have carefully cultivated over the past decades".

... most participants believe that the US's restrictions would doom the industry, as well as China's ambitions to achieve chip self-sufficiency.

Bloomberg reported on 20 October that China's Ministry of Industry and Information Technology (MIIT) convened a series of closed-door meetings over the past week with leading domestic semiconductor companies to assess the damage caused by the new restrictions and discuss the way forward.

People familiar with the matter revealed that the meetings included Yangtze Memory Technologies Co. and Dawning Information Industry Co., adding that most participants believe that the US's restrictions would doom the industry, as well as China's ambitions to achieve chip self-sufficiency.

There are also claims that Yangtze Memory had sought help from the MIIT over concerns of a possible crisis, but the company released a statement that same night saying that reports about its executives meeting MIIT were not true.

The Financial Times reported on 24 October that Yangtze Memory has asked its US employees in core tech positions to leave, while it works to comply with the new US export restrictions.

Will US sanctions destroy the semiconductor industry?

Analysts believe that the new US sanctions and regulations will deal a great blow to China's chip sector, which may be set back decades or even utterly destroyed. As for other non-Chinese enterprises, the ban also posed an immediate challenge that they have to overcome. There are also concerns that it could lead to greater repercussions in the international arena.

During his visit to Australia on 18 October, Singapore Prime Minister Lee Hsien Loong expressed concerns over an accelerated economic decoupling between China and the US as a result of the US's decision to curb the supply of microchips to China.

He said, "National security concerns are real. How wide or how narrowly they are defined, is the judgement of each government and administration. I think the Biden administration's latest move is a serious one. I am sure they have considered it carefully."

He added, "It can have very wide ramifications. We will have to see how things work out. But we will do [sic] worry that valid national security considerations may trigger off further consequences and may result in less economic cooperation, less interdependency, less trust, and possibly, ultimately a less stable world."

The long-term impact and effect of the US's sanctions against China's technology sector remain unknown. Will a cornered China find a way out?

A New York Times opinion piece said that China could evade the rules as it "has long been masterful at getting around sanctions, and microchips are small and potentially easy to smuggle".

The article added that it remains uncertain how well the Bureau of Industry and Security, the Commerce Department agency in charge of export controls, will be able to enforce the rules.

... even before the US imposed additional sanctions, China's semiconductor industry already faced many internal issues such as making overly ambitious plans, unfinished projects and corruption.

The Wall Street Journal warned in an article that China's solar and shipbuilding industries, once suppressed by the US, have become dominant global players, and are "lessons of history" that can be applied to the semiconductor industry as well.

It said, "Policy makers can recognise the challenges of America implementing its own industrial policy without mischaracterising China's mission as failed or doomed."

The article also added that "history and strategic prudence" have shown that the "US should take Beijing's ambitions seriously", regardless of "whatever embarrassing failures are hurting China's semiconductor industry these days". Furthermore, the US should not "underestimate the strength and resilience of China's economy, political system and industrial strategies".

Future of China's semiconductor industry

In fact, even before the US imposed additional sanctions, China's semiconductor industry already faced many internal issues such as making overly ambitious plans, unfinished projects and corruption. These problems would be exposed even further after the US cuts off China's chip supplies.

The 20th Party Congress report that was approved on 22 October reiterated the primary role of science and technology innovation in China's modernisation drive. Chinese President Xi Jinping also pledged to "adopt more proactive, open, and effective policies on talent", accelerate the implementation of an "innovation-driven development strategy", accelerate "efforts to build our self-reliance and strength in science and technology", and "achieve breakthroughs in core technologies in key fields".

Indeed, China will not passively await its doom in the face of US sanctions. However, in this high-tech field that relies on technology rather than willpower, it is easier said than done to rise from the ashes amid countless internal and external problems.

This article was first published in Lianhe Zaobao as "下午察:芯之所向,举步维艰".

Related: Chinese tech companies in chipmaking race to be self-reliant | Has China surpassed the US in the 5G race? | China's going full speed ahead on technology innovation. Will it work? | Why no country can win the chip war | Huawei founder: Global economic outlook will be grim for next few years | Financial decoupling: China's next step amid intensifying China-US rivalry?