'Homecoming' listings heat up in Hong Kong

(By Caixin journalists Kelsey Cheng and Yue Yue)

The once-booming trend of "homecoming" listings in Hong Kong is picking up speed as an ongoing regulatory dispute between Washington and Beijing is putting more US-listed Chinese companies at risk of forced delisting.

The US Securities and Exchange Commission (SEC) and the China Securities Regulatory Commission (CSRC) have long butted heads over permission for the US's top audit watchdog to directly access Chinese mainland-based companies' books, something that China refuses for national security reasons.

Under the Holding Foreign Companies Accountable Act (HFCAA) passed in December 2020, the SEC earlier this year drew up a list of stocks that would be on the chopping block if the access was not granted, ratcheting up investor anxiety. The list, which started with a handful of names, has ballooned to 162 as of Tuesday following the addition of the latest batches that included e-commerce giant Alibaba Group Holding Ltd. The development is likely to add to the financial decoupling between the world's two largest economies.

Chinese firms are now hedging against the threat of being kicked off New York's bourses by way of a secondary or dual-primary listing in Hong Kong. And that group is only expected to grow bigger, analysts say.

"We expect a trend of US-listed Chinese companies voluntarily choosing homecoming listings in Hong Kong, and more institutional shareholders shifting their positions to Hong Kong stocks, to cope with uncertainties stemming from the US audit requirements," Tianfeng Securities Co. Ltd. analysts said in a June report.

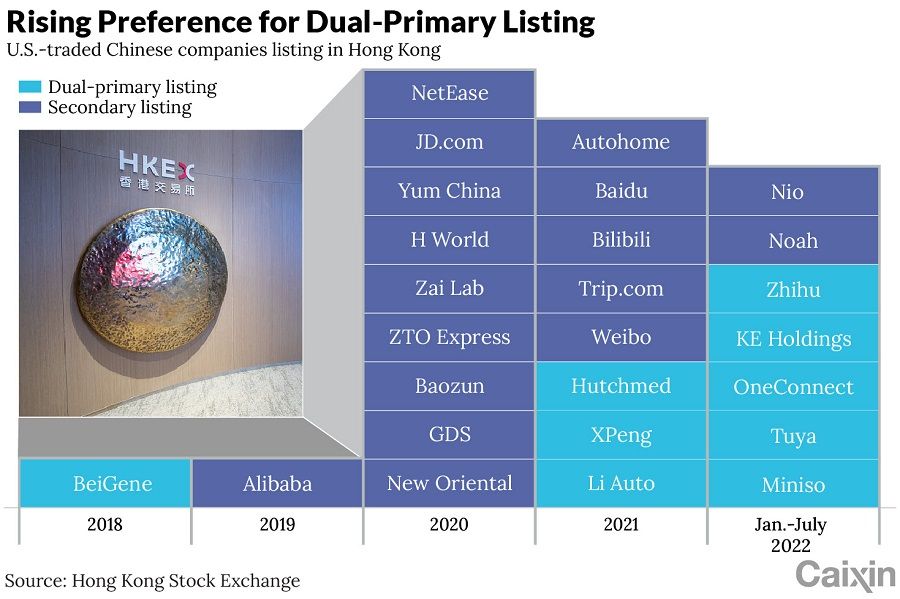

In the first seven months of the year, as many as seven US-listed Chinese companies listed in Hong Kong, while in the whole of 2020 and 2021, there were only nine and eight such listings, respectively.

In July alone, four US-listed Chinese companies debuted on the Hong Kong Stock Exchange: financial services software provider OneConnect Financial Technology Co. Ltd.; Internet of Things cloud platform provider Tuya Inc.; wealth management company Noah Holdings Ltd.; and retailer Miniso Group Holding Ltd. All four are listed on the New York Stock Exchange (NYSE).

Earlier in the year, NYSE-traded electric-vehicle maker Nio Inc., online Q&A platform Zhihu Inc., and KE Holdings Inc., which operates online property platform Beike, also turned to Hong Kong for homecoming listings.

In the first seven months of the year, as many as seven US-listed Chinese companies listed in Hong Kong, while in the whole of 2020 and 2021, there were only nine and eight such listings, respectively. There was just one in each of 2018 and 2019.

After the HFCAA was first introduced in the US Senate in March 2019, Alibaba became the first US-listed Chinese company to do a homecoming listing in Hong Kong, where it raised HK$88 billion (US$11.2 billion) via a secondary listing in November that year. Internet giants JD.com Inc. and NetEase Inc. followed suit the following summer soon after the Senate passed the bill. Since then, US-listed Chinese companies have flocked to Hong Kong in droves.

CSRC updates audit secrecy rules

US and Chinese regulators have been ramping up talks to resolve the longstanding audit dispute. In April, the CSRC threw its counterpart a bone by proposing to revise China's audit confidentiality rules to allow more flexible cross-border regulatory cooperation. The concession was viewed as a significant step toward enabling overseas-listed Chinese firms to open their books to foreign regulators.

The change effectively scrapped the requirement that onsite audit inspections proposed by foreign regulators be done primarily by Chinese authorities. This was aimed at helping reduce the risk of delisting faced by US-traded Chinese companies, some analysts said.

Either way, time is running out. Nearly 200 US-listed Chinese companies could be at risk of delisting if the PCAOB cannot complete audit inspections and investigations into the firms by early November...

But it was not enough to entirely assuage US regulators who continued to expand their list of Chinese stocks that are at risk of being delisted. If the SEC's Public Company Accounting Oversight Board (PCAOB) - the audit watchdog overseen by the commission - is unable to check the audit work papers of these companies for three consecutive years, the SEC will boot them out of US stock markets under the HFCAA. Legislation is being considered to shorten the number of non-inspection years to two.

Either way, time is running out. Nearly 200 US-listed Chinese companies could be at risk of delisting if the PCAOB cannot complete audit inspections and investigations into the firms by early November, according to a timetable provided in May by Y.J. Fischer, director at the SEC's office of international affairs.

Companies deemed noncompliant could face being kicked off US exchanges as soon as early 2023, after they file their annual reports, said Fischer.

In March, the SEC played a part in triggering one of the steepest sell-offs of US-listed Chinese stocks since the 2008 global financial crisis by naming the first batch of five Chinese companies whose audit working papers couldn't be inspected by the PCAOB.

The Nasdaq Golden Dragon China Index, which tracks 72 US-listed Chinese stocks including tech majors such as Alibaba, fell nearly 30% within a matter of days.

As of March, 261 Chinese companies were listed on US exchanges, with a total market capitalisation of US$1.3 trillion, according to the US-China Economic and Security Review Commission. Not all of them face delisting risks, as some have hired accounting firms that are not based on the Chinese mainland or in Hong Kong, whose audit work papers can be directly inspected by the PCAOB.

Still, as the SEC list grows and more companies prepare a backstop, a huge pool of potential deals is building for Hong Kong's stock market.

Homecoming wave builds

"Until discussions on cross-border audit oversight have reached an agreement or a turning point, the outlook for Chinese companies listing in the US will remain uncertain in the second half of 2022," Allen Lau, capital market services group leader at Deloitte China, said in a June 22 report. Lau added that "this will provide a support for Hong Kong's IPO market".

"Hong Kong continues to be the natural choice for homecoming listings because of the city's geographical proximity and its capital flow mechanisms with mainland China," accounting firm KPMG said in a mid-year review report of Hong Kong's IPO market.

A total of 59 US-listed Chinese firms, with a combined US$175 billion market cap, already met the basic requirements for a dual-primary listing on the city's main board, according to estimates by the Tianfeng analysts in June. Among them, 21 also met the bar for a secondary flotation. The dual-primary listing figure could increase to 64 if companies that potentially satisfy the requirements were also included, the analysts said. Those had a collective market cap of US$179 billion.

Some shareholders of US-listed Chinese firms that have already completed a homecoming listing in Hong Kong are also shifting away from these companies' American depositary shares (ADSs) - each of which represents varying numbers of ordinary shares - and toward their Hong Kong-listed stock. Nine such Chinese firms, including Alibaba and JD.com, saw an increased proportion of Hong Kong shares in 2021, according to Bloomberg calculations.

...the dual-primary listing is becoming the more popular method: among the seven homecoming listings in Hong Kong this year, five - KE Holdings, Zhihu, OneConnect, Tuya and Miniso - opted for this approach.

Secondary versus dual-primary listing

Both of the two main routes taken by US-listed Chinese firms to carry out homecoming listings - a secondary or dual-primary listing - allow a company's ADSs to be fully fungible with their Hong Kong-listed shares.

Each has its own advantages and disadvantages. In general, a secondary listing is less costly, and enjoys a lower listing threshold and a shorter review cycle, while a company seeking a dual-primary listing can still retain its primary listing status in Hong Kong in the event of being delisted in the US.

Furthermore, a primary listing means a company's shares could be eligible to participate in the Stock Connect programme, which enables mutual market access for investors in Hong Kong and on the Chinese mainland. That means it can potentially attract investment from the mainland.

Consequently, the dual-primary listing is becoming the more popular method: among the seven homecoming listings in Hong Kong this year, five - KE Holdings, Zhihu, OneConnect, Tuya and Miniso - opted for this approach.

"We expect a rising proportion of Chinese firms to choose a dual-primary listing on Hong Kong's main board," the Tianfeng analysts said. "We also anticipate more large companies with a secondary listing to convert to a dual-primary listing."

Nasdaq-listed video streaming platform Bilibili Inc. announced in May that it would convert its Hong Kong secondary listing status to a dual-primary status by early October.

Alibaba followed suit last month, revealing plans to upgrade its secondary listing to primary status, which could give hundreds of millions of investors on the Chinese mainland access to one of the country's original tech titans via the Stock Connect scheme.

"For a public company, obtaining a primary listing status on the Hong Kong Stock Exchange can help them better withstand the risk of being removed from overseas exchanges," analysts at investment bank China International Capital Corp. Ltd. said in a May report.

Apart from the dual-primary and secondary methods, US-listed Chinese companies will be keen to explore different ways of listing in Hong Kong, including introductory listings, and delisting from the US and re-listing in the city via a special purpose acquisition company (SPAC), said Lau at Deloitte.

"Their delisting and entering the Hong Kong exchange, like sharks in a small pond, would suck up liquidity and pose a threat to midcap and small cap stocks and the exchange itself." - Liao Ming, founding partner of Prospect Avenue Capital Co. Ltd

Listing by way of introduction is a relatively quick process that involves floating shares directly on a stock exchange without a public offering and, typically, no funds are raised. Whereas, listing via a SPAC, a type of shell company, could take longer to complete. The already listed entity would need to go through various regulatory and shareholder approval stages before acquiring a company and floating its shares on an exchange.

Impact on liquidity, valuations

Some analysts have cast doubt on whether Hong Kong would be able to offer a profitable haven for investors if US-listed China companies flood the city's capital market.

With a significantly lower liquidity level and a possible valuation haircut, market participants should not assume that Hong Kong is a perfect substitute for a US stock exchange, especially for Chinese tech companies, according to Liao Ming, a founding partner of Prospect Avenue Capital Co. Ltd.

"Some Chinese tech companies listed in the US are already among the largest in the world in terms of market cap," Liao said in a commentary published in December. "Their delisting and entering the Hong Kong exchange, like sharks in a small pond, would suck up liquidity and pose a threat to midcap and small cap stocks and the exchange itself."

"With too many prospective IPO companies in line, the Hong Kong exchange is seriously understaffed, making the traditional six-to-nine-month IPO execution time much longer," he added.

Other analysts believe that overall pressure on the Hong Kong bourse would be manageable should possible US removals prompt a wave of Hong Kong listings.

"If the 64 companies that meet or potentially meet requirements for a dual-primary listing return to the Hong Kong bourse and issue new shares equal to 15% of their current total shares, potential fundraising demand could amount to at most HK$210 billion," said the Tianfeng analysts. "If this figure is distributed between 2022 and 2023, the pressure on the main board will be manageable."

Meanwhile, the homecoming listings could prompt additional capital inflows such as from the mainland via the Stock Connect programme or by being included in benchmark market indexes, added the analysts.

Whether the Hong Kong market is liquid enough to digest such an influx of new listings now remains to be seen.

This article was first published by Caixin Global as "In Depth: Homecoming Listings Heat Up in Hong Kong". Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.

Related: Financial decoupling: China's next step amid intensifying China-US rivalry? | HK Stock Exchange to benefit from returning US-listed Chinese firms | Will China concept stocks pull out of the US completely? | New regulations to thwart Chinese companies' overseas listings? | HKEX a refuge for Chinese companies fleeing US stock exchanges?