The impact of Covid-19 on the agriculture sector in China

In late December 2019, a novel coronavirus (Covid-19) was identified as the cause of a significant number of human cases of a respiratory disease in China. The outbreak of Covid-19 was first detected in Wuhan city in Hubei province, a major domestic international economic and transport hub in China.

From the epicentre, the virus rapidly spread throughout the province which accounted for 83.5% of the cumulative confirmed cases of Covid-19 and 96.1% of deaths due to Covid-19 in China as of 1 March 2020. Massive quarantine and other preventive measures mounted by the authorities in the wake of the outbreak have confined the virus within Hubei province, mostly sparing other provinces of the worst of the pandemic.

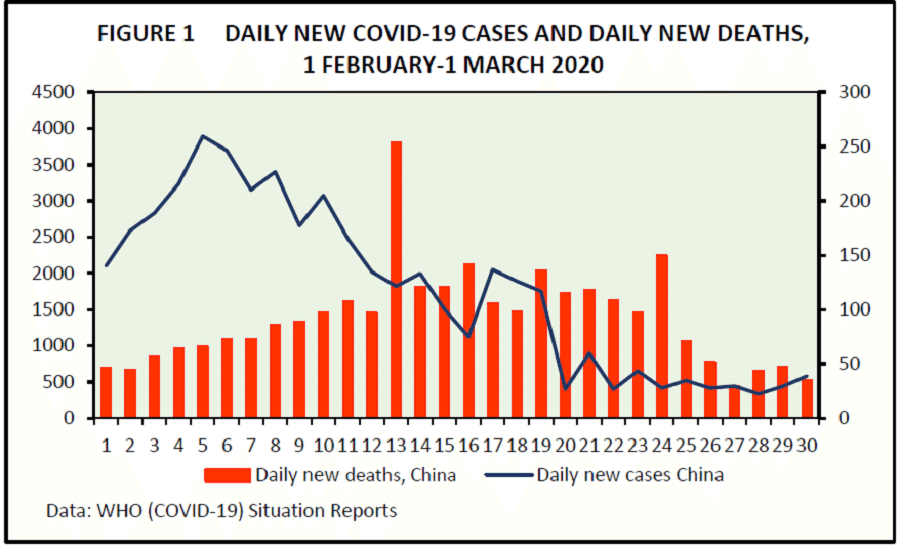

As of 1 March 2020, 98.5% of 579 new cases were located in Hubei, while 29 out of China's 34 provinces, regions and cities recorded zero new cases as the situation continues to improve and the number of new confirmed cases keeps falling (Figure 1). (NB: China's Health Commission reports that as of 30 March, there were 48 new confirmed cases - all imported cases - in mainland China. There were zero new confirmed or suspected cases reported in Hubei.)

Within two months, the pandemic has not only caused suffering to the people of China, but also resulted in the isolation of millions of people, a drastic reduction of trade, and disruptions to the local economy and people's livelihoods. The deadly virus is also impacting the financial market and generating fear that is spreading faster than the virus which appears to be highly contagious but less lethal than its well-known predecessors of the same coronavirus family, SARS and MERS-cov.

Although the share of agriculture, including forestry and fisheries, in the country's GDP is declining, its contribution to national GDP was 7.19% in 2018.

Although the Covid-19 pandemic is primarily a public health crisis, experts have voiced their concerns that the virus could have a much broader impact on the Chinese and global economies, leading to worldwide socioeconomic disruptions. If the 2003 SARS epidemic is taken as a reference point with which to extrapolate the course of evolution of this novel coronavirus pandemic, from a public health and socio-economic perspective, China's contribution to the world economy today is much greater than that of 17 years ago. It has also come a long way since SARS in its ability to rapidly and efficiently handle such emergencies.

China has become central to the global economy during the last decades, contributing 18.67% to the world GDP in 2018, while it accounted for 8.74% of world economic output in 2003, according to the International Monetary Fund. China is also the world's biggest trading nation that is deeply entrenched in global trade through a multitude of bilateral and multilateral trade agreements.

Although the share of agriculture, including forestry and fisheries, in the country's GDP is declining, its contribution to national GDP was 7.19% in 2018. The country's exports and imports cover destinations and sources spanning all regions of the world and agriculture and food constitutes a significant share of China's trade portfolio. This has subsequently raised questions about the impact of the new coronavirus pandemic on agriculture supply and demand, in China and abroad, with possible ripple effects on food prices and markets.

According to industry estimates, market input of chicken and ducklings has decreased by about 50%. China's pig industry that was under the shadow of African swine fever in 2019 is hit again by the outbreak.

The impact is mainly due to massive containment efforts - lockdown of cities and population centres, mandatory quarantine, snapping of transportation links, checkpoints and roadblocks - to prevent the spread of the virus that brought economic activities to a standstill and disconnected consumers from markets, and producers from suppliers of raw materials and production inputs. The impact of Covid-19 on the economy or the agriculture sector will very much depend on the time needed to stop the spread of the deadly virus and that a full picture will only emerge in a few months.

Challenges faced by the agriculture sector in the past six weeks

(1) Disruption of the food supply chain

During the Spring Festival holidays, restrictions in several agricultural production areas prevented poultry, fruit and vegetables from being delivered to urban markets causing spikes in prices. China's consumer prices rose 5.4% year-on-year in January, the fastest in more than eight years; the prices of pork jumped by 116% and vegetables by 17.1%. Other meat products, including beef, lamb and poultry also witnessed 10.4% to 20.2% increases.

(2) Stressed agricultural value chains

Value chains of animal-origin foods such as poultry and meat are expected to be hit hardest. Due to the transportation blockages, some firms had experienced input shortages like feed, difficulties in product delivery and labour shortages. The ban on the movement of live poultry has stopped farmers from getting chickens and eggs to the markets. According to industry estimates, market input of chicken and ducklings has decreased by about 50%. China's pig industry that was under the shadow of African swine fever in 2019 is hit again by the outbreak.

(3) Disruption in spring planting activities

Delays in the supply of production inputs such as seeds, fertilisers, pesticides, animal feeds and farm labour could lead to disruption in the planting of early spring food crops such as rice, maize and vegetables. In the medium to long term, as the outbreak has raised production costs, market prices of agriculture commodities are likely to rise, exerting further impact on agriculture production. According to Lin Guofa, BRIC Agri-Info Group research director, logistics problems are likely to adversely affect the cash flow of poultry producers, creating challenges to post-pandemic supply.

(4) Possible labour shortages

Many companies have given workers extended leave in response to the outbreak, leaving many manufacturing and service enterprises short-handed. Large numbers of migrant workers have been trapped in their hometowns when they returned for the Lunar New Year break because of quarantine measures, but the situation is slowly returning to normal. The resulting labour shortages will likely impact both domestic and global supply chains.

(5) Impact on the rural economy

A recent study led by Zhang Hongyu, vice director of the China Institute for Rural Studies, Tsinghua University, showed that the Covid-19 crisis has generated chain reactions through the rural economy. The livestock and poultry sectors were the first to feel the impact of transport restrictions imposed to contain the outbreak. Food distribution, migrant farm employment and agricultural trade have all been impacted. As a result, increasing the income of farmers as part of the national targets for poverty alleviation will be more difficult to achieve.

(6) Impact on trade

China's food exports have suffered, with trade restrictions (partial or total bans) imposed on Chinese agricultural products by several countries on Chinese food products under the precautionary principle.

Mitigation measures implemented by the government of China

As the pandemic winds down in China, the situation is getting better with the mitigation measures as well as supportive policy measures rolled out by the government to support the farming sector.

It (General Administration of Customs) would grant market access to more countries and companies, speed up customs clearance, shorten quarantine and review times, and open green channel for agricultural products and food imports in key ports.

On 27 January 2020, the Ministry of Agriculture and Rural Affairs (MARA), Ministry of Human Resources and Social Security and National Health Commission issued a joint statement to farmers on ways to prevent and control the spread of the virus in rural areas. Recognising the importance of ensuring the supply of food in good quantity and quality during the crisis period, MARA also issued on 30 January 2020 a notice to support and guarantee winter and spring food production during the pandemic period and beyond.

On 10 February 2020, MARA published a follow-up notice to support spring planting on time. The notice specified incentives for farmers to initiate their farming activities using necessary disease prevention measures; recommendations for field management of crops (winter wheat, rapeseed, vegetables, fruits and tea); farm mechanisation support for areas hit hard by the pandemic; and measures to eliminate labour shortages.

MARA and two other central ministries jointly published "Urgent Notice on Addressing Practical Difficulties for Resuming Production in Livestock and Poultry Sectors", targeting shortages in labour, feed and product sales on 15 February. The notice detailed measures to support the resumption of operation of feed, slaughtering and meat processing enterprises at the first opportunity; efforts to ensure the smooth delivery of raw materials and products including a "green channel" policy for feed, breeding animals, meat, dairy products, seafood; and incentives to support livestock farming.

To encourage food imports in order to ease pressure on food production and supply during the outbreak, the General Administration of Customs (GAC) announced on 16 February 2020 that it would grant market access to more countries and companies, speed up customs clearance, shorten quarantine and review times, and open green channel for agricultural products and food imports in key ports. On 27 February 2020, the National Forestry and Grassland Administration gave notice of a ban on the illegal trade of wild animals and food consumption of terrestrial wildlife, a decision by the Standing Committee of the National People's Congress (NPC).

On 15 February 2020, the Ministry of Science and Technology announced that a test on more than 4,800 animal samples collected from pigs, poultry, dogs and cats by China Animal Health and Epidemiology Centre suggested a preliminary rule-out of involvement of poultry and livestock in the current outbreak.

Supportive policy measures

Apart from mitigation measures to provide immediate support aimed at undoing the damage caused by disruptive preventive measures, the government of China has also announced a series of measures to provide policy support to stimulate and sustain agricultural growth and productivity.

The Ministry of Water Resources announced its first agricultural water quota for wheat irrigation to curb water wastage, which will be officially implemented on 1 March 2020. MARA published "2020 Planting Work Plan", outlining key tasks (minimum targets for crop planting areas, ensuring grain production and supply, improving planting structure, and promoting green production) and regulatory measures controlling pesticide and fertiliser use in crop production. The State Council released on 11 February 2020 a special policy document for the efficient utilisation and enhancement of agricultural germplasm (genetic resources). Following the Standing Committee of the NPC decision on the ban on illegal wildlife trade and its food consumption, MARA announced that wildlife protection will be strictly implemented by law and regulation.

While the turnaround might not be that spectacular this time given the structural transformation that the Chinese economy had undergone during this period, it is sufficient to leave behind the worst concerns and prepare ground for new beginnings.

Under the One Health approach, FAO is working closely with national partners, MARA and the Chinese Academy of Agriculture Sciences (CAAS), the China Agriculture University (CAU) among others as well as international organisations such as the World Health Organisation (WHO) and the World Organisation for Animal Health (OIE) to assist in identifying the potential animal hosts of this virus and assess its socio-economic impact.

While the Covid-19 outbreak provides a better understanding of how such viruses emerge at the human-animal-environment interface, it is also a stark reminder of the significant risk of wild animal trading and mixing of animal species in local markets. The measures and investigation taken have provided a unique opportunity for traditional fresh food markets or wet markets to tighten market access rules, impose stricter sanitation requirements, enable digitalised supervision and explore new channels of distribution, including through e-commerce.

Although a difficult period looms as the country is slowly emerging from one of the most challenging crises it has faced so far, there is cautious optimism that the setbacks suffered during January-February 2020 would not leave a lasting impact on China's agriculture and food security. As the measures announced by the government along with other post-emergency measures go into implementation, it might not take much time for growth to return and propel the economy much in the same way as it did in the aftermath of the SARS epidemic in 2003. While the turnaround might not be that spectacular this time given the structural transformation that the Chinese economy had undergone during this period, it is sufficient to leave behind the worst concerns and prepare ground for new beginnings.

This article was earlier published as EAI Commentary, No. 13, 25 March 2020 as "Mitigating the Impact of COVID-19 on the Agriculture Sector in China" by Vincent Martin.