The US’s financial sanctions weapon against China

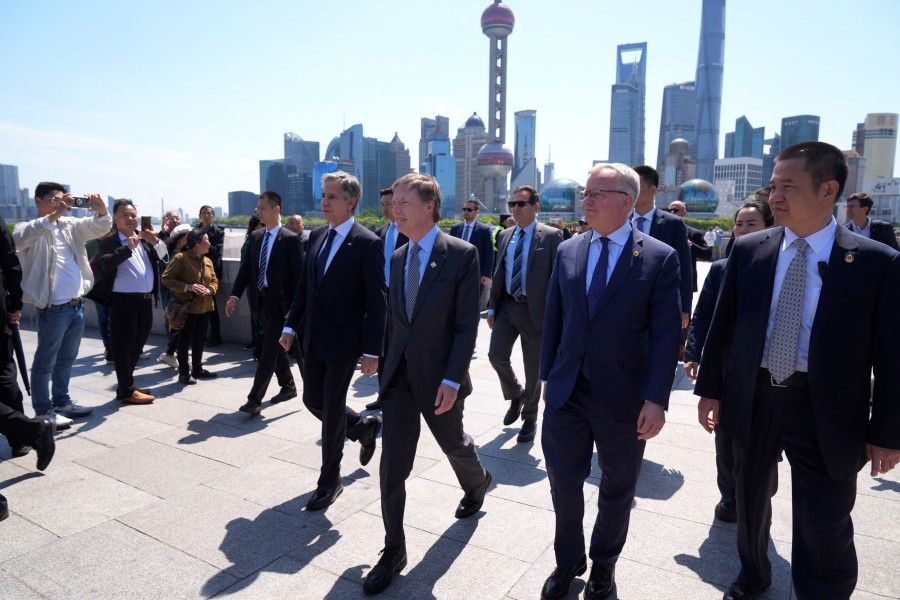

Less than a year from his last visit, US Secretary of State Antony Blinken is once again in China. Compared to the short two-day trip to Beijing then after the China-US balloon incident, Blinken’s three-day visit now seems to be less hurried.

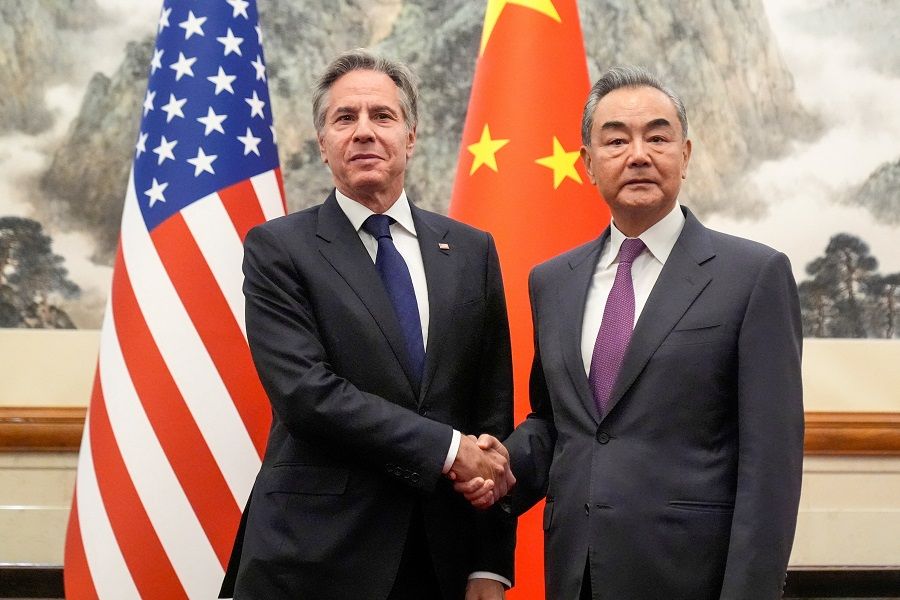

After arriving in Shanghai on 24 April, he met with Shanghai party secretary Chen Jining on 25 April before heading to Beijing to speak on 26 April with Politburo member and Foreign Minister Wang Yi. He will also meet with President Xi Jinping.

Just a while ago, US Treasury Secretary Janet Yellen also visited China, thrice sampling local Chinese cuisine from south to north, making sure to dine in public where both her culinary diplomacy and “chopsticks prowess” were on full display. Blinken has likely caught on to this approach; in Shanghai he dined at Yu Gardens, ate Nanxiang steamed buns, watched a basketball match, and even met with the leaders of AmCham Shanghai and students from the New York University’s campus in China, expressing encouragement and support for China-US exchanges.

A visit where the US has ‘a bone to pick’

Yet, all these friendly gestures are but a warm-up to an intense diplomatic game, akin to a calm before the storm.

It is clear that Blinken came prepared for sparring. Over the past few weeks, the US’s actions against China have not stopped. These include attacking China’s production overcapacity, deploying a midrange missile launcher system in the Philippines, issuing a human rights report that lambasts China for its treatment of Uighurs as “genocide” — a report issued by Blinken himself just a day before he set off on his trip to China.

On the day that Blinken arrived in China, US President Joe Biden signed off on a package of legislation passed by both houses, which included military aid to Taiwan as well as a “sell-or-ban” law on TikTok in the US.

... the threat of a big stick that is financial sanctions is being brandished about.

Among these, the most hostile threat towards China would be rumblings that the US is drafting a sanctions bill to force China to stop exporting dual-use equipment to Russia, such as circuitry, aircraft parts, machinery and machinery tools and so forth. The US felt that China’s exports support Russia’s military-industrial complex, and if China does not accede to these requests, the US could cut off Chinese banks from the global financial system.

This was reported in an article carried by the Wall Street Journal this week, which cited an anonymous source as revealing that Blinken was “armed” with diplomatic leverage for his visit. However, less than a few hours after, Reuters cited another informed source who claimed that though Washington “has preliminarily discussed sanctions on some Chinese banks”, there were no concrete measures in the short run to implement sanctions, and that there was hope that diplomacy would avert the need for such sanctions.

Though the Reuters report may seem to bring down the heat, in effect there is no difference in meaning — the threat of a big stick that is financial sanctions is being brandished about. Evidently, though there are a host of issues for Blinken to discuss during his trip — such as how both countries can collaborate on counternarcotics, the Middle East, the Taiwan Strait, the South China Sea and so on — the China-Russia trade issue is the most crucial and toughest “bone to pick” for Blinken’s trip this time around.

... China is a major trading partner for many countries, excluding China from SWIFT could cause global financial and economic turmoil.

Kicking China out of the global financial system?

Looking back, when Biden spoke with Xi Jinping on 2 April, he expressed concerns about China’s support for Russia’s military industry. The bill signed by Biden on 24 April focuses on allocating US$61 billion in US aid to Ukraine to ensure that Ukraine holds on; if Ukraine cannot hold on until the US elections in November, Biden’s chances of re-election are slim. The importance of restricting trade between China and Russia to Biden is evident. According to Chinese figures, China-Russia trade increased by 26.3% in 2023, reaching a record US$240.11 billion.

Will the US resort to using the “financial nuclear bomb” of kicking China out of the global financial system to force China to compromise? After Russia invaded Ukraine in 2022, the US and Europe removed several Russian financial institutions from SWIFT, effectively prohibiting Russia from using the US dollar internationally. Several Chinese public accounts are already concerned about whether the US will impose similar sanctions on China.

Logically, if the US makes that move, China and the US would be close to falling out and total decoupling. If that happens, China will undoubtedly suffer, but US companies and investors will not benefit either, as China will surely retaliate harshly. From a global perspective, as China is a major trading partner for many countries, excluding China from SWIFT could cause global financial and economic turmoil. Moreover, it would also force China to accelerate the development of its own payment system.

At the end of the day, despite sparks flying, both countries have a common bottom line: they cannot let China-US relations break down.

Therefore, the so-called financial sanctions may be a “smokescreen” by the US to create leverage before negotiations and to take the initiative to overwhelm the opponent. However, since the US has already revealed its “weapon”, China will not ignore it and will also be wary that the US might target one or two small Chinese banks as a warning to others.

US and China need each other

From another perspective, Blinken’s high-handed stance also shows that the US is in need of China. China may not reduce its trade or assistance to Russia, but it may do so more discreetly or bargain in other areas, such as trade or the Taiwan issue.

From the exchanges over the past month to Blinken’s visit to China, the highlight of his trip is how China and the US conduct business behind the scenes. At the end of the day, despite sparks flying, both countries have a common bottom line: they cannot let China-US relations break down. Are the visits by high-level US officials to China not intended to set up guardrails?

Therefore, although it looks like a car crash is imminent, neither side will allow the relationship to rupture. A model of joint management has already formed in the Taiwan Strait, and the Philippines in the South China Sea is unlikely to engage in conflict with China, while the so-called “genocide” in Xinjiang is just verbal sparring.

However, this does not mean that US-China relations are stable; on the contrary, it will always be accompanied by various conflicts and risks. Now that the “financial nuclear bomb” has been revealed, we cannot rule out the possibility of it being used someday. How to deal with the threat becoming reality will be a major test for China.

This article was first published in Lianhe Zaobao as “美国会对中国金融下手吗?”.