Russia and China in Southeast Asia: Pragmatic cooperation against US primacy

Sino-Russian relations have strengthened considerably over the past decade, anchored in shared threat perceptions and growing mutual interests.

Moscow and Beijing view US primacy as contrary to their national interests and a threat to regime survival. They are convinced that the US is pursuing a dual containment strategy (against Russia through the expansion of NATO, and against China through the Free and Open Indo-Pacific) that seeks to deny both countries their great power status and prevent them from recovering "lost" territories or dominating historical spheres of influence (the post-Soviet space for Russia and East Asia for China).

The Russian and Chinese leaderships also believe the US is determined to overthrow their authoritarian political systems by orchestrating "colour revolutions". Economic synergies - China wants Russia's energy resources, Russia seeks Chinese investment - is another important driver in the relationship. Closer bilateral ties have also been facilitated by good personal chemistry between President Vladimir Putin and President Xi Jinping.

Increased levels of trust between Russia and China is demonstrated by the scope, frequency and sophistication of their combined military exercises, and growing cooperation in sensitive areas such as defence technology, satellite navigation, anti-missile systems and space exploration.

"Russia and China will never be against each other, but they will not necessarily always be with each other." - Dmitri Trenin, Russian foreign policy expert

Avoiding a formal alliance

Officially, Russia and China refer to their relationship as a "comprehensive strategic partnership of cooperation". While some observers have described Sino-Russian relations as an alliance, or a de facto alliance, Moscow and Beijing scrupulously avoid that term.

Their joint statement on 28 June 2021, marking the twentieth anniversary of the signing of the Treaty of Good Neighbourliness and Friendly Cooperation, stressed that Russia-China relations do not constitute a Cold War-style "military and political alliance".

A formal alliance - especially one with a mutual defence clause - is regarded by both countries as unnecessary and undesirable: neither side wants to be drawn into a conflict over the other country's interests; an alliance would undercut their narratives that US military alliances in Europe and the Asia-Pacific are obsolete remnants of the Cold War; and alliances tend to be hierarchical and Russia does not wish to be perceived as the junior partner.

Russian foreign policy expert Dmitri Trenin has characterised Sino-Russian ties as an entente - not an alliance but more than a strategic partnership, a relationship based on "a basic agreement about the fundamentals of world order supported by a strong body of common interest". The essence of that relationship, according to Trenin, is that "Russia and China will never be against each other, but they will not necessarily always be with each other".

Alignments and points of divergence

Russia's and China's interests are not completely convergent, and the relationship is not without its problems. As China's economic and military power has grown, the relationship has become increasingly asymmetrical.

Since the Kremlin's annexation of Crimea in 2014 and the steep fall in energy prices, Russia's economy has become more dependent on China and some Russian analysts have voiced concerns that Beijing could use this as leverage to obtain political concessions.

Moscow is wary of China encroaching on its interests in areas over which it has sovereignty - the Arctic and the Russian Far East - and in areas it considers to be within its sphere of influence, that is, the post-Soviet space, especially Central Asia which is a key node in Beijing's Belt and Road Initiative.

However, as President Putin recently stated, Moscow does not view China as a threat, and Russia's rivalry with America outweighs any long-term concerns regarding Beijing's strategic intentions in Eurasia.

In Southeast Asia, the two countries' perceptions of regional security are broadly in alignment. Russia and China oppose US primacy and the alliance system that underpins it. However, on some issues, their interests do not overlap.

...although China is increasing its market share of defence sales in Southeast Asia, it remains far behind Russia.

Competition in arms sales

Arms sales is Russia's single most important interest in Southeast Asia and is also the one area where Russia considerably outperforms China in the region. Since 2000, Russia has become the region's biggest arms supplier with sales valued at US$10.66 billion (the US is second at US$7.86 billion).

However, the value of Moscow's arms sales to Southeast Asia is declining for several reasons.

First, Vietnam - Russia's most important defence customer in Southeast Asia accounting for 61% of its regional sales - has slowed its military modernisation programme due to budget constraints, an anti-corruption drive and competing priorities within the armed forces.

Second, the threat of US sanctions against countries that purchase Russian military equipment has made some regional states think twice about buying Russian arms.

Third, Russia faces increased competition from arms manufacturers in other countries, including China. Russian defence companies have long complained that some of the equipment that China sells overseas has been reverse engineered from weapons systems purchased from Russia.

However, although China is increasing its market share of defence sales in Southeast Asia, it remains far behind Russia. Between 2000 and 2020, China's defence sales to Southeast Asia were valued at only US$2.78 billion.

In the regional arms market, Russia has two distinct advantages over China.

First, Russian defence companies have a better reputation than their Chinese counterparts for the quality and reliability of their weapons systems, as well as after-sales services such as technical support, maintenance and the supply of spare parts.

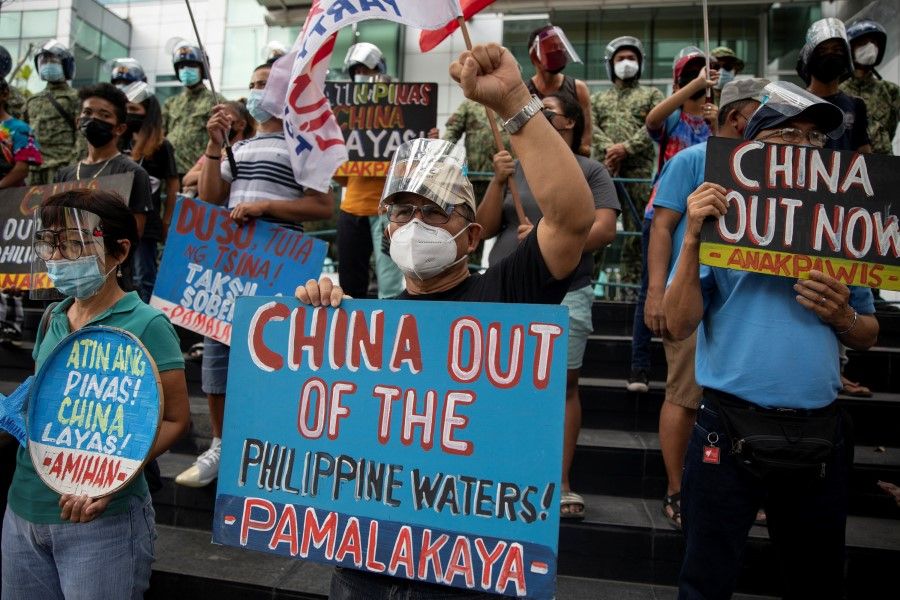

Second, regional states with maritime territorial and jurisdictional disputes with Beijing in the South China Sea - Malaysia, the Philippines, Brunei, Indonesia and especially Vietnam - have avoided procuring arms from China.

Russian and Chinese arms manufacturers are in direct competition for certain kinds of military equipment in Southeast Asia, especially tanks, armoured and other military vehicles, surface warships (frigates, corvettes and offshore patrol boats) and submarines.

China has been particularly successful in Thailand where it has undercut Russia on price for tanks and submarines.

However, China cannot compete with Russia in one crucially important area: aircraft, specifically fighter jets and military helicopters.

Since 2000, Russia has sold 11 SU-27 and 35 SU-30 fighters to Vietnam, 18 SU-30s to Malaysia, 30 MiG-29s and 6 SU-30s to Myanmar, and 5 SU-27s and 11 SU-30s to Indonesia. Russia has also sold Mi-17 heavy lift helicopters to Cambodia, Indonesia, Laos, Myanmar, Thailand and Vietnam, and Mi-35 attack helicopters to Indonesia, Myanmar and Vietnam.

Although China manufactures fourth-generation fighter jets, it has conspicuously failed to break into the lucrative global market for combat aircraft. Myanmar is the only Southeast Asian country that has purchased fast jets from China. In 2015, it ordered 16 JF-17 Thunder jets (jointly manufactured by China and Pakistan) of which only six have been delivered.

Although China has offered for export its Chengdu J-10 and the more advanced FC-31 Gyrfalcon stealth fighter, it has not secured a single order anywhere in the world.

In July 2021, Russia unveiled a direct rival to China's FC-31 (and America's F-35 Lightning II), the SU-75 Checkmate, a relatively cheap (US$20-30 million per aircraft) single-engine stealth fighter aimed at developing countries. Potential customers include Vietnam and Myanmar.

China has also been unsuccessful at developing heavy lift military helicopters and has instead pursued joint production with Russia.

Myanmar crisis offers opportunities for Russia

China's and Russia's interests in Myanmar are almost identical and differ only in scale.

China's stakes in Myanmar, and therefore Myanmar's strategic importance to Beijing, far exceed those of Russia. As Myanmar's largest cumulative investor, largest trading partner and biggest arms supplier, China has shielded both military and civilian governments from criticism of their human rights records at the UN.

Russia's economic interests in Myanmar are much smaller but its arms trade with the country is second only to China's. Moscow has also joined Beijing in providing diplomatic cover at the UN for successive Myanmar governments. The Kremlin views the 1 February 2021 military takeover as an opportunity to expand its interests in Myanmar and Southeast Asia as a whole.

Following the coup in Myanmar, Russia and China coordinated their positions at the UN Security Council, using their narratives of respecting state sovereignty, non-interference in the internal affairs of other countries, and the nonexistence of universal norms and values. They have succeeded in toning down statements critical of the Myanmar armed forces (Tatmadaw) and its use of violence against unarmed protesters.

Given their extensive military sales to Myanmar, the two countries abstained on a vote at the UN General Assembly calling for an arms embargo.

Russia and China have also supported ASEAN's Five-Point Consensus on the Myanmar crisis.

Because Russia does not have a land border with Myanmar, and is a minor player in the country's economy, it does not share China's concerns.

Despite Beijing's longstanding political ties to Naypyidaw, Moscow was much quicker to recognise the ruling junta, the State Administration Council (SAC).

China refrained from immediately backing the SAC in an effort to contain the growth of anti-China sentiment in Myanmar which manifested itself in protests outside the Chinese Embassy, boycotts of Chinese-manufactured goods and attacks on Chinese-owned factories.

China needs stability in Myanmar to protect its extensive economic interests and energy pipeline infrastructure, and prevent conflict between the Tatmadaw and ethnic armed organisations along the China-Myanmar border.

Because Russia does not have a land border with Myanmar, and is a minor player in the country's economy, it does not share China's concerns. Moscow does not seem to care whether its actions in support of the junta damage its reputation in Myanmar or in the West. Accordingly, the Kremlin has moved swiftly to consolidate relations with the SAC.

Russia has utilised its military-industrial complex as its primary interface with the regime in Yangon. Deputy Defence Minister Colonel General Alexander Fomin - who has cultivated a close relationship with coup leader Senior General Min Aung Hlaing since he became commander-in-chief of Myanmar's armed forces in 2012 - was the highest ranking foreign dignitary to attend Armed Forces Day in Naypyidaw on 27 March 2021. He declared that Russia wanted to strengthen ties with Myanmar which he described as its "reliable ally and strategic partner" in Asia. Fomin was presented with a medal and ceremonial sword by Min Aung Hlaing.

Russia is eager to bolster relations with the SAC for four reasons.

First, it can help bolster Russia's arms sales to Myanmar which totalled US$1.591 billion between 2000 and 2020, not far behind China's US$1.699 billion. Moscow is keen to sell a range of big-ticket items to the SAC, including additional SU-30s or SU-35 fighter aircraft (and possibly SU-75s in the mid-2020s), military transport and attack helicopters, drones, air defence systems, surface warships and submarines. The Kremlin's goal is to become Myanmar's primary arms vendor.

Second, closer military-to-military ties will provide Russia with opportunities to expand its defence diplomacy activities in the region including training exercises and naval port calls.

Third, Russia wants to become a player in Myanmar's energy sector by participating in offshore oil and gas development projects and the sale of nuclear power stations.

Fourth, Moscow wishes to expand trade ties between the two countries which stood at a paltry US$60 million in 2020. To achieve that goal, it could push for a free trade deal between Myanmar and the Russia-led Eurasian Economic Union (EAEU).

...the SAC Chairman [Min Aung Hlaing] described Russia as a "forever friend" while calling China and India "close friends".

Min Aung Hlaing is keen to avoid repeating the mistake of becoming over-dependent on China. He has therefore reciprocated Moscow's friendly overtures.

Since seizing power in February, he has made only two overseas trips: to an ASEAN leaders' meeting in Jakarta in April and to Russia in June. During the latter, arms procurement was at the top of his agenda.

In Irkutsk, he visited the United Aircraft Corporation which manufactures Sukhoi combat aircraft, and in Moscow the headquarters of Rosoboronexport, the state-run agency responsible for the export of Russian arms. Although he did not meet with Putin, Min Aung Hlaing met with Defence Minister Sergei Shoigu and the secretary of Russia's Security Council Nikolai Patrushev. In Moscow, he was awarded an honorary professorship by a military university.

Tellingly, in a media interview, the SAC Chairman described Russia as a "forever friend" while calling China and India "close friends".

Attempts by Russia to advance its interests in Myanmar will not be opposed by China. Economic strife in Myanmar caused by the Covid-19 pandemic and popular resistance to the coup will cement China's position as the country's most important partner for trade, aid and investment, a position Russia will never be able to usurp.

Moreover, increased Russian arms sales to Myanmar will help the junta consolidate power - thereby ensuring China's economic interests are protected - and divert negative publicity away from China's own defence sales.

South China Sea dispute the potential fault line

The South China Sea dispute is the most complex issue and a potential fault line in Russia-China relations in Southeast Asia.

While Moscow has been generally supportive of Beijing, China's jurisdictional claims and its position on a Code of Conduct in the South China Sea (CoC) threaten Russian interests in Southeast Asia. Meanwhile, the Kremlin's arms sales to Vietnam have complicated China's maritime strategy.

Russia's official stance on the South China Sea is one of neutrality. Moscow does not take a position on the competing territorial claims and has called for the dispute to be settled peacefully in accordance with international law. By taking a neutral position, Russia avoids offending its two strategic partners - China and Vietnam - as well as other claimant and non-claimant Southeast Asian states.

Overall, Russia has an interest in peace and stability in the South China Sea, the free flow of maritime trade and unimpeded access for its warships. Nevertheless, a degree of tension in the South China Sea creates demand for Russian arms and distracts Washington from Moscow's activities in the post-Soviet space.

Russia and China have agreed to support - or at least not oppose - each other on issues concerning their respective core interests.

Accordingly, Moscow is generally empathetic towards Beijing's position on the South China Sea. The Kremlin agrees with China that the dispute should not be "internationalised" and that non-regional powers, specifically the US, should not "intervene" in the dispute.

Russia sympathised with China's decision not to participate in the legal case brought by the Philippines in 2013 which challenged Beijing's jurisdictional claims in the South China Sea. The Kremlin's view is that small countries should defer to the interests of great powers, and agreed with Beijing that the composition of the Arbitral Tribunal was pro-Western and therefore biased against China.

Beijing was pleased when President Putin came out in support of its rejection of the Tribunal's award in July 2016, one of the very few world leaders to do so.

Sino-Russian combined naval exercises in the South China Sea in September 2016 and in the Baltic Sea in 2017 were interpreted as Russia and China supporting each other in sensitive regions.

Over the decades, Russia's arms sales to China have given the Chinese armed forces a qualitative edge over the other claimants, most recently the sale of SU-35 fighter jets and the S-400 surface-to-air missile batteries.

Beijing has increasingly used China Coast Guard (CCG) vessels to harass survey ships and oil rigs operating in the EEZs of the coastal states...

However, China's jurisdictional claims in the South China Sea - represented by the nine-dash line which encompasses 80% of the sea - threatens one of Russia's main interests in Southeast Asia: the development of offshore energy fields. The nine-dash line overlaps with Vietnam's exclusive economic zone (EEZ) where three Russian state-owned energy companies - Zarubezhneft, Gazprom and Rosneft - have operations.

Zarubezhneft is relatively small in Russia but a major player in Vietnam, where its 40-year-old joint venture with PetroVietnam, Vietsovpetro, operates five offshore oil and gas fields and contributes hundreds of millions of dollars to the state budget each year.

In 2013, as a result of its takeover of TNK-BP, Rosneft - Russia's largest oil company - acquired a 35% stake in Blocks 06-01 and the adjacent Block 05.3/11 in the Nam Con Son basin off the southern coast of Vietnam. By 2018, Block 06-01 was providing 30% of Vietnam's gas needs.

Gazprom - Russia's largest gas company - operates another joint venture with PetroVietnam, VietGazprom, which is active in several offshore areas. In 2017, Blocks 05-2 and 05-3, off the southern coast, accounted for 21% of Vietnam's overall gas production. VietGazprom also has exploration contracts for Blocks 129-132 off the southeastern coast (located within the nine-dash line) as well as for Blocks 111/04, 112 and 113 in the southwestern part of the Gulf of Tonkin.

In recent years, Vietnam and other claimants have come under sustained pressure from China to end joint development projects with foreign energy companies operating inside the nine-dash line.

In 2017 and 2018, Vietnam ordered the Spanish energy firm Repsol to cancel drilling activities in Blocks 136-03 (close to VietGazprom's Blocks 129-132) and 07-03 after being threatened with military action by China.

Beijing has increasingly used China Coast Guard (CCG) vessels to harass survey ships and oil rigs operating in the EEZs of the coastal states, presumably to pressure Southeast Asian governments into negotiating joint development deals with Chinese energy companies.

Despite closer Sino-Russian relations, Russian energy companies have not been spared.

At Vanguard Bank, between June and October 2019, CCG vessels harassed Hakuryu-5, a drilling platform operated by Rosneft in Block 06-01 since May 2018. The tense four-month stand-off, involving dozens of Chinese and Vietnamese ships, only ended when the Hakuryu-5 returned to port.

In July 2020, a CCG vessel repeatedly harassed the Lan Tay drilling rig, also operated by Rosneft in Block 06-01. Soon afterwards, Rosneft was forced to cancel a contract with Noble Clyde Boudreaux to deploy an oil rig to Block 06-01, reportedly due to pressure from China.

As Rosneft is Russia's largest single trade partner with China, and increasingly dependent on the Chinese market due to Western-imposed economic sanctions, it cannot afford to offend Beijing. As a result, in May 2021, Rosneft agreed to sell its stakes in Block 06-01 and 05.3/11 to Zarubezhneft.

Zarubezhneft has partnered with Indonesian energy giant Pertamina to develop energy resources in the Tuna Block north of the Natuna Islands and close to its new assets in Block 06-01. However, the area falls within the line-dash line and in July 2021 CCG vessels were reported to have tried to interfere with drilling operations.

While China's nine-dash line is at odds with Russia's interests in the South China Sea, Moscow's arms sales to Vietnam represent a challenge to Beijing's maritime ambitions.

China's negotiating position on the CoC is also at odds with Russia's commercial and strategic interests in Southeast Asia.

In 2018, China inserted two provisions into the draft text aimed at giving it a veto over foreign activities in the South China Sea, namely:

(i) only energy companies from China and Southeast Asia should undertake joint offshore energy development projects; and (ii) none of the 11 parties to the CoC should undertake military exercises with a foreign navy in the South China Sea without the prior consent of all parties.

These two provisions would exclude Russian energy companies from participating in oil and gas projects in the EEZs of Southeast Asian countries and limit Russian naval activities in the South China Sea. However, it is highly unlikely that the ASEAN member states will agree to either of these provisions.

While China's nine-dash line is at odds with Russia's interests in the South China Sea, Moscow's arms sales to Vietnam represent a challenge to Beijing's maritime ambitions.

Russian manufactured fighter aircraft, surface warships and submarines have enabled Hanoi to pursue an anti-access/area denial (A2/AD) strategy aimed at deterring China from occupying Vietnamese-controlled atolls in the South China Sea. Vietnam's A2/AD strategy will be strengthened if Hanoi moves forward with the procurement of SU-35, SU-57 or SU-75 combat aircraft and S-400 missile systems from Russia.

However, while Beijing is unhappy with Russian weapons sales to Vietnam, it views them as preferable to military sales from the US as Beijing could conceivably apply pressure on Moscow to withhold critical defence supplies from Hanoi during a crisis in the South China Sea. Even though Vietnam is aware of this strategic vulnerability, it still considers Russia to be a reliable defence partner.

Cooperation against US primacy

As US-Russia and US-China strategic rivalry grows, the Sino-Russian nexus will strengthen. While the two countries will refrain from becoming formal treaty allies, military cooperation and diplomatic coordination will increase.

In Southeast Asia, Russia and China will continue to oppose US hegemony and work to undermine America's alliances and partnerships.

There will be an element of competition in their arms sales, but Russia will retain its lead over China.

In Myanmar, Chinese and Russian interests will be largely complimentary as Beijing retains its role as the country's most important economic partner even as Moscow becomes the junta's principal arms supplier.

The South China Sea remains a potential seam in the relationship as Beijing continues to push its claims. Moscow will either have to quietly push back against Beijing's threats to its commercial interests or ultimately defer to China's claims in order to preserve the overall strategic partnership.

This article was first published by ISEAS - Yusof Ishak Institute as ISEAS Perspective 2021/117 "The Russia-China Strategic Partnership and Southeast Asia: Alignments and Divergences" by Ian Storey

Related: Russia in Southeast Asia: Falling influence despite being largest arms seller | What if China and Russia join forces? | Why China and Russia should join forces now | Will Beijing hinder Moscow's operations in the South China Sea? | Extension of China-Russia friendship treaty does not mean ties are solid