Cambricon’s meteoric rise collides with harsh reality check

With the US tightening restrictions on China’s access to advanced chipmaking technologies, investors have rushed to domestic players like Cambricon, betting they will benefit from Beijing’s “domestic substitution” policy. Despite the optimism, Cambricon faces real hurdles. The company is grappling with production bottlenecks and low chip yields. Analysts say its full-year capacity may not be sufficient to meet the needs of even a single large client.

(By Caixin journalists Liu Peilin and Han Wei)

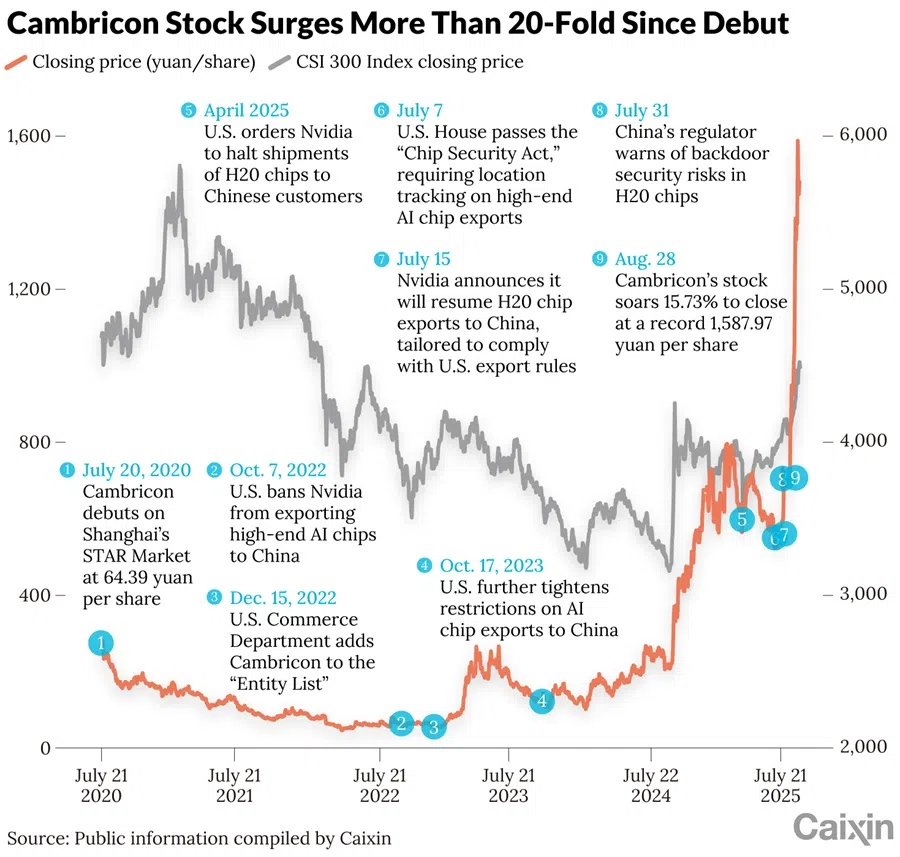

Chinese artificial intelligence (AI) chipmaker Cambricon Technologies Corp. Ltd. briefly claimed the title of the most expensive stock on the Chinese mainland on 28 August, capping a stunning rally fuelled by investor fervour around Beijing’s push for semiconductor self-sufficiency.

Shares in Cambricon soared 15.73% that day to close at a record 1,587.91 RMB (US$222.32) per share, lifting it a market capitalisation to as much as 660 billion RMB. The company overtook liquor giant Kweichow Moutai Co. Ltd. as the priciest stock in mainland market before it pulled back. The stock traded down as low as 1,202 RMB in the following week amid a broader market correction but has since rebounded to around 1,400 RMB.

With the US tightening restrictions on China’s access to advanced chipmaking technologies, investors have rushed to domestic players like Cambricon, betting they will benefit from Beijing’s “domestic substitution” policy.

Since early July, Cambricon stock has soared more than 170%. Over the past year, shares are up more than 500%.

The rollercoaster has reignited debate over how to value China’s emerging technology champions as the US-China tech rivalry deepens. Cambricon has become a barometer of China’s urgent push for tech self-reliance.

With the US tightening restrictions on China’s access to advanced chipmaking technologies, investors have rushed to domestic players like Cambricon, betting they will benefit from Beijing’s “domestic substitution” policy. The result, analysts say, is a wave of speculative enthusiasm based less on current fundamentals and more on future potential — what some are calling “sci-tech special valuation”.

That momentum is being reinforced by sweeping policy support. In August, China’s State Council unveiled its AI+ action plan, outlining goals to deploy AI across industries by 2027 and develop a “smart economy” by 2035. As the only listed Chinese AI chipmaker with large-scale production, Cambricon is seen as a key beneficiary.

Cambricon’s ascent comes amid heightened scrutiny of foreign rivals. US chipmaker Nvidia Corp. has faced questions over its H20 chip tailored for China, with critics raising concerns over tracking and remote shutdown capabilities — allegations Nvidia has denied. Still, the episode pushed more Chinese firms to source chips domestically.

“The backdoor concerns around Nvidia’s H20 chip served as a wake-up call,” said Leslie Wu, CEO of Dalian Ronghe Enterprise Management Consulting Co. Ltd. “Domestic chips are progressing rapidly. Even if the US loosens export controls, the trend toward domestic substitution is irreversible.”

Wu expects China’s AI chip market to enter rapid expansion next year, underpinned by growing capacity and demand.

Investor excitement has also been stirred by speculation of major deals. A source told Caixin that ByteDance Ltd. has pre-ordered 200,000 Cambricon chips. On 1 September, however, Alibaba Cloud denied rumours it had ordered 150,000 chips from the firm.

... Cambricon was born in the wake of Google’s AlphaGo breakthrough. Its co-founders — brothers Chen Tianshi and Chen Yunji — were considered child prodigies and trained in semiconductors...

Despite the optimism, Cambricon faces real hurdles. The company is grappling with production bottlenecks and low chip yields. Analysts say its full-year capacity may not be sufficient to meet the needs of even a single large client.

Still, some remain bullish. Goldman Sachs recently raised its 12-month price target on Cambricon to 2,104 RMB per share, citing increased capital expenditure from Chinese cloud operators.

A meteoric rise

Founded in 2016, Cambricon was born in the wake of Google’s AlphaGo breakthrough. Its co-founders — brothers Chen Tianshi and Chen Yunji — were considered child prodigies and trained in semiconductors at the Chinese Academy of Sciences (CAS).

The startup quickly drew attention from both state and private investors. At launch, its ownership was split 70-30 between the founders and a CAS subsidiary. Backers included Oriza Yuandian Venture Capital and iFlytek Co. Ltd. A US$100 million Series A funding round in 2017 brought in SDIC Venture Capital, Alibaba Group Holding Ltd., Lenovo Capital and CAS Investment.

According to an early investor, state-owned SDIC Venture Capital invested 900 million RMB early on, even before Cambricon booked significant revenue. SDIC also played a key role in client development.

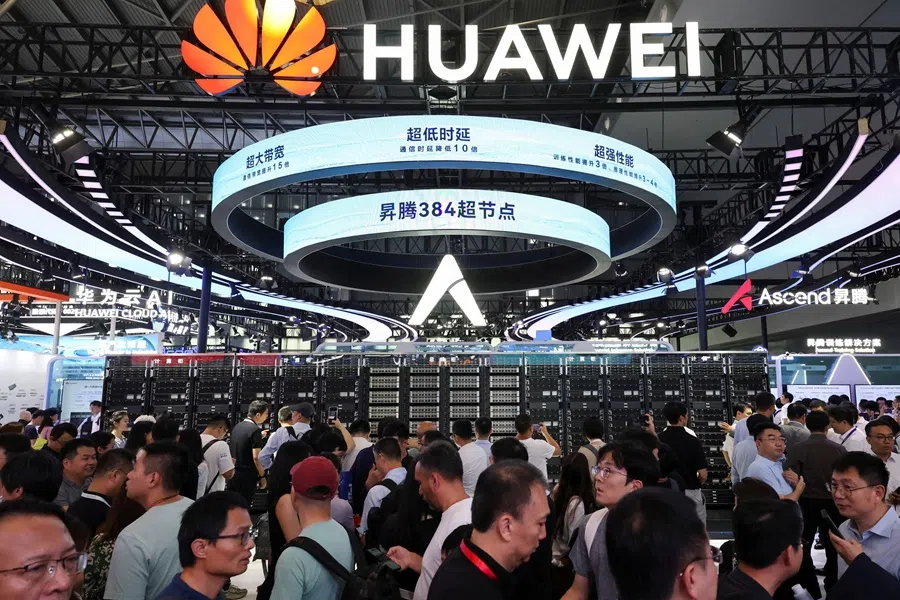

Cambricon’s early business revolved around supplying AI chip IP for Huawei Technologies Co. Ltd.’s smartphones. Before 2019, Huawei made up nearly all of its revenue. But when US sanctions forced Huawei to shift to in-house chipmaking, Cambricon’s revenue cratered. Income from Huawei fell nearly 80% in the first half of 2020 to just 5.5 million RMB.

In 2020, Cambricon listed on the STAR Market as China’s first IPO by an AI chipmaker. However, the market was wary: its stock stagnated for nearly two years due to its narrow customer base.

The company pivoted toward government contracts, helped by Beijing’s push to build intelligent computing centres. In 2020, Cambricon listed on the STAR Market as China’s first IPO by an AI chipmaker. However, the market was wary: its stock stagnated for nearly two years due to its narrow customer base.

The turning point came in October 2022, when the US imposed sweeping export controls on China’s chip sector. In December, Cambricon was added to the US Commerce Department’s Entity List, cutting it off from its key manufacturing partner Taiwan Semiconductor Manufacturing Co. Ltd.

Paradoxically, the sanction became a catalyst. With Nvidia’s exports curbed, local demand for domestic chips skyrocketed. Cambricon pivoted to work with China’s leading foundry, Semiconductor Manufacturing International Corp. (SMIC). By 2024, financial filings showed a spike in materials purchases, signalling localised production and rising output.

Meanwhile, US sanctions had profoundly reshaped China’s chip market. State-owned telecom operators — major builders of AI computing power — have fully switched to domestic sourcing for new AI centres. Internet giants, once heavily reliant on Nvidia, also began shifting to domestic chips.

The potential market is enormous. Sealand Securities Co. Ltd. estimates that if Nvidia’s access to China is fully restricted, it could open up a market worth over 100 billion RMB for domestic players.

“Cambricon has been lucky,” a person close to the company said, noting its stock price has far exceeded the company’s internal expectations.

Turning point or bubble?

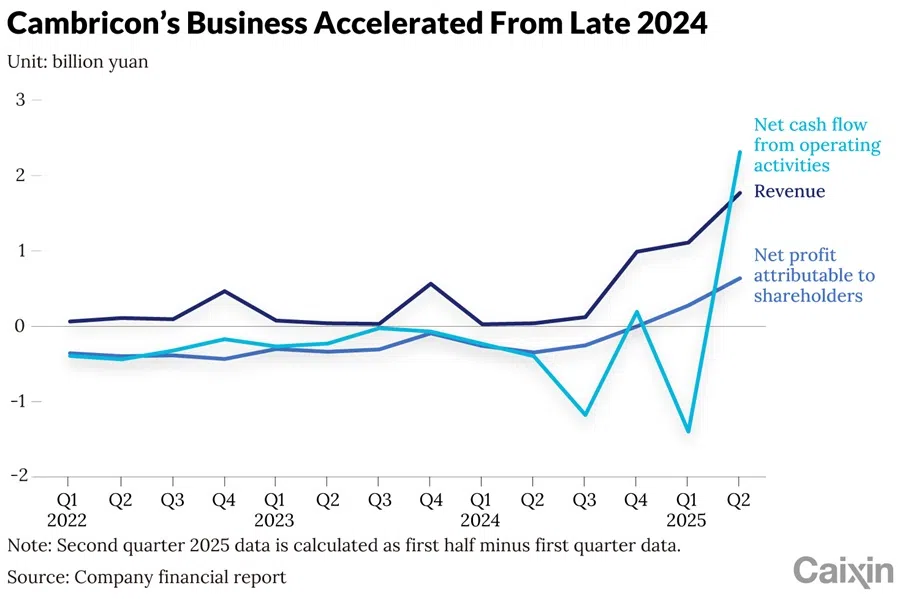

Cambricon’s explosive revenue growth highlights a fundamental shift in its business — from reliance on slow-moving state clients to cash-rich tech firms.

In the first half, the company reported a 43-fold surge in revenue to 2.88 billion RMB, while posting its first-ever positive operating cash flow. Cloud-related products accounted for virtually all of its sales.

The surge in demand stems from an arms race in AI computing. According to Goldman Sachs, Alibaba’s spending doubled year-over-year in the second quarter, while Tencent Holdings Ltd.’s saw an unexpected 119% jump. State-owned telecom carriers are also pouring in capital, with China Mobile Ltd. planning a 16% increase in AI computing power for 2025.

Industry sources told Caixin that ByteDance Ltd. placed a preorder for 200,000 AI chips from Cambricon at the beginning of the year, although the order has not been fully delivered due to production bottlenecks. Alibaba, Tencent and Baidu Inc. are also testing Cambricon chips but have yet to commit to large-scale purchases.

A new competitive dynamic is forming, primarily between Cambricon and Huawei. The nation’s three major telecom operators have largely lined up behind Huawei, favouring its larger production capacity and service support. But for tech firms competing with Huawei in cloud businesses, Cambricon presents a more attractive option.

... Huawei shipped 300,000 to 400,000 its Ascend AI chips in 2024, while Cambricon shipped just over 10,000.

A Tencent insider told Caixin the company is urgently seeking scalable computing power, both by deploying its existing stockpile of foreign chips and sourcing domestic alternatives. He noted that chips from Huawei, Cambricon and others have performance approaching Nvidia’s H20, but all face production constraints. An Alibaba source said the company plans to rely more on its in-house chips.

Wu of Dalian Ronghe said Huawei shipped 300,000 to 400,000 its Ascend AI chips in 2024, while Cambricon shipped just over 10,000. He predicts Huawei could reach 1 million units in 2025, with Cambricon potentially reaching 80,000 and doubling again in 2026.

Goldman Sachs forecasts that Cambricon’s AI chip shipments will reach 1 million units by 2028, capturing 11% of the Chinese market, and surpass 2 million units by 2030. The investment bank said continued investment in AI chips and software will reinforce Cambricon’s lead among domestic suppliers and broaden its customer base.

Valuation dilemma

Cambricon’s market capitalisation now exceeds 500 billion RMB, more than 20 times its IPO level. But is it justified?

On 28 August, its rolling price-to-earnings ratio soared to 5,117.75 — far above the industry average of 88.97. Despite this, Goldman Sachs has set out a 2,104 RMB price target for the coming year, implying a market value of 880 billion RMB.

Some argue the valuation is not entirely unreasonable. One brokerage executive noted that if Cambricon captures 10% of Nvidia’s estimated US$16 billion of China sales with a 20% margin, its revenue could reach 2.4 billion RMB — supporting a high valuation. Still, the company’s 2025 revenue guidance is only 5 billion RMB to 7 billion RMB.

The stock’s ascent has been amplified by massive fund inflows. The inclusion of Cambricon in major indexes like the SSE STAR 50 and CSI 300 created built-in demand from passive exchange-traded funds. Meanwhile, active funds piling into the AI theme have few liquid, pure-play targets, leading to crowded trades.

As more domestic chip firms go public, Cambricon may lose its scarcity premium.

A 5-billion-RMB private placement plan proposed in April has struggled to move forward as the company’s stock surged. In July, Cambricon cut the fundraising target to 3.985 billion RMB in response to regulatory concerns over its scale, securing final approval from the China Securities Regulatory Commission on 9 September. However, attracting suitable investors may prove difficult. One broker said Cambricon is seeking strategic backers such as China’s national chip fund, but its lofty valuation poses “decision-making pressure”.

As more domestic chip firms go public, Cambricon may lose its scarcity premium. “Many believe Cambricon’s price is unsustainable,” said one analyst. “But the market still needs it as a benchmark.”

Qu Yunxu contributed to the story.

This article was first published by Caixin Global as “In Depth: Cambricon’s Meteoric Rise Collides With Harsh Reality Check”. Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.