China-US chip war heats up ahead of Trump 2.0

The Biden administration has hit China with another wave of tech sanctions, heating up the chip war ahead of President-elect Donald Trump’s administration. Lianhe Zaobao correspondent Yu Zeyuan takes a look at the impact of the chip rivalry between the two major powers.

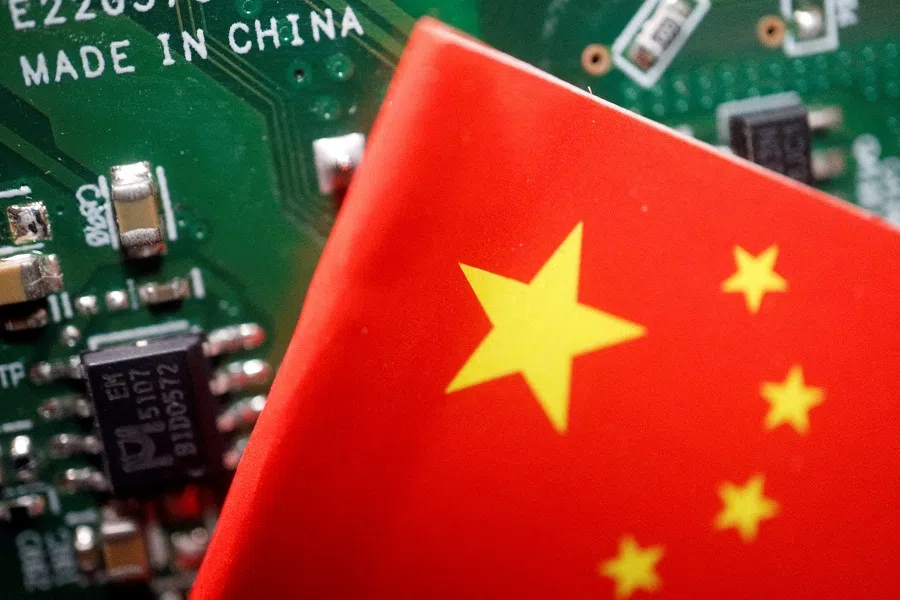

In a major move against China’s chip industry, on 2 December the Biden administration announced a third wave of export controls targeting nearly 140 Chinese entities. The affected sectors include electronics, communications, artificial intelligence, computer and network technology, as well as transportation infrastructure.

In response, China declared US chips as unsafe and unreliable through four major industry associations, and advised domestic companies to exercise caution when purchasing US chips.

Widened scope of sanctions and China’s countermeasures

Since 2018, the US has frequently targeted China’s tech industry, which is heavily centered on chips. This latest action is unprecedented in its scope and depth, not only applying to exports by US manufacturers and suppliers, but also that by US, Japanese and Dutch manufacturers made in other parts of the world to certain chip plants in China. While equipment made in Japan and the Netherlands will be exempt, that made in Israel, Malaysia, Singapore, South Korea and Taiwan will be subject to the rules.

However, China has adopted a more assertive stance this time around, abandoning its previously restrained stance. Not only has it voiced its protest, it has also taken a firm “you don’t sell, I won’t buy” attitude, signalling its intention to no longer take its lumps and to directly confront the US in the tech field.

On 3 December, the Internet Society of China, the Chinese Association of Automobile Manufacturers, China Association of Communications Enterprises and the China Semiconductor Industry issued a statement in Beijing, accusing the US of arbitrarily changing trade rules and expanding the concept of national security, causing substantial harm to the security and stability of China’s related industries and supply chains. They advised domestic companies to be cautious in purchasing US chips.

These four industry associations are clearly government-founded organisations, and their stance reflects that of the Chinese government. While they advise “cautious procurement” on the surface, they essentially call for Chinese companies to reduce their reliance on US chips and seek domestic alternatives. This marks the beginning of China’s decoupling war against US chips.

This begets the question: how developed is China’s chip industry? Would a decoupling from US chips lead to great setbacks for China’s hi-tech industry?

US sanctions have clearly not stifled the progress of China’s tech industry.

China’s chipmaking capabilities

Over recent years, US pressure on Chinese tech companies has intensified. In 2018, the US sanctioned ZTE, forcing it to compromise. In 2019, the US sanctioned Huawei; Huawei then opted for independent research and development (R&D). After 2022, the US continued to widen its sanctions on China, expanding from restricting chip use in smartphones to military, medical and automotive fields, and now covering virtually all sectors.

However, US sanctions have clearly not stifled the progress of China’s tech industry. Take Huawei for example. Despite suffering significant losses and being forced to sell part of its smartphone business, it survived and achieved major development in various fields, including smartphones.

Last year, Huawei released phones equipped with 7-nanometre chips and recently launched phones with the more powerful Kirin 9020 chip, with smartphone production maintained at a scale of tens of millions. Evidently, US sanctions have not hindered Huawei’s independent R&D and iteration of high-end chips.

At the same time, China has made remarkable progress in the broader application range of low-to-mid-end chips. Last year, China imported US$350 billion worth of chips, making it the largest import item for China. However, from January to October this year, China’s chip exports have already exceeded 930 billion RMB (US$128 billion) and could easily surpass 1 trillion RMB for the whole year, with China becoming the world’s second largest chip exporter, behind the US.

Although China’s exports are primarily low-to-mid-end chips, these chips cover a wide range of applications.

Although China’s exports are primarily low-to-mid-end chips, these chips cover a wide range of applications. Moreover, the example of Huawei demonstrates that China is already capable of developing and producing some high-end chips.

China holding US at a chokehold

So, China’s decision to take on the US in the chip industry is due to its confidence in reducing reliance on US chips. Besides, the Chinese government has mandated domestic companies to seek domestic alternatives, which will not only impact the sales of US and other foreign chip companies but also accelerate R&D and iterations of Chinese-made chips. One might say the decoupling between China and the US in high-tech fields such as chips has already begun.

Moreover, on 3 December, China’s Ministry of Commerce announced a ban on the export of critical dual-use materials such as gallium, germanium, antimony and superhard materials to the US. In other words, China aims to counter the US by targeting its reliance on raw materials.

While the US can seek alternative sources of these raw materials globally to avoid being “choked” by China, it takes time to extract and refine these materials, at a significantly higher cost than sourcing them from China.

In fact, China had already imposed export restrictions on certain raw materials last year. According to S&P Global data, antimony prices surged by as much as 212% as of November this year. Gallium and germanium prices increased by 53.4% and 64.2% respectively in August.

While the US can seek alternative sources of these raw materials globally to avoid being “choked” by China, it takes time to extract and refine these materials, at a significantly higher cost than sourcing them from China. As a result, production costs for related US industries are expected to rise sharply in the short term.

On 4 December, Chinese Vice Foreign Minister Hua Chunying posted on social media platform X, condemning the US government for engaging in trade protectionism under the guise of “national security”, and questioning the US’s right to deprive China of its legitimate right to development.

As the Biden administration nears the end of its term and the Trump administration prepares to take office next month, an unprecedented tech war has erupted between China and the US.

Some believe that the Biden administration is preemptively playing the cards that the Trump administration intended to use, both to showcase Biden’s tough stance on China and to leave Trump with a mess to clean up, making his dealings with China more difficult.

Meanwhile, China’s strong countermeasures are due to its confidence in decoupling from the US in the chip sector, and to send a message to the Trump administration that it is ready for both a tech war and a trade war.

The tech decoupling battle between China and the US will not only affect the two nations but also disrupt global industrial and supply chains. One can expect that in the coming years, tensions between China and the US will persist, and global peace will be difficult.

This article was first published in Lianhe Zaobao as “中美科技打响脱钩战”.