Why Tesla’s FSD feels like an ‘unacclimatised American driver’ in China

Tesla’s full self-driving (FSD) system failed to impress Chinese Tesla owners, who were less than satisfied with the system’s incompatibility with Chinese roads and traffic customs. Lianhe Zaobao’s China Desk looks into the issue and discusses Tesla’s market strategy in China.

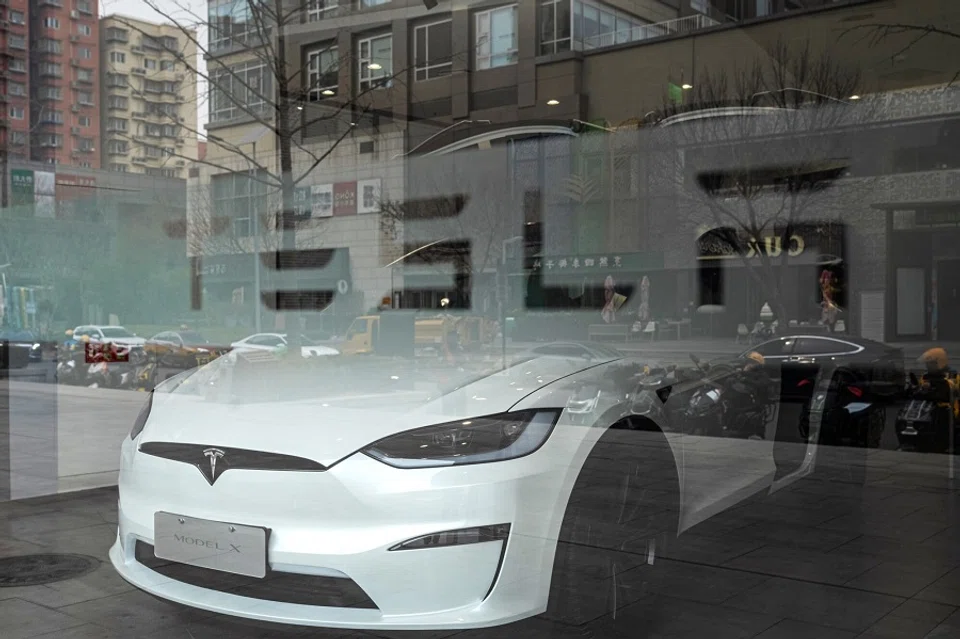

Leading American electric vehicle manufacturer Tesla has rolled out an update to its full self-driving (FSD) system in China, marking the official entry of the highly anticipated function into the Chinese market. However, many Chinese users appear to be dissatisfied with the performance of the new system.

When Tesla unexpectedly pushed the system update to Chinese car owners on 25 February, many were eager to try it out, hoping to experience the cutting-edge FSD technology.

Chinese Tesla owners underwhelmed by FSD system update

But their anticipation was immediately met with disappointment, as the update merely optimised the Enhanced Autopilot system, and not the full FSD functionality touted by CEO Elon Musk as being safer than a human driver by “a factor of ten”.

According to Tesla’s Chinese website, the new features included in the update are: traffic light detection, navigation assist and automatic lane-changing depending on speed and route. An in-car camera will also monitor driver attention.

However, the features added in this update are still a far cry from the full-fledged FSD system available in the US. The US version can essentially drive wherever there are roads, but the Chinese version is strictly limited to highways, expressways and urban roads.

Also, the Chinese version lacks the ability to find parking spots like its US counterpart, and requires frequent driver intervention, unlike the US version, which requires minimal intervention.

... what is more frustrating for car owners is that the Chinese version of the FSD system falls short of expectations, with many aspects still requiring optimisation.

On 25 February, some Chinese media outlets also discovered that the phrase “full self-driving capability” on Tesla’s Chinese website had been quietly changed to “FSD intelligent driving assistance function”, while the description “In the future, your vehicle will be able to complete most driving tasks with minimal driver intervention” had been added.

But the description of FSD on Tesla’s US website is: Your vehicle will be able to drive itself almost anywhere with minimal driver intervention.

However, even with this scaled-back version, the buyout price for FSD in China is 64,000 RMB (approximately US$8,808), which is still more expensive than the US version (US$8,000).

But what is more frustrating for car owners is that the Chinese version of the FSD system falls short of expectations, with many aspects still requiring optimisation.

Like ‘an unacclimatised American driver’

Many users and media outlets conducted reviews of the Chinese version of the FSD system following its launch, and reached the same conclusion: while Tesla’s FSD feature operates smoothly under most circumstances, it still behaves like an “unacclimatised American driver”.

The review pointed out that Tesla’s FSD sometimes exhibits excessive courtesy to pedestrians and other vehicles, appearing hesitant at intersections...

For example, ifeng.com’s auto review platform (凤凰车研所) concluded after driving 80 kilometres on Beijing roads that Tesla’s FSD feature demonstrates a confident driving style, capable of stable cornering and navigating complex intersections. However, this does not mean it drives recklessly; instead, it is extremely respectful of pedestrian right-of-way and strictly adheres to traffic rules.

The auto review platform described that Tesla’s FSD “knows how to drive, but does not know China”, likening it to “a foreign coach with excellent skills but lacking in understanding of local customs”.

The review pointed out that Tesla’s FSD sometimes exhibits excessive courtesy to pedestrians and other vehicles, appearing hesitant at intersections — “its prided adherence to rules seems to clash with Beijing’s traffic culture where the bold driver often wins”.

Some other reviews pointed out that Tesla’s FSD often misinterprets China’s traffic rules, such as encroaching on the road shoulders or non-motor vehicle lanes when turning, and continuing straight in dedicated left or right turn lanes.

Tesla’s self-driving system seems to be unfamiliar with China’s unique traffic light configurations as well. For example, a review video uploaded by a Shanghai car owner shows the system misinterpreting a left-turn green light as a signal to proceed straight through an intersection with ground-level traffic lights, resulting in the vehicle beating a red light.

A comparison of the driver assistance systems of Tesla, Li Auto, and Huawei Aito by Chinese automotive testing platform “Dongchedi” revealed that Tesla required driver intervention 24 times and received 34 violation warnings during the test. This was much higher than Li Auto’s nine interventions and 14 violations, as well as Aito’s 12 interventions and 14 violations.

In the most extreme cases, some Tesla owners have had their driving licences revoked and received 12 demerit points due to errors in Tesla’s FSD judgement.

... there are a large number of couriers and food delivery riders on the roads, along with unique road elements such as bus lanes and diverging islands, all of which present a challenge for Tesla’s US-focused FSD system.

Technological barriers prevent Tesla from training its FSD system to suit China’s roads

China’s traffic regulations and road environment differ significantly from that of the US. For instance, there are a large number of couriers and food delivery riders on the roads, along with unique road elements such as bus lanes and diverging islands, all of which present a challenge for Tesla’s US-focused FSD system.

Musk has long been aware of the potential difficulties that Tesla’s FSD could face in China. He admitted in a previous investor call that Tesla cannot currently solve the problem of bus lanes. Many owners report that Tesla’s FSD often directs cars into bus lanes, incurring numerous fines for the owner.

However, Tesla seemed to have no solution. The training of autonomous models heavily relies on vast amounts of driving data, but China prohibits Tesla from transferring collected driving and map data overseas, and the US also banned Tesla from training FSD models in China.

Constrained by technological barriers from both China and the US, Tesla could only use online road videos to create a simulated environment for FSD training — akin to teaching an American driver how to drive in China by watching videos.

The initial assessments have exposed significant shortcomings, such as a lack of localisation and poor adaptation to traffic regulations, among other issues. These issues stem from Tesla FSD’s inadequate understanding of China’s actual road environment, making it hard for the system to cope with more complex road conditions. On the day Tesla launched their version of FSD for China, the company’s shares in the US plummeted over 8% overnight.

Does Tesla have a first-mover advantage?

Some analysts believed that Tesla hastily introduced an underdeveloped self-driving system to the Chinese market as a gamble to secure a first-mover advantage, before other Chinese carmakers could launch their systems.

This gamble is driven by Tesla’s bottleneck with regard to sales growth, as well as the intense competition in the Chinese automobile market.

Tesla’s global deliveries last year fell by 1.1% year-on-year, marking the first decline in a decade. Although Tesla’s sales in China reached a historic high last year, its market share is being eroded by local emerging forces such as BYD.

Faced with this predicament, FSD has become Tesla’s perceived cash cow. In April 2023, Musk even boldly claimed that if FSD were launched in China, “technically, we could sell [our products] for zero profit”.

Has Tesla shown its hand too quickly?

However, as Tesla’s ace in the hole, the core issues exposed in initial assessments for the FSD have made the market aware of a dire mismatch between its software capabilities and its high price.

Xpeng’s self-driving algorithm model evolves every 72 hours, whereas Tesla has only pushed four major updates in China over the past year.

In contrast, Huawei’s self-driving system, which performed better in assessments, is priced at just 30,000 RMB. BYD, Xpeng and other companies are also planning to offer free self-driving systems with car purchases. This approach is bound to be more appealing to Chinese consumers, who are less inclined to pay for self-driving systems.

Additionally, Chinese carmakers possess the inherent advantage of direct access to local driving data, allowing them to iterate technology more rapidly and develop self-driving systems better suited to Chinese road conditions. In contrast, Tesla’s core algorithms still rely on optimisation by its US team, which results in slower updates.

Xpeng’s self-driving algorithm model evolves every 72 hours, whereas Tesla has only pushed four major updates in China over the past year. Chinese carmakers — which have continuously evolved amid tough competition — are continuously eroding Tesla’s technological and first-mover advantage.

In such a fiercely competitive environment, launching an FSD with incomplete functionality and localisation could be a gamble by Musk to help Tesla reclaim its fading lustre amidst the onslaught of new Chinese electric vehicle manufacturers. However, the cost of this gamble might be the squandering of one of Tesla’s few remaining trump cards.

This article was first published in Lianhe Zaobao as “特斯拉FSD入华水土不服?”.

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)