What financial decoupling?

It has been four years since former US President Donald Trump began putting tariffs and other trade barriers on China to retaliate against what the US claimed were "unfair trade practices" and "intellectual property theft". The underlying assumption was that unfair trade practices contributed to the US-China trade deficit, and there were concerns over a transfer of US technology to China.

It is textbook economics that bilateral trade wars negatively impact the economies of both countries. In the US, it led to higher costs for manufacturers, higher prices for consumers and financial difficulties for farmers. In China, the trade war slowed the rate of economic and industrial output growth. It compounded the drive of many American companies to shift their supply chains to elsewhere in Asia to achieve lower costs. The trade war caused economic damage in other countries, though some benefited from increased manufacturing shifted from China.

FDI flows to developing Asia were resilient. Inflows in China increased by 6%...

Financial decoupling not yet evident

Some raised fears that financial decoupling will occur between these two largest economies in the world. Yet financial decoupling is not yet evident in the trade data. In its World Investment Report 2021, the United Nations Conference on Trade and development (UNCTAD) revealed that while foreign direct investment (FDI) flows in 2020 fell globally by 35% in 2020, largely due to the Covid-19 pandemic economic slowdown, with FDI flows to Europe having fallen by 80% and flows to North America by 42%, FDI flows to developing Asia were resilient. Inflows in China increased by 6%, while Southeast Asia saw a 25% overall FDI decline, with its reliance on global value chains an important factor.

Doing business in China is in many ways becoming easier.

More recent data from China's Ministry of Commerce reveals a continuation of increasing FDI into China - up by 15.9% year-on-year during the first 11 months of 2021. Foreign investment into the service sector rose 17%, while high-tech industries saw FDI inflow jump 19.3%. The main FDI contributors include countries along the Belt and Road and the ASEAN countries, with the amount of FDI leaping by 24.7% and 23.7% respectively.

What do managers say? Responding to a survey by the American Chamber of Commerce in Shanghai in 2021, 60% of firms reported increased investment compared to 2020, up 31 percentage points, and near 2018's 62%. Of manufacturers producing in China, 72% had no plans to move any production out of China in the next three years. Of the remaining 28% that plan to move any production, only two companies (1.6%) planned to move all production in the next three years. No companies were relocating their production from China to the US.

Drivers of this have been a strong Chinese currency - up more than 8% so far in 2021 against a basket of 24 other currencies, and almost 3% against the US dollar

Easier for foreign companies to do business in China

Doing business in China is in many ways becoming easier. Just this week, China's top economic planning agency announced that Chinese authorities will allow full foreign ownership of passenger car manufacturing in the country beginning 1 January 2022. While China has gradually rolled back limits on foreign ownership in the domestic auto industry, restrictions or bans still apply in some industries such as rare earths, film production and distribution, and tobacco products. In other instances, such as establishing medical institutions, foreign entities must form joint ventures with local partners, which typically have the majority stake.

Nor has there been a decline in passive financial inflows into Chinese stocks and bonds from abroad, with investors increasingly eschewing indirect methods of investing through financial instruments listed in global financial hubs, turning instead to investing in mainland Chinese markets directly. International investors' holdings of renminbi-priced equity and fixed income securities were up by over 11% in the nine months to the end of September 2021. This is despite the tightening of regulations in the technology and education sectors and fears over the debt burden and liquidity crisis that has placed Evergrande into default.

Drivers of this have been a strong Chinese currency - up more than 8% so far in 2021 against a basket of 24 other currencies, and almost 3% against the US dollar - as robust exports and relatively high returns on Chinese government bonds have proven attractive, with the Chinese economy recovering from the slowdown triggered by Covid-19.

while both Beijing and Washington have been raising hurdles to slow or stop Chinese companies listing (and cross-listing) their shares in the US markets, their stocks are often still available to foreign investors through alternative channels...

Ride-hailing giant Didi Global announced in December 2021 that it would withdraw from the New York Stock Exchange after coming under scrutiny from Chinese regulators. China has imposed new restrictions on offshore listings by firms in sectors that are off-limits to foreign investment. Chinese firms in industries banned from foreign investment will need to seek a waiver from a negative list before proceeding for share sales.

Yet, while both Beijing and Washington have been raising hurdles to slow or stop Chinese companies listing (and cross-listing) their shares in the US markets, their stocks are often still available to foreign investors through alternative channels, such as through the Hong Kong Stock Exchange or by means of private equity ownership.

The histories of the growth of economies including Japan and the Republic of Korea are well-established precedents for catching up.

Natural progression for Chinese economy to seek stronger autonomy

Little different from many developing economies, Chinese economic policy for its real economy has, notably since 2005, focused on reducing dependence on foreign science and technology. In its 2005 Medium- and Long-Term Plan for Science and Technology Development (2006-2020), the government called for increasing domestic content in 11 sectors to 30% by 2020 through import substitution.

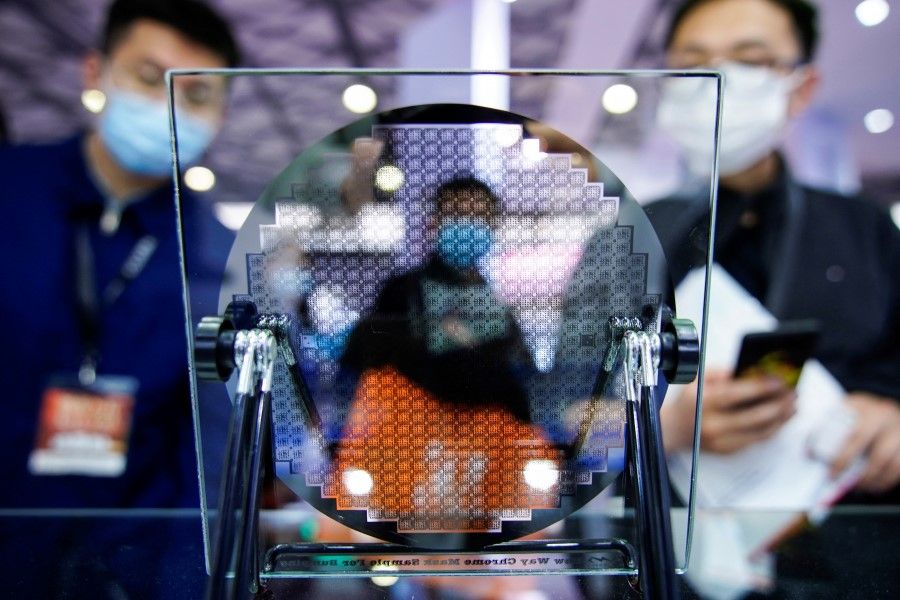

In 2015, the Chinese government announced its national strategic plan and industrial policy, Made in China 2025 (MIC2025), which aimed to increase the Chinese-domestic content of core materials to 40% by 2020 and 70% by 2025. To reduce dependence on foreign suppliers, the initiative encouraged increased production in high-tech products and services, with its semiconductor industry central to the industrial plan. In sectors including AI, 5G, aerospace, semiconductors, electric vehicles, and biotech, MIC2025 sought to indigenise those technologies with the help of national champions, to secure market share domestically within China, and ultimately to capture foreign markets globally.

The follow-up China Standards 2035 plan aims to establish China as the global standard setter for technologies including 5G, the Internet of Things (IoT), and AI.

What's new? Perceived as a threat to US technological leadership, these plans laid out policy objectives to be expected from developing economies seeking stronger autonomy and economic power. The histories of the growth of economies including Japan and the Republic of Korea are well-established precedents for catching up. Increasing portfolio and direct financial flows into China reflect investors' expectations of relative success, measured by available returns. There is complementarity between moves in the real and financial economies and a deepening of global integration. To label this process decoupling is a misnomer.