Why no country can win the chip war

The semiconductor sector, which is a big part of our daily life, is one of the most important and biggest industry sectors in the world. Any problem happening in the semiconductor supply chain will have knock-on effects on our mobile phones, computers, cars, household appliances and other common industrial products.

According to a semiconductor market report published by market research company International Data Corporation (IDC), even though the Covid-19 pandemic has had an impact on many industries, annual global semiconductor sales still increased by 10.8% in 2020 to reach US$464 billion. The forecast for 2021 is that annual global semiconductor sales will hit US$522 billion, or an increase of 12.5% year on year. Positive outlook notwithstanding, the China-US trade war and global chip shortage in the last two years have drawn more attention to the risks in the global semiconductor supply chain.

A typical semiconductor manufacturing process contains more than 1000 steps, and many countries are involved. From start to end, the product may cross international borders more than 70 times before the final product is handed over to the client.

The semiconductor supply chain is one of the most complex systems in the world. A typical semiconductor manufacturing process contains more than 1000 steps, and many countries are involved. From start to end, the product may cross international borders more than 70 times before the final product is handed over to the client.

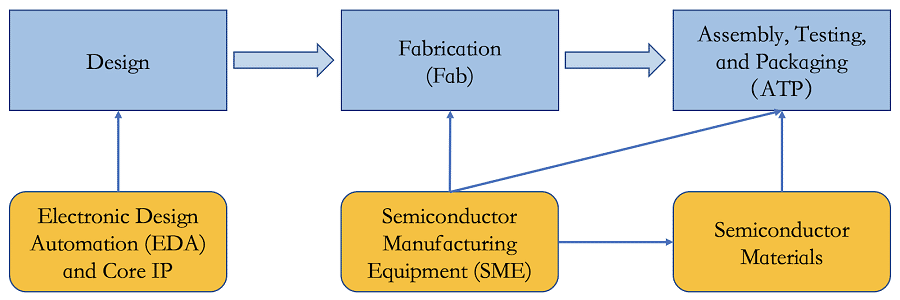

Overall, this supply chain comprises three main steps and three related fields. The three steps are Design, Fabrication (Fab), and Assembly, Testing and Packaging (ATP), and the three related fields include Electronic Design Automation (EDA) and Core IP, Semiconductor Manufacturing Equipment (SME), and Semiconductor Materials.

Chip design and manufacturing becoming more complex

Before the 1970s, chip structure was relatively simple, with chip designs hand-drawn by engineers. The accelerated development of chip technology in the past four decades has resulted in highly complex chip designs that are impossible to draw by hand. A modern-day chip often contains billions of interconnected electrical components. As such, designing chips nowadays involves the usage of design automation tools in EDA software. Chip designing has also become highly modular. It is common for companies that own Core IP, such as ARM (a British company that has been acquired by Japan's SoftBank), to design reusable modules of components and license other companies to incorporate such components into their chip designs.

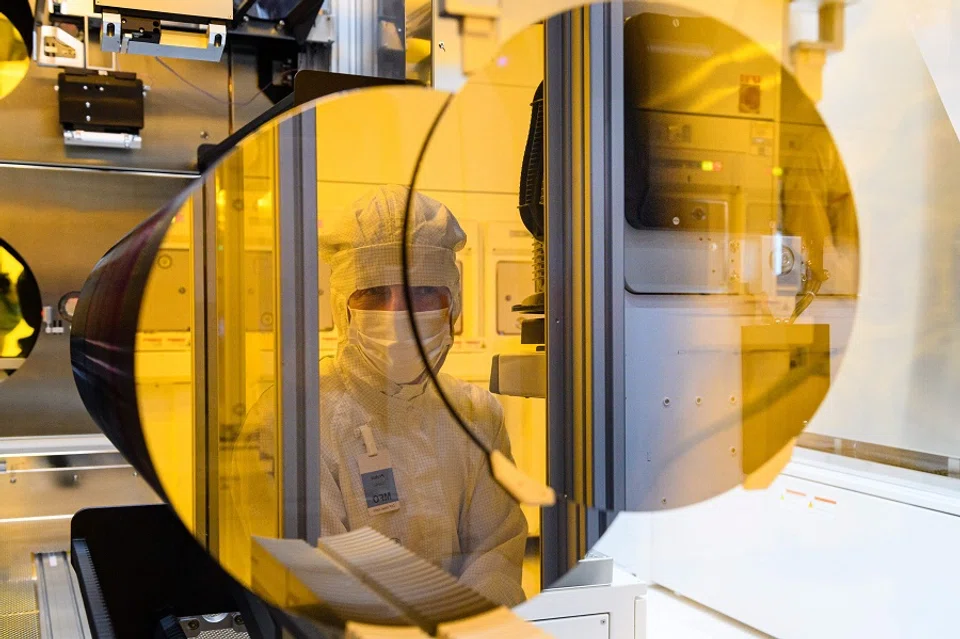

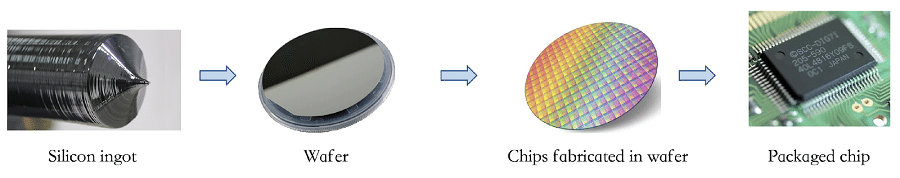

Manufacturing follows the completion of chip design. First, silicon, the main ingredient of chips, is processed into silicon ingots of high purity before being sliced into circular wafers. Then, chips are fabricated on the wafers in wafer fabs using highly complex manufacturing processes. Wafer fabrication is the most complex and precise manufacturing process, and has to take place in very clean and dust-free environments. Building a wafer fab today often costs billions or even tens of billions of US dollars. The major manufacturing steps in a wafer fab include ion implanting, deposition, lithography, etch and clean, and chemical and mechanical planarisation (CMP) etc.

The wafers with chips built on them are then transported from wafer fabs to ATP plants where they are diced into individual chips, and each chip is then assembled into a package so that it can be connected to external electronic components easily. Before the chips are delivered to the end client, they must undergo rigorous testing to ensure that their performance is in line with design specifications.

The semiconductor supply chain is highly internationalised, and no country or region has full control over every segment in the supply chain. On the whole, seven countries or regions including the US, South Korea, Japan, Europe, Taiwan, mainland China, and Southeast Asia play major roles in the supply chain and have nearly total control of it. The analysis in the following paragraphs is based on the three main steps and three related fields mentioned earlier.

But in most other semiconductor chip designing segments, mainland Chinese companies lag far behind the market leaders.

Each country or region has its specialisation

First, the design phase. Almost all semiconductor chips are designed in the US, South Korea, Japan, Europe, mainland China, and Taiwan. The US has a commanding lead in logic chip design. Such chips include central processing units (CPU), graphics processing units (GPU) and field-programmable gate arrays (FPGA) produced by many well-known tech giants like Intel, Qualcomm and Nvidia. As for memory chips such as dynamic random access memory (DRAM) and NAND flash storage, South Korea is the leader. The two big South Korean semiconductor companies of Samsung and SK Hynix are front runners in the memory chips market. The American firm, Micron Technology, is also a leading company in this market.

As for analogue chips, American companies like Texas Instruments, Analog Devices and Skyworks are market leaders, while European companies such as Infineon, ST and NXP are also very strong competitors. As for non-IC chips such as discrete devices, optoelectronics and sensors, Europe is in the lead, but the market is highly fragmented, and American and Japanese companies have a very strong presence too. Core IP and EDA tools are essential to the chip designing phase and basically dominated by Europe and the US. The top three EDA suppliers in the world are all American companies, while American and British companies control most of the Core IP.

Mainland Chinese firms are also involved in the design of various semiconductor products, and some have performed well in certain segments, such as HiSilicon in the production of CPUs for mobile phones. But in most other semiconductor chip designing segments, mainland Chinese companies lag far behind the market leaders. In addition, mainland Chinese chip designers still rely heavily on foreign Core IP and EDA tools. For instance, 95% of Chinese chip designs utilise IP under license from ARM.

Next, the fabrication phase. Based on the geographical distribution of wafer fabs, companies in the US, mainland China, Taiwan, South Korea, Japan, Europe, and Singapore control nearly all the fabrication capacity in the world. Depending on their business model, wafer fabs can be classified as integrated device manufacturers (IDM) or foundries. IDMs such as Intel and Samsung produce chips using their own designs, and account for nearly two thirds of the global semiconductor fabrication capacity. On the other hand, foundries such as Taiwan Semiconductor Manufacturing Company (TSMC) and Globalfoundries focus on producing chips commissioned by their clients, and account for about one third of the global semiconductor fabrication capacity. Currently, only TSMC and Samsung are capable of fabricating 7-nanometre (nm) chips, so the duo dominates the global production of these most advanced chips. As the leading foundry, TSMC's share of the logic chips foundry market is 54%. At the same time, it is the pioneer in the cutting edge 5nm fabrication process.

The rapid development of Asian companies in semiconductor fabrication has reduced the market share of American companies from 37% in 1990 to 12% today. The Semiconductor Industry Association (SIA) predicts this to fall further to 10% in 2030 as the market share of Asian companies grows to 83%.

Mainland China has been ramping up its semiconductor fabrication capacity rapidly. For example, four out of the six new wafer fabs completed around the world in 2019 were built in mainland China. Nonetheless, mainland China wafer fabs do not have advanced fabrication processes. Semiconductor Manufacturing International Corporation (SMIC), the most advanced mainland China wafer foundry, only started fabricating 14nm chips in 2019 and in highly limited quantities. Many mainland China wafer fabs are not competitive and rely on government support to stay afloat. As such, government subsidies form a larger portion of the revenue of mainland China wafer fabs as compared to leading global wafer fabs.

Trade restrictions imposed by the US on China mean that mainland China wafer fabs are unable to import these top-notch EUV machines from the Netherlands, thereby hindering mainland China wafer fabs in their development of capabilities to manufacture 7nm or smaller chips.

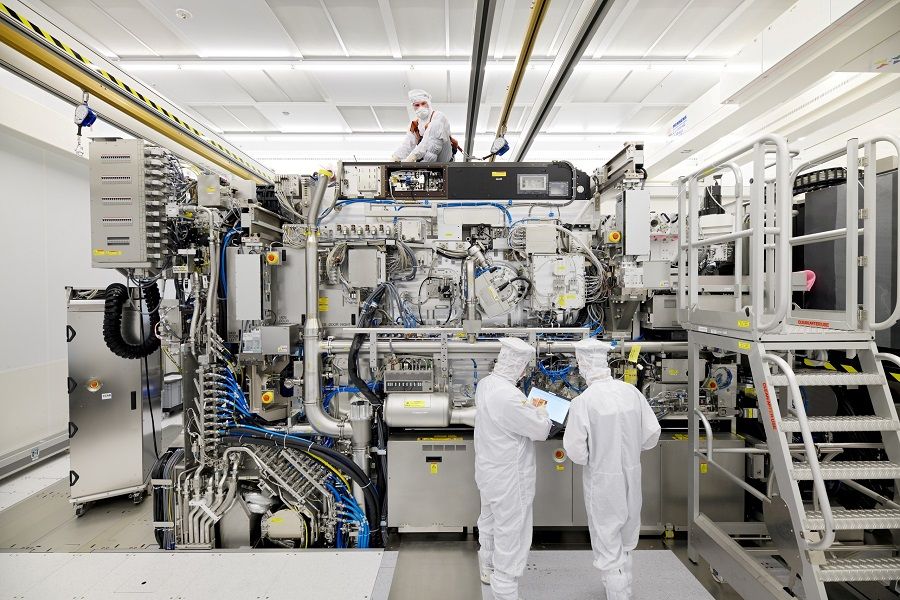

SME lies at the heart of wafer fabs. American, European and Japanese companies dominate this market at present. Such equipment is used in the various wafer processing steps, including wafer fabrication, wafer marking, wafer and photomask processing, ion implanting, lithography, deposition, etching, cleaning, CMP, process control, and testing. In the SME market, the top three countries in terms of market share are the US (41.7%), Japan (31.1%) and the Netherlands (18.8%). Other than in assembly and packaging equipment, mainland China has almost no presence in the main SME market segments.

In terms of the manufacturing of most SME, the US has a considerable share of the market, but when it comes to the critically important lithography machines, the Dutch company ASML and Japanese companies Nikon and Canon have almost complete control of the market. Amongst the trio, ASML is the sole supplier of extreme ultraviolet (EUV) lithography machines. Lithography machines can be said to be the most critical part of wafer fabrication, and they are the most expensive and complex equipment. In today's market, a unit of the most advanced EUV lithography machine costs about US$120 million.

Trade restrictions imposed by the US on China mean that mainland China wafer fabs are unable to import these top-notch EUV machines from the Netherlands, thereby hindering mainland China wafer fabs in their development of capabilities to manufacture 7nm or smaller chips. This is the primary obstacle to the development of the mainland China semiconductor manufacturing industry.

Lastly, the ATP phase. Similar to wafer fabs, there are two different business models for ATP plants. ATP services can be performed by IDMs and foundries, or Outsourced Semiconductor Assembly and Test (OSAT) companies. Traditionally, the ATP phase is automated and of low value, but it is also an important part of the semiconductor supply chain. ATP operations mainly take place in mainland China, Taiwan and Southeast Asia.

In recent years, as assembly and packaging technologies become more developed, this phase has become an important avenue of innovation in the semiconductor supply chain. While the density of transistors in logic circuits and of memory cells in chips continues to grow exponentially, the density of connections (determined by assembly and packaging) between logic circuits and memory devices has been growing at a slower pace, throttling communication speeds between chips. A possible slowing of the rates at which logic and memory density grow will also provide more opportunities for innovation in assembly and packaging.

In the last few years, mainland China has invested heavily in advanced assembly and packaging. Based on data from SEMI and Techsearch, out of the 120 OSAT companies and 360 IDM assembly and packaging plants around the world in 2018, more than 100 plants were in mainland China, with another 100 or so in Taiwan, 43 in Southeast Asia, and the rest in Europe or the US. ATP equipment is mainly produced by Japanese, Chinese, Singaporean, South Korean and American companies. Amongst these, the Chinese and Singaporean firms are stronger in the production of assembly and packaging tools, while firms from the other three countries produce most of the testing tools.

In terms of semiconductor materials, the various countries also have their respective advantages. The data shows that most of the raw materials required for manufacturing the wafers, such as silicon and gallium, originate from mainland China. As for polysilicon production, mainland China's share of the market is more than 70%. In the semiconductor silicon wafer market, Japanese companies account for about 56% of the market share. In the photomask and photoresist markets, Japanese companies also have a clear lead, with a market share of 53% and 90% respectively. The US, Japan, France and mainland China are the main producers of CMP materials. As for materials needed for the deposition step, the US and Japan are the main producers, while mainland China can produce many of the materials required too. As for semiconductor process gases, the US, France, Japan, Germany and mainland China are all capable of producing them. In terms of wet chemicals, the US, Germany and Japan are the main manufacturers.

The highly complex and precise nature of this supply chain means that an issue with any segment will disrupt the delivery of chips to end clients.

All in all, while the global semiconductor supply chain is highly internationalised, certain segments in it are controlled by a small number of countries. In some critical segments, some companies control more than 50% and even as high as 90% of the market, such as ASML in EUV lithography machines and TSMC in cutting-edge chip foundry services. The highly complex and precise nature of this supply chain means that an issue with any segment will disrupt the delivery of chips to end clients. Therefore, the supply chain is rather fragile and faces several risks, including geopolitics and natural disasters.

Even though countries and regions recognise the underlying risks in the semiconductor supply chain and hope to exert greater control over the supply chain through investment, establishing a presence in any part of the supply chain involves huge outlays of capital and human resources. Time is also needed to accumulate experience, and this cannot be achieved overnight. As such, the status quo of this supply chain dominated by the seven countries and regions mentioned above is unlikely to undergo wholesale changes in the near term. To ensure the continued healthy development of the semiconductor supply chain, it is of paramount importance that countries find the right balance for long term cooperation.

Related: Faced with a shortage of water, electricity and vaccines, can Taiwan still deliver the chips? | America turning to state intervention to win US-China tech war | Kai-Fu Lee: Five ways artificial intelligence will put China ahead | Taiwan's booming semiconductor industry plays crucial role on world stage