The Yangtze River Delta region: Promoting economic integration amid provincial competition

The Yangtze River Delta (YRD) region is one of the most significant in the Chinese economy. It conventionally includes three provincial-level administrative regions - Shanghai, Jiangsu and Zhejiang. In 2019, the State Council announced in a major government guideline that the YRD region would now include an additional province, Anhui, making it a total of four provinces.

The core area of the YRD includes Shanghai and 26 out of 40 prefectural-level cities in Jiangsu, Zhejiang and Anhui. Occupying only 4% of the total area of the country, the YRD was home to about 230 million residents, or about 16.7% of the total population in China in 2020, up from 15.7% in 2006. Population levels in another two major regions in China, namely, the Greater Bay Area (GBA) and Beijing-Tianjin-Hebei (BTH) regions also increased respectively, from 4% to 5.2% and from 7.3% to 7.8%.

The YRD region registered a gross domestic product (GDP) contribution to the national economy of 24% in 2020, a jump from 19% in 1991. In comparison, the share of the GBA region's contribution was 11% in 2020 while the share of the BTH region's contribution was 8.5% in 2020. The YRD economy is hence larger than other major economic regions in China.

Externally, the region is equally important. In 2019, the value of export from the region as a share of the country's total was approximately 39% and for import, it was 32%. Utilisation of foreign direct investment (FDI) accounted for 31% of the national total in the same year.

Yangtze River Delta region vibrant but still lags behind globally

However, economic development in the YRD has been a cause for concern in recent years. The economic development level is still low compared to other major city clusters in the world, so is its GDP per capita. For example, GDP per capita from the Great Lakes Megalopolis (including Chicago, Detroit, Pittsburgh, Toronto, Montreal and Quebec) is about five times that in the YRD. Shanghai, as the most developed city in the region, has only one-fifth of the GDP per capita of New York City.

...about half of the cities in the region listed the metallurgical and petrochemical industry, which can dramatically promote GDP and investment, as a priority for industrial development in their 13th Five-Year Plan (2016-2020). This reduced the efficiency of the allocation of capital across localities.

A reason for the disparity in economic development is the low productivity due largely to resource misallocation at the micro level, which is in turn a result of distorted factor markets such as labour, land, technology and capital.

Many local governments are incentivised to implement local industrial policies to generate more tax revenue and local growth. To support their industrial policies, local governments may create entry barriers that will segmentalise the market as they give priority to industries that are associated with high investment and high output. Hence, the YRD also suffers from misallocation of capital as a result of local industrial policies.

For example, about half of the cities in the region listed the metallurgical and petrochemical industry, which can dramatically promote GDP and investment, as a priority for industrial development in their 13th Five-Year Plan (2016-2020). This reduced the efficiency of the allocation of capital across localities.

The lack of support between firms, universities and research institutes in technology innovation is another concern. Some reports suggest that without much support from universities and research universities, enterprises in the region do not have a strong incentive to invest in R&D activities.

However, these initiatives failed to fully address the concerns of factor mobility in the economic development of the region as local governments had no incentive to collaborate with each other and there were no clear mechanisms to support regional integration.

Few incentives for regional integration

Developing city clusters is known to support regional integration, facilitate factor mobility and exploit the agglomeration effect in innovation. Policy efforts to support the development of city clusters started decades ago in China.

In the 1980s, a Shanghai Economic Zone was established and ten cities in Jiangsu and Zhejiang provinces were members of the economic zone, joined thereafter by Jiangxi, Anhui and Fujian provinces. In the 1990s, after establishing the Pudong New Area, 14 cities in Jiangsu and Zhejiang provinces were considered a part of the YRD region. In 2010, a major regional development plan was released.

However, these initiatives failed to fully address the concerns of factor mobility in the economic development of the region as local governments had no incentive to collaborate with each other and there were no clear mechanisms to support regional integration.

To further address these constraints, two major initiatives, namely, the development of city clusters in 2016 and the national strategy of regional integration released in 2019, were promulgated; the two initiatives are set to have long-term effects on economic development in the region.

In 2016, the National Development and Reform Commission (NDRC) released the Yangtze River Delta City Cluster Development Plan. In the plan, the Yangtze River city cluster consists of Shanghai and 25 cities in Jiangsu, Zhejiang and Anhui provinces. Policies to improve factor mobility, including initiatives for public service integration as well as improving urbanisation, cost-sharing in environment protection and tax enforcement were also singled out in the guideline.

The need for improving factor mobility has become so salient that the Chinese government made the economic integration of the YRD a national development strategy in 2018. Shortly in 2019, the Chinese Communist Party Central Committee and the State Council issued The Outline of the Yangtze River Delta Regional Integrated Development Plan. The plan set 2025 as the year for significant progress in the integration of the YRD to be attained. In this guideline, one more city (i.e., Wenzhou) was included in the Yangtze River city cluster, making it a total number of 27 cities.

Technology a key thrust

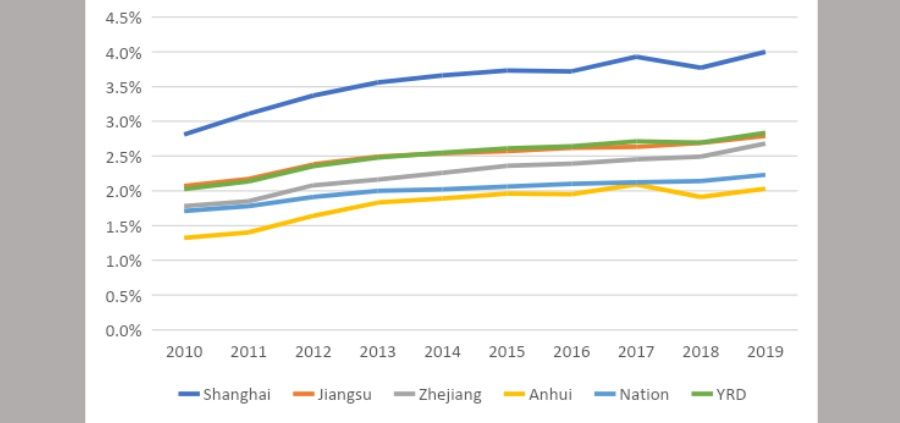

The guideline highlighted that 2025 would also be the year for at least 80% of the YRD to be covered with 5th generation (5G) mobile networks, for urbanisation rate to hit 70% and for its R&D expenditure as a GDP in the region to reach 3%, from 2.8% in 2019. This indicates the emphasis on the role played by technological innovation in the region's development.

Based on the guideline, the lead role will still be played by Shanghai, particularly in finance and innovation.

In this guideline, the advancement in technological innovation will also be applied to support international industrial clusters and facilitate technology transfers. This would require integrating innovation with industry and building an innovation ecosystem to support indigenous innovation. Two comprehensive national science centres, namely, Zhangjiang in Shanghai and Hefei in Anhui, have been singled out for support. By 2025, the gross output from the high-tech industry has been set at 18% of total output of above-scale industries.

Based on the guideline, the lead role will still be played by Shanghai, particularly in finance and innovation. Development of the Shanghai metropolitan area together with select cities (i.e., Shanghai, together with Suzhou, Wuxi and Changzhou in Jiangsu province), will be supported. The Shanghai metropolitan area will also have the additional role of coordinating the development of the Nanjing and Hefei metropolitan areas as well as between the Hangzhou and Ningbo metropolitan areas in Zhejiang.

The institution leading this national-level regional development strategy is the national-level Small Leading Group of Yangtze River Delta Integration coordinated by Vice Premier Han Zheng, with the NDRC as the coordinating government agency. After the release of the 2019 national guideline for the integration of the YRD, all four major regions released their own action plans and named their offices responsible for regional integration.

Some bottom-up initiatives to increase collaborations across cities also took place in recent years. The "G60 science and technology innovation corridor" was initiated by the Songjiang district of Shanghai in 2016 to build an integrated development platform in the region. The alliance, named after the highway linking Shanghai, Zhejiang, Jiangsu and Anhui, now has nine member cities in the region.

The region is set to play an important role in the dual circulation strategy first mentioned at a politburo meeting in May 2020. Enhancing domestic consumption and promoting indigenous innovation are major elements of the dual circulation strategy to prepare the country for the next stage of economic development.

Shanghai, Zhejiang and Jiangsu ranked respectively first, third and fifth among all provinces in disposable income per capita in 2020. These provinces will play an important role in promoting consumption given their high income. The region is also critical for indigenous innovation as R&D expenditure of the region accounted for 31% of the national total in 2019.

R&D expenditure on the increase

R&D expenditure as a share of GDP in all provinces in the region has risen in recent years (from 2% in 2010 to 2.8% in 2019, Figure 1) with an increase from 2.8% in 2010 to 4% in 2019 for Shanghai. Four out of 10 top semiconductor foundries in the world including Semiconductor Manufacturing Corporation (SMIC), Huahong group, United Microelectronics Corporation and Taiwan Semiconductor Manufacturing Corporation (TSMC) have factories in Shanghai. Of note is Zhangjiang High-Tech Park in Shanghai which is a "comprehensive national science centre" hosting many major semiconductor, biomedical and software firms among others. In July 2021, a major government guideline about transforming Pudong in Shanghai to a "pioneer zone" was released in which Pudong has its sights on being a leading international innovation hub.

While other provinces also saw an uptick in the innovation field in recent years, they are still way behind Shanghai in terms of research intensity. R&D expenditure as a share of GDP in Hangzhou and Suzhou in 2019 reached 3.45% and 3.25% respectively, much higher than the national average of 2.2%. Hefei, the capital city of Anhui province, is now a comprehensive national science centre, in the same rank as Shanghai's Zhangjiang and Beijing's Huairou and Shenzhen. It is also home to China's first DRAM chipmaker ChangXin Memory. Annual expenditure in R&D as a share of GDP in Hefei was 3.1% in 2019, much higher than the national average of 2.2%.

Nevertheless, the tension between local economic development and regional integration remains an issue to be addressed. As local officials are held responsible for local economic and social issues, they are incentivised to develop the local economy and compete with other localities.

A more detailed industrial development plan is hence necessary to facilitate collaboration between local governments.

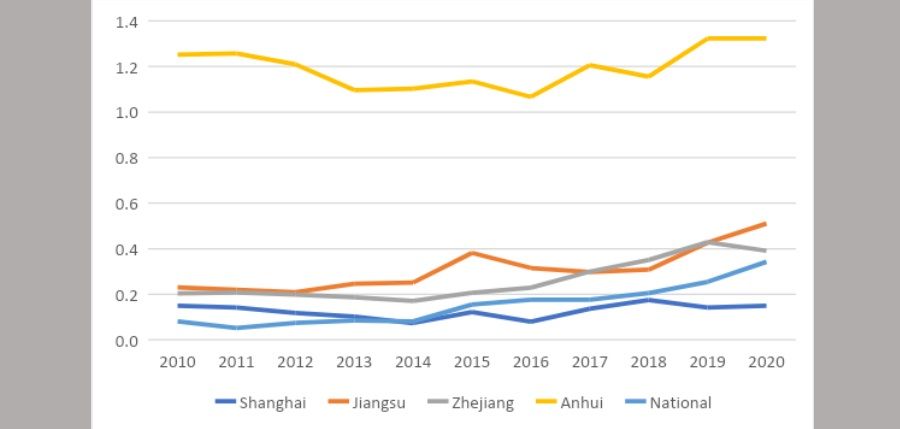

Fiscal support for the integration of public services and infrastructure building is very much a concern. Figure 2 shows the ratio of fiscal deficit and fiscal revenue in provinces in the region. Jiangsu, Zhejiang and Anhui have a higher ratio than the national average (0.25). In particular, Anhui province's fiscal deficit has seen a rapid increase in recent years. Its fiscal deficit was 132% of fiscal revenue in 2020, compared to 107% in 2016.

While provincial-level action plans highlight the importance of a division of labour among provinces, all provinces direct their efforts at the same high-tech and high value-added industry. Artificial intelligence, semiconductor and biomedical industries are in the development plans of all four provinces in the region. A more detailed industrial development plan is hence necessary to facilitate collaboration between local governments.

Further, the division of labour between policy intervention and market mechanisms has not been clearly spelt out. Currently, administrative intervention is the major mechanism for regional collaboration. For example, small leading groups have been set up by central and local governments to facilitate collaboration in investment and industrial development when the market mechanism is known to be more efficient in allocating resources to support collaboration. How to use market mechanisms to support regional integration would need more discussion and facilitation.