Is Shanghai on track to becoming an international financial centre in 2020?

Zhang Yugui, dean of the School of Economics and Finance at the Shanghai International Studies University, weighs up Shanghai's chances of becoming an international financial centre that can vie with leading cities such as New York and London. While he is certain that Covid-19 will not affect Shanghai's progression towards its goal, he feels there is no need for Shanghai to be overly fixated on letting the world know that it has become an international financial centre by a certain date.

The Covid-19 outbreak has not affected China's financial opening up, or the pace of pushing Shanghai to become an international financial centre.

On 14 February, the People's Bank of China, China Banking and Insurance Regulatory Commission, China Securities Regulatory Commission, State Administration of Foreign Exchange, and the Shanghai Municipal Government published Views on Accelerating the Building of Shanghai into an International Financial Centre and Financial Support for the Development of the Yangtze River Delta Economic Zone.

This comes as the whole of China is fighting the Covid-19 epidemic. It shows that even while this "black swan" incident has hit China hard, it is still doing all it can to make Shanghai an international financial centre. This signals the importance of an international financial centre to China.

These measures are targeted, and come with clear policy aims. The intention is to make Shanghai more open and innovative. Key elements and regulations are in place, to build Shanghai into an international financial centre that matches China's economic strength and the international status of the renminbi.

The Shanghai municipal government is wasting no time in following through on its long-held plans.

Then-mayor of Shanghai, Ying Yong (now Communist Party Secretary of Hubei), reaffirmed this in his 2020 Government Work Report delivered on 15 January. He said the groundwork to transform the municipality into an international financial centre, befitting of China's economic prowess and the global standing of its currency, would be completed within the year. A financial institutions system that is competitive internationally will also take shape as Shanghai speeds up the establishment of a global centre for the innovation, trading, pricing, and clearing of Renminbi (RMB) products; accelerates the building of a global asset management centre; and focuses on the development of financial technology (fintech).

To transform Shanghai into an international financial centre, the Shanghai municipal government released the Plan for Accelerating the Establishment and Implementation of the Shanghai Fintech Hub on 19 January. It includes 25 innovative and practical working measures in five areas, with the aim of making Shanghai a global fintech centre within five years.

Subsequently, the city took measures against the epidemic's impacts with the support of the central government's financial agencies. These include improving financial services, increasing funding support, and implementing financial support for epidemic efforts, hard-hit industries and small- and medium-sized enterprises. Fast tracks and other innovative services are made available in financial markets. There are more channels for direct financing for companies working on epidemic control, and transaction fees are waived in some instances. The Shanghai Stock Exchange even offers immediate approval to companies applying to list on the Sci-Tech innovation board (STAR Market).

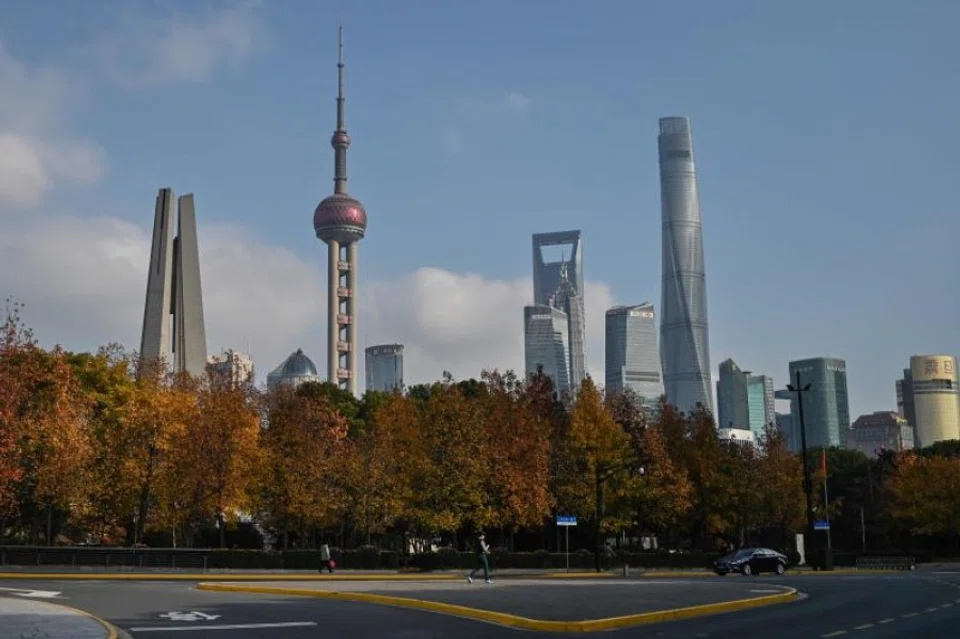

Today, Shanghai has the most developed financial exchange in mainland China, serving the securities, futures, foreign exchange, currency, gold, insurance, negotiable instruments, and diamond markets.

Of course, this also begs the question of whether Shanghai is aiming to become an international financial centre by 2020 or 2025. Besides, what are some of the bottlenecks encountered by China in its journey of turning Shanghai into an international financial centre? What are the characteristics of the financial centre that Shanghai is trying to become? When it becomes an international financial centre, will Shanghai be able to match up to New York and London? These are important questions worth pondering.

Building Shanghai's financial centre

In the 1930s, Shanghai was an international financial centre in the Far East. However, China was very poor and weak back then. So, as a financial centre, Shanghai mainly catered to the needs of foreign companies doing business in China and Chinese special interest groups. This meant that Shanghai did not have much national strategic significance as a financial centre then. The idea of establishing Shanghai as China's international financial centre was first mooted in the 1990s when the opening up and development of Pudong was underway. The financial instincts of Deng Xiaoping, the chief architect of China's reform and opening up, had a big role in this.

In 2008, nearly two decades later, Shanghai had the highest concentration of financial institutions in mainland China. The financial market in Shanghai was organised and well-structured. Today, Shanghai has the most developed financial exchange in mainland China, serving the securities, futures, foreign exchange, currency, gold, insurance, negotiable instruments, and diamond markets.

In retrospect, the 2008 global financial crisis provided Shanghai with a real opportunity to become a Chinese international financial centre with strategic significance. Chinese leaders realised that the black swan event was a historic opportunity for the country to redouble its efforts of establishing an international financial centre because the US and Europe were battered by the financial crisis and needed China's help.

During his working trip to Shanghai in July 2008, Wen Jiabao, the Chinese Premier then, proposed accelerating its development as an international financial centre, as well as an international shipping centre. The announcement was accompanied by the issuance of State Council documents. For many years, Shanghai had been seeking unequivocal support from the Party Central Committee for the international financial centre issue. This was an important signal.

In the Global Financial Centres Index (GFCI) that covers five key areas (business environment, human capital, infrastructure, financial sector development, and global standing), Shanghai is ranked fifth worldwide, behind New York, London, Hong Kong, and Singapore, but ahead of Tokyo.

In April 2009, at a State Council executive meeting chaired by Premier Wen Jiabao, the "Opinions of the State Council on Promoting the Rapid Development of Modern Service Industry and Advanced Manufacturing Industry in Shanghai and Making It an International Financial and Shipping Center" document was introduced.

It outlined the laying of groundwork to transform Shanghai into an international financial centre befitting of China's economic prowess and the global standing of its currency by 2020. In the decade which followed, the Shanghai municipal government, with state guidance, focused on improving financial factor markets and the financial institutions system, deepening financial reform and innovation, and optimising the market environment for financial development. Significant progress was made in these areas.

In January 2019, the People's Bank of China (PBOC) and seven other government departments jointly published the Action Plan for the Construction of Shanghai International Financial Center (2018-2020). The plan described China's objective of making Shanghai an influential player in the global financial market. RMB products will take centre stage in Shanghai and the municipality will become more adept at allocating financial resources. The financial services sector in Shanghai will be fair, under the rule of law, innovative, efficient, transparent, and open. Shanghai will essentially become one of the top international financial centres, befitting of China's economic prowess and the global standing of its currency.

Shanghai's strengths

As a financial centre, Shanghai's financial sector is increasingly internationalised. China A-shares and Chinese bonds have been included in major global indices.

Going by the conditions and support factors leading to the formation of international financial centres, China, as one of the two major global economies in the first part of the 21st century, should have an international financial centre that can match up to New York. This is why China is positioning Shanghai as an international financial centre. Both the central government and the Shanghai municipal government have injected a lot of human, material and financial resources towards building the international financial centre initiative. A number of breakthroughs have also been made in terms of institutional innovation, as well as in building and improving factor markets. In the Global Financial Centres Index (GFCI) that covers five key areas (business environment, human capital, infrastructure, financial sector development, and global standing), Shanghai is ranked fifth worldwide, behind New York, London, Hong Kong, and Singapore, but ahead of Tokyo.

According to the Shanghai Municipal Financial Regulatory Bureau, the main framework of the Shanghai international financial centre is basically in place. The Shanghai international financial centre's price formation and RMB payments clearing functions are relatively well-developed. Shanghai futures in gold and oil etc have improved the international capabilities of pricing RMB assets, and the municipality has become the primary hub for clearing global RMB payments. As a financial centre, Shanghai's financial sector is increasingly internationalised. China A-shares and Chinese bonds have been included in major global indices. Initiatives such as the Shanghai-Hong Kong Stock Connect, Bond Connect, and the Shanghai International Gold Exchange have been rolled out. Foreign financial institutions such as Goldman Sachs and BlackRock have also been expanding their market presence in Shanghai.

However, when measured against the relevant benchmarks of bona fide international financial centres such as New York and London, Shanghai is at best a regional financial centre with some international influence.

The supporting services of the Shanghai financial centre is becoming more comprehensive, and there are now more than 370,000 financial practitioners in the municipality. In many international rankings such as those on added value of the financial industry, and financial markets trading volume, Shanghai has performed very well. Therefore, it is entirely plausible for Shanghai to become an international financial centre on schedule.

Competition from Beijing and the world

However, when measured against the relevant benchmarks of bona fide international financial centres such as New York and London, Shanghai is at best a regional financial centre with some international influence. In the Asia Pacific, not only is its actual standing as a financial centre behind that of Hong Kong and Singapore, but it also trails its neighbour, Tokyo.

...it is more than 1000 km away from Beijing. Even with modern modes of transportation and communication, the issue of decision-making being out of sync with the market cannot be resolved effectively.

Additionally, Shanghai also faces domestic competition from Beijing - where financial policies are crafted and headquarters of top financial organisations are located - and Shenzhen, the most innovative region in China and a digital finance testbed. This means that, unlike London and New York, Shanghai does not enjoy the full support of the world or even China (in terms of financial resource allocation) in its journey to becoming a world-class financial centre.

Based on geographical location, the major international financial centres of London and New York (360 km from Washington and where the UN Headquarters is located) are either located in or near a country's capital. Other international financial centres such as Tokyo, Paris, and Singapore are situated in capitals. The reasons behind such a scenario are manifold, and include political, economic, historical and cultural ones. A key consideration, however, is ensuring that financial decision-making is in tune with the financial market.

In comparison, even though Shanghai has a rich history as a financial centre and is the most developed financial market in China, it is more than 1000 km away from Beijing. Even with modern modes of transportation and communication, the issue of decision-making being out of sync with the market cannot be resolved effectively. In fact, since its inception in 1997, academics in the monetary policy committee of the PBOC, which advises the central bank on its monetary policies, come mainly from renowned universities and research institutions such as Peking University, Tsinghua University, the Renmin University of China, the Chinese Academy of Social Sciences, and the Development Research Center of the State Council. One would be hard-pressed to find an expert from a Shanghai university or research institution in the above-mentioned committee.

...foreign companies account for less than 0.5% of the outstanding shares traded on the exchange. In comparison, the proportion of foreign companies is 32% and 16% on the New York Stock Exchange (NYSE) and London Stock Exchange (LSE) respectively.

In August 2005, the PBOC inaugurated a second headquarters in Shanghai to improve its decision-making and operational processes in order to promote the transformation of Shanghai into an international financial centre. Nevertheless, the problem of decision-making being out of sync with the market was not thoroughly resolved.

Even today, many financial professionals in Beijing view the 1.17 square kilometres of land on Beijing Financial Street - a financial news centre and the heart of the country's financial decision-making, financial regulatory, asset-management, and payment-clearing activities - as China's de facto financial centre.

In terms of financial market quality, being business-friendly, having the international nature and service standards of factor markets, and the market presence of foreign capital, Shanghai is still a long way behind New York and London, and the gap would take time to bridge. While the Shanghai Stock Exchange (SSE) has rolled out initiatives such as the Shanghai-Hong Kong Stock Connect and the Shanghai-London Stock Connect, and its stock market is among the top five globally in terms of size, foreign companies account for less than 0.5% of the outstanding shares traded on the exchange. In comparison, the proportion of foreign companies is 32% and 16% on the New York Stock Exchange (NYSE) and London Stock Exchange (LSE) respectively.

...it lags behind New York and London, and even Tokyo, Hong Kong, and Singapore in terms of business environment (software), high-end human resources, and reputation.

Furthermore, while foreign investors make up more than 20% of all investors on the NYSE, they account for less than 2% on the SSE. As for the bond market, even though the proportion of investment in the Chinese bond market by foreign organisations has increased to 2%, this pales in comparison to the situation in the US. For instance, in US treasury securities alone, foreign organisations account for 20% of investments. When it comes to the futures and derivatives markets, Shanghai is also far behind New York.

As for providing a business-friendly environment, even though Shanghai offers world-leading infrastructure (hardware), it lags behind New York and London, and even Tokyo, Hong Kong, and Singapore in terms of business environment (software), high-end human resources, and reputation.

As for the highly symbolic development of a global RMB-asset allocation and pricing centre, considerable progress has been made since 2015. However, RMB internationalisation is a monumental undertaking in itself, and it would already be quite remarkable if Shanghai can achieve its goal of becoming a RMB-asset pricing centre by 2030.

It embodies a nation's (and even global) technological levels, output, innovation, and ability for international coordination and leadership.

Whether Shanghai can obtain the rights to price global financial assets depends on the levelling up of China's economic development and the progress of RMB internationalisation. It also depends on whether top financial organisations such as Goldman Sachs, Morgan Stanley, JPMorgan, BlackRock, HSBC, Citi, and UBS view Shanghai as the most important platform to reap the dividends from China's economic development and RMB internationalisation. Presently, Goldman Sachs, JPMorgan, UBS and Nomura Securities are increasing their market presence in Shanghai as China further opens up its financial sector to foreign companies. This is certainly beneficial for Shanghai's quest to become an international financial centre.

If there comes a time when tech companies from the US, Europe, and Japan seek to be listed on the SSE's Science and Technology Innovation board (just like how Alibaba went public on the Nasdaq stock exchange), it would signify that Shanghai has established itself as an international financial centre in Asia.

International financial centres owe much to dominance in global politics, economy and security

Looking at the history of how international financial centres evolve and the contest for global financial leadership, one observes that financial centres are very important symbols of a country's standing in the regional or even global division of labour. In fact, financial centres are no longer just about market development and talent aggregation, and no longer a natural outcome of a nation's economic development. To a certain extent, a financial centre is the result of a country's strengths in manufacturing and in the global value chain. It embodies a nation's (and even global) technological levels, output, innovation, and ability for international coordination and leadership.

...there is no need for Shanghai to be overly fixated on letting the world know that it has become an international financial centre by a certain date.

The enduring success of London and New York as international financial centres owes much to the dominance that the UK and the US enjoyed (or enjoys in the case of the US) in global politics, economy and security. While the UK is no longer an economic superpower, and Brexit will further diminish its international standing, the international influence of its currency and London's role as an international financial centre mean that it continues to rank as a global financial heavyweight, just behind the US.

To the US, the financial sector is of paramount importance. After the global financial crisis in 2008, the US came up with a series of measures to consolidate its real economy in order to cement New York's position as an international financial centre. It would definitely not want to see Shanghai become an international financial centre, and competing with New York and London because that would mean it has to share a highly lucrative slice of the global wealth allocation pie with Shanghai, and global financial asset pricing power with China. Clearly, this is a highly sensitive issue that no American president or Wall Street capitalist can overlook.

The process that could take 20 to 25 years

Undoubtedly, China must push forward with its stated objective of completing the groundwork for Shanghai to become an international financial centre by 2020 instead of dragging its feet. However, from the perspective of laws of the market, global financial competition, and the strategic competition between China and the US, there is no need for Shanghai to be overly fixated on letting the world know that it has become an international financial centre by a certain date. This author is of the view that the evolution of China's financial market, opening up of its financial sector, RMB internationalisation, and improving its financial regulatory system are lengthy processes with numerous milestones.

China's real economy and financial might form the basis for its leadership in the global arena. Whether its leadership is enduring and credible depends on its performance in the face of complex international challenges, and this examination is a process that could take between 20 to 25 years. If China is able to continue developing at a steady pace, Shanghai can enhance its international financial centre fundamentals in an increasingly liberal market environment, and both the Chinese and American leadership are able to come up with an effective mechanism for sharing the benefits of global financial leadership amidst their strategic competition, then, Shanghai becoming the Wall Street of the East would be the most important event in the changing global financial landscape of the 21st century.

China will have to improve on early warnings for sudden public health incidents and step up on national governance, to stabilise China's economic development forecasts and better navigate the increasingly complex economic community.

The Western adage, "money never sleeps", is just as applicable in the East. Whether the East can harmonise with the West in the financial world requires more than just making platforms compatible through modifying trading rules. Political leaders also need to act wisely and have an accurate grasp of changing trends.

One final reminder: this Covid-19 outbreak has had some negative impact on China's economy, including some sunk costs that will be difficult to recover. It cannot be ruled out that some MNCs with investments in China and Shanghai will be worried about the fragility of being over-reliant on China's supply chain, and consider pulling out of the China market, which will be detrimental to building Shanghai into an international financial centre. China will have to improve on early warnings for sudden public health incidents and step up on national governance, to stabilise China's economic development forecasts and better navigate the increasingly complex economic community.

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)