Can China's ailing stock market turn the tide after the Chinese New Year?

Government intervention has seemingly given investors some respite amid the tumbling stock market. However, can the upward trend continue past the Chinese New Year? Lianhe Zaobao correspondent Yang Danxu looks into the matter.

"Life is not only about the stock market, but also about parents, spouses, children and friends. We recommend that investors temporarily leave the stock market, let go of their obsessions, change their mood and welcome the New Year with a relaxed and peaceful mood."

Amid China's recent stock market slump and waves of criticism and doubt, a listed company in China urged investors to take a break from the stock market in an online forum on 2 February.

Taking grievances to foreign embassies' social media

In an attempt to appease investors, the company added, "A company or individual investors can't possibly do anything to change the volatility of this market. We can only accept and adapt to this market environment."

The fact that nothing can be done to change the situation is perhaps the reason why the vast majority of investors and enterprises held hostage by the general environment are feeling helpless. Over the past weekend, helpless investors took to the Weibo accounts of foreign embassies in China to air their grievances.

On 2 February, the comment section of a social media post about giraffe conservation by the US embassy in China became the avenue for Chinese netizens to vent their frustrations about the economic downturn and stock market slump. In just a couple days, the post amassed over 100,000 comments and hundreds of thousands of likes. The comment section of the embassy's post on Chinese New Year was also hijacked in this manner.

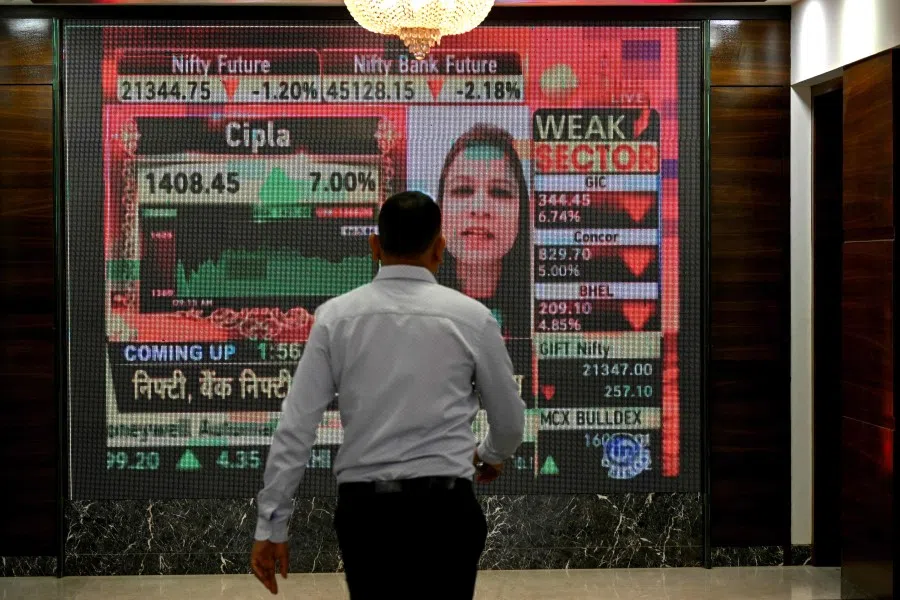

After their posts were taken off, some netizens then took to the Weibo account of the Indian embassy in China, lamenting that it was the Indian stock market that was "truly brimming with optimism".

A Chongqing netizen wrote the following couplet in the comment section: "Thousands of stocks fell to bid farewell to the old year; tens of thousands of people went into liquidation to welcome the new one."

A Fujian netizen responded with the horizontal scroll: "It's green all around." (Green in China denotes falling stock prices.)

With just a few days left until the Chinese New Year, whether Chinese investors can welcome the new year in a relaxed and peaceful mood depends on the market condition in the coming few days.

The CSRC further promised that the malicious short sellers who dare to flout the law will "lose their shirts and rot in jail".

Upward trend after government intervention

Chinese officials most likely foresaw the impending fight to protect the stock market prior to the Chinese New Year. According to sources, the China Securities Regulatory Commission (CSRC) among other supervisory organisations were set to report to Chinese President Xi Jinping on 6 February on the market situation as well as possible new measures. An informed source also told Bloomberg that the CSRC has worked round the clock, even on weekends, while the National Administration of Financial Regulation held more than ten meetings over the past two months to discuss how to stabilise the capital market.

The CSRC has repeatedly expressed their positions on problems such as share pledges and financial guarantees since 4 February. The authorities have also issued regulatory warnings, declaring that they would crack down on fraudulent issuance, financial fraud among other disinformation violations, as well as market manipulation and malicious short selling.

The CSRC attributed the underperforming stock market to "market manipulation and malicious shorting", which "seriously erode people's wealth, and stand on the opposite camp of individual investors". The CSRC further promised that the malicious short sellers who dare to flout the law will "lose their shirts and rot in jail".

Amid the gloomy stock market, the Chinese sovereign wealth fund, Central Huijin Investment Ltd., announced on 6 February that it would spare no effort in backing A-shares, adding that it fully recognises the current market allocation value of A-shares. It said that it recently expanded the scope of additional holdings in exchange-traded funds and would continue to increase its holdings and expand its size.

... nobody can be sure how long the officials would continue to intervene, whether it would be successful in turning things around for the ailing stock market, and whether this upward trend will sustain past the Chinese New Year.

After the various announcements from the "national team", the Chinese stock market started to see a rise across the board, with the Shanghai Composite Index at one point hitting the 2,800 mark. The index rose by 3.23%, the Shenzhen Component Index by 6.22%, and the ChiNext Index by 6.71%. Northbound funds, long seen as a bellwether for foreign investor sentiment towards Chinese assets, also significantly increased their positions, with net buying reaching around 12.6 billion RMB (approximately US$1.77 billion) on 6 February.

If this rising trend persists up till the Chinese New Year, it would at least provide some respite for shareholders, who can then calmly embrace the new year. But nobody can be sure how long the officials would continue to intervene, whether it would be successful in turning things around for the ailing stock market, and whether this upward trend will sustain past the Chinese New Year.

Maintaining China's growth story

The current situation in the Chinese stock market is largely due to confidence issues. Official messages aimed at stabilising the market and interventions by the national team are helping to shore up slipping confidence. However, relying on these measures to support the stock market does not address some fundamental issues affecting the market, including the sluggish real estate market, slow progress in transitioning between old and new economic drivers, and policy uncertainties - all of which are challenges facing the Chinese economy.

In a report on 5 February, Goldman Sachs pointed out that government interventions can help break the downward spiral of the stock market, but reforms, policy consistency, and plans to address macroeconomic structural challenges are necessary conditions for the valuation of Chinese stocks to rebound.

With the Chinese stock market experiencing volatility and the economy facing headwinds, many investors are also questioning whether China's years of prosperity are a thing of the past.

... investors are now withdrawing billions of dollars from a struggling China and redirecting most of that capital to India, which is now seen by Wall Street titans as a major investment destination for the next decade.

A recent Bloomberg report highlighted a significant shift in global markets. After two decades of betting on China as the world's largest growth story, investors are now withdrawing billions of dollars from a struggling China and redirecting most of that capital to India, which is now seen by Wall Street titans as a major investment destination for the next decade.

Since its reform and opening up, China has welcomed foreign investment with open arms, offering a vast market and an array of opportunities. Chinese entrepreneurs have dared to take risks, and the workforce has been diligent and hardworking. These upward forces have contributed to China's vibrant growth.

However, compared with the past few decades, both the Chinese stock market and the economy now appear sluggish and lacklustre, necessitating a new upward thrust. Only through bold reforms can a new consensus be formed and new momentum unleashed to maintain China's growth story.

This article was first published in Lianhe Zaobao as "中国股民能否过个安心年?".

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)