China and the world renew economic ties post-pandemic

As economic activities pick up in China after the country lifted its strict Covid-19 control measures, foreign businesses are raring to return to the world's second-largest economy. However, they remain hesitant due to the long time away and geopolitical considerations. Zaobao associate editor Han Yong Hong finds out if China can easily rebuild its economic ties with foreign businesses and the outside world.

Yesterday afternoon, my Beijing-based colleagues shared on WeChat that while they were scouting a shopping mall for a place to eat, they saw long, snaking queues forming outside several restaurants. This prompted them to ask if consumption has returned?

Modest start

It is indeed food for thought whether China's consumption has returned. Over the past few days, CCTV's Xinwen Lianbo has been reporting on the rebound in economic activities across various Chinese provinces. Many other Chinese media outlets are also focusing on the recovery in travel and consumption during the Spring Festival holiday, greatly boosting market confidence.

Globally, observers and businesspeople are keeping watch on the performance of China's consumer market, eager to know two things: one, did China's pandemic containment policy of "quickly getting past the peak" work, and are people resuming their daily activities? Two, how quickly will the world's second largest economy return to its former glory and time of pre-pandemic growth when there were opportunities for everyone?

Given the current situation, we can be cautiously optimistic. In January, China's manufacturing Purchasing Managers' Index (PMI) - an indicator of factory activities - rose for the first time in four months. During the Spring Festival holiday, consumer-related service sectors were also off to a modest start, although with some ways to go to return to their former stellar performance.

China is set to serve as the locomotive and stabiliser of the global economy again.

China's domestic travel during the Spring Festival holiday recovered to 88.6% of 2019 figures for the same holiday period, while domestic tourism revenue recovered to 73.1% of the 2019 level, highlighting that the people's anxiety about the pandemic has all but subsided. However, the country's per capita consumption expenditure still lags behind.

Notwithstanding, consumption has returned in certain areas such as e-commerce and the box office. Based on value-added tax data released by the State Taxation Administration, the sales revenue of China's consumption-related sectors recorded an average annual growth of 12.4% during the Spring Festival holiday compared with the same period in 2019.

Some analysts thus described China's consumer market in the first post-pandemic Spring Festival holiday as "lukewarm", that is, not quite a "revenge rebound in spending" but a stemming of losses.

Seasoned entrepreneurs who have forayed into China are well aware that despite the Western media's doubts, China's latest Covid-19 wave has passed its peak.

Pull of the massive market

However, the awakening of this massive economy cannot be ignored. In late January, the International Monetary Fund (IMF) revised up its 2023 global growth forecast from 2.7% in October 2022 to 2.9%, mainly because China's reopening has "paved the way for a faster-than-expected recovery". The IMF also revised China's growth forecast significantly higher from 4.4% in October to 5.2% this year. Indeed, China is set to serve as the locomotive and stabiliser of the global economy again.

During the Spring Festival gatherings, the businesspeople in my social circle would often ask: "When are you travelling to China?" Seasoned entrepreneurs who have forayed into China are well aware that despite the Western media's doubts, China's latest Covid-19 wave has passed its peak. However, after drifting apart due to the three-year-long pandemic, they have lost their familiarity with China. They are now somewhat hesitant and need a little more courage to find their former momentum to expand their businesses in China.

Since the China-US trade war began in 2018, many businesses avoided putting all their eggs in one basket by shifting part of their supply chain outside of China, to markets including Southeast Asia, India and Africa. China's harsh Covid-19 measures since 2020 and rumours of political interference and unfriendliness - as well as the real measures implemented - towards enterprises also deterred them from stepping into China.

... a large market and economic growth potential are China's greatest and most universal pull and soft power.

It is undeniable that the other markets are a far cry from China in terms of scale, depth and growth potential, but the risk has to be spread out. However, once China opens up, everyone will still want a share of it.

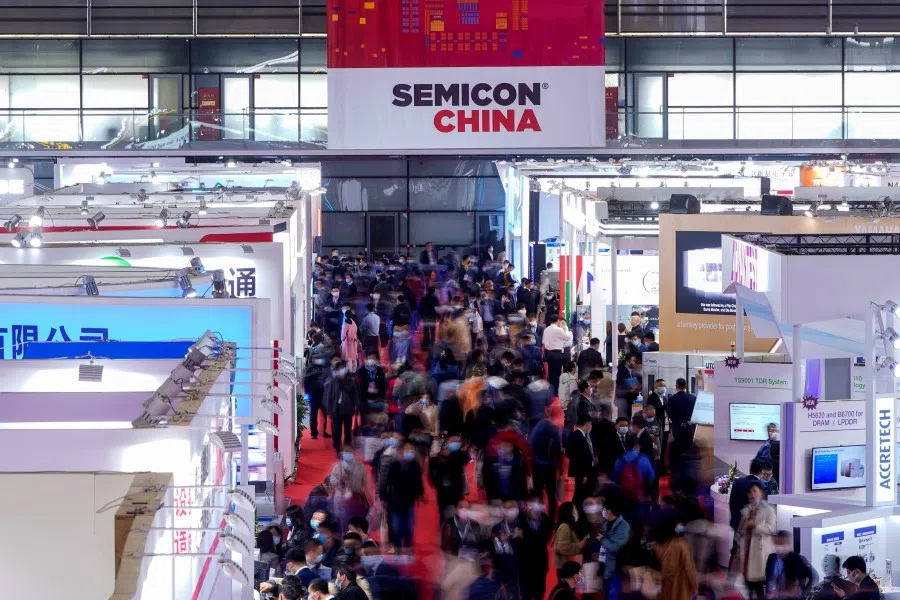

How can China do without foreign businesses? Since mid-December, many provincial governments and foreign companies have chartered flights overseas to pull in business and attract funds, mainly from places such as Germany, Japan, South Korea, Singapore and Sweden.

China media outlets reported that a member of a trade delegation from the Jiangsu and Zhejiang areas was full of worries on the flight: "We haven't been back for three years, would our old friends still have a place for us?"

But her old client eventually placed a large order after their in-person meeting, just as Europe continues to face challenges such as the energy crisis. Another exporter lamented that this post-Covid trip was not so much a fight for orders, but a return to the world.

These anecdotes illustrate that a large market and economic growth potential are China's greatest and most universal pull and soft power.

Despite the geopolitical considerations, some countries with different values from the West are choosing to strengthen economic cooperation with China...

Geopolitical considerations

China is fully aware of the power of its market, and so it relaxes or lifts market entry approvals to friendly countries as "rewards", but "punishes" unfriendly ones.

However, China sometimes underestimates the costs of doing so, because using the market as a tool is a double-edged sword. Once the other party has no expectations of China's market, they have no stake in it and nothing to lose.

One example is the recent worsening of relations between China and South Korea. Following the THAAD incident, South Korean companies have pulled out of China and South Korean stars cannot enter the China market. As a result, fewer South Koreans are learning Chinese and many Chinese language centres in South Korea have closed down, while universities are no longer able to run Chinese language classes. All this has added to the barriers and animosity between both sides.

The current US government is very clear about China's strengths and weaknesses, and has come up with aggressive measures such as cutting off technology supply and decoupling, to contain China's technology development while drastically reducing the world's mutual dependence with China.

These measures have proved effective - as mentioned above, multinational companies have shifted parts of their supply chains out of China to avoid being caught between the China-US geopolitical struggle. Furthermore, the war in Ukraine in 2022 has added to these geopolitical tensions. Now that China is actively returning to the world, geopolitics is a new burden that it cannot shed.

Despite the geopolitical considerations, some countries with different values from the West are choosing to strengthen economic cooperation with China, with many examples in the Middle East.

As China and the world renew their ties, new political risks, an unfamiliar environment and China's uncertain speed of recovery, are factors that everyone has to adapt to, but there are always more solutions than problems.

The past three years have been a unique lesson on the fact that China and the world cannot do without each other - even if there is some trepidation now, they will have to get close to each other again.

This article was first published in Lianhe Zaobao as "中国与世界战战兢兢重返彼此".