China expected to continue stellar economic performance in 2021

China is leading the recovery of the global economy from the Covid-19 pandemic. It is the only major economy with a positive growth in 2020 as its gross domestic product (GDP) registered 2.3% growth in 2020, which is higher than the 2.1% growth projection, according to the latest data released by the National Bureau of Statistics on 18 January.

The expansion in industrial production and fixed asset investment, by 2.8% and 2.9% respectively, played an important role in boosting the economic recovery, whereas the retail sales sector lagged behind, falling by 3.9% compared to 2019.

The country's GDP in the fourth quarter of 2020 hit 6.5% growth year-on-year, which is well above the 4.9% achieved in the third quarter and exceeds the growth projection of 6.2% in a Bloomberg poll.

Pandemic control gave China a push off the starting blocks

What sets China apart from the rest of the major economies is that the country has controlled the pandemic well, whereas other major nations are now re-imposing curfews, lockdowns and other health restrictions to curb new waves. The difference pulls China ahead of other major economies and enables it to be a driving force for the recovery from the global crisis.

According to the report published by the World Bank in December 2020, the swift recovery of China's economic activity is attributed to its skillful and effective management of the pandemic, strong policy support and surprising resilience of the exports sector.

Despite being the first place to be struck by Covid-19, China was well-placed to contain the transmission of the coronavirus by taking many stringent measures, including imposing quarantines in the cities with Covid-19 cases, limiting social gatherings, implementing social distancing, etc. Furthermore, responding to the economic collapse caused by the pandemic, China's central and local governments have been rolling out a series of policies to help businesses to resume production.

According to recent customs data, exports rose 21.1% in November from a year earlier, bringing it to a record in the country's history.

By as early as March 2020, most of China's factories had resumed their normal production activities. Now, nearly eleven months on, most economic activities have returned back to its pre-Covid 19 trajectories. China's Purchasing Managers' Index (PMI), which is an index of the prevailing direction of economic trends in the manufacturing and service sectors, came in at 51.9 for December, which was called "the second highest reading for last year after it hit a three-year high in November" by China Daily.

Brisk factory recovery and high demand for products

The brisk factory recovery and the strong global demand for medical products and electronic goods made exports the biggest contributor to the impressive rebound in China's manufacturing sector in 2020. According to recent customs data, exports rose 21.1% in November from a year earlier, bringing it to a record in the country's history. And it achieved 18.2% in December, above expectations of a 15% increase, even with a stronger RMB exchange rate policy. For all of 2020, exports increased 3.6% whereas imports edged down 1.1%, providing an evident boost to GDP growth.

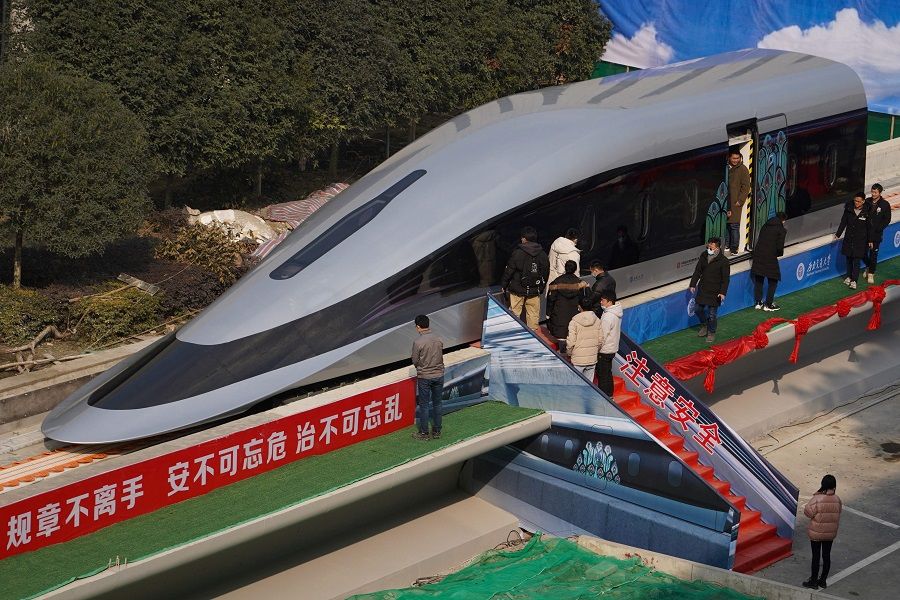

Meanwhile, accelerating fixed asset investment including infrastructure and property was also a strategy used to counteract the economic impact of Covid-19. Earlier in March 2020, most major cities made plans for infrastructure projects. They put more emphasis on high-tech sectors such as 5G networks, big data centres, industrial Internet, inter-city high-speed rail, etc. And in August 2020, China Railway group published its plans to increase the country's high-speed network, almost doubling it in size by 2035. It will expand the internal market and allocate social resources more evenly across the country.

As for foreign direct investment (FDI), global FDI plunged dramatically, falling 49% in the first half of 2020, while China FDI was up 6.3% in the first 11 months of 2020 year on year.

It is worth mentioning that in order to help small and micro enterprises to maintain cash flow, the People's Bank of China (PBOC) decided to use 400 billion RMB (about US$ 61.7 billion) of a special re-lending quota to purchase 40% of inclusive loans to small and micro businesses issued by local banks from 1 March to 31 December.

Paying attention to micro, small and medium enterprises

Covid-19 hit micro, small and medium enterprises (MSMEs) much harder, especially those in the services industry, as they could not comply with the strict health rules and were not able to let their employees work from home. Nevertheless, smaller companies continued to be a main driver of China's economic performance. According to government statistics published in 2019, "about 30 million small and medium-sized businesses contribute more than 60% of the country's GDP", and they "employ more than 80% of China's workers". Hence, it was crucial to cushion these businesses from the pandemic recession.

To save these struggling businesses and prevent mass unemployment, the central government not only pumped billions of dollars into the money market but also required local governments to take combined measures to help small businesses, such as through the provision of tax, fee reductions and exemptions, financial support, deferral loan repayment, social security benefits, etc., to accelerate the nation's recovery. It is worth mentioning that in order to help small and micro enterprises to maintain cash flow, the People's Bank of China (PBOC) decided to use 400 billion RMB (about US$ 61.7 billion) of a special re-lending quota to purchase 40% of inclusive loans to small and micro businesses issued by local banks from 1 March to 31 December. And these stimulus measures have been extended to 2021 as needed, according to the latest government statement.

China's steady rebound has not only been boosted by the supply side of the economy, it has also been strengthened by the demand side, although these two sides are not quite balanced at the current stage. Looking at the earlier data in August 2020, industrial output rose by 5.6% year-on-year, while China's retail sales, which reflect domestic consumption, rose only 0.5%. But recent retail data shows that consumption has picked up. In November 2020, China's retail sales of consumer goods rose by 5% year-on-year, which was the fastest growth in retail trade since December 2019. Those mid-end consumers were the main supporters of retail sales, especially for the cosmetics, jewellery sectors and luxury goods, said Iris Pang, ING'S chief economist for Greater China.

And on the first day of the golden week (China's National Day), it saw 97 million tourists, which was 73.8% of the number last year, according to the Ministry of Culture and Tourism of China.

Domestic tourism promising

With Covid-19 under good control along with international travel restrictions, domestic tourism has quickly recovered to near pre-pandemic levels. Earlier in September 2020, ticket sales from Trip.com, China's biggest online travel agency, showed that local tourism has recovered to around 80% compared to 2019. And on the first day of the golden week (China's National Day), it saw 97 million tourists, which was 73.8% of the number last year, according to the Ministry of Culture and Tourism of China. Furthermore, local tourism also stimulated the offshore duty-free sales on Hainan island to about 25 billion RMB for 2020, according to official figures, as Chinese consumers, who usually go abroad to buy cosmetics, jewellery and watches, cannot travel very much internationally. Last week, Trip.com CEO Jane Sun said the portal is very optimistic and "more confident than ever" about the recovery of China's domestic tourism in the long run.

Much of the whole world has a positive view of China's economic growth prospects in 2021. China's growth rate is expected to grow extraordinarily fast in 2021, jumping to 8% before slowing to 4.9% in 2022, according to a recent report released by the Organisation for Economic Cooperation and Development (OECD). Whether China is able to meet such expectations depends on how the government effectively implements its "dual-circulation" strategy, which keeps China open to the world and reinforces its own market at the same time. In addition, external factors such as global recovery and the tension with the US will also affect the nation's performance in the future.