China looks to Southeast Asia for AI edge

Amid ongoing US-China AI rivalry, China recognises the importance of global partnerships and has shifted its focus towards Southeast Asian countries, say academics Shaleen Khanal and Zhang Hongzhou.

The pursuit of technological superiority stands as a defining feature in today's arena of global strategic competition. In this pursuit, artificial intelligence (AI) occupies a central role owing to its emergence as a disruptive force with far-reaching consequences. The race to AI dominance features two clear challengers - the US and China. These two nations are leading in terms of research and development (R&D) and the applications of AI.

Focus area and impetus from US restrictions

Many scholars attribute AlphaGo's victory over human champions between 2016 and 2017 as the genesis of China's fascination with AI. However, the earliest official plan to promote AI as a strategic industry had already appeared in 2015 with the launch of the Internet Plus Action Plan which recognised AI as one of the 11 industries as priority sectors. Beijing launched its first AI-specific plan, the New Artificial Intelligence Development Plan (NGADP) in 2017 which showcased the country's recognition of AI as a frontier breakthrough technology, and signalled its ambition to be a global leader of AI research and application by year 2030.

To pursue this goal, the government has announced a significant increase in investments to promote R&D and applications in AI. As a consequence, the AI sector in China is booming. At present, there are more than a million AI-related businesses in China, and this number is growing every year. China globally leads the world in terms of patents and research output on AI.

... progress in AI development and governance demands global partnerships.

Recognising the growing Chinese presence in the domain of AI, the US has imposed a wide range of measures to curb China's access to cutting-edge AI technology. This has involved putting Chinese companies on its Entity List, limiting access to high-performance AI chips and semiconductor manufacturing machines, and restricting Chinese investments in critical technology sectors including AI.

These measures have prompted Chinese policymakers to pursue a strategy of self-reliance in AI technology within China. However, progress in AI development and governance demands global partnerships. For one, international collaboration is key to generating high-quality research output. Additionally, even though China is big, external markets are vital to securing technology lock-in and increasing reliance on Chinese technology in the global markets. Finally, global leadership implies going beyond research and application, but also securing rights to global governance mechanisms including setting standards and legal framework. This requires international support.

... ASEAN has emerged as a key strategic partner for China.

China seeks ASEAN partners in AI

In this context, ASEAN has emerged as a key strategic partner for China. ASEAN's geographic and cultural proximity, growing population and vibrant economy have been key features of its attraction for China. Even before AI, China, under its "neighbourhood diplomacy", has considered ASEAN as an important strategic and economic partner. Moreover, since 2013, with the inception of the Belt and Road Initiative (BRI), which has been a cornerstone of China's global outreach, China has been prioritising the Southeast Asia region in its outward economic and political engagement, aiming to enhance regional connectivity and foster closer ties. Then, the Digital Silk Road, as an extension of BRI, represents China's vision to extend its digital and technological prowess beyond its borders which has a specific focus on Southeast Asia.

Southeast Asia, with its burgeoning tech market, has emerged as a critical arena for these expansion efforts, offering a unique blend of opportunities and challenges for Chinese tech firms. As a result, over the years, China and the Southeast Asia region have seen growth in economic dependency with increasing patterns of trade, investments and industrial alignment. In recent times, AI has emerged as another key driver in this partnership through three important mechanisms: the expansion of large Chinese technology companies in the Southeast region; research collaborations between Chinese and ASEAN scholars; and government-led collaboration initiatives.

China's "go global" strategy has been in effect for more than two decades now. Large technology companies and state-owned enterprises in China receive subsidies and tax breaks to invest abroad. Many countries in ASEAN also encourage investments from such large technology companies in their country. Even without such encouragement, the pool of skilled professionals and large market is attractive to Chinese companies. Companies like Alibaba, Tencent, Huawei and SenseTime are actively engaging with governments and markets in various ASEAN countries.

Research has emerged as another area of collaboration between ASEAN and China.

Win-win collaborations on AI research

Singapore, for instance, hosts the regional offices of Alibaba and Tencent. These companies have also opened their own research laboratories, and have partnered with local universities attracting a local research talent pool. While their presence in other countries such as Malaysia, Thailand and Indonesia is not as prominent, it is increasing over time where they are working with local companies and governments in areas of smart city development, talent development, infrastructure investment and providing AI-related products and solutions.

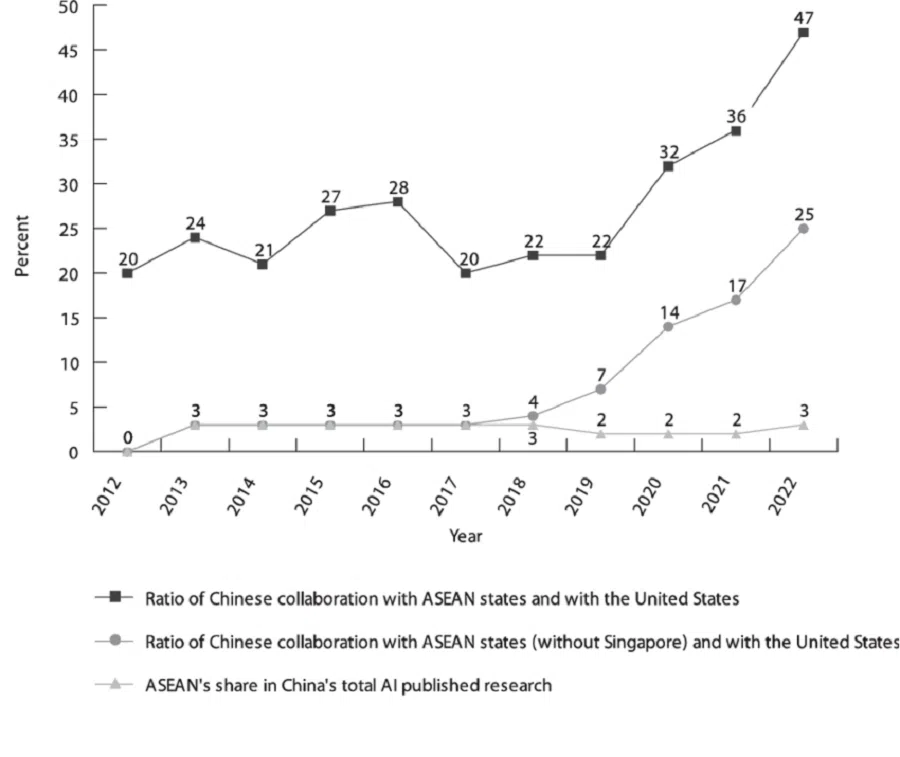

Research has emerged as another area of collaboration between ASEAN and China. While companies have been at forefront of this effort as well, working closely with universities in ASEAN countries, research bodies within China have also engaged with their ASEAN counterparts to work on AI research. For example, a government-to-government agreement between China and Malaysia has led to AI research collaboration between China Academy of Information and Communications and Universiti Malaya. The China Academy of Sciences has a similar arrangement with Chulalongkorn University. Such cooperation efforts have been noticed with Indonesia and Singapore as well. As a result, there has been a steady rise in joint research collaborations (in terms of academic articles' co-authorship) among Chinese and ASEAN scholars.

... regions and provinces like Guangxi and Yunnan have utilised their proximity with ASEAN countries to increase investments in the region.

Local governments in China seek out ASEAN partners

The last mechanism is the proactive role taken by Chinese governments both at the central and local levels to strengthen AI cooperation with the Southeast Asian countries through various challenges. At the central level, initiatives have involved greater cooperation with ASEAN as at regional level on issues such as digital cooperation, e-commerce and artificial intelligence. At a bilateral level, partnership on AI has mostly involved Singapore, perhaps the most AI-ready country in ASEAN. China has expressed willingness to join the Digital Economy Partnership Agreement with Singapore and the two countries have agreed to set up a digital policy dialogue to develop partnerships around issues of digital trade and artificial intelligence. Agreements with other ASEAN countries have mostly focused in areas of digital trade, and establishment of technology centres.

At the sub-national level, historically, provinces like Jiangsu and Sichuan have worked with foreign governments (most notably Singapore) to build industrial and technology parks in the provinces to import knowledge and technology by attracting technology-related investments. More recently though, regions and provinces like Guangxi and Yunnan have utilised their proximity with ASEAN countries to increase investments in the region. Guangxi, in particular, has been highly active in leveraging AI as a mechanism for diplomacy. Through initiatives such as the China-ASEAN Artificial Intelligence Summit, China-ASEAN Information Harbor (and Forum), and the Forum on China-ASEAN Technology Transfer and Collaborative Innovation, it has attempted to foster collaboration between Guangxi (and more broadly China) with other ASEAN countries.

... the increasing investment of Taiwanese semiconductor firms in Southeast Asia indirectly benefits Chinese companies.

Inadvertent boost from Taiwan companies

Interestingly, amid escalating tech/AI rivalry between China and the US, mainland China and Taiwan are increasingly engaging with Southeast Asia, albeit with distinct strategies and objectives. Mainland entities, encompassing tech corporations and government bodies at both central and local levels, are pursuing broad goals, including tapping into new markets, acquiring data, securing funding and garnering support for their roles in regional and global governance frameworks.

Conversely, Taiwanese interests, primarily spearheaded by semiconductor manufacturers, such as TSMC, are focused on mitigating geopolitical risks and achieving supply chain resilience. Nevertheless, the increasing investment of Taiwanese semiconductor firms in Southeast Asia indirectly benefits Chinese companies. Despite facing challenges in accessing advanced semiconductor technologies domestically - largely due to US sanctions - Chinese firms would find the region more appealing due to the presence and activities of Taiwanese tech companies which have been injecting new energies to the local huge semiconductor sector.

The ongoing AI rivalry between China and the US represents a technological marathon with significant worldwide implications. As the US strives to limit China's access to advanced AI technologies through close coordination with its allies, China is taking a two-pronged approach in response. On the one hand, with strong commitment from top leadership and substantial investments in AI R&D, China is determined to achieve self-reliance in AI. On the other hand, China recognises the importance of global partnerships and has shifted its focus towards Southeast Asian countries.

This pivot towards Southeast Asia demonstrates China's understanding of the critical role of international collaboration in the pursuit of AI supremacy. The ongoing China-US rivalry extends beyond a simple bilateral competition and has far-reaching implications for the future of AI technology and its global governance framework.

An initial version of this article was first published in Asia Policy, January 2024.