China's auto exports belie roadblocks to conquering Europe and US

Chinese automakers have performed well in their push to go global, especially as Europe is now its biggest overseas market. But with Europe and the US ramping up policies to promote their own EV industries, the road ahead for Chinese automakers is not without hurdles.

(By Caixin journalists An Limin, Chen Lixiong and Ding Yi)

Riding the wave of an electric vehicle (EV) frenzy and the global shift towards electrification, Chinese automakers have performed well in their push to go global, but the road ahead is not without hurdles, especially from some governments in Europe and the US, which are ramping up policies to promote their own EV industries.

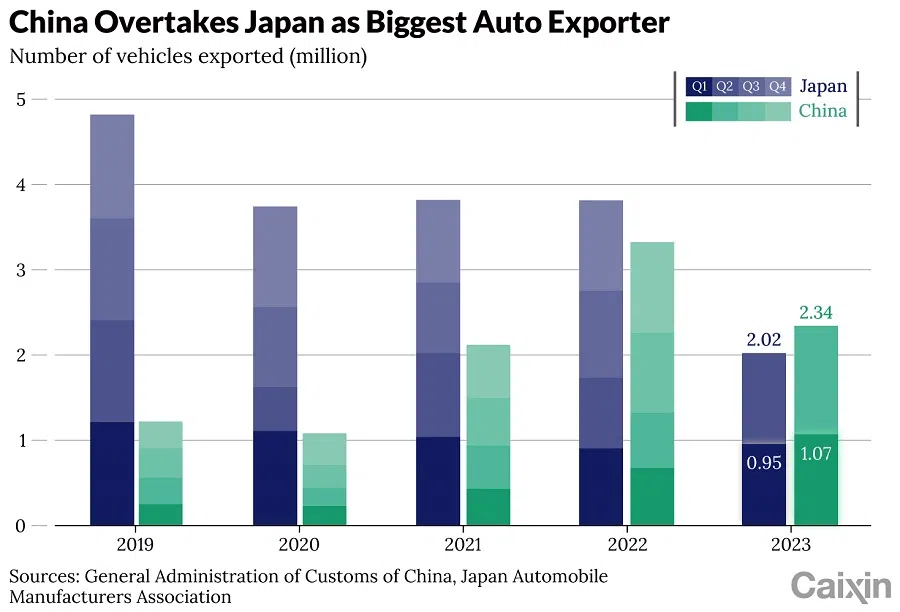

In the first six months of 2023, Chinese auto exports ballooned 75.7% year-on-year to 2.14 million vehicles, extending strong growth seen in the first quarter when China overtook Japan as the world's largest car exporter for the first time, according to data provided by the China Association of Automobile Manufacturers (CAAM).

First-half overseas shipments of new-energy vehicles (NEVs) - a category that consists mainly of pure electric and hybrid models - more than doubled to 534,000 units, accounting for nearly a quarter of the total car exports.

The rosy figures have fuelled a belief that China will claim the top spot for the full calendar year, with some analysts predicting that Chinese automakers will ship more than four million vehicles in 2023...

The rosy figures have fuelled a belief that China will claim the top spot for the full calendar year, with some analysts predicting that Chinese automakers will ship more than four million vehicles in 2023, with the contribution from NEVs jumping to around 35% from 21.8% in 2022.

European growth

In a May report, analysts from Germany-based Allianz Research described China as leading the global EV race, with a competitive edge in nearly all aspects of the industry value chain due to the country's massive investment in its EV ecosystem, starting more than a decade ago.

In the late 2000s, the Chinese government began offering purchasing and tax incentives to support the development of the domestic electric car industry, recognising the then-niche segment of the auto market as a future arena for global competition.

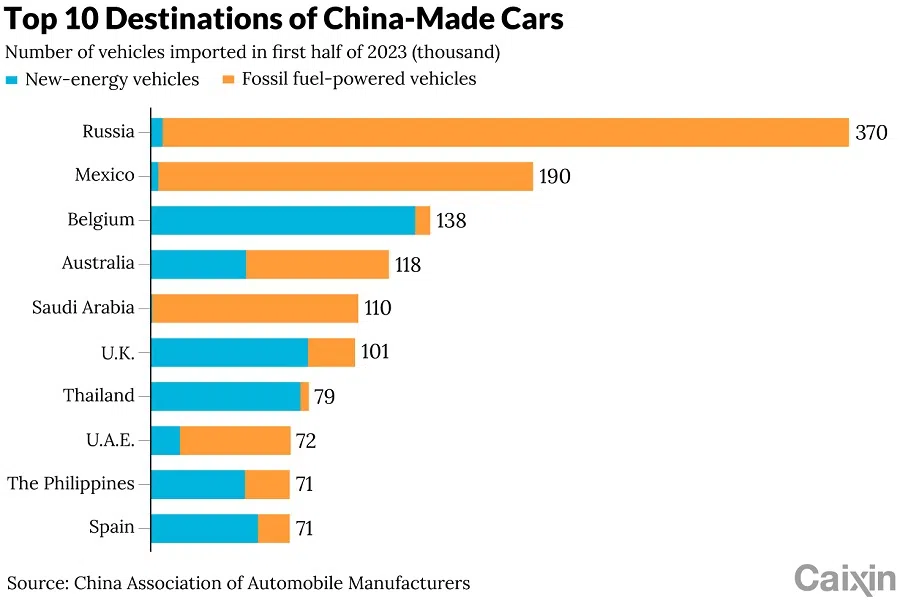

Europe is now the biggest overseas market for Chinese automakers, which used to focus on emerging markets in Asia, the Middle East and South America, according to the report. Three of Europe's best-selling EVs in 2022 were Chinese imports.

... Chinese carmakers are facing roadblocks in their expansion overseas as factors such as changes in government policies and geopolitical influences weigh on their ability to grow unchecked.

The report also predicts that Europe-made cars are likely to be displaced by those made in China, irrespective of whether they are Chinese, American or European brands, as the EU has approved a law banning the sale of new fossil fuel cars from 2035.

Chinese automakers' growing presence in Europe is evident in Germany, the region's largest car market. As of the first quarter of 2023, there were six Chinese carmakers selling EVs in Germany, compared with only two from the same time last year, according to the report. The firms' sales accounted for 3.7% of all EV sales in the country in the first three months of the year, up from 1.2% a year ago.

Yet Chinese carmakers are facing roadblocks in their expansion overseas as factors such as changes in government policies and geopolitical influences weigh on their ability to grow unchecked.

France, for example, announced in May a plan specifically to subsidise purchases of new EVs that are manufactured in Europe and meet the EU's low-carbon standards.

One possible workaround beneficial for European countries and China would be allowing Chinese investment in European car assembly, similar to the way the US opened up to Japanese carmakers in the 1980s.

The move, which analysts said would help the region's auto industry withstand the threat of cheaper Chinese imports, comes amid the fact that about 40% of the yearly 1.2 billion euro electric car purchase incentives paid out in France since January 2023 went to EVs made in Asia, according to Finance Minister Bruno Le Maire at a presentation of the Green Industry draft bill in May.

"We are not going to use French taxpayers' money to accelerate non-European industries," French President Emmanuel Macron said.

One possible workaround beneficial for European countries and China would be allowing Chinese investment in European car assembly, similar to the way the US opened up to Japanese carmakers in the 1980s.

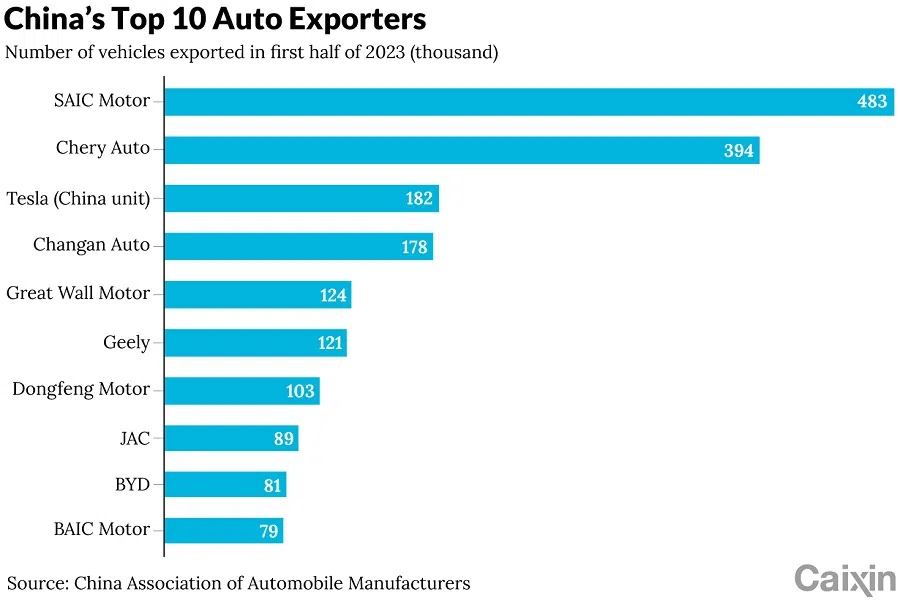

Some Chinese manufacturers are already pursuing this route. In July, state-owned SAIC Motor Corp. Ltd. unveiled a plan to build an EV factory in Europe, where its sales topped 100,000 units in 2022. The company retained its crown as China's biggest auto exporter in the first half of this year, shipping 483,000 cars overseas, according to CAAM.

US resistance

Penetrating the US market is perhaps the biggest challenge for Chinese automakers.

The Biden administration in August 2022 signed into law the Inflation Reduction Act, which includes a provision entitling a car buyer to a tax credit of up to US$7,500 for the purchase of an EV assembled in North America, while barring so-called "foreign entities of concerns", possibly including Chinese manufacturers.

The Act also stipulates that a certain proportion of the critical minerals and battery components used in EVs sold in the US must be produced locally. The amount is expected to rise annually.

The two provisions are another blow as China's EV makers try to expand in the world's second largest auto market while bogged down by taut trade relations between Beijing and Washington.

The US already imposes a 27.5% import tariff on China-made cars, which was introduced by the Trump administration.

In addition to regulatory hurdles, many Chinese automakers still lack experience in developing products for overseas consumers and doing business in foreign markets, an industry insider told Caixin.

One option for Chinese carmakers that can reduce the risks of expanding overseas is to acquire foreign brands. - Wang Hua, associate dean of the Emlyon Business School

A slight misstep could turn their overseas ventures into a "profit blackhole", he said, giving an example of an unnamed carmaker that had its EVs rejected by a European country's customs agency because their batteries did not meet local standards, after already shipping the vehicles to the port.

One option for Chinese carmakers that can reduce the risks of expanding overseas is to acquire foreign brands, said Wang Hua, associate dean of the Emlyon Business School, citing SAIC's purchase of British brand MG Motor as an example.

The MG brand accounted for nearly 70% of SAIC's overseas sales in the first half of 2023, and the company expects sales of its MG4 EVs to reach 100,000 in Europe this year, Yu De, SAIC's managing director of international business, told media in July.

In a similar move, privately owned auto giant Zhejiang Geely Holding Group Co. Ltd. purchased Volvo Cars from Ford Motor Co. in 2010. The acquisition also boosted Geely's global image and gave it access to the Swedish company's cutting-edge technology.

This article was first published by Caixin Global as "In Depth: China's Auto Exports Belie Roadblocks to Conquering Europe, U.S.". Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.

Related: Chinese exporters turn toward emerging markets | Chinese smart-car makers get into Tesla's lane | Shanghai Auto Fair: Battle of the Chinese EV giants | Chinese automakers rev up price war in race for market dominance | Chinese EV manufacturers face tough challenge against Tesla amid subsidy cuts