China's family-run businesses face succession issues

(By Caixin journalists Zhang Erchi and Han Wei)

China's economic boom over the past four decades has driven the flourishing of private entrepreneurship and led to the emergence of tens of millions of family businesses that have contributed to the country's rise as a global manufacturer. Now, many of these businesses are facing a common challenge: passing the baton to second-generation owners.

Private businesses have proliferated in China since the 1980s, when the country intensified efforts to reform its economy and engage with the global market. While some companies have evolved into world-renowned entities, such as the heavy equipment maker Sany Group and the appliance manufacturer Midea Group, the majority remain small- and medium-sized family businesses in niche markets, primarily in manufacturing and trade.

As the first-generation business founders approach retirement age, deciding whether to pass their companies on to their children and how to navigate the transition has become an imminent task.

According to a report by the All-China Federation of Industry and Commerce, more than 80% of China's 1 billion private enterprises are family-owned, with about 29% of these businesses in traditional manufacturing. From 2017 to 2022, around three-quarters of China's family businesses are in the midst of a leadership transition, marking the largest succession wave in Chinese history.

... private companies account for over 90% of all business operations in China. They contribute more than 60% of the country's GDP, half of tax revenue, more than 70% of technological innovation and research, and over 80% of urban employment.

The pandemic has sped up succession within Chinese family businesses. According to a 2022 survey by PricewaterhouseCoopers (PwC), the global professional services firm, 59% of family enterprises surveyed claimed to have "developed a succession plan", a considerable rise from about 19% in 2021. The pandemic and subsequent business uncertainty were likely the driving factors, according to PwC analysts. Travel restrictions enforced by the pandemic led family members to stay together, prompting discussions on succession, said the report.

The management shifts have major implications for China's economy as private companies account for over 90% of all business operations in China. They contribute more than 60% of the country's GDP, half of tax revenue, more than 70% of technological innovation and research, and over 80% of urban employment.

"Succession in private enterprises is not merely an internal issue for the businesses themselves but, to a certain extent, it also influences the development of the Chinese economy," Xiang Bin, founding dean and professor of China business and globalisation at Cheung Kong Graduate School of Business, said in an interview with Caixin.

The massive wave of succession also comes amid a changing business environment. Over the past decade, China's manufacturing industry has encountered successive shocks due to technological transitions, the China-US trade war, the Covid-19 pandemic and rising geopolitical tensions. Challenges such as a slowing domestic economy, rising labour costs and concerns about overcapacity are also posing challenges for the younger generation of business owners.

The wave of succession in China's private sector is bringing profound changes in the country's industrial landscape and holds implications for the global supply chain, experts said.

The new generation

Huang Xiyi, 28, is a so-called factory heir for taking her parents' business. Following Huang's studies in Boston, she returned to her hometown in Foshan, Guangdong province, and began working in her family's machinery manufacturing business. In an article that went viral on China's internet, Huang described her struggle to learn how to run the business. The journey has been "very bitter and lonely", she wrote.

Huang's article attracted thousands of followers who shared similar stories of inheriting businesses.

"Previously, it was competition among the first-generation entrepreneurs," she wrote. "In the future, it will be among the second generation."

Unlike their parents who started the businesses from the ground up, the heirs are usually less familiar with the operations and less enthusiastic about traditional industries. Although they were born to inherit the businesses, many of them would have chosen not to assume the responsibility, said Xu Zewei, secretary-general of the All-China Federation of Industry and Commerce's Youth Entrepreneurs Committee.

"As the first generation of entrepreneurs from the reform and opening-up era near their time to step down, businesses face a transition, with some second-generation members unwilling to take the helm," said Ding Xuedong, deputy chairman of the National Council for Social Security Fund. This is a factor behind shrinking private investment that weighs on the economic recovery, Ding said.

The new owners are more inclined to adopt digital solutions for factory transformation, invest in brand building and innovation, and implement modern corporate management methods.

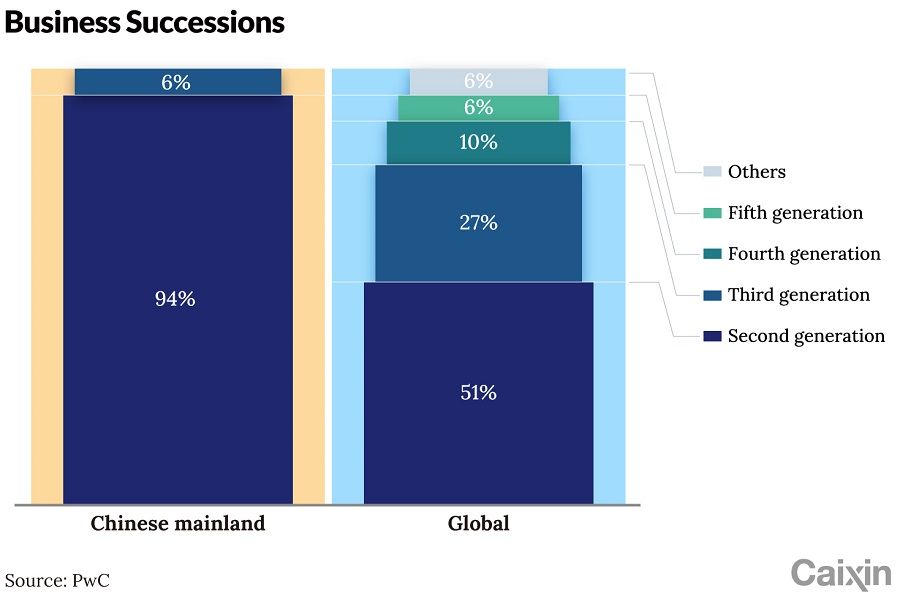

The 2022 PwC survey indicates that, among family-owned enterprises in the Chinese mainland, 94% have just passed to the second generation, with only 6% reaching the third generation. Globally, 51% of family enterprises have changed leadership to the second generation, 27% to the third generation, and 16% have reached the fourth generation and beyond.

In July, the central government issued guidelines to support the growth of private industry. The measures include guiding young entrepreneurs and facilitating succession plans. Policymakers believe that ensuring a smoother transition for second-generation entrepreneurs is crucial for bolstering private investment, according to government sources.

The younger generation of business owners stands out from their parents in many respects, including educations abroad and familiarity with the internet and new technology. The new owners are more inclined to adopt digital solutions for factory transformation, invest in brand building and innovation, and implement modern corporate management methods.

Fan Xinyu, an assistant professor of economics at Cheung Kong Graduate School of Business, said he has confidence in China's second-generation factory owners. "Give them three to five years, and there will be remarkable growth," Fan said.

Journey for succession

Over the past few years, many factory heirs have typically engaged in company management through new ventures, using their international experience and language skills to enter into cross-border e-commerce, foreign trade, or spearhead the companies' digital transformation. Their business records also are laden with unsuccessful attempts.

Zhao Yifan, 31, studied in the UK since high school and had his first job at a real estate agency in London. His father, Zhao Niangao, founder of Zhejiang Linya Group, has been persuading him for years to return to China and to take over the family business.

Started from a grass mat business in 1988, Zhao's father has built Linya into a mid-size conglomerate with businesses ranging from property development, construction materials to international shipping services. The company employs thousands of people.

In 2015, Zhao decided to return home to help his father and spent months in the factory to do all kinds of basic jobs. Since 2016, he has led Linya's new business of cross-border e-commerce, trying to sell its products aboard through online marketplaces such as Tmall and Amazon.

But Zhao underestimated the risks associated with cross-border logistics and the China-US trade war cost the business millions of RMB in losses for the new business and forced him to call a halt to some of the new business initiatives.

Several factory heirs told Caixin that they believe exports to developed markets in the US and Europe remain crucial for business and profit, yet it is challenging to sustain amid supply chain reshuffles.

It wasn't until 2021 when the US government provided substantial subsidies to counter the pandemic that Zhao saw the opportunity to revive Linya's cross-border e-commerce business. Surging orders from the US spurred Linya's overseas sales to a record $300 million RMB (US$41 million) that year.

The pandemic led many factory heirs who were studying abroad to return home to China where they started ventures in emerging businesses such as cross-border e-commerce, said Yan Xuedong, a senior executive of Alibaba's online cross-border retail service provider AliExpress.

Several factory heirs told Caixin that they believe exports to developed markets in the US and Europe remain crucial for business and profit, yet it is challenging to sustain amid supply chain reshuffles. Emerging markets are the new frontier, presenting both competitive advantages and risks for Chinese exporters.

Young business heirs are also behind companies' digital transformation, according to corporate digital solution providers like Alibaba's Ding Talk and WeChat's corporate service.

"When you return to the factory, it's more about factory workers teaching you how to do things - you'll always be the one with the least experience," Huang said. "But if you transform it into a digital factory, then it becomes us leading them forward."

Compared with their parents, who spent decades in factories involved in manufacturing processes, the younger generation of owners generally lack any knowledge about production, said Qiu Da, an executive of Ding Talk. What they do have are digital tools to help them identify problems and make judgements, he said.

"As more of the younger generation inherit businesses, digital transformation will become a necessity," Qiu said.

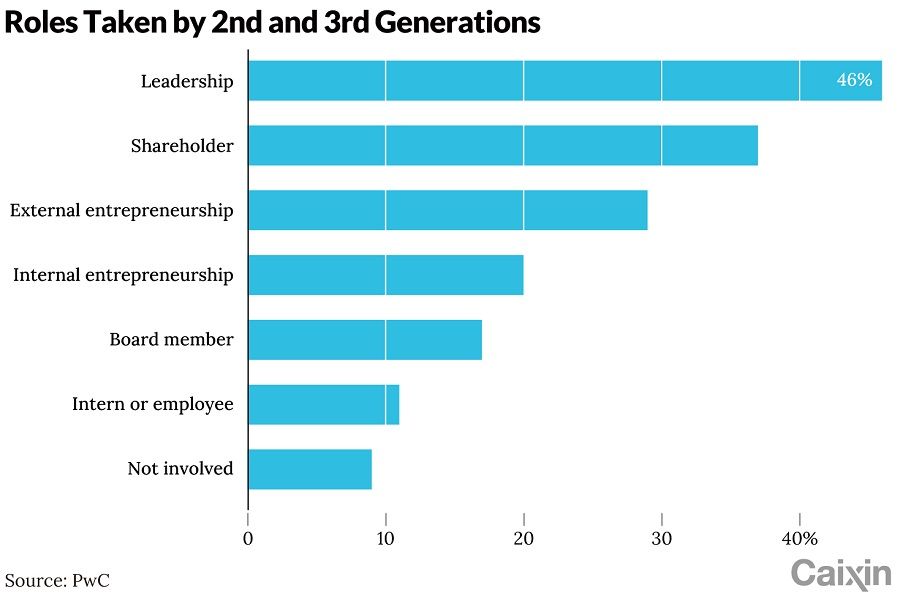

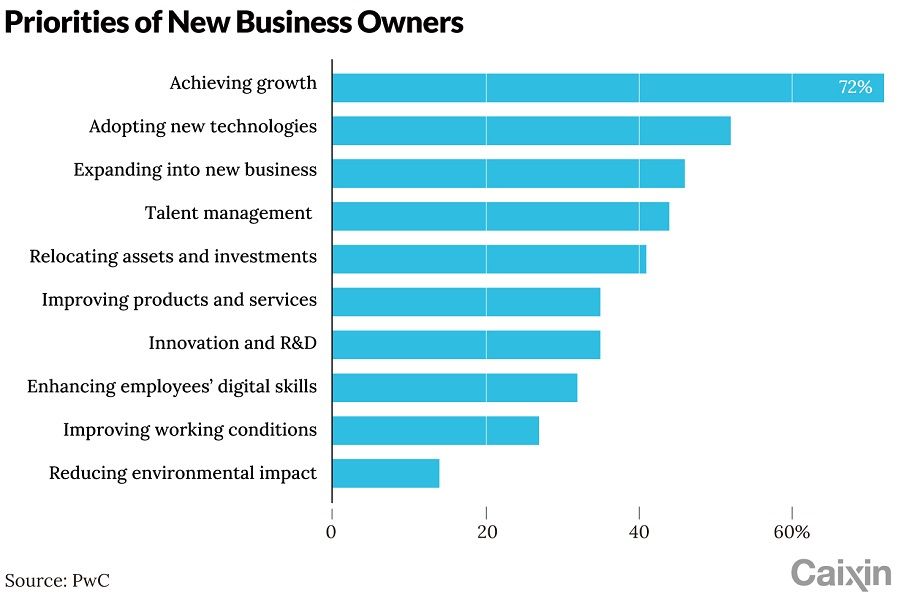

The PwC survey found that China's new generation of private business owners saw achieving business growth as their primary task over the next two years, followed by adopting new technologies, expanding into new industries or markets, and attracting more talents.

Passing the baton

Succession in China's family-owned businesses face several challenges, including a lack of reference experiences because of the short period of the country's business development, according to Chen Ling, the director of Zhejiang University's Family Business Research Institute. The nation's old one-child policy also leaves many owners with limited options for passing their enterprises to heirs.

Most family businesses in China have no detailed plan for succession of ownership, Chen said.

Among the top 100 family-owned enterprises in China, 31% plan for family members to inherit the business, 54% are planning for internal executives to take over, and 15% will hire professional managers from outside, according to report last year by Boston Consulting Group.

Liu Chuanzhi, founder of Lenovo, established a rule to prevent the children of senior executives from entering the company, regardless of how exceptional they may be.

Leading companies like Midea and Lenovo have passed the baton to internal executives. Liu Chuanzhi, founder of Lenovo, established a rule to prevent the children of senior executives from entering the company, regardless of how exceptional they may be.

But for most smaller family businesses, passing the business on to children remains the primary option, partly due to the inadequate internal governance system, according to Huang, the factory heir who wrote about her experience.

With business expansion and improved corporate governance, especially after going public, hiring professional managers becomes a more viable option. Several second-generation heirs told Caixin that their aim is to lead the company through an IPO, which will make succession easier once the family business transitions into a public entity.

"Our generation faces different challenges compared to our predecessors," Huang told Caixin. "Being stubbornly traditional or developing in isolation without accepting new ideas both hinder the continuity of a business."

This article was first published by Caixin Global as "Cover Story: China's Family-Run Businesses Face Succession Issues". Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.