Clock ticking on Country Garden's debt bomb

Amid China's property crisis, Country Garden is on the way to becoming the next casualty as it teeters on the brink of its maiden bond default. Compared with many of its distressed peers, Country Garden was in a better position during the early stages of the property market downturn. But now, the company is scrambling for a lifeline.

(By Caixin journalists Wang Jing, Wang Juanjuan and Han Wei)

Country Garden Holdings Co., which was China's top developer in terms of sales for six consecutive years starting in 2017, is now poised to become the next casualty in the nation's property crisis as it teeters on the brink of its maiden bond default.

The Guangdong-based developer is facing imminent payments in September for three bonds either to mature or with a put option due with a combined principal of 7.3 billion RMB (US$1 billion), as it grapples to secure sufficient funds to meet its debt obligation.

Overleveraged developers

On 7 August, the company spooked the market when it failed to meet interest payments amounting to US$22.5 million on two offshore US dollar bonds, setting it on a path towards its first public default if the payments are not made within a 30-day grace period.

The property sector, which according to National Bureau of Statistics data accounts for around 14% of China's GDP when taking into account related industries, declined 1.2% in the second quarter from a year ago and was a major drag on the faltering recovery of the world's second largest economy.

"A crisis of Country Garden will hit the real estate industry akin to Evergrande's collapse as the company's bond borrowing trails only Evergrande," said a bond market investor.

Chaired by Yang Huiyan, formerly China's richest woman, Country Garden is among the rare private property developers that have successfully avoided bond defaults until now. The recent missed payment has ignited renewed concerns that a potential default could mirror the severity of China Evergrande Group's late 2021 default, which triggered an industry-wide liquidity crisis.

Evergrande disclosed in July that its total liabilities amounted to 2.4 trillion RMB as of December 2022. By comparison, Country Garden had 1.7 trillion RMB in total assets and 1.4 trillion RMB in total liabilities by the end of 2022, its annual report shows.

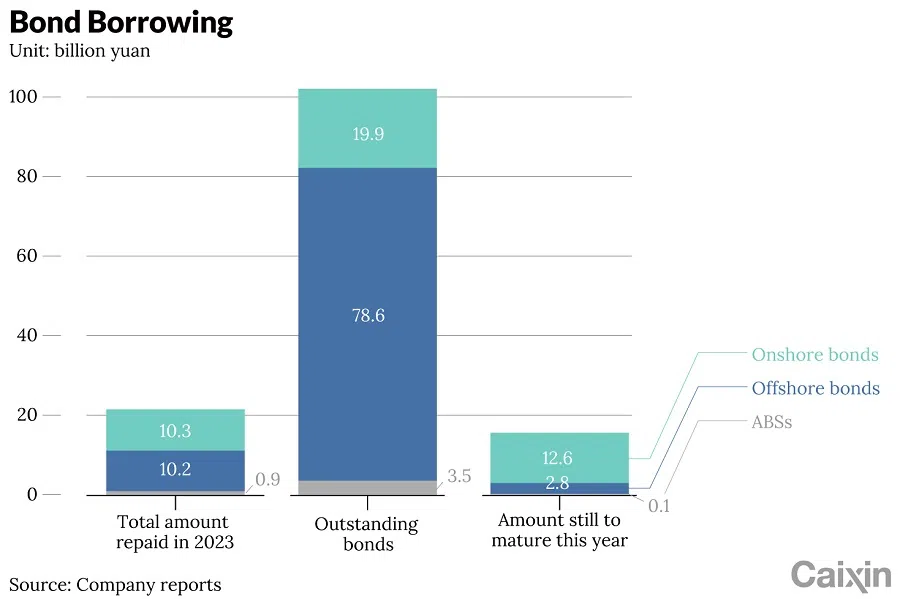

As of the end of July, Country Garden had outstanding bonds including asset-backed securities totalling some 104 billion RMB, with 26 billion RMB of onshore bonds and 78 billion RMB of offshore bonds, according to Shenzhen-based ratings agency Ratingdog.

Before regulators tightened controls on their financing in 2020, Country Garden thrived on borrowed money.

Adding to investors' anxiety, Country Garden on 10 August said that it expected its net loss in the first half of 2023 to reach 45 billion RMB to 55 billion RMB, well above the company's net loss of 3 billion RMB for all of 2022, the first since it went public in 2007.

Two days later, Country Garden and its subsidiaries announced the suspension of trading for 11 domestic bonds starting from 14 August, fuelling speculation that the company is preparing to restructure the debt.

Country Garden's stock and bond prices have tumbled in the past few weeks on concerns over its financial health. Almost all of its dollar bonds have plunged below US$0.10, according to data from Bloomberg, while its shares in Hong Kong fell below HK$1 last week, plunging 75% from this year's 27 January peak.

Despite the grim news, Country Garden is attempting to project a positive message, albeit with a nod to the challenges, with company president Mo Bin saying in an 10 August statement: "Although the company has encountered the biggest difficulties since its establishment, we have always been confident in the prospects of China's economy."

Country Garden "has made every effort to ensure the company's cash flow security".

Like many other property developers, Country Garden's business took off in 2015, when many cities started urban redevelopment projects, becoming the largest developer by sales in 2017.

Before regulators tightened controls on their financing in 2020, Country Garden thrived on borrowed money. Relying on high leverage, rapid turnover and massive borrowing, the company expanded quickly in China's small- and medium-sized cities.

But the crackdown on financing aimed at curbing risks at overleveraged developers put an end to that growth model.

"If no external force comes to its rescue and Country Garden falls apart, other private property developers will collapse one by one, and the last bit of market confidence will be worn away." - Bond investment company executive

Others could collapse one by one

Compared with many of its distressed peers, Country Garden was in a better position during the early stages of the property market downturn as it managed to repay debts, deliver projects and make use of government support to borrow money from financial institutions and issue bonds. However, the deepening market decline since mid-2021 has amplified the company's capital challenges.

Now, Country Garden is scrambling for a lifeline. The company is mulling over restructuring its onshore bonds and has hired China International Capital Corp. Ltd. as a financial adviser, sources with knowledge of the matter told Caixin.

As the company is short of cash to make repayments for its maturing onshore bonds or those with a put option due in September, it may first extend those before dealing with offshore bonds, according to the sources. Relieving some of the immediate repayment pressure could help it focus on completing presold housing projects, they said.

Country Garden last week proposed extending an onshore bond maturing in September by three years, but faced challenges in securing approval from bondholders. On 25 August, the company made a last-minute change to postpone the deadline for holders to vote on its debt extension plan in the latest effort to avert a default.

"If no external force comes to its rescue and Country Garden falls apart, other private property developers will collapse one by one, and the last bit of market confidence will be worn away," an executive at a bond investment company said.

Sliding into crisis

By the end of 2022, Country Garden's financials appeared fairly sound. The company had 147.6 billion RMB in available cash on its balance sheet, including unrestricted cash and cash equivalents amounting to 128.3 billion RMB - sufficient to cover its short-term debt of 93.7 billion RMB due in 2023.

However, the company recently told creditors that its available funds are only enough to complete existing projects, without giving any explanation of its worsening liquidity, a bondholder said.

Country Garden is known for its strategy of tightly controlling spending based on revenue. Land acquisition and construction costs usually constitute the major portion of a developer's expenditures.

As the market cooled and sales slowed, Country Garden's spending on land purchases slid to 5.8 billion RMB in the first seven months, ranking 24th in the industry, according to independent real estate research institution China Index Academy.

But the company's spending on construction has remained high as it strives to deliver projects on schedule under pressure from authorities. Last year, discontent over long stalled projects triggered protests and mortgage boycotts in many cities, forcing local governments to step in and urge developers to complete construction on time.

... Country Garden's heavy bet on third- and fourth-tier cities means its promise of housing deliveries could be much pricier as housing sales and prices have plunged deeper in smaller cities.

In 2022, Country Garden delivered 700,000 housing units, the most among all developers and exceeding the combined amount completed by China Vanke and Evergrande, according to Caixin's calculation based on public information. Country Garden said that it expects total 2023 deliveries to reach another 700,000 units, with its first half deliveries totalling 278,000.

But compared with Vanke and Evergrande, which focus more on big cities, Country Garden's heavy bet on third- and fourth-tier cities means its promise of housing deliveries could be much pricier as housing sales and prices have plunged deeper in smaller cities.

"Consider a project with 500 units. If only 100 units were pre-sold, the entire project must be completed to ensure the delivery of these 100 units, regardless of when the remaining 400 units can be sold," a real estate company staffer said. The greater the number of units that are sold in advance and at higher prices, the lesser the funds developers need upfront to cover construction costs, said the person.

S&P Global estimated that Country Garden's 2023 construction costs will be around 130 billion RMB.

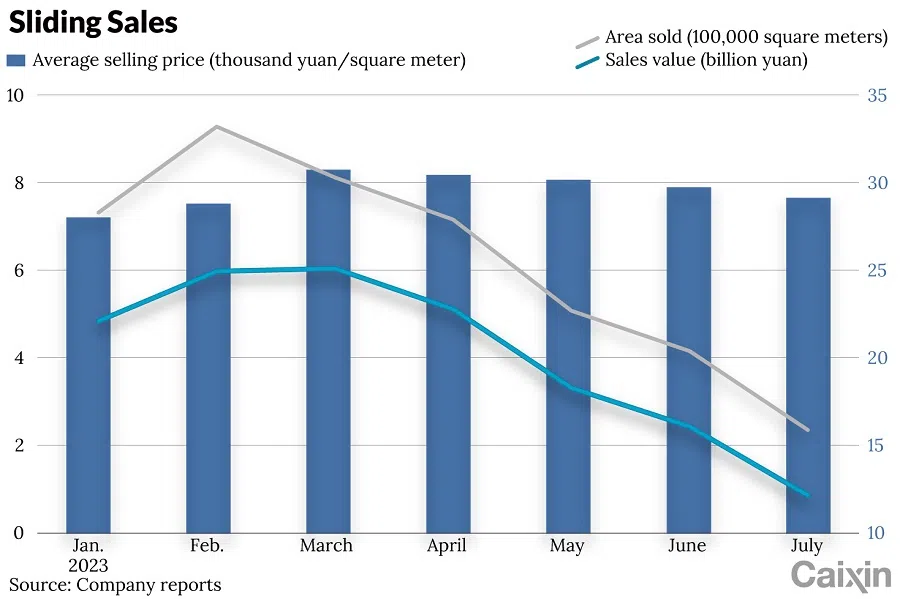

Based on Country Garden's 2022 financial data, the company needs monthly sales of at least 22 billion RMB to keep construction on schedule and maintain basic operations, excluding debt payments and land purchases, according to a banking industry insider.

But Country Garden's sales have been sliding this year. In the first seven months, they fell 35% year-on-year to 140.8 billion RMB, according to the company. This exceeds the industry's average drop of 4.7% during the period, according to data from China Real Estate Information Corp. (CRIC).

Although Country Garden maintained its top position in terms of area sold, it slid to sixth place in terms of sales value, CRIC data showed. That underscores the company's business weakness due to its focus on smaller cities, which experienced faster growth over past years, but were also hit much harder in the latest housing market downturn.

Amid weakening demand, housing inventories in third- and fourth-tier cities reached 19 months of supply in May 2023, compared with 12.3 months in the top-tier cities, according to CRIC.

In a recent letter to investors, Country Garden's management apologised for its recent troubles and for the first time acknowledged the company's overreliance on smaller cities, saying its awareness of potential risks was inadequate.

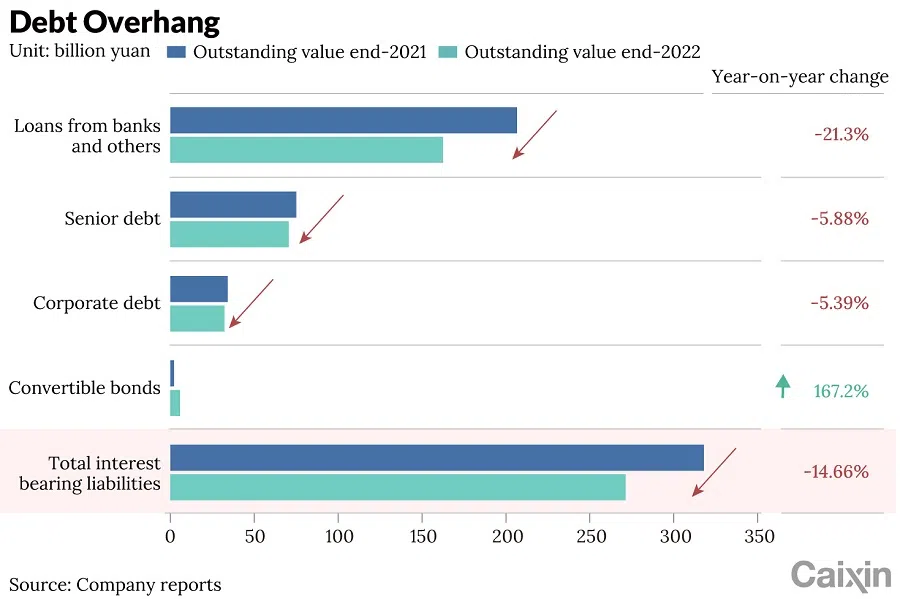

Capital drain

At the end of 2022, Country Garden's interest-bearing liabilities totalled 271.3 billion RMB, a decrease of 98.3 billion RMB or 26.6% from 369.6 billion RMB in 2019, according to the company's financial report.

Country Garden's efforts to reduce its debt burden are evident, but the sheer magnitude of the problem remains a significant challenge and has greater financing demands, several financial institution sources said.

"The current financing environment for private enterprises is undeniably harsh," said a banking source familiar with the company.

Country Garden had maintained a positive cash flow from financing for 13 consecutive years before 2019, company financial reports showed. But it did an abrupt about face in 2020 after authorities laid out "three red lines" that set leverage benchmarks builders had to meet if they wanted to borrow more money. From 2020 to 2022, the company posted an accumulative net outflow of 125.7 billion RMB.

Bank loans were an important source of funding for Country Garden. In 2022, its borrowing from banks and other institutions totalled 162.5 billion RMB, down 44 billion RMB from the previous year.

"In the second half of 2022, Country Garden had trouble repaying loans," said a Guangdong financial industry source. "Local governments intervened to arrange loan extensions with banks, but new lending has remained limited."

In November, a 16-point policy package to direct more financial support to the ailing property market was unveiled by the government. But industry sources said that the effects have been limited, especially for private developers.

"While many private developers obtained significant preliminary credit approvals, companies that actually received loan disbursements are scarce," said a property industry researcher at a brokerage firm.

Property projects in smaller cities in particular are given a wide berth by banks due to concerns about weak sales, said a bank executive. Another banker at a state-owned lender said government-backed developers are much more favored than their private counterparts when it comes to bank loan approvals.

Between delivering presold housing projects and making debt repayments, the holes in its cash flow have become too big to fill. - Zhu Wence, property market analyst

Financial institutions have significantly lost confidence in private developers, and Country Garden is no exception, a person close to the central bank said.

Borrowing from the bond market is also challenging for private developers. In the first seven months, bond financing by the real estate sector totalled 285.6 billion RMB, of which only 16.5 billion RMB was raised by private developers, according to China Index Academy.

The small scale of bond issuances by private developers is not due to any regulatory restrictions, but rather because there is no demand for them, a bond regulatory official said.

Prior to its current predicament, Country Garden had better access to funding compared with most private developers as it was still able to take out loans and issue bonds with a government-backed guarantee.

Indeed, in 2022 Country Garden raised over 9 billion RMB through ten bond issuances, according to Caixin's calculations based on public information. But so far in 2023, the company has issued only two medium-term notes in domestic market to raise 1.7 billion RMB and an offshore note of 1 billion Thai baht (US$28.5 million).

But the money raised is just a drop in the bucket compared with Country Garden's debt obligations.

"The 1.7-billion-RMB financing is not even enough for Country Garden to cover two weeks' expenses," a banking industry source said.

Between delivering presold housing projects and making debt repayments, the holes in its cash flow have become too big to fill, Zhu Wence, an independent property market analyst, wrote earlier this month.

So far this year, Country Garden has repaid 21.4 billion RMB of its bonds. As of 15 August, the company had outstanding bonds including asset-backed securities totalling some 102 billion RMB, with 19.9 billion RMB of onshore bonds and 78.6 billion RMB of offshore bonds, according to Ratingdog. About 15.5 billion RMB of the debts will mature by the end of 2023.

Grasping for a lifeline

If Country Garden keeps up its debt repayments, it would deplete its cash, a person close to the company said. Then, even completing existing projects will be a challenge, said the person.

On 12 August, Country Garden and two subsidiaries announced plans to suspend trading of 11 bonds starting 14 August. The suspended bonds, with an outstanding value of 15.7 billion RMB (US$2.2 billion), will mature or have a put option due by the end of June 2024. Three of them, with an outstanding value of 7.3 billion RMB, will encounter either situation in September.

"This is the signal that Country Garden will formally initiate negotiations for bond extensions or restructuring," said an institutional investor who recently slashed holdings in Country Garden's bonds.

On 14 August, Country Garden unveiled a plan to extend a 3.9 billion RMB bond due next month. The bond, a non-public note known as 16 Bi Yuan 05, will be the first among the debts to mature.

Country Garden proposed stretching out repayment by three years, allowing the developer to pay only interest once it matures on 2 September. After that, it would pay off a share of the principal in set intervals starting with 2% for each of the first three months after maturity.

"The extension proposal for 6 Bi Yuan 05 could pave the way for subsequent bond restructuring by Country Garden," a bond market source said.

"... if a public default starts, the risk will proliferate to all debts, impacting the interests of the entire industry chain and homebuyers and further eroding market confidence." - Bond investment fund executive

But the proposal has one major hurdle to overcome: securing approval from bondholders. To reach an agreement to extend 16 Bi Yuan 05, which was issued in 2016, Country Garden needs approval from creditors holding more than half of the outstanding principal.

Some holders have demanded that the embattled developer pay the principal and interest in full by 2 September, Caixin has learned. Major holders include Bank of China Ltd., China Guangfa Bank Co. Ltd., China Merchants Bank Co. Ltd. and several private funds, one bondholder told Caixin. Some of the funds object to the extension, the investor said.

A vote to decide the fate of the proposal was scheduled to end late Friday. But about four hours before the original deadline, Country Garden pushed the deadline back to 31 August.

For Country Garden, the clock is ticking. If bondholders agree to extend repayment of 16 Bi Yuan 05, its largest outstanding onshore bond, it might try to get the holders of other bonds to accept similar restructuring deals, allowing it to keep more money to deal with the impact of the sales plunge, said a bond market investor.

"The share of bonds in Country Garden's total liability is not big, but if a public default starts, the risk will proliferate to all debts, impacting the interests of the entire industry chain and homebuyers and further eroding market confidence," a bond investment fund executive said.

This article was first published by Caixin Global as "Cover Story: Clock Ticking on Country Garden's Debt Bomb". Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.

Related: The dangerous link between China's real estate demise, the economy and the financial system | China's property crisis contagion spreads to state-backed developers | China's housing downturn: Household registration reform needed | Chinese local governments facing debt crisis: Waiting for bailouts | China's property companies going bust may be a common sight in 2023

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)