Beyond the stock market: How can China unlock its economic growth potential?

Academic Gu Qingyang assesses that there is still a lot of room to manoeuvre for China’s policies, and only through a series of structural reforms and stable policy implementation can China unlock its economic growth potential, just as it has recently done so for the stock market.

China’s recent stock rally has attracted widespread attention from global investors. Against the backdrop of the US Federal Reserve’s interest rate cuts, the People’s Bank of China (PBOC) introduced a slew of measures last week to support the housing market, reduce interest rates and lower the reserve requirement ratio, along with new policy tools to support the stock market.

These measures brought unexpected policy dividends to the market, with the subsequent Politburo meeting further reinforcing the optimistic sentiment.

For the Chinese economy, what really needs to be addressed is the advancement of structural reforms and the restoration of long-term confidence.

Converting short-term market sentiment into sustainable growth

The scale and intensity of this round of policy stimulus have been unprecedented, not only reflecting the central bank’s determination to address the downward pressure on the economy, but also marking a major shift in macroeconomic policy thinking.

Unlike previous relief measures that were gradually released, the current measures place greater emphasis on establishing long-term expectations. This combination of stimulus policies not only focuses on stabilising market sentiment in the short term but also conveys to the market a clear direction and firm commitment for future policies.

With the transparency and predictability of policies, expectations for the future have been strengthened. The innovation lies in the use of forward guidance and a clear policy roadmap, strengthening market confidence for the future.

While the stock market saw a strong rebound as a result of the policy announcements, the real challenge lies in converting this short-term market sentiment into sustainable economic growth. Short-term gains in the stock market cannot hide the long-standing problems of the economy.

For the Chinese economy, what really needs to be addressed is the advancement of structural reforms and the restoration of long-term confidence. Given that the lack of confidence is the biggest challenge to China’s economy, the management of market expectations and confidence is the core task of China’s economic recovery.

The challenges for the Chinese economy are not only cyclical adjustments but also deep, multidimensional structural problems. Amid growing geopolitical uncertainty, the long-term stability of the Chinese economy increasingly depends on market expectations and confidence in policies.

Thus, in the current market boom, managing expectations and boosting confidence are the more crucial issues. Managing expectations should extend beyond monetary policy to include a broader spectrum of macroeconomic regulation and control, as this will play a more crucial role in future policy stimulus.

Policies are often hastily adjusted in response to worsening short-term economic indicators, eroding any trust the market has in the long-term coherence of policies.

Managing expectations and boosting confidence

At its core, managing expectations is about continuously building confidence in future development among the various market players. The key task is to ensure policy consistency and continuity.

In recent years, policy uncertainty and repetitiveness have caused market confusion and anxiety. Policies are often hastily adjusted in response to worsening short-term economic indicators, eroding any trust the market has in the long-term coherence of policies.

This not only makes it difficult for investors to make rational long-term plans, it also impacts decisions on innovation and expansion for businesses. Therefore, the formulation of policy should focus on the long term while maintaining transparency, and enhance communication with the market to avoid negative interpretations.

By setting a clear direction for future development and specific goals, expectations can be more efficiently guided, and the market would have a clearer understanding of the policies, in turn reducing any doubts and anxiety.

Policies must be consistent, implemented as stated, and aligned with their objectives to enhance credibility and dispel negative expectations. This will set a higher standard for policy quality and emphasise the importance of policies being forward-looking, innovative and coherent.

Additionally, policies should build confidence by managing expectations; only through changes in behaviour and actions can confidence truly grow. Ultimately, building confidence relies on the effectiveness of the policies as a guarantee.

Presently, managing the expectations of investors, consumers and government officials is crucial. Strengthening legal protection for the private economy will boost investor confidence; leveraging social security mechanisms and establishing income adjustment mechanisms will boost consumer confidence; while improving incentive mechanisms for civil servants will boost government officials’ confidence. Moreover, the continued advancement of a modernised system of governance will also boost the confidence of international investors.

To boost confidence would require policy alignment and coordination across the board, and it is especially essential to solve the structural bottlenecks that have long restricted China’s economy.

China still has considerable room for improvement in areas such as supply-side structural reforms, financial market opening, and local government fiscal reforms.

Resolving structural bottlenecks

Firstly, the long-term stability of policies is key. While short-term measures could stabilise the market to a certain extent, the enhancement of long-term confidence depends on institutional reforms and policy continuity. The decision makers need to communicate clear policy signals to the market, and express their commitment to consistently push for reforms. When policies lack coherence, the market is often more susceptible to the impact of sudden events, leading to a weakening of an establishment of long-term confidence.

Second, promoting structural reforms is vital. While short-term monetary and fiscal policies can temporarily stimulate market sentiment, only deeper structural reforms can genuinely boost long-term confidence. China still has considerable room for improvement in areas such as supply-side structural reforms, financial market opening, and local government fiscal reforms. Only by deepening reforms in these areas can there be a more stable and predictable economic environment for the market, thereby enhancing the long-term confidence of investors, businesses and consumers.

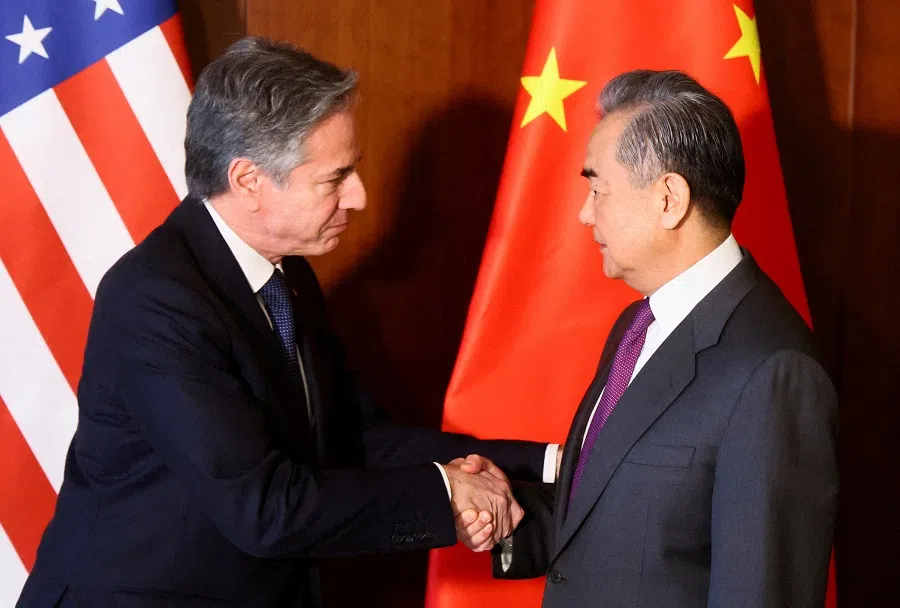

Third, stabilising China-US relations and alleviating external pressure. Shifts in China-US relations directly impact market expectations and investment decisions, particularly amid current escalating global trade tensions and technological competition. A stable China-US relationship not only provides a more favourable external environment for China’s economy but also mitigates market concerns about future uncertainties.

Finally, enhancing institutional transparency and strengthening communication with the market. Market confidence not only depends on policy content but also on how policies are communicated and implemented. Policymakers must establish effective interaction with the market through transparent communication channels. Frequent policy changes, excessive regulation and poor timing can lead to uncertainty in market behaviour, causing confusion, pessimistic expectations and declining confidence.

Regulators and market entities have a symbiotic relationship, not an adversarial one, and regulation and development must be balanced. Policymakers should consult market opinions before implementing policies and maintain a market-friendly approach to reduce uncertainty and boost investor confidence.

China’s economic growth model has shifted from traditional investment-driven to innovation and consumption-driven, requiring robust institutional guarantees.

Continuing the favourable momentum

Establishing confidence will not happen overnight; it requires long-term consistency, transparency and tangible reform outcomes to foster positive expectations. Institutional development is the key foundation for boosting confidence. China’s economic growth model has shifted from traditional investment-driven to innovation and consumption-driven, requiring robust institutional guarantees.

Through law-based, market-oriented and internationalised institutional designs, the government can provide a more transparent, fair and predictable environment for the market, enhancing confidence among various economic stakeholders. Continuous and in-depth institutional reforms are the key to restoring confidence, which is also a lesson learned from China’s successful reform and opening up over the decades.

In summary, the prosperity of the stock market is a good starting point, but it is only half the battle. We must seize this favourable momentum and introduce comprehensive and systematic reform measures. More importantly, effective policy tools and institutional reforms are needed to sustainably boost market expectations and confidence. China’s economic growth potential remains vast, and the PBOC’s policies have unleashed the underestimated potential of the stock market.

China’s economic growth in recent years has yet to reach its potential. Only through a series of structural reforms and stable policy implementation can China unlock its economic growth potential, just as it has with the stock market. So, there is still a lot of room to manoeuvre for China’s policies. Further promoting reform and opening up and managing long-term expectations will ensure China’s economic stability and longevity.