[Big read] Chinese sellers embrace TikTok despite US ban fears

Lianhe Zaobao journalist Zeng Shi notes that with the rise of the social media e-commerce business model, TikTok has rapidly expanded its global e-commerce footprint in recent years. Chinese sellers have flocked to the platform to sell their products directly to the world through short videos and livestreams. However, the looming threat of a US ban casts a shadow over their prospects.

“If you are still not on the platform, now’s the time to make your move!” urged an e-commerce blogger in a short video posted on Chinese social media platform Xiaohongshu, encouraging Chinese e-commerce vendors to take the leap and start selling on TikTok.

Even though the app has stirred up a fair bit of controversy around the world and is facing an outright ban in the US, it is still trying to get more Chinese brands and merchants on board. Short videos and posts with captions such as “The early bird gets the worm”, “2024 is the year to boldly expand into TikTok”, “It’s still not too late to join” are everywhere on major Chinese social media platforms as TikTok users vigorously discuss the opportunities and challenges of selling on the platform.

With the rise of social media e-commerce, TikTok has rapidly expanded its global e-commerce footprint in recent years. Using its Chinese counterpart, Douyin, as its blueprint, the popular social media app launched its TikTok Shop functionality in Indonesia and the UK in 2021. TikTok Shop has since expanded to countries such as Malaysia, Thailand and Vietnam. It became available in the US last September.

As TikTok’s e-commerce arm grows rapidly, many Chinese sellers are rushing in to sell their products direct to consumers around the world through short videos and livestreams.

TikTok e-commerce training courses

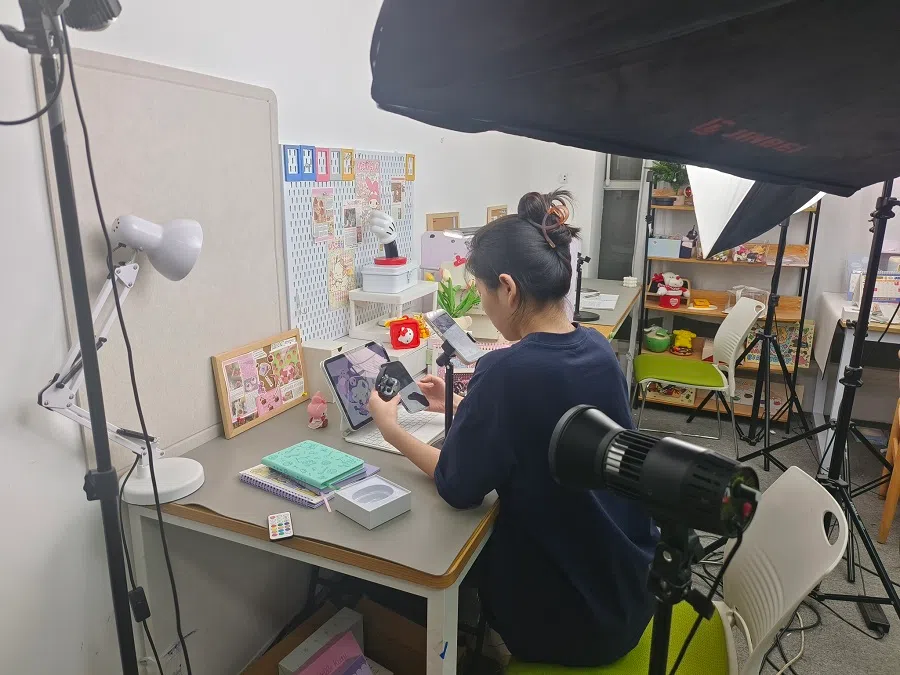

E-commerce training providers in various parts of China have held multiple sessions of TikTok training short courses as learners from different walks of life sign up to learn how to sell on the platform and promote their products to overseas customers.

Based on information found on the website of Guangzhou-based e-commerce training provider Mede Education Technology (美迪电商教育), students who sign up for such short courses will learn about product selection, boosting traffic and monetising on TikTok. The course also covers how to access the app since it cannot be downloaded in mainland China, so Chinese sellers who want to use the platform must first learn how to overcome the internet restrictions.

Liang Haizhen, who is responsible for TikTok Shop operations in the US for Guangzhou Xingke Electronics (广州星科电子有限公司), told Lianhe Zaobao, “Most Chinese cross-border merchants with reliable supply chains are now selling on TikTok.” Against the backdrop of a surge in cross-border e-commerce, a growing number of Chinese foreign trade companies and individuals have switched tracks in recent years and turned to e-commerce platforms to expand into new markets abroad.

Similarities between Douyin and TikTok an advantage

Liang’s company mainly sells electronics such as earphones and speakers, with its prices on TikTok ranging mostly from US$10 to US$30. In 2021, the Guangzhou company started selling its products on TikTok Shop to consumers in the UK and Southeast Asia, and subsequently entered the US market after the functionality went online there. Through initial platform subsidies and traffic boosts, it quickly made impressive gains with fast-growing sales.

According to Liang, the US is the main contributor to her company’s TikTok sales volume, followed by Southeast Asian countries such as Singapore, Malaysia, Thailand and Vietnam.

... news that TikTok Shop will become available in several major markets this year as it expands into Europe and Latin America continues to encourage companies and groups to join the fray at the promise of new market possibilities. — Xiao Ping (pseudonym), an operations staff at a multi-channel network organisation

Xiao Ping (pseudonym), an operations staff at a multi-channel network (MCN) organisation in Foshan, told Lianhe Zaobao that the Chinese vendors’ foreign trade platforms used to be dominated by Amazon, AliExpress and eBay, but this has fundamentally changed in recent years. With the rise of social media e-commerce, cross-border e-commerce platforms such as TikTok have quickly caught the eye of Chinese merchants.

Xiao said that Chinese sellers can use their experience of selling on Douyin to navigate TikTok Shop given the similarities in the two platforms’ algorithms. The possibility of successfully replicating their Douyin operating models and the lower barriers to entry such as the ease of operation and lower initial costs also encourage Chinese sellers to be more receptive to TikTok.

She added that scores of Chinese vendors have started using TikTok since 2023. Even though the app is now at risk of being banned in the US, news that TikTok Shop will become available in several major markets this year as it expands into Europe and Latin America continues to encourage companies and groups to join the fray at the promise of new market possibilities.

Southeast Asia becomes pivotal amid unclear US situation

TikTok, which has performed very well, is facing its most severe existential crisis to date. On 24 April, US President Joe Biden signed a bill to ban TikTok in the US if its owner, Chinese tech firm ByteDance, fails to divest the app within a year.

ByteDance subsequently announced that it does not intend to sell TikTok and is instead seeking to overturn the ban by filing a legal suit against the US government for multiple violations of the US constitution with the bill. Several TikTok creators have also joined the lawsuit as co-plaintiffs in a bid to prevent the bill from coming into force.

If the TikTok ban is enforced, the app’s e-commerce merchants would certainly be impacted. At the same time, Chinese businesses using the platform to unlock foreign markets would also face many uncertainties.

Provided there is still a demand for its products, a company that faces restrictions in the US can still operate in other markets such as the Middle East or Europe, or even on other e-commerce platforms. — Goh Rhay Gynn, Founder, Raphya African fashion wear

Investing heavily to get on board

Xiao Ping from the MCN organisation pointed out that many businesses invest a lot of energy and money to sell on TikTok. In its initial phase of entering the US market, her company conducted several rounds of testing to measure the effects of product placements through short videos and livestreams. Each test lasted from a few months to half a year before her company was able to gain some useful experience. The current uncertainty in the situation would very likely negatively affect the company’s enthusiasm for the US market.

Xiao’s company ventured into TikTok three years ago and now focuses on consumers from the US, UK and Malaysia. She pointed out that it was only after their exploratory phase in the first two years that her company’s move started to pay dividends. If the US ban takes effect, its business would definitely be affected in the short term, but it has prepared for this by considering pivoting its overseas expansion to other markets such as Southeast Asia.

Goh Rhay Gynn, founder of Raphya African fashion wear and an e-commerce consultant for several companies, told Lianhe Zaobao that businesses with solid products and established brands that are familiar with operating and monetising across different cross-border e-commerce platforms would not be impacted even if one of the platforms were banned. Provided there is still a demand for its products, a company that faces restrictions in the US can still operate in other markets such as the Middle East or Europe, or even on other e-commerce platforms.

Goh said that branding is still important for businesses that are looking to expand overseas. This is currently one of the main obstacles for Chinese companies as he noted that “there are not many well-known Chinese brands despite the products being very cheap”.

Zuo Xiaolei, a consultant for the China Cross-border Ecommerce 50-person Forum and former chief economist at China Galaxy Securities, told Lianhe Zaobao that despite the potential obstacles in the US market, many Chinese businesses still recognise the opportunities, but the crux is how to seize them and stand out from the competition, and how to switch track in the face of difficulties.

Zuo noted that while companies are striving to come up with solutions, they are also eyeing emerging markets in South America and the Middle East. At the same time, they continue to expand in European and Southeast Asian markets for more development opportunities.

She also pointed out that among the Chinese vendors operating on TikTok Shop, some fashion manufacturers have indicated that the US ban has not put them under pressure. They mitigate the issue by registering their retail arms as US companies, finding local partners, or pursuing more feasible approaches to continue their overseas expansion.

... fast-fashion retailer Shein, Pinduoduo’s Temu, Alibaba Group’s AliExpress and Bytedance’s TikTok Shop have been labelled the “four little dragons” of overseas expansion.

Long-term operating challenges

Even though there are still various uncertainties in China’s economic recovery, the continued prosperous development of cross-border e-commerce forms an important part of the country’s strategy to stabilise foreign trade in recent years.

Official data indicate that total imports and exports by Chinese cross-border merchants reached 2.38 trillion RMB (US$331.1 billion) in 2023, growing by 15.6% year-on-year, of which exports accounted for 1.83 trillion RMB, a 19.6% year-on-year increase. In the first quarter of this year, the figure continued to rise by 9.6% to reach 577.6 billion RMB.

Over the last few years, Chinese cross-border ecommerce platforms whose main play is to bring Chinese goods to foreign consumers have grown rapidly, so much so that in China, fast-fashion retailer Shein, Pinduoduo’s Temu, Alibaba Group’s AliExpress and Bytedance’s TikTok Shop have been labelled the “four little dragons” of overseas expansion.

These platforms offer fully-hosted, semi-hosted and independent operating models for their vendor partners. At the same time, they provide a suite of services in website traffic, cross-border logistics, legal affairs and after-sales for businesses to flexibly choose from based on their needs, making it much easier for them to venture abroad.

Even though Temu only started operating in September 2022, it leveraged the experience and business model of its parent company, Pinduoduo, to quickly expand its international presence. According to Chinese media outlet LatePost, Temu’s annual sales totalled US$18 billion in 2023. This year, it aims to more than triple that to US$60 billion.

Similarly, TikTok Shop, AliExpress and Shein have all set ambitious targets of 150%, 125% and 40% growth respectively in annual aggregate transactions for 2024.

Nonetheless, it is still no mean feat for Chinese brands and products to keep finding space to grow in foreign markets. The strength of Chinese businesses in using extremely competitive prices to enter new markets also means that they are exposed to the risk of fierce competition and the vicious cycles of price wars. Furthermore, Chinese products also face regulatory, legal and compliance challenges abroad.

... product attractiveness is key to Chinese businesses developing sustainably in foreign markets, especially in places such as Europe and the US where there is greater emphasis on brand effect. — Xiao Ping

Brand effect trumps low prices in Europe and US markets

Xiao Ping from the MCN organisation pointed out that Chinese and foreign consumers have different consumption habits and cultural backgrounds, thus some Chinese e-commerce merchants quickly learnt that the livestreaming and short video tactics they employ at home are ineffective overseas.

Furthermore, product attractiveness is key to Chinese businesses developing sustainably in foreign markets, especially in places such as Europe and the US where there is greater emphasis on brand effect. China still relies on bulk sales at low prices to make a profit for most of the products it sells overseas.

Liang Haizhen from Guangzhou Xingke Electronics said that a considerable portion of the Chinese merchants who jumped onto the cross-border ecommerce bandwagon in the last two years have failed in their overseas ventures.

She feels that cross-border ecommerce is a bigger test of business strategies and tactics. Without a suitable array of products, advertising and a reliable supply chain, even companies that profit in the short term may find it difficult to sustain its survival.

This article was first published in Lianhe Zaobao as “美禁令虽拉响警报 TikTok中国电商不畏触礁破浪求生”.