Can China be the world’s lighthouse in a trade storm?

China should capitalise on the chaos of US President Donald Trump’s “Liberation Day” tariffs by positioning itself as a beacon of hope and stability for affected countries, says Lianhe Zaobao China news editor Yang Danxu, who discusses the effects of these reciprocal tariffs.

Since the start of his second term, one of President Donald Trump’s most iconic policies — reciprocal tariffs — is set to be implemented on what he refers to as “Liberation Day”.

The day before details were announced, the Office of the United States Trade Representative (USTR) released an encyclopaedic annual report on foreign trade barriers on 31 March akin to a “list of charges”, detailing the tariff rates of America’s trade partners along with various cumbersome non-tariff barriers.

‘Dirty 15’?

Compared with most other economies — which took up only a few pages of the report — the section on China spanned a total of 48 pages, while the section for the EU reached 34 pages. Although Washington did not explain how this nearly 400-page report would affect Trump’s reciprocal tariff plan, the extensive coverage on specific economies implied that China and the EU were likely to be the main targets for these tariffs.

US Treasury Secretary Scott Bessent had earlier introduced the “Dirty 15” concept, proclaiming that reciprocal tariffs would primarily target countries with the highest tariffs on US goods and countries with significant trade volumes with the US. White House National Economic Council chairman Kevin Hassett also mentioned that the main targets of the reciprocal tariffs would be the 10 to 15 countries with which the US has the most severe trade deficits.

This uncertainty also reflects how difficult it is to make sense of the concept of reciprocal tariffs Trump introduced — especially when the underlying logic is not clear.

According to last year’s data, the 15 economies which accounted for the largest trade deficits with the US are, in order: mainland China, the EU, Mexico, Vietnam, Taiwan, Japan, South Korea, Canada, India, Thailand, Switzerland, Malaysia, Indonesia, Cambodia and South Africa.

‘Liberation Day’ marked by confusion, fear and uncertainty

However, Trump himself seemed reluctant to use the term “Dirty 15”. On 30 March, he indicated to the media that the tariff scope would include all countries. He also suggested that initial tariffs would be “generous”. The Wall Street Journal quoted informed sources as saying that the Trump administration is still weighing different options, including whether to impose varying rates on different trade partners or to adopt a “one size fits all” approach.

Ultimately, nobody will be able to make heads or tails of the reciprocal tariffs before the other shoe finally drops. This uncertainty also reflects how difficult it is to make sense of the concept of reciprocal tariffs Trump introduced — especially when the underlying logic is not clear.

Compared to the clear actions taken when imposing tariffs on China during his first term, Trump’s return to the White House has bamboozled markets, academic circles and public opinion. Be it tariffs threatened against Canada and Mexico, a newly announced 25% tariff on imported cars, or the forthcoming reciprocal tariffs, the situation remains confusing and uncertain.

Speculation and analyses abound. Are these actions driven by industrial logic aimed at promoting trade balance and bringing manufacturing back to the US, or are the tariffs a bargaining tool for the next round of negotiations? Are they short-term trade considerations, or as recent market rumours suggest, is Trump “going big” in using tariffs as a bargaining chip to devalue the US dollar, enhance American export competitiveness, and reduce US debt pressure? In other words, is he attempting to force countries into a so-called “Mar-a-Lago Agreement” to ultimately reshape global trade and financial order?

Many fear that the tariff war initiated by Trump could lead to a repeat of the Great Depression of the 1930s.

While no one can quite figure out what Trump has up his sleeve, one can foresee that the turmoil under Trump’s tariffs will be hard to avoid. With tariffs looming, the Nasdaq index fell by 10.5% in the first quarter of this year, marking its worst performance since the second quarter of 2022; the S&P 500 index also declined by 4.6% in the first quarter, its largest single-quarter drop since the third quarter of 2022. Goldman Sachs recently raised the probability of a US economic recession in the next 12 months from 20% to 35%.

Many fear that the tariff war initiated by Trump could lead to a repeat of the Great Depression of the 1930s. Back then, the US enacted the Smoot-Hawley Tariff Act in response to domestic economic downturns, attempting to protect its economy through trade protectionism. However, other countries retaliated with their own tariffs, which caused global trade to collapse by nearly 66% and worsened the economic recession worldwide. This crisis was later regarded as one of the key triggers of World War II.

... China could seize the opportunity to position itself as a stabilising force, thereby expanding its strategic space.

A valuable chance for China to step up and assert leadership

Countries are actively seeking countermeasures in response to the potential shockwaves that Trump may unleash on the global trade system. For China, this situation presents both risks and opportunities. A tariff war with the US may be unavoidable, but as the US aggressively dismantles the free trade and multilateral trade systems and ceases to uphold a rules-based international economic order, China could seize the opportunity to position itself as a stabilising force, thereby expanding its strategic space.

One example is the economic meeting — the first in five years — between China, Japan and South Korea on 30 March, where the three nations pledged to deepen economic and trade cooperation. Although China has structural tensions with Japan and South Korea — both US allies — the three sides share an interest in strengthening cooperation in the face of tariff disruptions. This creates a positive opening for China to improve its relations with its two neighbours.

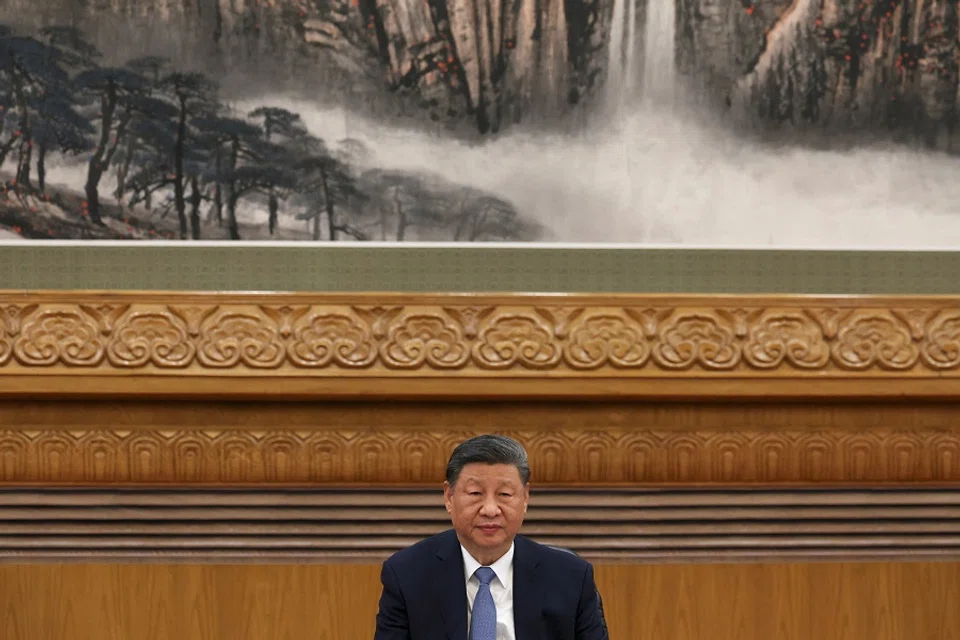

Beijing appears to be actively seeking to capitalise on this opportunity. Over the past week, a series of high-profile events — from the China Development Forum, the Boao Forum for Asia, to a meeting between Chinese President Xi Jinping and about 40 foreign business executives and trade association representatives — show that the government is signalling China’s openness and is seeking to portray itself as a stabilising anchor in a turbulent world.

At a time when global trade rules are at risk of unravelling, such rational voices are welcomed by many. However, turning verbal commitments into concrete actions will require substantial reforms, some of which may be particularly challenging. This is the greatest obstacle China must overcome if it hopes to seize this opportunity.

This article was first published in Lianhe Zaobao as “对等关税动荡中的中国机遇”.

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)