Hong Kong no longer the 'East-meets-West' financial hub of yesteryear

Hong Kong's stock market has taken a beating recently, with the number of IPOs and trade volumes in a slump. Amid the different factors causing the poor performance, including the economic situation in mainland China, analysts believe that the Hong Kong Stock Exchange's long-running focus on the West and oversight of Southeast Asia needs to be addressed. Lianhe Zaobao journalist Liu Sha finds out more.

Hong Kong's stock market, originally one of the world's most active markets, has been experiencing a cold winter in the past six months due to slow initial public offering (IPO) fundraising activity and low trading volume.

Kenny Siu, a Hong Kong securities trading licensee with more than a decade of experience in the financial sector, told Lianhe Zaobao that business has been bad for him and his peers over the past six months.

International financial centre status in question?

In order for a company to be listed on the Hong Kong Stock Exchange (HKEX), specialists who are registered or licensed with the Securities and Futures Commission (SFC) must conduct due diligence on the company and assist in the drafting of the prospectus. When these highly sought-after specialists lament the lack of business, Hong Kong's severe lack of IPOs is evident.

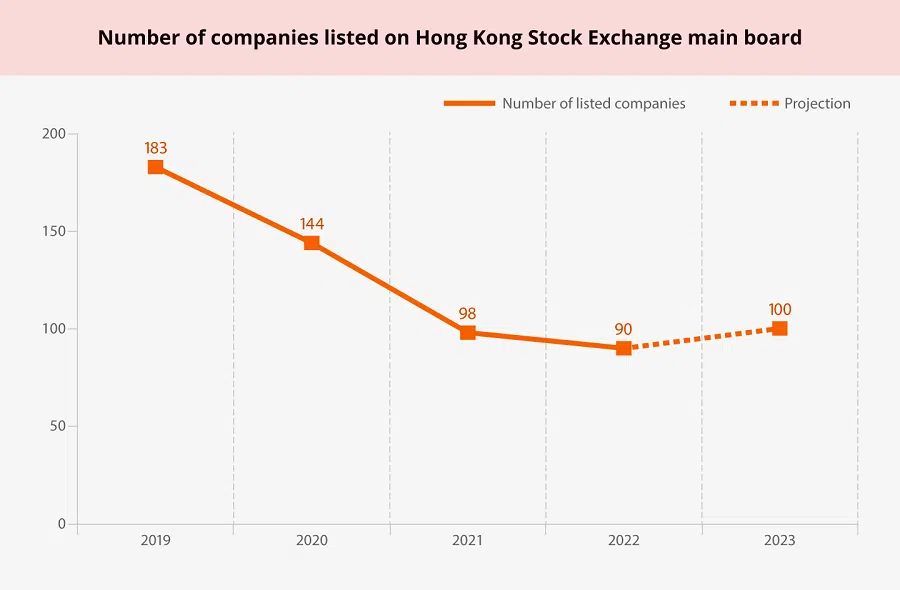

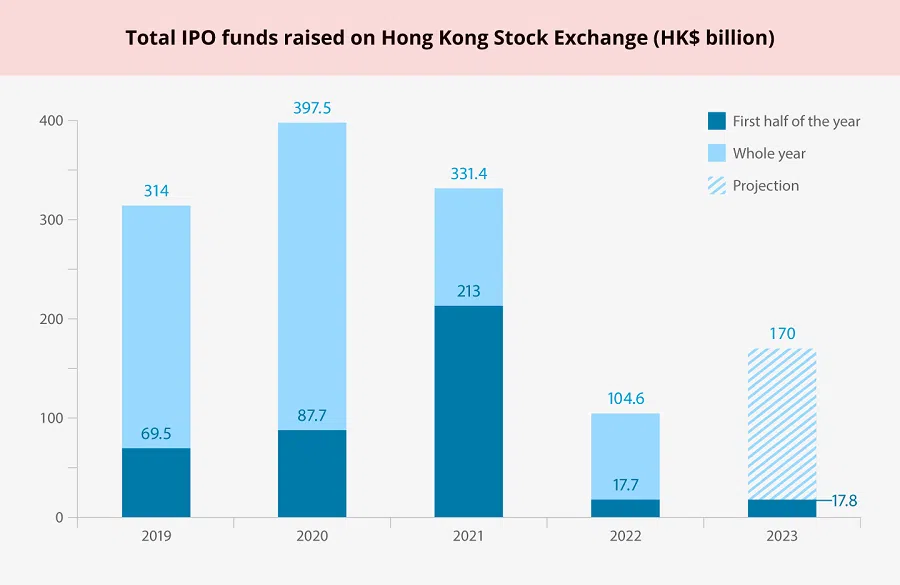

According to Deloitte's June report on the mainland's and Hong Kong's IPO market performance, Hong Kong slid to sixth place for IPOs, with 31 IPOs listed in the first half of the year. The total of HK$17.8 billion (US$2.27 billion) raised marked a decline of nearly 10% year-on-year.

In contrast, Hong Kong has ranked as the world's top IPO venue in seven of the last 13 years and never fell out of the top five in the other years. Deloitte's report pointed out that Hong Kong's fundraising amount from IPOs dropped to the lowest point in a decade, inching up just 1% from last year.

... a financial centre should be a place where capital from both the East and the West can easily flow in and out, but this is hardly the case in Hong Kong nowadays. - Kenny Siu, Hong Kong securities trading licensee

The new IPOs did not perform well either. In the first half of the year, 15 of the 31 IPOs listed in Hong Kong fell below their issue price on the first day of trading. Existing companies on the HKEX have also been stuck with low valuation and trading volume, greatly reducing investors' willingness to enter the market.

Under such circumstances, some people questioned the financing capacity of Hong Kong stocks and asserted that Hong Kong is no longer worthy of its status as an international financial centre.

Siu, who is a responsible officer at China Enterprise Securities Co. Ltd., said candidly that a financial centre should be a place where capital from both the East and the West can easily flow in and out, but this is hardly the case in Hong Kong nowadays. "In the past, the Hong Kong market would move up and down and people were always buying and selling. But now, the market lacks momentum and vitality," he lamented.

Inseparable from mainland China's economy

Hong Kong's slowing financial market is closely related to mainland China's struggling economy.

Mainland Chinese companies account for 77% of the HKEX's market capitalisation. They also accounted for 90% of the new listings in Hong Kong in the first half of the year, up from 88% in the same period last year. This makes it difficult for Hong Kong stocks to be impervious to the ebbs and flows of the mainland Chinese economy.

In the second quarter of the year, the market turnover of the HKEX main board totalled HK$6.06 trillion, a decrease of HK$1.58 trillion or 20.68% year-on-year.

Looking at the performance of the Hang Seng Index over the past year, Aletheia Capital China strategist Vincent Chan told Lianhe Zaobao that after anti-Covid measures were lifted at the end of last year and the beginning of this year, the market was optimistic about the likelihood of economic recovery and the index briefly surged to 22,000 points. However, it rapidly plunged and hovered around 19,000 points when mainland China's economic recovery remained lacklustre.

Chan noted that since the beginning of this year, mainland China's economic recovery has been slow and its three main pillars of growth - real estate, consumption and exports - have remained sluggish. The lack of results from the government's stimulus policies has also directly affected the profit expectations of companies listed on the HKEX.

Amid a weak economic outlook, the low trading volume of Hong Kong stocks, which has long been criticised, has come under the spotlight as well. In the second quarter of the year, the market turnover of the HKEX main board totalled HK$6.06 trillion, a decrease of HK$1.58 trillion or 20.68% year-on-year.

The HKEX's low trading volume and fundraising amount in turn affected the willingness of mainland Chinese companies to be listed in Hong Kong, making matters worse for the HKEX.

Deloitte's report also showed that from January to May this year, the number of enterprises that failed to list after their applications were approved increased by over 40% year-on-year. This means that some companies chose not to get listed after obtaining approval.

At the same time, the number of delistings has been on the rise. The Securities Times (《证券时报》) reported that 15 enterprises have chosen to delist last year, while 12 enterprises published delisting announcements in the first half of this year alone. Among them, a mainland Chinese enterprise said that they decided to delist because the Hong Kong stock market valuation could not reflect the company's fundamentals, which was detrimental to its reputation. At the same time, it was costly to maintain the listing status, and the loss outweighed the gain.

... mainland Chinese capital inflow is unable to promptly fill the gap of capital outflow from Europe and the US, Hong Kong's stock market remains weak with a worsening financing capacity.

Losing its shine

Additionally, as a result of the massive outflow of foreign capital from Hong Kong, the Hang Seng Index is hovering at a low level and the trading volume of Hong Kong stocks has continued to decline, causing Hong Kong stocks to lose their international appeal.

Based on a Citic Securities report released in May, accumulated foreign capital outflows from Hong Kong stocks have reached HK$1.05 trillion since 2021. The latest large-scale foreign capital outflow occurred after February this year, when over HK$140 billion flowed out of the Hong Kong stock market. The report also pointed out that foreign capital outflows have reached a record high.

Analysts assessed that Hong Kong's GDP of less than HK$3 trillion is not large enough to support a stock market with a market capitalisation of nearly HK$40 trillion. At the same time, because mainland Chinese capital inflow is unable to promptly fill the gap of capital outflow from Europe and the US, Hong Kong's stock market remains weak with a worsening financing capacity.

Interviewed academics believe that geopolitical tensions and risks associated with Chinese assets are the main reasons why foreign capital is withdrawing from Hong Kong.

China International Capital Corporation acted as a sponsor for 34 Hong Kong IPOs last year, more than Morgan Stanley and Goldman Sachs combined.

While Hong Kong's stock market has always been an important entry point for foreign institutions seeking to invest in Chinese assets, there is little incentive for them to do so now. Aletheia Capital China's Chan explained, "Foreign investors are focused on whether China's economy is indeed slowing and whether a full decoupling is in store for China and the US. But there's no good news on either front."

Over the years, international investment banks have also become less prominent in Hong Kong's IPOs, with their positions being replaced by Chinese securities firms. The Securities Times reported that the China International Capital Corporation acted as a sponsor for 34 Hong Kong IPOs last year, more than Morgan Stanley and Goldman Sachs combined.

China Enterprise Securities' Siu said, "In the past, the Americans used to lead the IPOs. Now, mainland Chinese organisations are doing that."

This is partly related to the China Securities Regulatory Commission (CSRC)'s requirement for Chinese companies to comply with new filing requirements for overseas listing, which gives Chinese securities firms an advantage over international ones in dealing with these matters.

"Hong Kong's status as an international financial centre could be jeopardised if Western capital withdraws from the region and mainland Chinese IPOs refuse to get listed in Hong Kong." - Vincent Chan, China strategist, Aletheia Capital

However, Chan noted that in the past, there were a number of market-driven private enterprises in mainland China, in which foreign investors had participated in the financing during the growth period, were listed in Hong Kong and were welcomed by international investment banks.

But such companies are now few and far between, as more state-backed heavy industry, tech and semiconductor companies are growing bigger and going public. These enterprises often have a large number of government orders, which are also related to national security, and are thus avoided by international investment banks.

Chan said, "Hong Kong's status as an international financial centre could be jeopardised if Western capital withdraws from the region and mainland Chinese IPOs refuse to get listed in Hong Kong."

Expanding into Southeast Asia

Interviewed academics and industry practitioners think that the root cause of Hong Kong's stock slump is the gloomy mainland China economy. However, they assessed that the slump is only temporary.

Professor Liu Jing of Cheung Kong Graduate School of Business told Lianhe Zaobao that financial centres can never exist separately from the real economy; the difficulties of the Hong Kong stock market reflect the challenges encountered by the real economy in mainland China. However, as the foundation of Hong Kong's position as a financial centre is still in place, Hong Kong stocks will be revitalised if the mainland economy resumes healthy growth.

ONC Lawyers partner Angel Wong believes that activity will return to Hong Kong stocks in the second half of the year. She predicts that several star enterprises, including Alibaba affiliate Ant Group, will get listed in Hong Kong, which will attract more IPOs and revitalise market activity. Outstanding enterprises will also prompt the return of capital that had previously withdrawn from the market.

Hong Kong has always done business with the West and taken little notice of Southeast Asian markets. But with the withdrawal of capital from Europe and the US and the rapid growth of Southeast Asia, it is time for Hong Kong to reposition itself. - Kenny Siu, Hong Kong securities trading licensee

In the long term, Liu thinks that even with the decoupling of Chinese and Western industries, Hong Kong remains a bridge between mainland China and the Belt and Road Initiative (BRI) on the one hand and Southeast Asian countries on the other. This provides new space for Hong Kong as a financial centre.

HKEX CEO Nicolas Aguzin announced on 16 August that HKEX is actively expanding into the Middle East and Southeast Asian markets.

However, Hong Kong also faces competition in the Southeast Asian market. Liu pointed out that in the Asian market, Singapore has a similar institutional design to Hong Kong, but boasts of a better coverage of Southeast Asia and the ability to maintain good relations with both mainland China and the West, posing as a formidable rival to Hong Kong.

But China Enterprise Securities' Siu said candidly that Hong Kong has always done business with the West and taken little notice of Southeast Asian markets. But with the withdrawal of capital from Europe and the US and the rapid growth of Southeast Asia, it is time for Hong Kong to reposition itself.

He said, "Hong Kong must transform from a financial centre of China and the West to a bridge between China and the BRI and Southeast Asian markets."

This article was first published in Lianhe Zaobao as "大陆经济复苏乏力 港金融中心经历寒冬".

Related: Will an investment summit revive Hong Kong's status as a financial hub? | Hong Kong's left turn could hit its financial centre status | 'Homecoming' listings heat up in Hong Kong | HKEX a refuge for Chinese companies fleeing US stock exchanges? | HK Stock Exchange to benefit from returning US-listed Chinese firms

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)