Malaysia–China economic relations: Riding the dragon’s tail for structural transformation

Strengthening the economic relationship between Malaysia and China can potentially contribute towards Malaysia’s structural transformation in terms of re-industrialisation and greening of its economy.

Malaysia and China are celebrating the 50th anniversary of establishing mutual diplomatic relations this year. One key feature of the relationship between the two countries is the deepening of economic interactions in terms of trade and investment.

The strength of this relationship is reflected in the State of Southeast Asia 2023 published by ISEAS – Yusof Ishak Institute, in which 65% of the Malaysian respondents in the survey identified China as the most influential economic power in Southeast Asia.

Understanding Malaysia-China relations

Malaysian Prime Minister Anwar Ibrahim has already made two official trips to China since assuming office in November 2022, and the value of economic deals inked in the various memoranda of understanding signed during the two trips amounted to about 200 billion ringgit (US$41.7 billion).

Beyond these headlines, how will Malaysia gain from the further enhancement of its economic relations with China? Answering this question requires an understanding of the economic challenges presently facing Malaysia; there are also uncertainties over how current global geopolitical tensions will affect the economic linkages between the two countries.

This article addresses these areas by examining the economic challenges facing Malaysia, the current state of Malaysia-China economic relations, and finally, the potential role that China can play in Malaysia’s economic transformation.

Malaysia’s economic slowdown

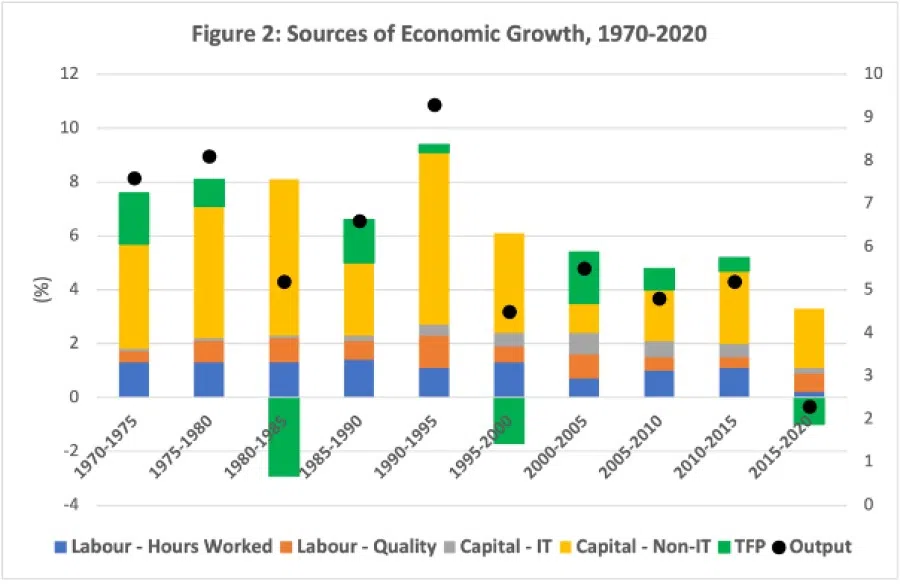

The Malaysian economy has been slowing down for the past two decades (Figure 1). From 2010 to 2019, it grew at an average annual rate of 5.4%, which is considerably lower than the 9.3% growth rate during 1988-1997. There are two major causes for the economic slowdown, namely, lower levels of investment, and total factor productivity (TFP) (Figure 2). TFP is related to innovation-related productivity (as opposed to labour productivity).

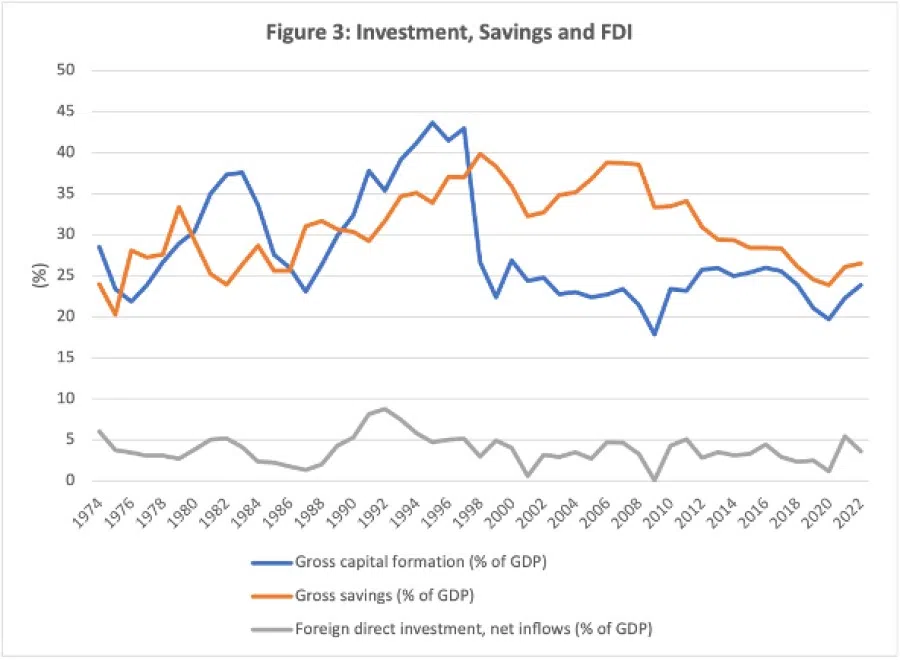

The long-term decline in domestic savings since 2008 has put additional pressure on the need to increase investment through FDI.

The long-term decline in investment has serious consequences as it lowers the economy’s productive capacity. In the past, two surges in investments — during 1976-1983 and 1987-1997 — laid the foundations for the high growth rates in the 1970s, 1980s and 1990s (Figure 3).

FDI played an important role in boosting investments in the 1990s. However, a significant proportion of investments originated domestically, with the private sector share of domestic investment gradually increasing from 55% in 2010 to 78% in 2022. The long-term decline in domestic savings since 2008 has put additional pressure on the need to increase investment through FDI (Figure 3).

Decline in role of manufacturing and trade

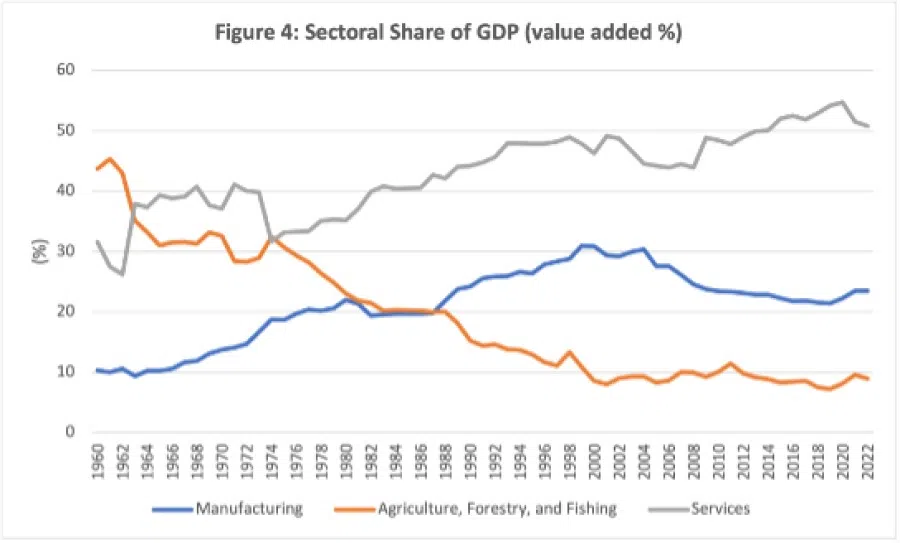

The decline in investment since the late 1990s has been accompanied by a decline in the role of manufacturing in the economy. Manufacturing’s share of GDP was stagnant at around 30% from 1999 to 2004 before declining to 21% in 2019 (Figure 4).

The relative decline in the manufacturing sector has sparked concerns about premature deindustrialisation — involving a relative decline in a country’s manufacturing sector before the country has become a developed nation.

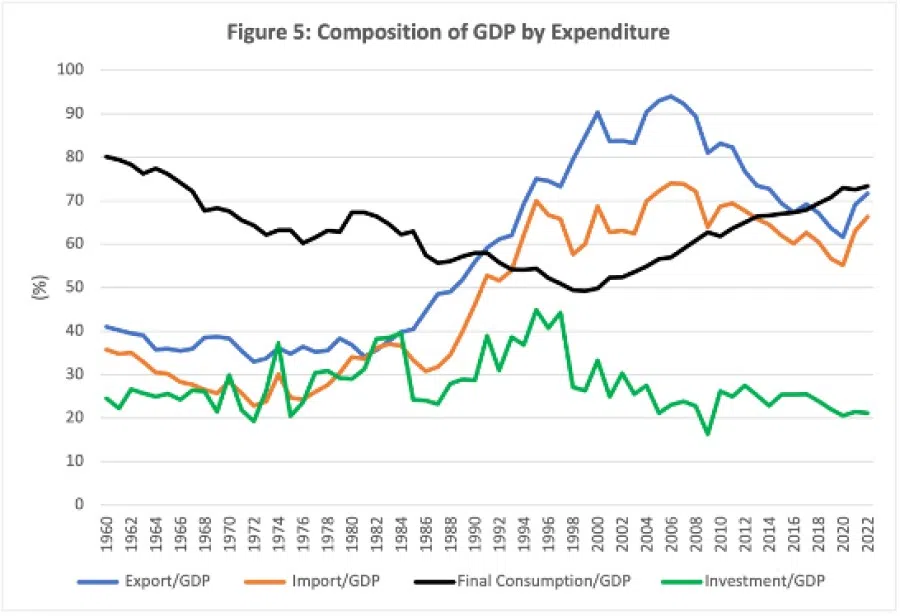

Since Malaysia’s manufacturing sector is very export-intensive — with more than half of its manufacturing output being exported — the country’s export-to-GDP share has declined since 2006 (Figure 5). The size of net exports (or exports minus imports) has also shrunk.

There was a mini revival in trade during the pandemic, but this has not reversed the long-term decline in trade as an engine of growth for the country.

Despite the slowdown in overall exports of goods from Malaysia to China, Malaysia’s export of electrical machinery and equipment to China has been increasing rapidly in recent years...

Malaysia-China trade relations strengthening

China is one of Malaysia’s most important trading partners. China accounts for around 15% and 21% of Malaysia’s exports and imports respectively.

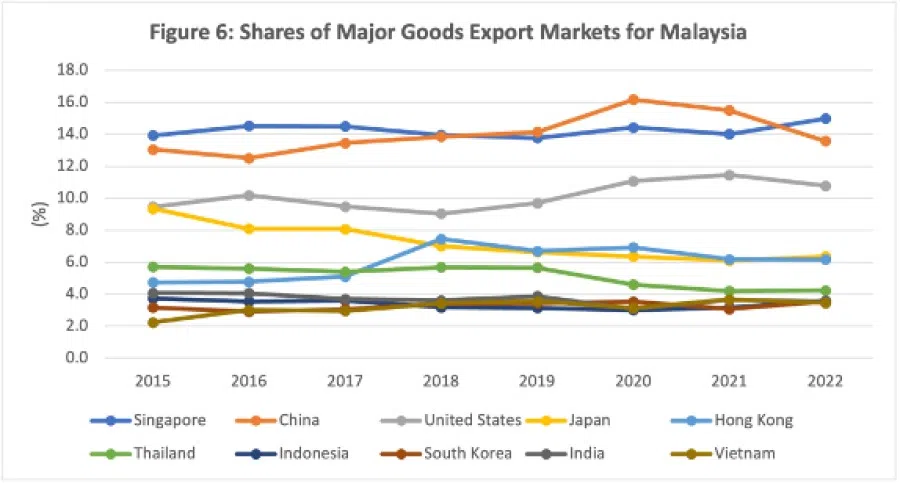

Even as Malaysia’s trade ratio declines, China’s share of the country’s goods export has increased consistently until the outbreak of the Covid-19 pandemic in 2020 (Figure 6). Subsequently, the pandemic in China caused a slowdown in Malaysia’s export of goods to China, resulting in a decline in China’s share of Malaysia’s goods exports after 2020.

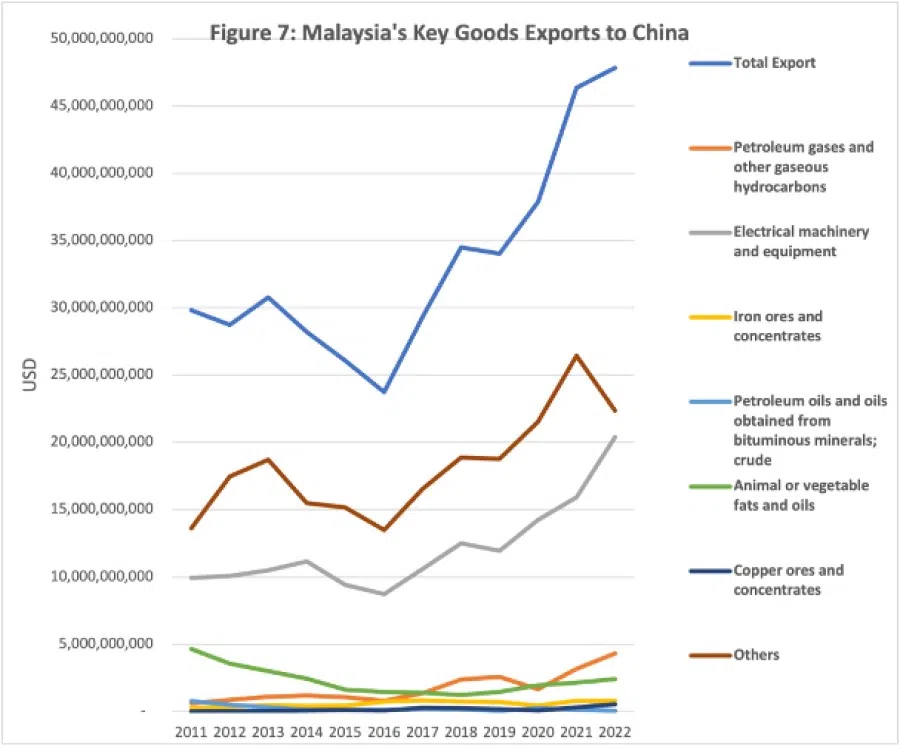

Despite the slowdown in overall exports of goods from Malaysia to China, Malaysia’s export of electrical machinery and equipment to China has been increasing rapidly in recent years (Figure 7).

The increasing importance of China as an export market for electrical machinery and equipment is a long-term trend. Data from COMTRADE show that the share of electrical machinery and equipment in Malaysia’s total exports to China increased from 33.3% in 2011 to 42.6% in 2022. Imports of electrical machinery and equipment products have also increased, consistently exceeding the export of these products. Both trends indicate that Malaysia is embedded in China’s regional value chain in this industry.

Malaysia’s dependence on China has deepened

There is additional evidence that the supply chain linkages between these two countries in the electrical machinery and equipment industry have deepened over time.

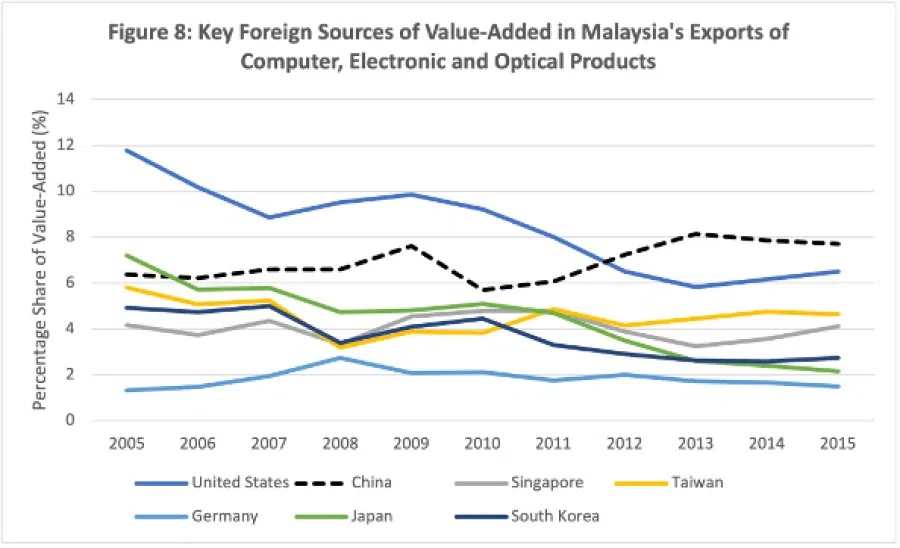

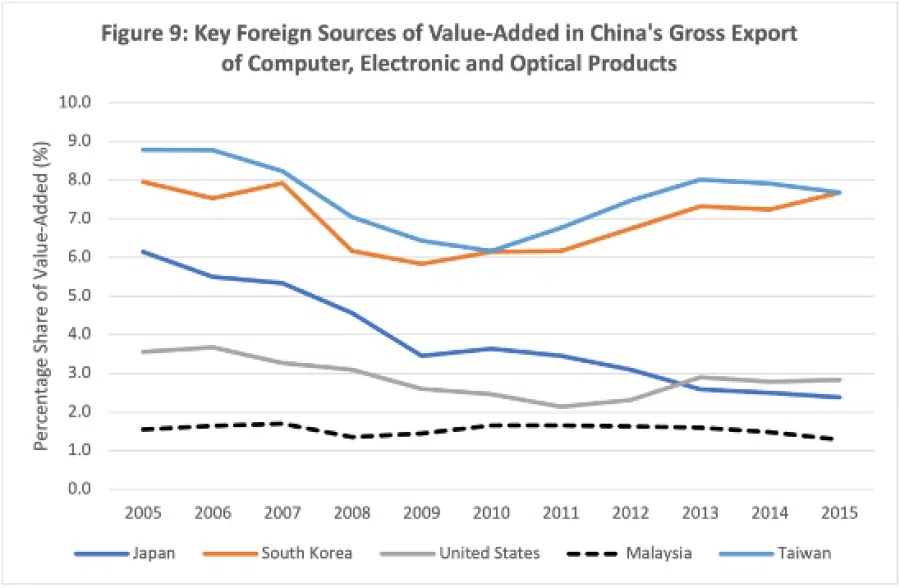

Historical data from OECD’s Trade in Value Added (TiVA) dataset show that the share of value-added originating from China (via imports) in Malaysia’s exports of computer, electronic and optical products has increased, especially since 2010 (Figure 8). In the opposite direction, the share of value originating from Malaysia in China’s exports of computer, electronic and optical products has remained relatively stable at slightly more than 1% during the same period (Figure 9).

Malaysia’s dependence on China has deepened as it has increased its outsourcing to China (by importing more parts and components), but the reverse flow has not happened.

Comparing the two trends in this industry (technically, backward participation and forward participation rates, respectively), Malaysia’s dependence on China has deepened as it has increased its outsourcing to China (by importing more parts and components), but the reverse flow has not happened. Crucially, more recent data are needed to assess whether the trade tension between China and the US has changed these trends.

Foreign direct investment from China

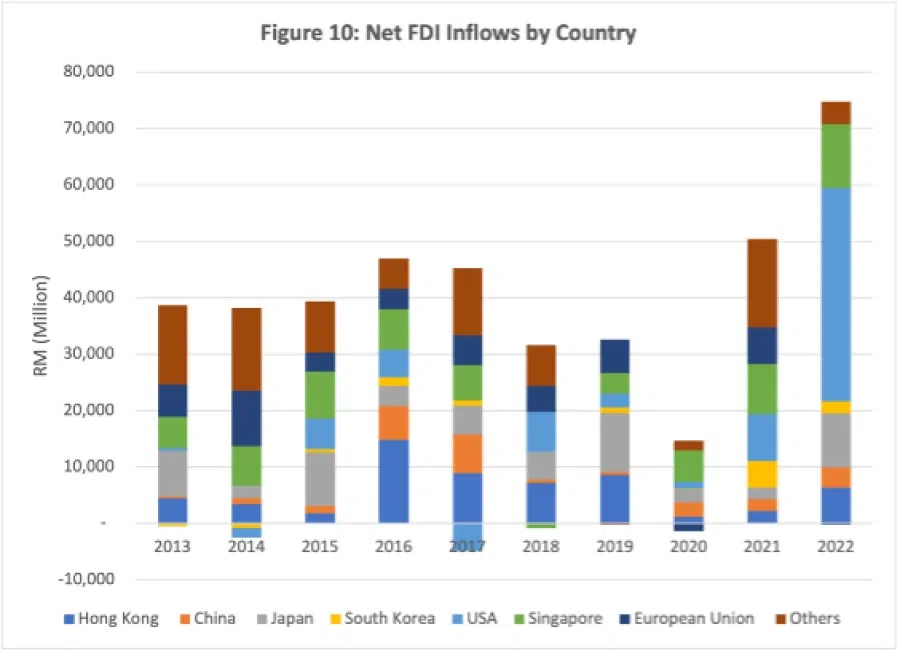

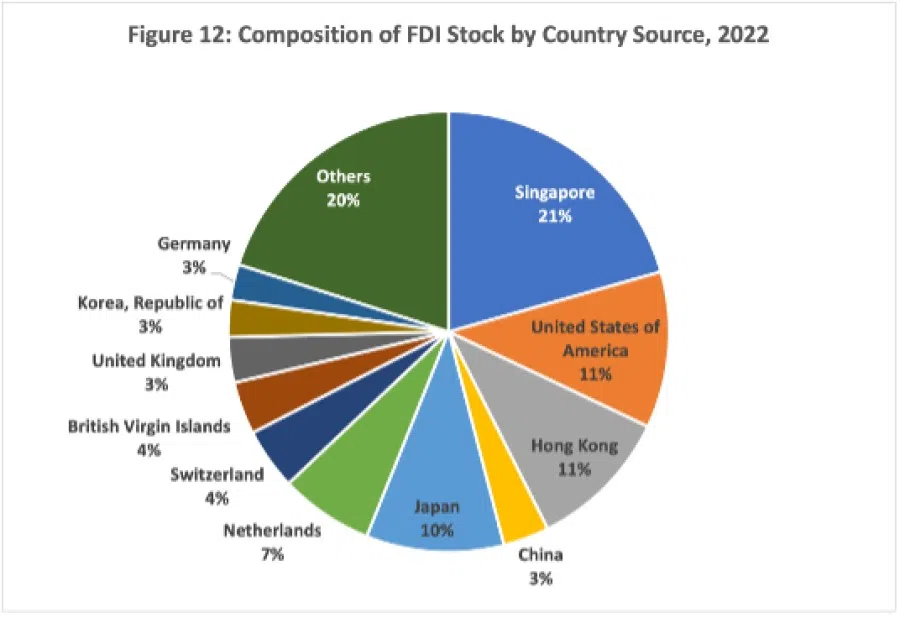

Before the pandemic, annual net FDI inflows into Malaysia averaged around 30 to 45 billion ringgit (Figure 10). In the post-pandemic period, the recovery in FDI has been driven mostly by FDI inflows from Japan, Singapore and the US.

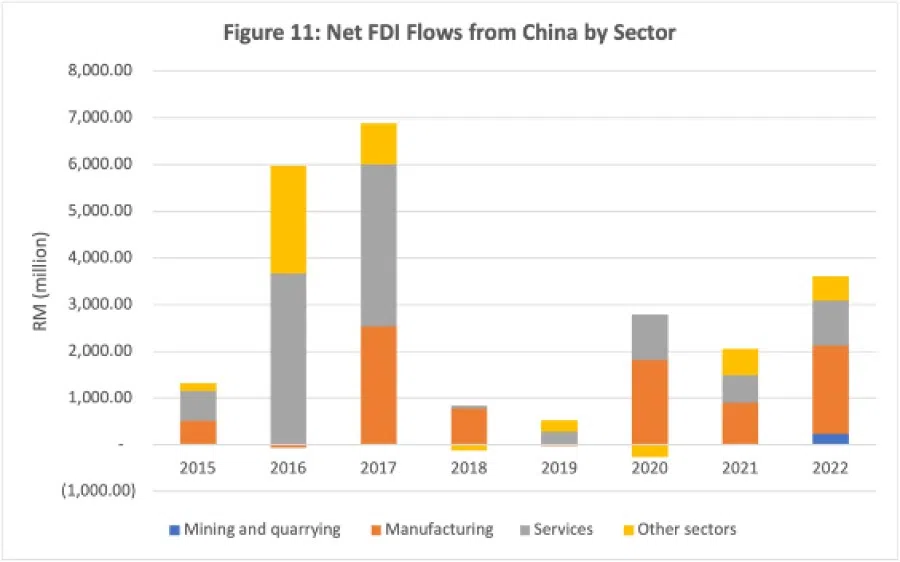

Official data for 2022 and the first nine months of 2023 indicate that more than 60% of the FDI went to the manufacturing sector, especially the electrical and electronics (E&E) industry. The FDI flows from China had been relatively small before the pandemic except for 2016 and 2017.

FDI from China, however, is a more recent phenomenon, exhibiting two major surges — first between 2015 to 2017, and more recently, since 2019.

A significant proportion of recent FDI inflows from China went to the manufacturing sector (Figure 11). In terms of the share of total FDI stock (or cumulative investments) in Malaysia, China’s share was at 3% in 2022. Most of China’s FDI stock in Malaysia is split evenly (41% each) between manufacturing and services.

China’s role in Malaysia’s structural transformation

Trade and investment relations between Malaysia and China have deepened over the years. Malaysia’s trade relations with China accelerated after China’s accession to the WTO. FDI from China, however, is a more recent phenomenon, exhibiting two major surges — first between 2015 to 2017, and more recently, since 2019.

These trade and investment linkages between the two countries hold long-term implications where the structural transformation of the Malaysian economy is concerned. The current set of economic strategies undertaken by the government provides a useful context in which to assess the significance of these investments, and also of future ones.

For this purpose, two recent medium-term and long-term policies are examined here, namely, the New Industrial Masterplan 2030 (NIMP) and the National Energy Transition Roadmap (NETR).

New Industrial Masterplan 2030

Malaysia launched the New Industrial Masterplan 2030 (NIMP 2030) to revitalise the country’s manufacturing sector for the next seven years, from 2023 to 2030. The Masterplan is underpinned by four “missions”, namely the innovation and production of more technologically sophisticated (complex) products, digital transformation, net-zero future, as well as economic security and inclusivity.

A number of strategies are listed under each mission and each strategy has a list of implementable action plans. Most of the action plans are cross-cutting and only a few are sector- and project-specific. These specific action plans provide some clues on the potential contributions of China to Malaysia’s manufacturing sector.

A total of 21 sectors and four new growth areas are covered in NIMP2030. The five key sectors targeted are electrical and electronics (E&E), chemical, pharmaceutical, medical devices and aerospace. The sector-specific action plans that focus on the E&E include integrated circuit design and wafer fabrication.

Despite having a relatively smaller production presence in Malaysia, China plays an important role in terms of market demand.

Electrical and electronics sector: coexistence of China and the West in Malaysia?

The role of China in Malaysia’s E&E sector is complex. There is a heavy presence of American and European multinationals in the industry. Recent examples of announced investments include those by Intel (a US$7 billion new chip packaging facility in Penang), Infineon Technologies (a US$5.5 billion investment in a new silicon carbide power fab plant in Kulim) and Texas Instruments (a US$3.16 billion investment in new assembly and test factories in Melaka and Kuala Lumpur).

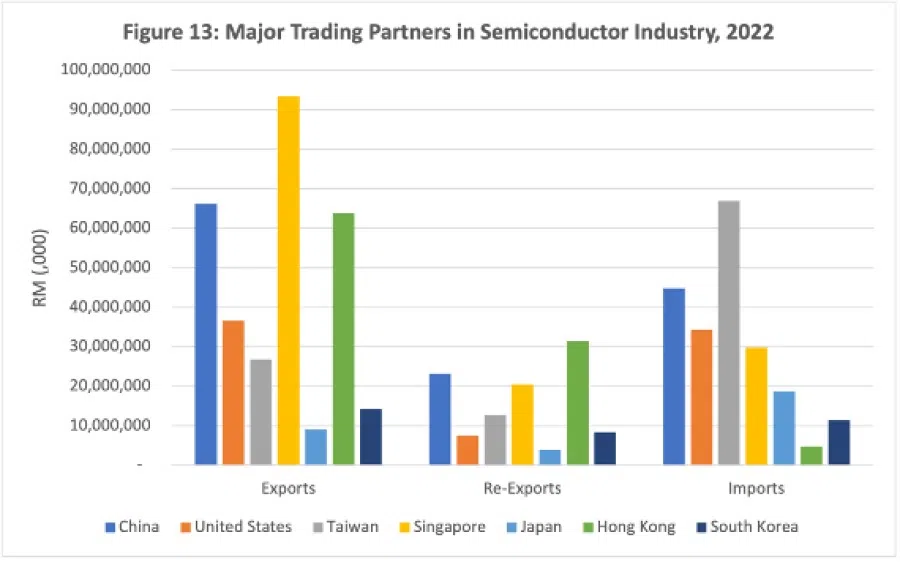

Despite having a relatively smaller production presence in Malaysia, China plays an important role in terms of market demand. China is a major export market for the semiconductor industry via direct exports to China or indirectly through Hong Kong (Figure 13).

The products from Infineon Technologies’s new plant are to be sold to renewable energy businesses and electric vehicle producers that will include Chinese companies. These developments, which involve economic spillovers across industries (e.g. E&E and EV), is a key strategy in the NIMP2030.

There are some uncertainties in terms of how the geopolitical rivalry and tensions between China and the US will impact both countries’ future roles in Malaysia’s manufacturing sector. The NIMP2030 takes cognisance of this challenge but only provides broad policy pronouncements in terms of pushing for “greater vertical integration across value chains” and for “an international, rules-based order, while maintaining ASEAN centrality” (NIMP2030, p.34).

At the industry level, recent media reports suggest that Chinese multinational enterprises (MNEs) in the E&E industry are increasing their footprint in Malaysia. Examples include Chinese-owned companies and domestic-owned firms involved in chip packaging for assembly graphics processing units.

These developments imply that the investment flows from the US and European countries that will strengthen trade linkages in E&E between Malaysia and China could continue despite the geopolitical tensions...

There is also anecdotal evidence that American multinational enterprises (MNEs) in the E&E industry are addressing the market restrictions that have emerged amidst the China-US geopolitical tensions by modifying their products.

When the US imposed export curbs on advanced chips (such as Nvidia’s A100 and H100), both Nvidia and Intel responded by altering their chips to bypass them. These developments imply that the investment flows from the US and European countries that will strengthen trade linkages in E&E between Malaysia and China could continue despite the geopolitical tensions, given the importance of the China market to American and European E&E MNEs.

National Energy Transition Roadmap

Malaysia’s strategies for industrial transformation are embedded in a broader goal of promoting greater use of green energy.

The National Energy Policy 2022-2040 was launched in September 2022 by former Prime Minister Ismail Sabri to achieve the Low Carbon Nation Aspiration. Subsequently, the Anwar administration launched the National Energy Transition Roadmap (NETR) in August 2023 with the aim of accelerating the structural shift of energy systems towards cleaner sources of energy.

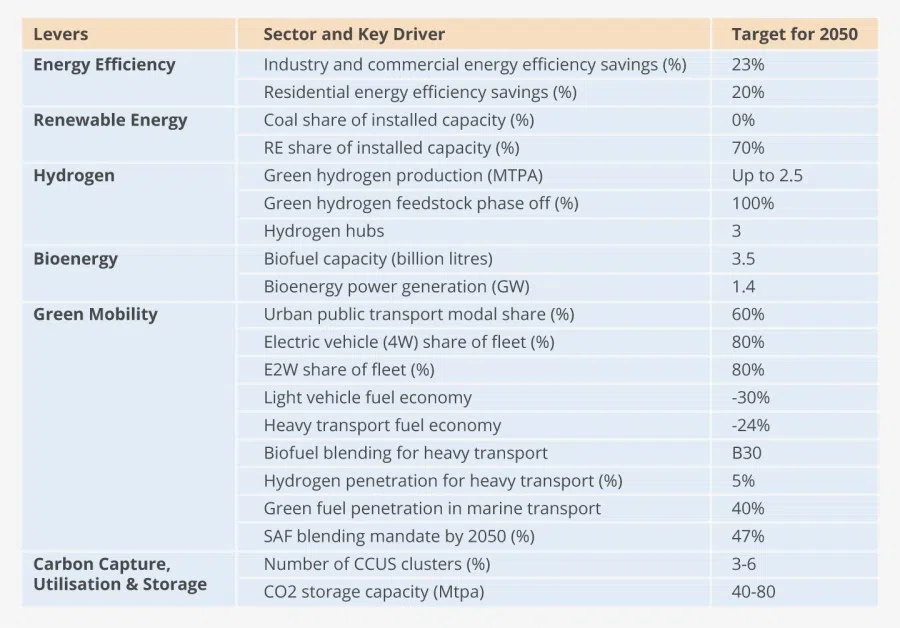

The NETR contains significant targets for green sources of energy as well as green mobility (Table 1). These include increasing renewable energy’s share of installed capacity to 70% and the share of four-wheel electric vehicles to 80% by 2050.

...the domestic demand for solar PV has been met by imports from China. Such imports have reduced the cost of solar PV installation in Malaysia.

Table 1: Targets in the National Energy Transition Roadmap

Can China play an important role in helping Malaysia achieve its goals for renewable energy?

Solar PV and EVs: Finding growth amid US-China rivalry

Under the NETR, the key focus for renewable energy is the development of solar power. The target for solar PV’s share of total installed capacity is 58% by 2050. The equipment to meet the demand for solar PV in the future will come from domestic production and imports.

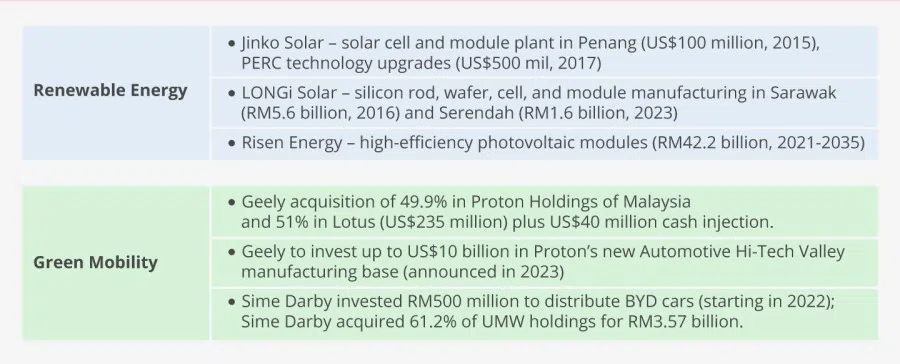

In the case of domestic production, Malaysia attracted significant FDI flows for solar module manufacturing from China in the period 2015-2016 (Table 2). This earlier wave of FDI flows from China was driven by the imposition of import quotas in Europe and import tariffs in the US on solar cells and modules from China.

One consequence of the FDI-driven buildup in solar module production has been the lowering of the cost and price of this product. However, the domestic demand for solar PV has been met by imports from China. Such imports have reduced the cost of solar PV installation in Malaysia.

Table 2: Selected foreign investments from China in Malaysia’s green economy

The present wave of FDI in the solar cell and module industry is set to further increase Malaysia’s exports within this industry. However, the export activities of this industry are also caught up in the US–China trade tensions.

In August 2023, the US Department of Commerce determined that a number of companies based in Cambodia, Malaysia, Thailand or Vietnam were exporting solar cells and modules to circumvent antidumping and countervailing duties levied by the US on these products from China.

In Malaysia’s case, two companies — Hanwha Q CELLS and Jinko Solar Technology (Chinese-owned) — were found not to be circumventing these duties, whilst the status of adverse facts available (AFA) were imposed on five companies. In these AFA cases (involving missing or deficient information due to non-cooperation of companies), the US Department of Commerce has discretionary powers to declare the involved companies as circumventing duties.

The Chinese automaker Geely, which currently owns 49.9% of Proton, has announced plans to establish Proton as a major EV hub in the Southeast Asia region via a US$10 billion investment.

China can potentially contribute to achieving Malaysia’s goals for green mobility as well as re-industrialisation. In the NETR, the electric vehicles’ (EV) share of the car fleet in Malaysia is expected to be 80% by 2050. The Chinese automaker Geely, which currently owns 49.9% of Proton, has announced plans to establish Proton as a major EV hub in the Southeast Asia region via a US$10 billion investment.

The regional focus of Geely is imperative given the relatively small size of the Malaysian EV market and the recent entry of BYD into the market via Sime Darby. Geely’s regional strategy — it is investing in Thailand as well — will link up the automotive supply chains in Malaysia and Thailand. This is a strategic move given Thailand’s existing comparative advantage in the automotive sector.

Thailand has already attracted FDI from many of China’s large EV companies such as BYD, SAIC Motor group and Great Wall Motor. Compared to the E&E and solar industries, the EV industry is less vulnerable to the geopolitical tensions between the US and China. Its supply chain and export markets are more regional.

Aligning with Malaysia’s strategies

Malaysia’s economic relationship with China has deepened since the two countries established diplomatic relations 50 years ago. There are opportunities for Malaysia to further strengthen the trade and investment relations between the two countries. This could be undertaken in such a way as to support Malaysia’s strategies for economic transformation in terms of re-industrialisation and greening its economy.

Industries that are export-oriented, such as E&E and solar, will see their export potential impacted more seriously by the geopolitical tension between the US and China. Export market diversification will be an important strategy for these industries.

This is an adapted version of ISEAS Perspective 2024/23 published on 27 March 2024. The paper and its references can be accessed at this link.