Russia in Southeast Asia: Falling influence despite being largest arms seller

Although Russia has been increasing its defence diplomacy activities in Southeast Asia, its military cooperation with the region remains overwhelmingly focused on arms sales. However, Russia is at risk of losing its position as the number one arms seller to Southeast Asia due to increased competition from American, European and Asian defence companies. Besides, Russian navy port calls to Southeast Asia and combined military exercises in the region are infrequent and small-scale compared to those of the US and China. ISEAS academic Ian Storey examines how Russia might expand its influence.

In the era of great power competition, defence diplomacy has become an increasingly important tool of statecraft.

Defence diplomacy serves a variety of purposes, including attempts to expand political, economic and military influence in another country and counteract the influence of a competitor; understanding another country's security perspectives and military capabilities; and strengthening defence cooperation with, and offering capacity-building support to, friends, partners and allies.

Defence diplomacy activities include arms sales, combined military exercises, educational exchanges, naval port calls, strategic dialogues, and participation in peacekeeping and humanitarian and disaster relief operations.

As part of President Vladimir Putin's Asia-focused "turn to the east" policy, Russia has been expanding its defence diplomacy activities in Southeast Asia since 2010. However, Russia's military cooperation with the region remains overwhelmingly focused on arms sales. Moreover, although Russia is the biggest seller of arms to Southeast Asia, its sales are declining due to increased competition from other countries and the threat of US sanctions on governments that buy Russian weaponry. Russia's other defence diplomacy pursuits, such as combined exercises and port calls, remain infrequent and small-scale compared to those of the US and China.

Russia's global arms exports and Southeast Asia

Overseas defence sales play a critical role in achieving the Kremlin's great power aspirations. The foreign currency Moscow earns from the sale of military equipment helps fund research and development into new technologies, provides employment for over a million people and helps Russia project influence abroad.

Russia is the second biggest player in the global arms market behind the US. However, whereas America's share of the market is rising, Russia's is declining. Between 2010 and 2019, America's global arms exports rose from US$43.2 billion (31% of the global market) to US$53 billion (36% of the global market), an increase of 23%. During the same period, Russia's defence sales fell from US$36.8 billion (31% of the global market) to US$30.1 billion (27% of the global market), a decrease of 18%.

China is a particular source of frustration for Russia because some of its arms exports are copied or retro-engineered from military equipment originally purchased from Russia.

Several reasons account for the decline in Russia's defence exports.

First, Russian defence enterprises face strong competition from US and European arms vendors, and increasingly from relative newcomers to the global arms trade, such as China and South Korea. China is a particular source of frustration for Russia because some of its arms exports are copied or retro-engineered from military equipment originally purchased from Russia. Moreover, because China views defence sales as a tool to acquire political influence rather than generate money, it is willing to undercut Russia on price.

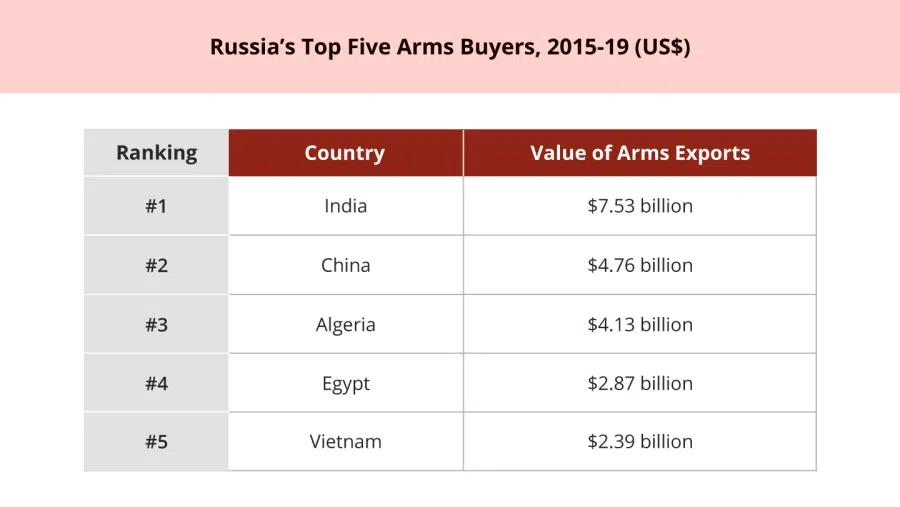

Second, some of Russia's most important traditional customers - especially China and India - are committed to developing their domestic arms industries to reduce dependence on foreign suppliers in order to achieve a higher level of self-sufficiency. While China has recently purchased SU-35 fighter jets and S-400 air defence systems from Russia, it is far less reliant on Russia's defence industry to modernise the People's Liberation Army (PLA) than it was in the 1990s and 2000s. And while New Delhi is still Moscow's biggest customer (see Table 1), Russian arms sales to India fell by 47% between 2010-14 and 2015-19 (US arms sales to India dropped 51% during the same period).

The third reason is US sanctions, or the threat thereof. In August 2017, then US President Donald Trump signed into law the Countering America's Adversaries Through Sanctions Act (CAATSA). CAATSA is designed to "counter [Russian] aggression" by imposing sanctions on countries or persons that have commercial dealings with Russia's military-industrial complex. However, since it came into force, Washington has invoked CAATSA sparingly.

...the threat of US sanctions appears to have had an impact on Russian efforts to sell military equipment to Southeast Asian countries.

In September 2018, the US imposed sanctions on the Chinese military for buying SU-35 fighter jets and S-400s from Russia. In response to complaints from the US Defense Department that CAATSA could be used to penalise US allies and partners, subsequent legislation allowed the US president to ask Congress for a waiver on national security grounds so long as he could demonstrate that the country buying Russian arms was committed to reducing arms purchases from Moscow, or was cooperating with the US on matters "critical to US strategic interests". Nevertheless, in December 2020, the US imposed sanctions on its NATO ally Turkey for purchasing S-400s.

Early indications that President Joe Biden may pursue a tougher line against Russia than his predecessor suggests the new administration may enforce CAATSA more vigorously. As discussed below, the threat of US sanctions appears to have had an impact on Russian efforts to sell military equipment to Southeast Asian countries.

Southeast Asia in Russia's global arms exports

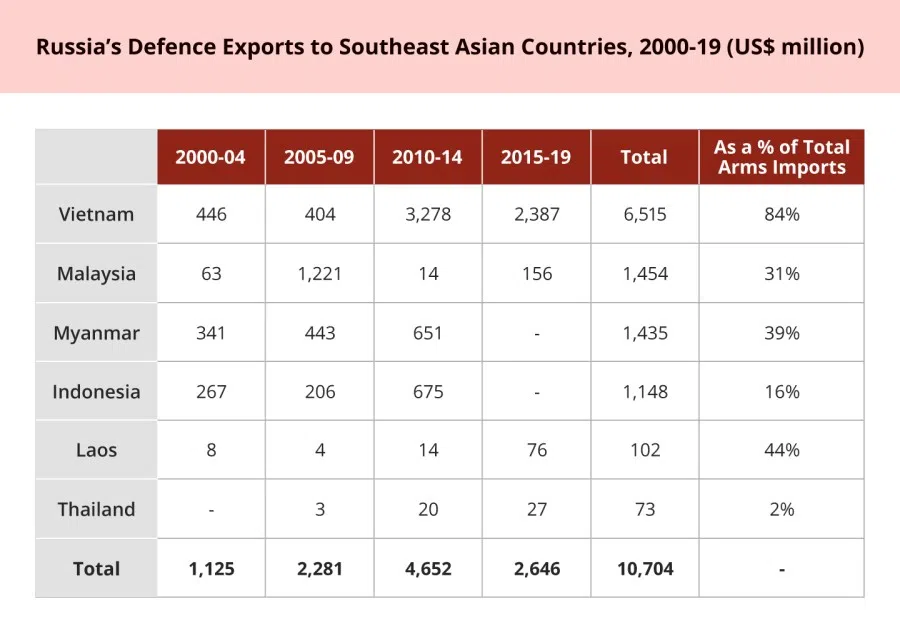

While Russia may be the world's second largest arms exporter, in Southeast Asia it is number one. Over the past 20 years, Russia has sold US$10.7 billion worth of defence equipment to regional states, compared with US defence exports of US$7.9 billion (see Table 2).

Many regional states view Russia as a valued source of defence equipment for several reasons.

First, Russia can provide a full range of military equipment, from high-end technologically advanced fighter jets and submarines, to low-end military vehicles and small arms.

Second, Russian defence systems are cheaper than their US equivalents, and Moscow is often willing to accept payment using a combination of hard currency and barter trade, including commodities.

Third, unlike the US and European countries, Russia does not make defence sales contingent on the human rights record of the receiving country. Russia has never imposed an arms embargo on any ASEAN member state.

Nevertheless, as with its share of the global arms trade, Russia's defence sales to Southeast Asia have been declining. In 2015-19, Russia's arms exports to the region accounted for 8.8% (US$2.7 billion) of its global sales, down from 12.7% (US$4.7 billion) in 2010-14. The most important reason is fierce competition from the US, Europe, China and South Korea, as well as the threat of US sanctions. Although the data is not yet available for 2020, the impact of the Covid-19 pandemic is likely to have had a negative impact on Russian arms sales as economic contraction has forced some Southeast Asian countries to cut their defence budgets.

In terms of regional purchases of Russian arms, Southeast Asian countries can be divided into three main groups: long-standing customers (Vietnam, Malaysia, Myanmar, Indonesia and Laos); new and potentially new customers (Thailand, the Philippines and Cambodia); and low-potential countries (Singapore and Brunei). A country breakdown of Russian arms exports to Southeast Asia over the past 20 years can be seen in Table 3.

Vietnam

Vietnam has a decades-long defence relationship with Russia dating back to the Vietnam War. Following the end of the Cold War, there was a brief lull in Vietnam-Russia defence cooperation as the two countries worked out new payment arrangements for Moscow's military assistance. However, from 1995 onwards, Russia once again quickly established itself as Vietnam's most important source of arms imports. Between 1995 and 2019, Vietnam imported US$7.38 billion worth of Russian weaponry - 84% of its total arms imports (approximately 5% of Russia's total global defence exports). Over the past 20 years, 61% of Russia's defence exports to Southeast Asia have gone to Vietnam (see Table 3).

Beijing is unhappy with Russian arms sales to Vietnam, but regards them as preferable to US arms sales.

As tensions between Vietnam and China in the South China Sea escalated from the mid-1990s, Russia became instrumental in the modernisation of Vietnam's armed forces. In the 2000s, Russia supplied Vietnam's air force with 11 SU-27 and 35 SU-30 fighter aircraft, and its navy with four frigates, 12 corvettes, six missiles patrol boats and, most significantly, six Kilo-class submarines. In 2016, Vietnam signed a contract with Russia for 64 T-90 main battle tanks and deliveries were completed by 2019. In January 2020, Vietnam agreed to purchase 12 Yak-130 combat training aircraft for US$350 million. The contract was seen as an indication that Vietnam plans to purchase SU-35 fighter aircraft or possibly even Russia's 5th generation SU-57 combat jet in the near future.

Moscow's military assistance has helped transform the Vietnamese military into one of Southeast Asia's most modern and capable armed forces, providing Hanoi with a limited but potent deterrent against China in the South China Sea. Beijing is unhappy with Russian arms sales to Vietnam, but regards them as preferable to US arms sales. Russia's growing strategic alignment with China is likely to encourage Vietnam to diversify its arms imports but there will be limitations. Vietnam will be dependent on Russia for munitions, spare parts, maintenance and upgrades for at least the next two decades.

And although the US lifted its arms embargo on Vietnam in 2016, Hanoi is unlikely to place major defence orders with US companies any time soon because US arms are more expensive than Russian equipment and cannot easily be integrated with Vietnam's existing weaponry from Russia. Moreover, the US Congress is unlikely to approve major weapons sales to Vietnam in view of the country's human rights record. It remains to be seen whether the Biden administration will threaten to impose CAATSA sanctions on Vietnam or issue a waiver. Given Vietnam's important strategic location in Southeast Asia, and growing US-Vietnam military cooperation in response to China's increasing assertiveness in the South China Sea, it would not be in Washington's interest to use CAATSA against Hanoi. As such, Russia is likely to remain Vietnam's most important defence partner for the foreseeable future.

Malaysia

As part of the country's defence diversification policy, Malaysia purchased a number of fighter aircraft from Russia following the end of the Cold War. In 1994 it bought 10 MiG-29s, and in 2003, 18 SU-30s. The MiG-29s are no longer in service, and due to maintenance problems, less than half the SU-30s are operational.

Under Prime Minister Najib Razak, Malaysia sought to acquire a new fleet of fighter aircraft under the Multi-Role Combat Aircraft (MRCA) acquisition programme. Malaysia looked at a number of options including America's F-18, France's Rafale, Sweden's Gripen, Europe's Typhoon and Russia's SU-30 and SU-35. As it had done in 2003, Russia said it was willing to accept part payment for any new fighters in palm oil. Russia also offered to sell Mi-17 military transport helicopters, T-90 tanks and armoured fighting vehicles, and explore the establishment of joint production and licensing facilities in Malaysia.

However, in 2018, Najib's successor, Prime Minister Mahathir Mohamad, shelved the MRCA and other procurement projects due to the country's severe economic problems. Instead, a joint Malaysia-Russia company was established to extend the life of the SU-30s by another 10-15 years. The MRCA has been replaced with the Light Combat Aircraft (LCA) acquisition programme, and Russia's Yak-130 is a contender.

Myanmar

During the 1990s, China became the largest supplier of arms to Myanmar, including tanks, artillery, armoured personnel carriers, trucks, fighter aircraft, helicopters and naval ships worth an estimated US$1.6 billion. In the early 2000s, however, the Myanmar armed forces (Tatmadaw) began to source more of its arms imports from Russia, both because it was disappointed with the quality of Chinese equipment and in an effort to reduce dependence on China.

Over the past two decades, Russia has been the second largest supplier of arms to Myanmar after China.

Since 2000, Myanmar has purchased from Russia 30 MiG-29s, 12 Yak-130s, 25 Mi-17 transport and Mi-35 attack helicopters, and eight Pechora-2M anti-aircraft missile systems. In January 2018, Myanmar signed a US$204 million contract to buy six SU-30s. Myanmar was reportedly interested in buying submarines from Russia in 2013, but in 2020, India gifted the Myanmar Navy a Russian-built Kilo-class submarine. However, as the Myanmar Navy familiarises itself with the Russian-built vessel, future sales of submarines from Russia are a possibility.

Over the past two decades, Russia has been the second largest supplier of arms to Myanmar after China. Between 2000 and 2019, Myanmar bought US$1.7 billion worth of arms from China and US$1.44 billion from Russia.

Defence cooperation between the two countries looks set to strengthen since Senior General Min Aung Hlaing ousted the democratically elected government on 1 February 2021. Appointed commander-in-chief in 2011, Min Aung Hlaing has pursued closer defence ties with Russia and has visited the country six times. Several weeks prior to the coup, Russian Defence Minister General Sergei Shoigu visited Myanmar, and, in a sign of the growing importance of military cooperation between the two countries, signed a contract to supply Pantsir-S1 surface-to-air missiles and Orlan-10E surveillance drones to the Tatmadaw. During Shoigu's visit, Senior General Min Aung Hlaing praised Russia as a "loyal friend" which had "always supported Myanmar in difficult moments, especially in the last four years". So long as the Tatmadaw remains at the apex of power, Russia looks set to increase its defence sales to Myanmar.

Indonesia

Under President Sukarno (1945-67), the Soviet Union transferred to Indonesia a significant quantity of arms including fighter jets, submarines and destroyers. Subsequently, however, President Suharto's pro-Western New Order regime (1966-98) mainly looked to the US and Europe to meet its defence needs. After the fall of Suharto in 1998, Indonesia sought to diversify its arms imports following the imposition of a US arms embargo against the country due to human rights violations in East Timor. Between 2003 and 2012, Russia supplied Indonesia with five SU-27 and 11 SU-30 fighter jets, and 18 Mi-17 and three Mi-35 helicopters.

In February 2018, Indonesia's then Defence Minister, Ryamizad Ryacudu, signed an agreement with Russia to buy 11 SU-35 fighter aircraft for US$1.14 billion, half of which would be paid for in commodities including palm oil and rubber. The first SU-35s were expected to be delivered in August 2018. However, three years on, Russia has yet to transfer a single aircraft. According to media reports published in March 2020, the US had threatened to impose CAATSA sanctions on Indonesia if the deal went through, and instead offered to sell Indonesia US-built F-16s. A few days after the reports were published, Deputy Defence Minister Sakti Wahyu Trenggono admitted the deal with Russia was facing unspecified "obstacles". In addition to the threat of US sanctions, the Covid-19 pandemic has forced Indonesia to cut its defence budget, putting at risk the defence department's force modernisation plans.

On two occasions in 2020, Defence Minister Prabowo Subianto visited Russia to discuss the fighter deal and possible joint arms production arrangements. The outcome of those talks is unclear. In July 2020, Russia's ambassador to Indonesia, Lyudmila Vorobieva, denied that the sale had been cancelled. However, that the SU-35 deal was in serious doubt was lent credence when Prabowo visited four countries in October 2020 to look at alternative aircraft: F-16s or even F-35s from the US; 15 second-hand Typhoon Eurofighters from Austria; Rafales from France; and an indigenously built fighter in Turkey. At the time of writing, Indonesia's SU-35 deal was still in limbo and unlikely to go ahead.

Laos and Cambodia

Laos is a long-standing customer of Russia's defence industry. However, due to its small defence budget, sales have been minimal. Between 2000 and 2019, Russia's arms sales to Laos amounted to only US$102 million (see Table 3). Over the past several years, Russia has transferred an undisclosed number of T-72 tanks, BRDM-2M armoured vehicles, Mi-17 transport helicopters and Yak-130 aircraft to Laos. In part payment, Russia received a batch of World War Two-era T-34 tanks (for use in Russian military parades) and been granted mining concessions.

Cambodia's most important defence partner is China. Since Prime Minister Hun Sen consolidated power in 1997, China has donated a wide variety of defence equipment to Cambodia including uniforms, small arms and trucks, and provided soft loans for the purchase of 15 naval patrol boats. In 2018, Russia offered to supply the Cambodian military with Mi-17 helicopters but a contract has yet to be signed.

Since the military coup in 2014, China has become the leading supplier of military equipment to Thailand.

Thailand and the Philippines

Problems in the US-Thailand and US-Philippine alliances have been viewed by Moscow as opportunities to increase its defence sales to Bangkok and Manila. However, Russia has had little success thus far.

As shown in Table 3, Russia's defence exports to Thailand over the past 15 years have amounted to a mere US$73 million (mainly helicopters and military commercial jets). Russia offered to sell Kilos-class submarines and T-90 tanks to Thailand but was undercut by China on price. In 2015, Thailand's military junta invited countries to bid for the supply of two submarines within a budget of US$1.03 billion. Two years later, Bangkok accepted China's unbeatable offer to supply three S-26T diesel-electric submarines for the price of two. In 2015, the Thai military also sought bids for a new main battle tank and the competition was narrowed down to Russia's T-90 and China's VT-4. As the VT-4s were priced lower than the T-90s, China won the contract for 48 VT-4s at a cost of US$280 million. Since the military coup in 2014, China has become the leading supplier of military equipment to Thailand.

Since President Rodrigo Duterte took office in 2016, US-Philippine defence relations have come under strain. Duterte has pledged to pursue an "independent foreign policy" by reducing the Philippines' perceived dependence on the US and strengthening relations with "non-traditional partners" such as China and Russia. Accordingly, Duterte has sought to improve defence ties with Russia which were practically non-existent before he took office.

Moscow has been keen to cash in on Duterte's enthusiasm. When Putin met Duterte at the APEC summit in 2016, he offered to sell the Philippines a wide range of military equipment, from submarines to small arms. In 2018, Russia opened a defence attaché office at its embassy in Manila to facilitate talks on military sales. Since then, however, Russia has made little headway, largely because the Philippine military has a strong preference for US equipment and as well as from South Korea.

The threat of US sanctions has also made the Philippines cautious. Although Manila has been in talks with Russia for the supply of 16 Mi-17 helicopters, Defence Secretary Delfin Lorenzana has indicated that CAATSA might "derail" the planned acquisition. Instead, Lorenzana said the Philippines was looking to purchase US-designed (but Polish manufactured) Sikorsky S-70i Black Hawk helicopters.

Russia's offer to sell submarines to the Philippines has also failed to gain traction. In 2019, Russian Ambassador Igor Khovaev said Moscow was ready to supply the Philippine Navy with submarines at "very competitive prices". However, CAATSA appears to have been a factor in Manila's calculations and in 2020 the French defence company Naval Group revealed it was in "intense discussions" with the Philippines for the sale of two Scorpène-class submarines.

Singapore and Brunei

Neither Singapore nor Brunei have purchased defence equipment from Russia since President Putin took office in 2000. They are unlikely to do so in the future, given their preference for Western defence equipment.

Port calls

During the Cold War, warships from the large Vladivostok-headquartered Soviet Pacific Fleet regularly transited through and visited ports in Southeast Asia. Moscow's naval presence in the region was greatly facilitated by the establishment of a Soviet naval base at Cam Ranh Bay in Vietnam in the 1980s. With the collapse of the USSR, however, the Pacific Fleet atrophied, Moscow closed its base at Cam Ranh, and port calls to Southeast Asia decreased substantially.

Under President Putin, defence spending has increased and the Russian armed forces have undergone significant modernisation. Although the Northern Fleet has been prioritised, the Pacific Fleet has also received some new warships. Accordingly, since 2014 there has been an uptick in Russian Navy port calls to Southeast Asia (see Table 4).

As during the Cold War, Russia's naval presence in the region has been facilitated by its close relationship with Vietnam. In 2014, Hanoi agreed to give Russian warships and aircraft increased access to Cam Ranh port.

Russian Navy port calls have usually coincided with regular three-month naval deployments to the Indo-Pacific, and naval symposiums and trade fares. During port calls, the Russian Navy has occasionally conducted combined exercises with its Southeast Asian counterparts.

In contrast to both the US and China, exercises between the Russian armed forces and its Southeast Asian counterparts have been few and far between.

Combined military exercises

For decades the US has conducted hundreds of bilateral military exercises with Southeast Asian countries on an annual basis (though the number fell in 2020 due to the pandemic).

China's PLA only started holding bilateral exercises with regional states in 2005, but since then the frequency and scope of those drills have gradually increased. Between 2005 and early 2021, the PLA participated in 36 combined bilateral exercises with the armed forces of Southeast Asian countries.

In contrast to both the US and China, exercises between the Russian armed forces and its Southeast Asian counterparts have been few and far between. In November 2018, Russia held its first exercise with Brunei: a naval search and rescue drill in the South China Sea. Despite its longstanding defence relationship with Vietnam, it was not until December 2019 that the Russian Navy held an exercise with the Vietnamese Navy (a submarine rescue exercise). In the same month, Russia held its very first exercise with the Laotian armed forces: the 9-day "Laros 2019" drills involving 500 soldiers from each side in Laos. A second exercise with Laos, "Laros 2020", was scheduled to take place in Russia in the second half of 2020 but was cancelled, presumably due to the pandemic. In 2019 and 2020, the Russian Navy conducted basic passage exercises with its counterparts from the Philippines, Thailand and Indonesia. In September 2020, the Tatmadaw contributed a small number of personnel to the Kavkaz-2020 Russian-led multilateral exercises in southern Russia.

Philippine and Russian defence officials are currently negotiating a military cooperation agreement that would provide a legal framework for regular exercises to take place.

In November 2019, Russia's then Prime Minister Dmitry Medvedev proposed a maritime exercise with ASEAN of the kind the organisation's member states' navies had conducted with China in October 2018 and the US in September 2019. However, due to the pandemic, an ASEAN-Russia naval exercise has yet to take place.

Educational exchanges

Statistics on the number of Southeast Asian military personnel studying at Russian military educational institutions are hard to come by. However, media reports occasionally provide glimpses into the number of students from regional armed forces studying in Russia. Unsurprisingly, the largest number of students from Southeast Asia come from Russia's biggest arms customers. For example, during a visit to Myanmar in January 2018, Deputy Defence Minister Alexander Fomin revealed that 600 Tatmadaw personnel were studying in Russia. Although no figures are available, large numbers of students from Vietnam and Indonesia study at Russian defence academies. In early 2020, Thailand and Russia signed an agreement for members of the Royal Thai Armed Forces to undertake courses as Russian military academies.

ADMM-Plus

Russia has been able to advance its defence diplomacy in Southeast Asia through its participation in the ASEAN Defence Ministers' Meeting Plus (ADMM-Plus) of which it was a founding member in 2010. Between 2014 and 2016, Russia and Thailand co-chaired the ADMM-Plus' Expert Working Group (EWG) on military medicine, during which the ASEAN Center of Military Medicine (ACMM) was established in Bangkok. From 2020 to 2023, Russia and Vietnam will co-chair the EWG on counterterrorism. Russia has participated in the various ADMM-Plus table top and field exercises since 2012. Recently, however, it has attempted to limit the expansion of Western influence in the various ASEAN-led forums by trying to veto the applications of the UK, France, Canada and the EU for observer status to the ADMM-Plus' EWGs. Russia has been supported in this endeavour by China.

Russia likely to fall further in influence

For the past 20 years, Russia has been the largest supplier of arms to Southeast Asia. However, in recent years the value of its defence sales has dropped due to greater competition from other countries as well as the threat of US sanctions. Should Russia be able to increase sales of fighter aircraft and submarines to Southeast Asia - especially to Vietnam and Myanmar - it might be able to retain its lead. However, in other areas of military cooperation such as military exercises and port visits, Russia lags far behind the US and China and is likely to fall even further behind as Sino-US rivalry escalates.

This article was first published as ISEAS Perspective 2021/33 Russia's Defence Diplomacy in Southeast Asia: A Tenuous Lead in Arms Sales but Lagging in Other Areas by ISEAS - Yusof Ishak Institute

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)