[Big read] Cash-strapped Chinese metros turn to personal ads: A win-win?

Lianhe Zaobao journalist Zeng Shi observes that China’s metros are opening up their advertisement spaces to the public. Even as it gives people a novel way of putting up resumes or marriage proposals, it helps China’s metros generate a new income stream.

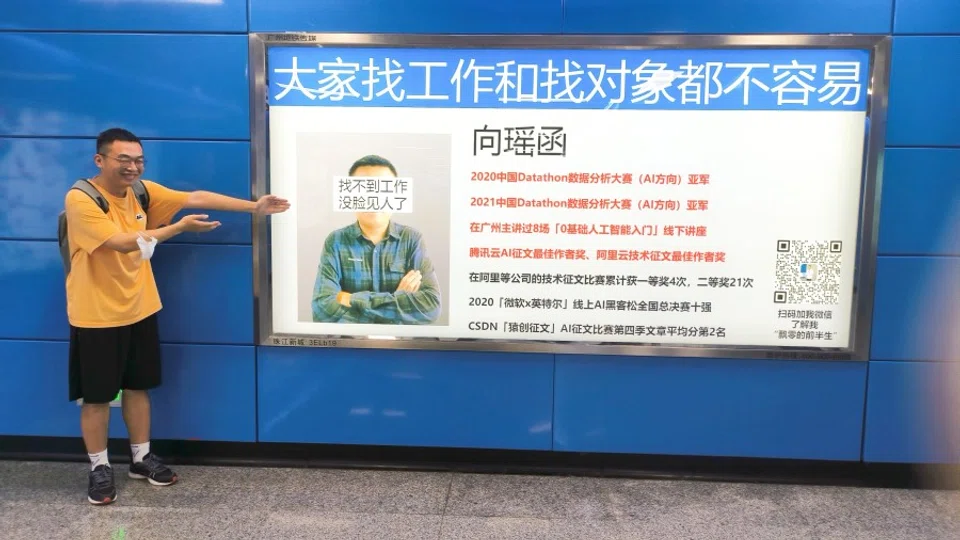

After months of unemployment, 27-year-old Guangzhou youth Xiang Yaohan made a bold decision.

In April this year, he paid 999 RMB (US$140) to Guangzhou Metro Company to design a light box poster with his resume and social media QR code, placing a personal advertisement at the metro entrance to promote himself.

Xiang’s jobseeking information was displayed at the bustling Zhujiang New Town metro station for five days. After the advertisement came out, more than 400 people scanned the QR code to contact him, including 50 companies from different industries.

He has work experience in the field of artificial intelligence (AI) and hopes to find a job related to his career experience. However, the companies that got in touch were not only those in AI; many companies with job openings unrelated to his resume, including livestreaming, insurance and real estate called up as well. He told Lianhe Zaobao that three months after posting the personal advertisement, he still has not found his ideal job and is still searching.

Beijing, Hefei, Chengdu, Hangzhou and Zhengzhou have opened up metro advertising to individuals, so that personal content, such as jobseeking, marriage proposals, birthday wishes and gratitude to teachers, could all pop up at nearby metro stations.

On Xiaohongshu, Xiang calls himself the “first person to post a resume through metro advertising”. In his view, this is a low-cost but interesting social experience. Although it did not immediately lead to his ideal job, it added something different to his daily life, making it an unforgettable experience.

Competitive pricing with various options

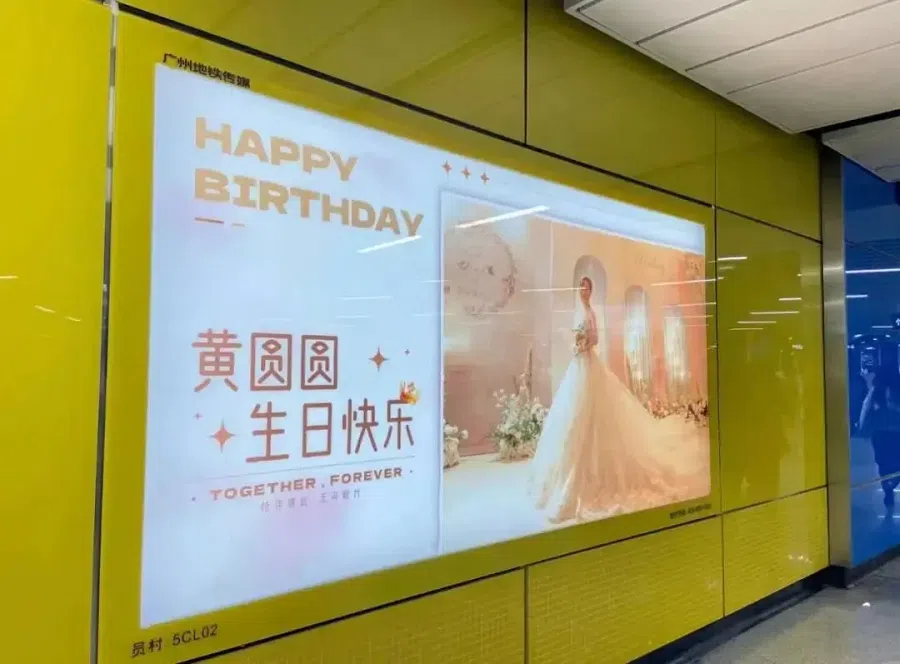

There is a growing wave of individuals like Xiang who post personal advertisements in the metro in some Chinese cities. Beijing, Hefei, Chengdu, Hangzhou and Zhengzhou have opened up metro advertising to individuals, so that personal content, such as jobseeking, marriage proposals, birthday wishes and gratitude to teachers, could all pop up at nearby metro stations.

Compared with commercial advertisements, personal advertisements are usually very competitively priced. In Guangzhou Metro, the price for personal advertisements ranges from 380 RMB to 999 RMB, and users can choose different metro locations, ad types and advertising periods.

For example, placing a personal ad for five days on Guangzhou Metro Media’s WeChat mini-program costs between 666 RMB and 999 RMB for 12 light boxes measuring 3m x 1.5m. This is significantly cheaper than commercial ads, which start at 48,000 RMB for the same 12 light boxes over four weeks on the same platform.

Fang Xiaochang, senior manager of the digital marketing department at Guangzhou Metro Media, told Lianhe Zaobao that the personal advertisement service, launched earlier this year, has quickly become a part of daily life. Its relevance and lively nature have been well-received, leading to a surge in personal advertisements on Guangzhou Metro, especially since June as more citizens have discovered the platform.

Fang said that personal advertisements, compared with commercial ones, connect better with passengers, are more likely to catch the eye of passers-by, and often get shared on social media. They can also enhance the impact of commercial ads and foster a warmer, more personal connection between passengers and Guangzhou Metro.

Currently, the main types of personal advertisements on Guangzhou Metro include birthday wishes, wedding celebrations, personal showcases, family and children, and celebrity support. These advertisements have attracted a lot of attention.

Personal advertisements in metro stations offer a new platform for this self-expression and address their emotional needs. — Zhou Xiaopu, Professor, School of Journalism and Communication, Renmin University of China

Meeting consumers’ emotional needs

This new trend in China’s advertising scene also caters to young people’s desire for novel experiences and personalised content.

Zhou Xiaopu, a professor at the Renmin University of China’s School of Journalism and Communication, told Lianhe Zaobao that, unlike in the past when people were more reserved, today’s young Chinese are eager to express themselves, showcase their individuality, and share their lives. Personal advertisements in metro stations offer a new platform for this self-expression and address their emotional needs.

She noted that while social media has expanded and raised media awareness by allowing people to create and share opinions, direct personal expression in public media remains rare. Some cities are now allocating metro advertising spaces to personal ads, bridging the gap between media and individuals and enhancing citizens’ sense of participation in urban spaces. Such innovations represent significant progress as public spaces gain more functions and meaning.

... after deducting local government subsidies, only the metro companies in five Chinese cities — Wuhan, Shenzhen, Jinan, Shanghai and Changzhou — were profitable.

High costs, little profits

Advertising revenue aligns with socioeconomic development. Metro stations, being crowded daily, offer valuable advertising space. By allowing personal ads, city metros aim to expand their customer base, diversify revenue, and address declines in commercial advertising and rising operational pressures.

The Guangzhou Metro has the highest passenger intensity in China, with an average daily passenger volume of 8.57 million last year and a ticket revenue of over 7 billion RMB. Yet, despite being one of the cities with the highest fare revenues, Guangzhou’s metro operation faces huge financial pressures.

According to its 2023 report released in June, Guangzhou Metro’s operating revenue increased by 1.84 billion RMB last year to a record high of 14.12 billion RMB. However, the net profit attributable to the parent company’s shareholders decreased by 817 million RMB, amounting to a mere 20.93 million RMB.

Apart from the huge cost of metro construction, operational costs such as manpower, energy consumption and maintenance are also heavy burdens. The Insight China (《小康》) magazine reported at the end of last year that according to statistics, after deducting local government subsidies, only the metro companies in five Chinese cities — Wuhan, Shenzhen, Jinan, Shanghai and Changzhou — were profitable.

Peng Peng, executive director of Guangdong System Reform Research Society, told Lianhe Zaobao that there are few profitable metros worldwide, and Hong Kong is a notable example — the main reason for its profitability is that the property development above the stations is doing well.

Despite rapid metro development in mainland China, driven by a fast-growing economy, the recent economic slowdown and ongoing maintenance needs have created a funding gap.

Peng pointed out that among the current metro construction projects in Chinese cities, some have been delayed, a portion are being scaled back due to higher thresholds for metro construction, while others are facing difficulties in maintaining operations.

With the rising costs of land acquisition, relocation, construction and manpower, the cost of urban metro construction is rising, averaging 700 million RMB to 800 million RMB per kilometre...

Slamming the brakes on metro construction

Over the past decade, China has been among the world’s fastest builders of metro and urban rail systems, with rising construction investments. According to the China Association of Metros, annual investment in urban rail transport increased steadily from 2014, peaking in 2020 before gradually declining. Total construction investment from 2014 to 2023 reached 4.94 trillion RMB.

As of 2023, 59 Chinese cities have urban rail transit systems with a total of 338 lines. Of these, eight cities have rail lines extending over 500 kilometres, while 16 cities have lines exceeding 200 kilometres.

With the rising costs of land acquisition, relocation, construction and manpower, the cost of urban metro construction is rising, averaging 700 million RMB to 800 million RMB per kilometre, with construction costs in first- and second-tier cities being even higher.

The China Business Journal (《中国经营报》) pointed out that it has become quite common for the cost of building a metro line to exceed 1 billion RMB per kilometre in first-tier cities; the construction cost of Shanghai Metro Line 19, which aims to be completed and operational by 2027, even exceeds 2 billion RMB per kilometre.

Statistics show that in 2022, China’s urban rail transit had an average operating revenue of 0.73 RMB per person per kilometre, compared with the corresponding operating cost of 1.49 RMB, which is a gap of 0.76 RMB. This means that the longer the urban rail transit system, the higher the potential losses.

In 2018, China raised the minimum threshold for urban rail construction, tightened the approval process for metro construction plans and took measures to prevent local governments from accumulating additional debt risks due to urban rail transit construction.

The requirements for cities applying to build metros were adjusted to include a GDP of over 300 billion RMB, an urban population of over 3 million, and a general public budget revenue exceeding 30 billion RMB. Also, metro plans for Alpha and Beta+ cities (according to the Globalization and World Cities Research Network’s classification of cities) were collectively scaled back or cancelled.

... now that China’s economy has entered a “new normal”, the property market is still facing adjustment pressures, and land leasing is difficult, the conditions for rapid metro expansion are no longer present. — Peng Peng, Executive Director, Guangdong System Reform Research Society

China’s metro planning follows a five-year cycle, with 2023 marking the final year of the previous round of metro constructions. The new round of metro planning and approval processes has begun, with some cities also conducting research for new metro plans. However, under the pressure of local debt risks, metro construction in several regions is expected to face restrictions.

Peng analysed that in the past, China’s metro expansion and the economy rapidly grew in tandem, with some cities relying on metro planning to drive property development and boost land prices. But now that China’s economy has entered a “new normal”, the property market is still facing adjustment pressures, and land leasing is difficult, the conditions for rapid metro expansion are no longer present.

He also pointed out that in the short term, no Chinese city has the requirements for hosting international competitions, and population growth is also slowing, reducing the urgency for metro construction. For some time yet, the brakes would be slammed on the construction of metros and other urban rail transit in China.

This article was first published in Lianhe Zaobao as “中国地铁开拓营收 个人广告任意发挥”.