[Big read] Golden passports, visas and residential permits: How the wealthy go places

Lianhe Zaobao senior correspondent Poh Lay Hoon takes a closer look at "golden passports" (passports in return for investment) market, including the popular countries to seek these passports, the cost of becoming a citizen of a foreign country, the impact it has on the people of the country issuing such passports, as well as whether money laundering has had an impact on the investment immigration business.

The attention on Singapore's S$3 billion (US$2.24 billion) money laundering case has prompted countries that issue "golden passports" (passports in return for investment) to increase their vigilance, strengthen background checks or tighten immigration policies.

However, Singapore's investment immigration companies claimed that stringent background checks are conducted on all their clients, stressing that only a minority of applicants have questionable backgrounds, and that the money laundering case had no impact on their business.

Hannah Ma, managing director at Globevisa, an immigration advice provider, said that undergoing background checks is a necessary step for immigration applicants, and that the company would conduct a check on every client prior to signing a contract in order to ensure a successful application.

She said, "For some that have been charged of money laundering, a search online would reveal their criminal record. Even if they were to engage us to help with immigration, they would not meet the criteria to sign a contract with us."

Globevisa has over 39 offices worldwide, with over 800 employees serving more than 10,000 families annually who are looking to migrate.

Ma stated that the company currently handles investment immigration business in more than 40 countries and regions, dealing with over 300 immigration programmes, with citizenship by investment (CBI) schemes accounting for only a small portion.

"... the Singapore government has continually raised the threshold for investment immigration in recent years, which caused many who find Singapore attractive to hold back." - Chloe Chen, Managing Director, Xincheng Group

No impact on investment immigration business

"We have many clients who migrate to Singapore, Canada, Hong Kong, Europe, the US and other areas through investment, setting up a business as well as other methods. The money laundering case has had a negligible impact on our business," said Ma.

Chloe Chen, managing director of Xincheng Group, a firm offering one-stop solutions for high-net-worth families, noted that the money laundering case had some impact on Singapore's image as a global financial centre, adding that "countries all over the globe that issue golden passports are also referencing the case and strengthening their background checks".

However, she is confident in Singapore's development, believing that the impact from the money laundering case will only be short-lived and will not affect her firm's business.

Chen shared, "As we are in the investment immigration industry, our investment immigration programmes have high Know Your Customer (KYC) standards and background assessments, and we are especially attentive to our KYC process and evaluation."

She pointed out that Singapore as a global financial centre is one of the world's largest asset management centres, and those that meet the criteria for investment immigration are usually from families with high net worth from around the world.

Singapore raising investment immigration barriers

Chen noted, "These families will conduct a comprehensive assessment of Singapore's economy, political stability, global financial position, security, education quality, international medical service among other areas." She added, "But the Singapore government has continually raised the threshold for investment immigration in recent years, which caused many who find Singapore attractive to hold back."

... a golden passport is a one-step method towards naturalisation into citizenship through investment (such as through donations, real estate purchases, treasury bonds purchases and savings). - Hannah Ma, Managing Director, Globevisa

On the common misconception that golden passports are illegally obtained documentation, Globevisa's Ma clarified that a golden passport is a one-step method towards naturalisation into citizenship through investment (such as through donations, real estate purchases, treasury bonds purchases and savings). "A golden passport is legal, as it is in line with the local immigration laws," she said.

Ma added that a golden passport is different from a golden visa or a golden residence permit. She explained, "A golden visa or a golden residence permit is mainly to allow foreigners to obtain long-term residency or permanent residency through investment, purchase of property and donations among other methods. After obtaining this visa or permit, there is a residency period to meet and language exams to take among other requirements. One would usually only attain citizenship after five to ten years."

Popular destinations for immigration

In the golden passport, visa and residence permit market, Portugal, Greece, Australia, the US and Singapore are popular choices.

Globevisa's most popular schemes for 2023 were golden visas for Portugal and Greece, followed by EB-5 investment immigration (Green Card) to the US. The largest sources of clients come from China, Vietnam, Turkey, India and Myanmar.

Meanwhile, the most popular schemes among Xincheng Group's clients are the Singapore family office, Europe golden visa, Australia investment immigration and US EB-5 investment immigration. Its largest sources of clients are from mainland China, Hong Kong, Taiwan, Australia, Indonesia, Cambodia, and Japan in that order.

Investment Migration Insider estimated the value of the investment immigration market at US$21.4 billion in 2019, and could reach US$100 billion in 2025.

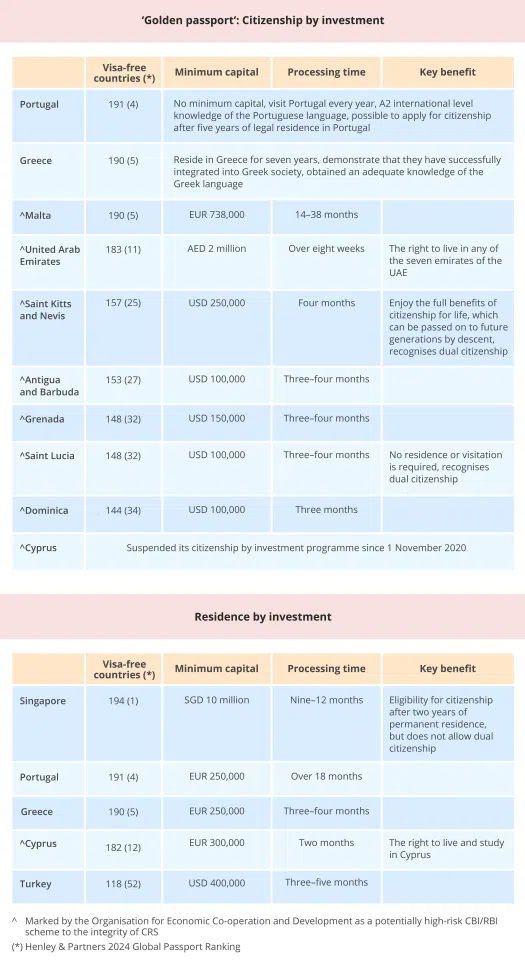

London-based investment immigration consultation firm Henley & Partners' Henley Passport Index for 2024 showed that there are 191 countries and areas with visa-free entry for Portugal, and 190 and 118 areas for Greece and Turkey respectively.

Globevisa's Ma commented that Portugal became a popular choice mainly because applicants only need to stay a minimum of seven days each year in the country, and after passing the A2 level of the Portuguese language test five years later, one could obtain a Portuguese passport.

She said, "Applicants do not need to give up their link to their current country of residence, and just simply have to spend a holiday in Portugal every year before obtaining a passport five years later. Portugal is part of the European Union (EU), and having a Portuguese passport means that one can freely do business, work or study in any member country of the EU without the need to apply for an additional visa."

... "the most popular method is obtaining residency directly through property investment, such as Greece's golden visa, Turkey's citizenship by investment and Singapore's family offices". - Chen

The Schengen area comprises 23 of the 27 EU countries - including Greece, Portugal, Spain and Germany, but excluding Bulgaria, Cyprus, Ireland and Romania - along with four non-EU countries, that is Iceland, Liechtenstein, Norway and Switzerland. According to the Schengen Agreement, holders of a Schengen visa or a valid identification (including a passport) from any of the member countries are able to travel freely among the member countries.

Ma commented that Greece is also a preferred spot. She said, "Greece requires applicants to purchase property worth at least 250,000 euros (US$270,500), and they are allowed to rent out their property without needing to live in it themselves. In this way, you can invest and obtain a backup permanent residency at the same time."

Property investment the preferred method

Xincheng Group's Chen commented that her firm is mainly focused on investment and allocation-related projects, adding that "the most popular method is obtaining residency directly through property investment, such as Greece's golden visa, Turkey's citizenship by investment and Singapore's family offices".

She pointed out that Greece's golden visa is popular because one can obtain a Schengen golden visa just by investing in property worth at least 250,000 euros.

As for Turkey, an applicant would get a Turkish passport in eight to ten months after forking out US$400,000 to US$600,000 to purchase property. "For some Chinese who are fond of investing in real estate, this is killing two birds with one stone," Chen said.

As for Singapore-based projects, she pointed out that asset allocation family offices are most popular.

Chen explained, "In recent years, high-net-worth families around the globe are looking at safe havens for their wealth. Singapore's low tax rate, good business environment, adequate educational resources and safe society are the reasons why many are considering immigrating here."

Hefty investment for ease of travel

Globevisa's Ma commented that the US has always been a popular choice for those looking to immigrate, adding that "in the past, the waiting period for EB-5 can be from eight to ten years, but in 2023 a new policy did away with this waiting period, which attracted a large group of potential immigrants".

Those who purchase golden passports do so mainly for the convenience of travel and do not mind putting up hefty investments to gain citizenship.

Ma said that a Singapore passport offers visa-free entry to many areas. On the contrary, passports of many countries such as India, Vietnam and China offer few visa-free entries, so those who wish to travel more easily invest in obtaining citizenship elsewhere.

Chen opined that in some countries, only citizens are legally allowed to buy land and construct buildings, so some businessmen would need a local passport if they wish to invest. She said, "They are tired of living in the same city for a long period and hope to become global citizens to enjoy the freedom of living, travelling and staying all over the world."

Ma pointed out that her firm's investment immigration clients are mostly between the ages of 40 and 60, and their capital comes from their businesses, financial products and real estate investment. She listed India, Myanmar, Turkey and Vietnam as fast growing markets.

Chen said that mainland China, Taiwan, Indonesia, India and Vietnam are all growing markets. Her company's clientele are mostly between 35 and 55 years old, with the source of their wealth coming from their salary, businesses, financial investment returns as well as inheritance.

Golden passports with a wider access to visa-free countries, especially to the Schengen Area, are extremely valuable and attractive to wealthy Chinese because they offer far more visa-free entry than the 85 countries that the Chinese passport provides...

Famous people driving demand

Zhang Lan, founder of Chinese F&B group South Beauty, and Yang Huiyan, chair of Chinese real estate giant Country Garden Holdings, are some of the well-known Chinese entrepreneurs who have a "backup" identity, and this in turn drives the golden passport market, enticing other wealthy Chinese to follow suit in joining these celebrities overseas.

The small Caribbean island nation of Saint Kitts and Nevis, a popular spot for the famous to obtain a passport, saw a decline in demand in the half year after its requirements were tightened in July 2023. The issuing of golden passports from Cyprus in the Mediterranean has also been suspended for more than two years due to reports of abuse and EU misgivings.

Zhang acquired a Saint Kitts and Nevis citizenship in 2012 in order to get her company listed, while Yang also obtained a Cyprus passport in 2018. Both are said to have given up their Chinese citizenship, as China - similar to Singapore - does not recognise dual citizenship.

Golden passports with a wider access to visa-free countries, especially to the Schengen Area, are extremely valuable and attractive to wealthy Chinese because they offer far more visa-free entry than the 85 countries that the Chinese passport provides, saving them the hassle of long visa processing times.

An F&B entrepreneur said on Globevisa that he decided to apply for a passport after seeing the preferential policies that Zhang got to enjoy after obtaining a Saint Kitts and Nevis passport and seeing so many other entrepreneurs and personalities also applying for one.

This client who has already obtained a Saint Kitts and Nevis passport said that the move was to manage his assets and "make use of the tax benefits of naturalisation to maximise reasonable and legal tax savings".

Saint Kitts and Nevis passports losing popularity

Globevisa's Ma said that after the Saint Kitts and Nevis government doubled its CBI threshold last July, the number of applications plummeted.

Xincheng's Chen said that the Saint Kitts and Nevis CBI scheme is one of the oldest programmes of its kind in the world. She said, "Applications are currently on the decline because the government raised the threshold - it requires a contribution of US$250,000 for a main applicant and an additional US$50,000 for each dependent. This would mean a total contribution of US$400,000 for a family of four."

But both of them pointed out that the investment requirements for other Caribbean countries have remained unchanged and are still popular choices.

Jho Low, an international fugitive wanted by authorities in connection with the 1Malaysia Development Berhad (1MDB) corruption scandal, obtained a Saint Kitts and Nevis passport in 2011 and a Cyprus passport in 2015. After the 1MDB scandal broke in 2015, he fled abroad and both countries have since revoked his citizenship.

In 2020, an investigative report by Al Jazeera said that for the sake of money, between 2017 and 2019 the Cypriot government had issued about 2,500 passports to tycoons, including overseas criminals and wanted officials accused of corruption.

The report said that since 2013, the golden passport programme has brought in over US$8 billion to prop up the ailing Cyprus economy. Under fire from the EU and anti-money laundering agencies, Cyprus later announced that about 30 people were no longer eligible for citizenship. In November 2020, the country suspended its CBI programme.

Immigration policies tightened

The influx of foreign investors into golden visa countries has led to soaring home prices as a result of their massive purchases. Their preferential tax arrangements have also triggered backlash in society and pressured the government, leading to tightened immigration policies in some countries.

In March 2022, the EU has also urged its member states to ban golden passport schemes and tighten the golden visa programme by 2025.

In 2022, the UK abolished its golden visa scheme. Ireland also closed its immigrant investor programme in 2023.

To crack down on property speculation, Portugal removed the real estate investment pathway to Portuguese citizenship last October while retaining the option to invest 500,000 euros in a fund in Portugal.

An anonymous immigrant investor told Lianhe Zaobao that while the EU has repeatedly called on member states to control and suspend golden passports and golden visas over the years, member states have weighed their options and decided to maintain the programme nonetheless.

He explained that the sluggish European economies have led to a decline in national income and government revenue, resulting in financial tightening.

"While some EU countries may continue to offer golden visas and golden passports to maintain fiscal revenues, they have also gradually raised the investment threshold. Raising the threshold is advantageous because it indirectly lowers the number of applications, thereby controlling the risks associated with a high number of applications, while also ensuring a continuous flow of funds," he added.

... in comparison, people want to live and work in Singapore, which is not tax-free but has low taxes. - Loh Kia Meng, Chief Operating Officer and Senior Partner, Dentons Rodyk

All for preferential tax arrangements?

Loh Kia Meng, chief operating officer and senior partner at Dentons Rodyk, said that people normally apply for an island nation passport or establish companies there out of tax considerations.

There is no other reason apart from tax considerations and secrecy. Many island nations have zero or very low income taxes, and the lack of transparency also adds a layer of secrecy. However, it cannot be said that obtaining a golden passport is a convenient way to evade taxes, because enjoying zero or low income taxes is legal in the island nations.

"From what I know, among the people who have registered a business in the British Virgin Islands, Jersey and Guernsey, none of them are staying there. In fact, many of them have never been to those islands," he noted.

Loh pointed out that in comparison, people want to live and work in Singapore, which is not tax-free but has low taxes.

Ng Lip Chih, a director at Foo & Quek LLC, said that citizens of golden passport countries often enjoy tax exemptions for capital gains tax, dividends and inheritance tax.

"While Singapore has similar tax exemptions for capital gains tax, dividends and inheritance tax... Singapore does not allow dual citizenship," he noted.

He added, "The persons who apply for these golden passports are persons who usually wish to have dual citizenship. That is, they hold the golden passport as a second passport and do not have to give up their original citizenship or passport."

Ng said that these countries also offer low entry investment schemes to acquire the golden passport. The investment amount for a Saint Lucia passport, for example, is US$100,000. In contrast, Singapore does not allow an investment route to acquire Singapore citizenship.

He pointed out that the main consideration for tycoons in applying for golden passports is that these countries offer both tax and investment secrecy. He noted that some of the countries offering golden passports are true tax havens, and that the tax payment mechanism in these countries is very lenient compared with Singapore.

Potentially high-risk CBI/RBI schemes

The CBI/RBI (citizenship by investment/residence by investment) schemes of 14 countries have been identified by the Organisation for Economic Co-operation and Development as posing a "potentially high risk" to the integrity of the common reporting standard (CRS).

Seven popular Caribbean islands offering golden passports - Saint Kitts and Nevis, Antigua and Barbuda, Grenada, Saint Lucia, Dominica, Bahamas and Barbados - already account for half of the list.

Other countries on the list include the United Arab Emirates, Bahrain, Cyprus, Malta, Vanuatu, Seychelles and Turks and Caicos Islands.

Schemes that are potentially high risk refer to those that do not require significant physical presence of at least 90 days in the jurisdiction and that give a taxpayer access to a low personal income tax rate of less than 10% on offshore financial assets.

Based on the CRS framework, financial institutions are required to identify the account holder's country of residence for tax purposes and to exchange tax information to combat offshore tax avoidance and money laundering.

This article was first published in Lianhe Zaobao as "避税天堂当跳板 黄金护照任翱翔".