Entrepreneur Alice Hung: How to embrace life’s rollercoaster and stay kind

Lianhe Zaobao senior correspondent Chew Boon Leong speaks with Alice Yin Hung, entrepreneur and founder of Paeonia Group, who moved to Singapore from Hong Kong four years ago. Having been at the lowest rung of society in her early years, Hung seized the opportunities brought about by China’s economic takeoff to build her fortune. Hung also shares insights on her career and on investing, as well as her sense of connection with Singapore.

In April last year, a mystery buyer bought an industrial complex in Kampong Ampat from CapitaLand Ascendas REIT for S$35.58 million (US$26.5 million) — the price was a hefty 55% higher than the project’s valuation in late 2022, and three times what CapitaLand Ascendas had paid for the building in 2005.

The transaction immediately captured the market’s attention and garnered widespread curiosity: who was this mystery buyer? What is their story?

The buyer was none other than Alice Yin Hung, an entrepreneur from Hong Kong.

Hung is a veteran entrepreneur and venture capitalist who moved from Hong Kong to Singapore four years ago, establishing Paeonia Group. She was among the wave of investors setting up family offices as fund management vehicles in the country.

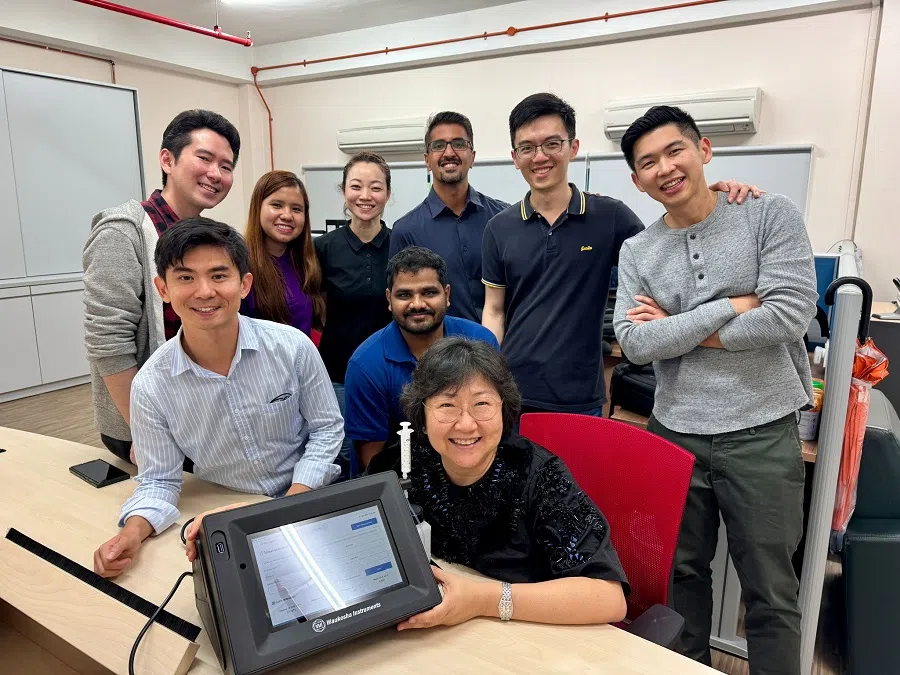

Aside from engaging in the manufacturing and sales of testing equipment, along with various investment projects, the group has also set up a foundation to support education, arts, healthcare and community development.

In person, Hung is affable and completely without airs; she is earnest and radiates positivity, offering words of wisdom and incisive insight from time to time. Her behaviour is also in keeping with her low-key demeanour, a departure from the flashy and ostentatious style of many newly minted millionaires.

While discussing her professional success with Lianhe Zaobao, Hung merely described herself as having had the good fortune to seize upon the opportunities that came with the once-in-a century ascent of China’s economy. Becoming a business mogul or making a lot of money were never her life goals.

For me, when you see others being happy, you too will feel happiness — and this enables you to find true peace and happiness within your heart.” — Alice Yin Hung, an entrepreneur from Hong Kong

In search of inner peace and happiness

Hung said, “I want an exciting life, full of variety, with a sense of inner peace and happiness.

“This sense of inner peace and happiness comes from the happy smiles of others. For me, when you see others being happy, you too will feel happiness — and this enables you to find true peace and happiness within your heart.”

The industrial building Hung acquired from CapitaLand Ascendas REIT is mainly for her company’s own use. “We are not real estate speculators; we are just treating the property as any other asset and allocating it accordingly.”

Hung recently had her eye set on another industrial building, but in discussions with her investment team, she was advised that the project might prove challenging to lease out, making it a risky investment.

“But I thought, if it’s difficult to find tenants, we can convert it into a community centre, so the children in the neighbourhood can come and study, or play games — that’s rather nice too,” she said.

Supporting educational and community organisations

For Hung, acquiring a building might be the first step to creating a community hub. Having lived through innumerable highs and lows, Hung is now at a phase of life where her focus is on giving back to society and building a lasting legacy.

In fact, Hung has been actively giving back to society, especially in education and research.

In February this year, Paeonia Foundation donated S$5 million to Nanyang Technological University (NTU), to support leadership development programmes in partnership with the University of Pennsylvania, and to establish new professorships to attract top global talent. Hung herself is a member of NTU’s board of directors.

Hung was also a sponsor of the public lecture on astronomy by physicist Didier Queloz, a Nobel laureate, at NTU in 2022.

“Money won’t last, but education will. As long as you are capable, you can go anywhere without fear.” — Hung

As a philanthropist in education and arts, Hung has also been a patron to many institutions, including the Wharton Business School, Oxford University, Cambridge University, Tsinghua University, Wuhan University, the National University of Singapore and the Hong Kong Philharmonic Orchestra.

She is also a donor of Fei Yue Community Services, among other community organisations.

In recognition of her contribution and support of charitable causes, she was named The Wharton School’s China Entrepreneur of the Year in 2019, and Outstanding Alumna by St. Mark’s School in Hong Kong in 2013.

According to Hung, a keen supporter of education and research, “Money won’t last, but education will. As long as you are capable, you can go anywhere without fear.”

Because Hung’s outstanding academic results enabled her to leave poverty behind, she is motivated by gratitude to help others do the same through funding education and research.

During the Second Sino-Japanese of 1937, her grandparents left China and passed through Singapore before arriving in Surabaya, where they became early Chinese immigrants to Indonesia.

Learning to be independent early in life

Born in Beijing, Hung’s ancestral home is Zhangzhou in Fujian Province, where an elder had served as a local official, and the family enjoyed a measure of respect in their hometown.

During the Second Sino-Japanese of 1937, her grandparents left China and passed through Singapore before arriving in Surabaya, where they became early Chinese immigrants to Indonesia. This also explains the sense of connection Hung feels for Southeast Asia. Moving to Singapore gave her a sense of homecoming.

Hung speaks fluent Hokkien and also some Bahasa Indonesian. Whenever she hears Malay being spoken in Singapore — which sounds similar to Bahasa — or tastes Indonesian food, there is a sense of déjà vu that evokes childhood memories of time spent with her maternal grandmother.

In the 1950s, Hung’s parents Hong Deyan and Yang Anqin returned to China, gaining admission into the physics and chemistry faculties of Wuhan University respectively.

Hung said that her parents had been seen as promising young scientific talents and were sent to Beijing after graduation to take up research work at the Chinese Academy of Sciences and the oil department respectively. But events of the time were both unexpected and life-changing. With the arrival of the Culture Revolution, the whole family was sent down to Qianjiang in rural Hubei province.

... while her parents were scientists, they could not speak Cantonese or English, and their qualifications from Wuhan University were not recognised by the Hong Kong government or the industry.

At the age of six, Hung moved to Hong Kong with her parents, brother and maternal grandmother. Her parents, the young scientists of yore, were forced to become factory workers.

Hung recounted that while her parents were scientists, they could not speak Cantonese or English, and their qualifications from Wuhan University were not recognised by the Hong Kong government or the industry.

So they had to start from the bottom: her father became a welder and her mother a seamstress. Hung and her brother would help with household chores after school and Hung also worked as household help to supplement the family income.

No dolls of her own

“My family lived in Tsuen Wan, in a place that was only 80 square feet in size,” Hung recalled.

She shared, “When I was young, we couldn’t even afford the HK$30 (US$3.8) fees for kindergarten. I remember my mother taking me to Kwan Chi Kindergarten, but the fees were too high, so she had to take me home.

“We had to use kerosene to heat water for bathing, so we could only afford to bathe twice a week. I learnt how to save time, to wash up in three minutes and finish my meal in five minutes, so I would have more time for more useful things such as studying and doing housework.”

She recalled with a wry smile that one of her chores as an underaged worker was to dress dolls, “But I never had my own doll.”

The fried chicken drumstick rice at Hong Kong fast food chain Fairwood left a deep impression on Hung, because it was where her parents took her as a reward for topping her class in Primary Four. She shared, “That was the first time I ever tasted fried chicken drumstick rice, and also when I realised how delicious the food at Fairwood was.”

Despite the family’s poverty, Hung has no complaints about her parents. She said, “Poverty and wealth are relative.”

She added, “At the time, our upstairs and downstairs neighbours were also poor, so it didn’t feel like we were poor; just the opposite, I felt it was not a bad way to live.

“Sometimes when the family ate together, we would be so happy to have a plate of braised pork to share. I have no complaints about my childhood, in fact I feel like it’s the best gift my parents could give me, enabling me to learn how to independently deal with hardship from young.”

Listening to a speech on China’s prospects by Simon Murray, former managing director of Hong Kong’s Hutchinson Whampoa Limited, prompted her decision to resign and go back to China.

Giving up a career in the US for opportunities in China

In the 1980s, following China’s reform and opening up, Hung’s parents began looking for more work and investment opportunities. Hung also found herself at a crossroad in life — she was accepted into a high school in the US.

Hung’s academic results have always been outstanding, and she often came first in her year. As a child, she had many dreams: being a great fan of martial arts or wuxia novels, she had dreamt about becoming a female Louis Cha, the preeminent wuxia author from Hong Kong. However, her parents hoped that she would become a scientist “like Marie Curie”. But her one long-standing dream was to study in the US at the world-renowned Harvard University.

In spite of her excellent results in mathematics and physics, she was not accepted by Harvard; instead, she was admitted by the University of Pennsylvania, and ultimately graduated from the university’s Wharton School of Business.

After graduating in 1990, Hung joined Lehman Brothers, one of the best known investment banks back then, and became an investment banker. But she only stayed for seven months. Listening to a speech on China’s prospects by Simon Murray, former managing director of Hong Kong’s Hutchinson Whampoa Limited, prompted her decision to resign and go back to China.

Four years later, she travelled to the US after gaining admission to her dream institution, Harvard University. However, after just three weeks, she decided to forgo what many considered a golden opportunity and returned to China to continue leading her own business.

In 1990, a little over a year after the Tiananmen incident, China was at a low point: it was suffering a recession, the population was growing, resources were drying up and the country was being shunned on the global stage.

But for Hung, the crisis also presented the opportunity of a lifetime.

She said, “When society undergoes a colossal change, opportunities will also come. I remained bullish on China, and put everything into China’s development; I believed it would rapidly rise in the future. If I had stayed on in Lehman or Harvard, I would have missed this once-in-a-lifetime opportunity.”

As time has proven, Hung made the right call. Her grasp of the opportunities presented between 1990 and 2015 as China’s economy took off proved impeccable, and fortune did indeed favour the bold.

In just a few short years, Hung set up Universal (Hong Kong) Technologies, which distributed testing and analytical instruments, on the foundation of her mother’s analytical instrument trading company. Following that, she established CFR Engines Group, which produced fuel testing equipment. The ventures made her the first pot of gold — which was followed by many more later on.

“Imagine if a square metre of land was worth the total price of all the bags from Gap you could fit in when I bought it. By 2018, the price had risen to that of Chanel bags, or even Hermès.” — Hung

Buying up properties

In addition to distributing and manufacturing testing equipment, Alice Hung was also a firm believer of the wealth-generating properties of real estate, and bought over 100 properties in China. Her investment strategy was to buy up villas near international schools to rent out, and to acquire office space in the central business areas near metro stations. Her real estate portfolio has largely been sold off around 2018, bringing her substantial profits.

On the subject of her real estate returns, she smiled as she said, “Imagine if a square metre of land was worth the total price of all the bags from Gap you could fit in when I bought it.

“By 2018, the price had risen to that of Chanel bags, or even Hermès.”

Moving from Hong Kong to Singapore for better investment opportunities

About four years ago, Hung decided to move to Singapore. She had been impressed by Singapore’s education system and stable social environment, and also felt optimistic about investment opportunities in the country.

Hung said her goal for her business was global expansion, and Singapore’s status as an international hub would facilitate the management of business operations around the world. In addition, the thriving venture capital ecosystem in Singapore also offers more opportunities for accessing the markets in South Asia and Southeast Asia. Her company has been investing in private equity, ventures and start-ups in the realms of quantum computing, machine learning and biotechnology.

Paeonia Group, which Hung founded, has also invested in a number of venture capital funds and start-ups in Singapore, such as Insignia Ventures Partners, IonMobility and Bifrost.

Hung’s two children, who are 15 and 18, are currently still in school.

“The only thing you can depend on is yourself. How do you depend on yourself? Through hard work, education, motivation, and then paying it forward and doing good for the world...” — Hung

Giving away most of her fortune to charity

While most of the super-rich are worrying about handing down their businesses and wealth to future generations, self-made entrepreneur Hung is unperturbed. She has already made the decision to give most of her fortune away through Paeonia Foundation. As Hung sees it, giving to education, the academe and social causes is far more meaningful than leaving her immediate family an inheritance.

She shared, “Our family has gone from riches to rags, and then come up again from rags. All of these ups and downs in life have taught me that the world is full of uncertainty — you could lose everything anytime.

“The only thing you can depend on is yourself. How do you depend on yourself? Through hard work, education, motivation, and then paying it forward and doing good for the world. Because kindness will be rewarded, and eventually, you too will be rewarded.”

Paeonia is the scientific name for the peony flower. As the saying goes: “The fragrance stays on the hand that offers roses (赠人玫瑰,手有余香).” Hung hopes that the impact of Paeonia Group’s philanthropy will be felt by everyone.

This article was first published in Lianhe Zaobao as “企业家洪燕:钱总会花掉 但教育留得住”.

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)