Alibaba fights Tencent for dominance over AI in China

As China’s AI landscape rapidly evolves, tech giants Alibaba and Tencent are locked in a fierce battle for supremacy. While Alibaba invests heavily in AI infrastructure and open-source models, Tencent focuses on integrating AI into its massive consumer platforms. With both companies reshaping the future of AI in China, the race to define the next era of computing is just beginning.

(By Caixin journalists Liu Peilin, Guan Cong and Denise Jia)

The world watched in February as a new name surged onto the global AI stage: DeepSeek. The Chinese startup, practically unknown weeks earlier, suddenly found itself the talk of Silicon Valley and Zhongguancun alike — and its 34-year-old founder, Liang Wenfeng, seated beside Tencent’s Pony Ma and Alibaba’s Jack Ma at a high-level private sector entrepreneurs’ roundtable with Chinese President Xi Jinping in Beijing.

For a moment, DeepSeek seemed to upend the entire power structure of China’s internet economy. But China’s longtime digital giants — Alibaba and Tencent — weren’t just watching from the sidelines. They were recalibrating, reorganising, and now, reentering the AI arms race with billions of dollars and renewed urgency.

Tencent vs Alibaba

Just four days before the meeting, Tencent had integrated DeepSeek’s foundational R1 model into its flagship AI chatbot, Yuanbao — marking a rare move of collaboration over competition. A week later, Alibaba’s new CEO Wu Yongming pledged an eye-popping 380 billion RMB (US$52.9 billion) across three years into AI and cloud infrastructure — more than the company spent in the entire past decade.

“2024 wasn’t a panic year for Alibaba, Tencent or ByteDance,” said a source close to Tencent’s leadership. “Everyone thought the game was about who had the most GPUs and cash. DeepSeek shattered that. Suddenly, with just 2,000 cards, you could build something disruptive.”

Indeed, DeepSeek’s surge was so sudden it couldn’t handle the traffic. But instead of retreating, Tencent doubled down — pressing pause on the training of its in-house Hunyuan model just to support DeepSeek’s integration into Yuanbao. Internally, the message was clear: good enough is not enough. Yuanbao started rolling out new features almost daily. Within weeks, its downloads surpassed DeepSeek’s.

The two juggernauts are not just racing each other — they are positioning themselves differently.

Meanwhile, Alibaba took a different route. While Tencent leaned hard into applications like Yuanbao, Alibaba reinforced its strategy around infrastructure and openness. Its Qwen model — a cornerstone of its Tongyi Qianwen platform — racked up over 100,000 open-source variations by March. The latest Qwen3 version was released just as Tencent’s models were evolving into multi-modal systems with vision and speech.

The two juggernauts are not just racing each other — they are positioning themselves differently. Alibaba is betting on cloud-based “Model-as-a-Service” offerings, while Tencent is focused on embedding AI into its massive consumer platforms such as WeChat. Their battlegrounds now extend into verticals like education: in May, both launched rival AI agents aimed at helping students with China’s gruelling college entrance exams.

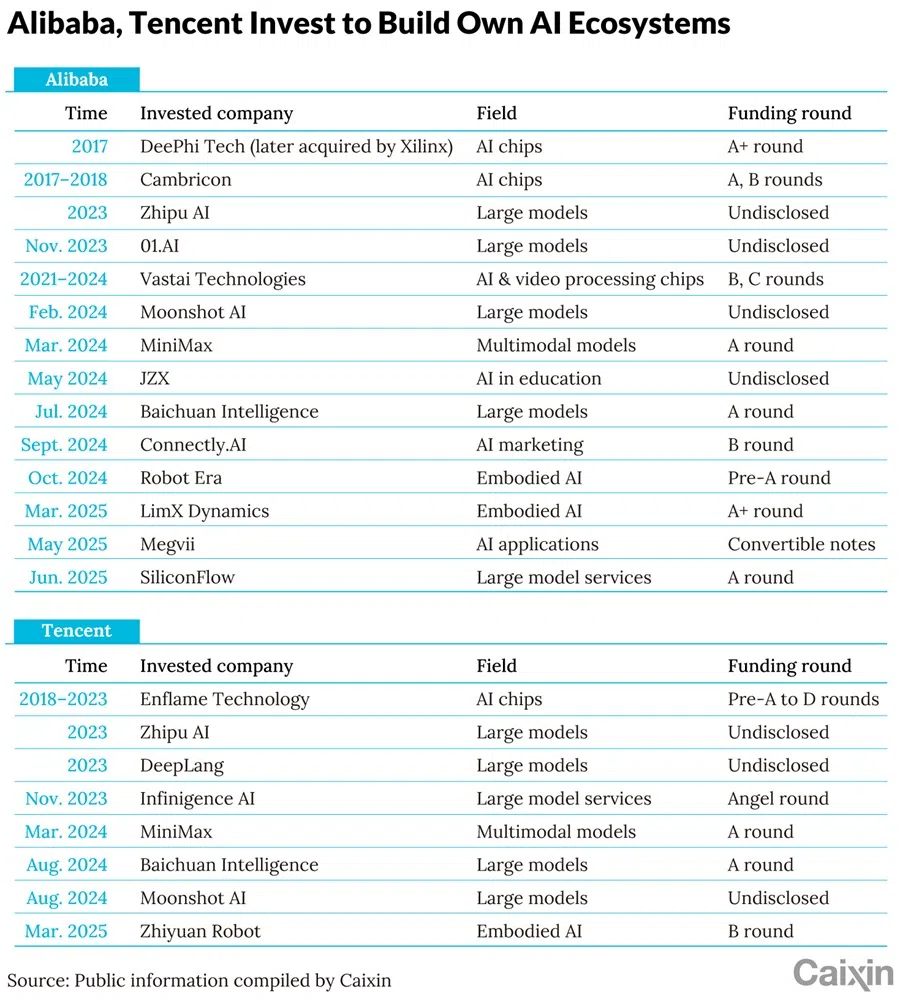

At the same time, the two giants have become aggressive investors. From 2023 onward, they have poured capital into nearly every major domestic model startup — MiniMax, Zhipu AI, Moonshot, Baichuan and more. Tencent even paused its own model development at times to back DeepSeek. Alibaba slashed non-AI investments to go all in.

Meanwhile, ByteDance — creator of TikTok and Douyin — has been steadily building its AI empire too, consolidating research under the new Seed division. With Wu Yonghui, former vice-president of Google’s DeepMind, at the helm, ByteDance is aiming to repeat its algorithmic dominance from the short-video era — only this time with generative AI.

The race is not just about who builds the best models. It’s about who defines the next era of computing in China — and beyond. As one Alibaba executive put it: “AI’s impact on the world has barely begun. It’s far too early to talk about winning. This is just the beginning.”

If Tencent is sprinting to dominate consumer-facing AI tools, Alibaba is digging in for a long war — one fought on the deeper, more expensive battlefield of infrastructure.

Alibaba’s bets on AI infrastructure

If Tencent is sprinting to dominate consumer-facing AI tools, Alibaba is digging in for a long war — one fought on the deeper, more expensive battlefield of infrastructure. It’s a strategy as technical as it is philosophical: open-source to shape the ecosystem, and model-as-a-service (MaaS) to monetise it.

Alibaba was one of the first major Chinese tech firms to fully embrace open-source AI development. “Their plan had three legs,” said a partner at a venture firm focused on AI applications. “Build their own base models, buy or build an AI chatbot company, and invest aggressively across the stack — from infrastructure to end-user applications.”

As it turns out, they only needed two. Alibaba’s foundational model family, Qwen, proved so robust that plans to acquire another base model firm were quietly shelved.

The company’s AI turn began as early as 2020, when it restructured its cloud division and brought in former Microsoft executive Zhou Jingren as CTO. Zhou also assumed technical leadership of DAMO Academy, Alibaba’s in-house AI lab. Within months, DAMO released its M6 model — a massive multi-modal system with over 100 billion parameters — and Zhou began championing MaaS internally.

Then came ChatGPT.

OpenAI’s 2022 release electrified the industry. It was, as one Alibaba executive put it, the iPhone moment for AI — proof that massive models could power applications with global appeal. For Chinese tech companies, it triggered a cascade of urgency. Model training kicked into high gear.

Alibaba kept pace in its own way. That same month, it quietly launched ModelScope, an open-source Chinese model hub. While overshadowed by more glamorous chatbots, it became a favourite among developers. DAMO contributed over 300 verified models — more than a third in Chinese — all fully open-source. ModelScope now boasts in excess of 70,000 models and 15 million developers.

In April 2023, Alibaba Cloud released Qwen, its first major foundational model. By that summer, it had gone open-source. By October 2023, it launched a second version with hundreds of billions of parameters. Since then, Alibaba has followed a breakneck update schedule — releasing new Qwen models every three to four months, including Qwen1.5, Qwen2, and Qwen3, as well as proprietary variants like Qwen-Max and Qwen2.5.

Their latest boast? Qwen3, released in April, is “the world’s most powerful open-source model”. With just one-third the parameters of DeepSeek R1, it claims to outperform it — while requiring only four Nvidia H20 chips to run, compared to R1’s 8 to 16. That’s a deployment cost reduction of 65% to 75%.

“Open-source, iteration speed, and multiple model sizes — these are the pillars,” an Alibaba Cloud executive said. “We release every few months so developers know what to expect. Even if they’re not using our cloud, they’ll know our name.”

Alibaba CEO’s cloud strategy

Behind the flood of models is a deeper strategy shift. In 2023, Wu took over as Alibaba Group CEO and, notably, retained his post as chairman of Alibaba Cloud. He quickly split the business, launching a dedicated public cloud unit and dropping low-margin private cloud services. The message: AI-first, cloud-first.

That shift culminated in a jaw-dropping February announcement: 380 billion RMB to be invested in cloud and AI over the next three years... nearly equivalent to the company’s total capital expenditures over the past decade combined.

In May 2024, the company set an ambitious goal: double-digit commercial growth for its cloud division by late 2025. By November, Alibaba rebranded its entire cloud direction as “AI-native” — a full alignment between its model and infrastructure arms.

That shift culminated in a jaw-dropping February announcement: 380 billion RMB to be invested in cloud and AI over the next three years. It’s nearly equivalent to the company’s total capital expenditures over the past decade combined.

Insiders insist this pivot wasn’t sparked by DeepSeek’s sudden stardom. “We’d been signalling this since November 2024,” said the Alibaba executive. “The real question now is how to turn foundational models into business models.”

The short answer is: MaaS. Since the 29 January Lunar New Year, demand for inference has exploded. Alibaba says 60% to 70% of new cloud demand comes from model inference. While direct monetisation from Qwen remains unclear, it’s driving traffic to Alibaba Cloud’s broader product suite.

Wu has compared cloud networks to the electric grids of the industrial era — silent, essential and increasingly valuable. “In the future, 90% of tokens will be generated and output through the cloud,” he said.

Alibaba’s latest quarterly earnings support that vision. Cloud revenue rose 18% to 30.1 billion RMB in the first three months of 2025, with AI-related sales notching triple-digit growth for the seventh straight quarter. Adjusted EBITA of the cloud segment hit 2.42 billion RMB, up 69% year over year.

The impact is spreading. By January, more than 290,000 developers and companies — including Baidu, State Grid, China Mobile, BMW and OPPO — had used Tongyi API services on Alibaba Cloud’s Bailian platform.

Even electric vehicle giant BYD signed on in June. But high-profile deals don’t guarantee smooth outcomes. Alibaba’s once-hyped collaboration with Apple’s AI team, for instance, has gone conspicuously quiet.

Meanwhile, competitors are circling. ByteDance’s Volcano Engine, which powers the Doubao model, is growing fast with rock-bottom prices. As of late May, Doubao was handling 16.47 trillion daily token calls — up 137 times since its introduction in May 2024.

“Last year we slashed Doubao’s cost by 99%,” said Tan Dai, president of Volcano Engine. “That’s what ignited the market.”

The result: Volcano Engine is now the fastest-growing and highest-margin product in ByteDance’s cloud portfolio. Its clients include nine of the world’s top ten smartphone brands, most major carmakers and most of China’s elite universities.

According to IDC, ByteDance captured nearly half of China’s public cloud model call volume in 2024 — far outpacing Alibaba.

If Alibaba is pouring billions into the unseen backbone of AI, Tencent is focused on what users touch first: the applications.

Tencent’s AI push

If Alibaba is pouring billions into the unseen backbone of AI, Tencent is focused on what users touch first: the applications. In early 2025, Tencent made a decisive shift, accelerating the deployment of AI by loosening its dependence on the company’s Hunyuan model and instead embracing integration with DeepSeek — most notably through its flagship AI assistant, Yuanbao.

To make this pivot possible, Tencent restructured its organisation chart in January. Yuanbao was moved out from the Technology and Engineering Group, which handles core engineering and infrastructure, and placed with three other consumer-facing applications — QQ Browser, Sogou Input Method and the intelligent workspace tool ima — under the Cloud and Smart Industries Group (CSIG). This gave CSIG control not only of Tencent’s enterprise cloud services, but also its fastest-evolving AI-powered consumer tools.

By the Lunar New Year, all four apps had integrated DeepSeek. The move marked a psychological shift inside Tencent. No longer merely a follower in the AI wave, the company stood ready to lead.

“Bringing in DeepSeek was like inviting a master into the dojo,” said the source close to Tencent leadership. “If Hunyuan isn’t there yet, it makes sense to walk on multiple legs while training to run faster.”

Yuanbao became Tencent’s headline AI product almost overnight, receiving massive internal support. On 16 April, WeChat — Tencent’s crown jewel and China’s dominant social app — soft-launched AI features for the first time by integrating Yuanbao under the guise of a “Red Packet Cover Assistant”. By April, it had officially rebranded to Yuanbao, appearing in users’ contact lists and opening a chat-triggered AI interaction. Even WeChat’s search bar began surfacing AI-generated responses.

It was a milestone, but also a compromise. Rather than rushing an AI-native WeChat experience, Tencent took a cautious route. DeepSeek’s occasional outages and hallucinations were unacceptable in an app used daily by over a billion people. “You can’t have DeepSeek fail to respond inside WeChat,” the insider said. “That’s a risk a mature 2C product just can’t afford.”

Most of WeChat’s computing power, the insider said, is still directed towards its video platform — Channels — which leaves little capacity to support fully native AI features. For now, the AI rollout will be incremental.

Still, Tencent isn’t holding back on ambitions. President Martin Lau said during a recent earnings call that the company plans to develop a dedicated WeChat Agent — an AI system that will integrate seamlessly into users’ contacts, conversations and content flows.

Tencent’s focus on everyday utility and productivity

Outside of WeChat, Tencent’s broader AI effort is beginning to take shape. In the first quarter, QQ Browser — boasting 400 million users — began testing AI features within Huawei’s HarmonyOS. In May, it officially rebranded as an “AI browser”, introducing QBot, a chatbot powered by DeepSeek and Tencent’s Hunyuan model.

Search remains a top target. Tencent’s internal data aligns with broader industry trends: out of China’s top 30 mobile apps by monthly active users in March, 23 had AI capabilities, and ten included AI search. WeChat’s AI search tool, Souyisou, now has 160 million monthly users. Tencent believes that, unlike in the West where subscriptions dominate, China’s monetisation path may begin with ads and evolve towards paywalls.

QQ Browser product lead Li Ruizhang said Tencent’s strategy prioritises user needs over competitor benchmarks. “In lower-tier cities, people might not download lots of new apps,” Li said. “But they’ll still use browsers to solve complex problems.”

In the world of AI search, however, product design is everything. Long responses overwhelm users, even if the model is accurate. “We ran dozens of experiments,” Li said. “Eventually, we learnt that keeping AI-generated answers short — ideally just two or three lines visible without scrolling — leads to higher engagement.”

China’s browser market includes almost 700 million monthly users, making it a major ad channel. Yet QQ Browser’s AI upgrade sacrificed many of those ad slots. “We cleared homepage space for AI features,” said a Tencent Cloud insider. “That was a strategic decision.”

Tencent’s AI products, while varied, often converge around productivity. Yuanbao sees higher usage on weekdays and on desktops — suggesting it’s becoming a workplace tool.

Beyond browsing, Tencent is quietly incubating next-gen AI tools. One standout is ima, a smart workspace assistant originally built around PDFs. In November, it launched a PC version capable of building personalised knowledge libraries from fragmented sources. The team pushed out a mobile version by the Lunar New Year and was one of the first in Tencent’s ecosystem to fully adopt DeepSeek. By March, ima’s PC user base was up 24.8% month-over-month.

Tencent’s AI products, while varied, often converge around productivity. Yuanbao sees higher usage on weekdays and on desktops — suggesting it’s becoming a workplace tool. Other apps like Tencent Docs and Tencent Meeting are embedding AI helpers trained to organise content, automate downloads or update software.

The results are showing. In March, Tencent Docs and Yuanbao both surpassed ten million monthly active users on PC — more than any other Chinese AI desktop app. Tencent Docs even outranked DeepSeek in usage frequency, with users averaging 12.6 sessions per month compared to DeepSeek’s 9.8.

Still, ByteDance looms large. Its AI chatbot Doubao remains DeepSeek’s only serious rival in active users, crossing the 100 million mark by March. Doubao is already embedded in TikTok’s Chinese twin, Douyin, where users can summon AI answers directly in chat.

But no one has yet solved the biggest problem: hallucination. All large language models, including those used by Tencent, remain prone to making things up — especially in Chinese. “DeepSeek feels dumber lately,” the Tencent source said. “That’s what people are telling us.”

It’s not about intelligence, but information quality. Much of the Chinese web is riddled with low-value content, and unless AI models are trained carefully, garbage in means garbage hallucinated out. Yet Tencent, with its news, social and video platforms, is sitting on what might be the country’s richest proprietary dataset.

From marketing to logistics, from games to global trade, Alibaba and Tencent are threading AI into everything they touch — starting with how their own employees work.

As one executive from ByteDance’s Volcano Engine told Caixin: “The linguistic barrier is dissolving. The issue isn’t content quality — it’s whether your agent knows how to search.”

AI moves in-house

If 2024 was the year Chinese tech giants raced to deploy large models, 2025 is when they started embedding them deep into the core of their business operations. From marketing to logistics, from games to global trade, Alibaba and Tencent are threading AI into everything they touch — starting with how their own employees work.

AI-assisted coding is now standard inside both firms, pushed from the top down as a pillar of internal workflow reform. But the clearest commercial wins so far are in advertising — the longstanding engine of China’s internet economy. Both companies have deployed large models to better match ads to users and generate campaign assets at scale.

Tencent began building trillion-parameter models for ad targeting as early as 2021. It now uses AI to craft everything from video scripts to virtual influencers. In this year’s first quarter, Tencent reported that AI had made “substantial contributions” to performance ads and its evergreen gaming franchises. WeChat added text-to-image tools for official accounts and rolled out model-backed search capabilities.

“Traditional banner ads had a 0.1% click-through rate. Feed ads hit 1%,” said Tencent Chief Strategy Officer James Mitchell. “With AI, some ad slots are hitting 3%. We don’t know what the ceiling is yet.”

AI has improved product conversion rates by 52% and customer reply speed by 36%, according to company data.

Alibaba, meanwhile, is transforming e-commerce. Historically focused on recommendation and search, its latest AI efforts generate content, streamline sourcing and automate cross-border trade. On its international B2B platform, Alibaba has launched AI agents for global buyers and sellers. In November, it introduced Accio, a trade search engine designed to interpret fuzzy prompts like “build a pickleball court” and instantly return full procurement plans — equipment lists, supplier suggestions, even floor coatings.

With over 40 links in a typical international supply chain, Alibaba says almost every one is being retooled with AI. Four trade-focused agents — handling product ops, customer service, marketing and compliance — now support over 100,000 merchants daily. AI has improved product conversion rates by 52% and customer reply speed by 36%, according to company data.

Domestically, Alibaba is reorienting its consumer AI lineup around Taobao, the Quark browser, and the chatbot Tongyi Qianwen, which was folded into the Smart Information Group in late 2024. That unit now also oversees Quark, Shuqi (its e-book brand), and marketing tech.

On the enterprise side, DingTalk and AutoNavi anchor Alibaba’s AI-to-B offerings. DingTalk is being built into a workplace agent where employees execute workflows in natural language. AutoNavi, China’s leading navigation app with 170 million daily users, is evolving into a full-fledged life services hub — AI-enhanced and context-aware.

Tencent’s approach is more fragmented, with different divisions racing to embed AI independently. In February, Tencent’s flagship battle game Peacekeeper Elite became its first title to adopt DeepSeek. Players can now chat with digital characters, and an “AI Teammate” feature is in the works.

Where Alibaba and Tencent retrofit existing products, ByteDance is leaning into reinvention. Its “product factory” mindset is spawning entirely new AI-native experiences.

In gaming, AI now powers both ends of Tencent’s pipeline. On the user side, it matches players by skill level and assists newcomers. On the production side, it enhances efficiency: a May update to Tencent’s Hunyuan Vision Platform allows game designers to transform crude sketches into polished art assets with just a few prompts.

Where Alibaba and Tencent retrofit existing products, ByteDance is leaning into reinvention. Its “product factory” mindset is spawning entirely new AI-native experiences. Led by Flow, a team helmed by Musical.ly founder Zhu Jun, ByteDance has launched a growing matrix of AI tools — Doubao AI tutor for education, Cat Box for social interaction, and Jimeng, an AI video app developed under former TikTok China head Zhang Nan, aimed at lowering the barrier to generative media creation.

In April, ByteDance rebranded its general-purpose agent builder Coze, adding Coze Space, a lightweight workspace that lets users generate pitch decks, reports and visualisations with one click. It integrates with Feishu Sheets and AutoNavi, and was so popular in internal testing that its servers temporarily crashed from user demand.

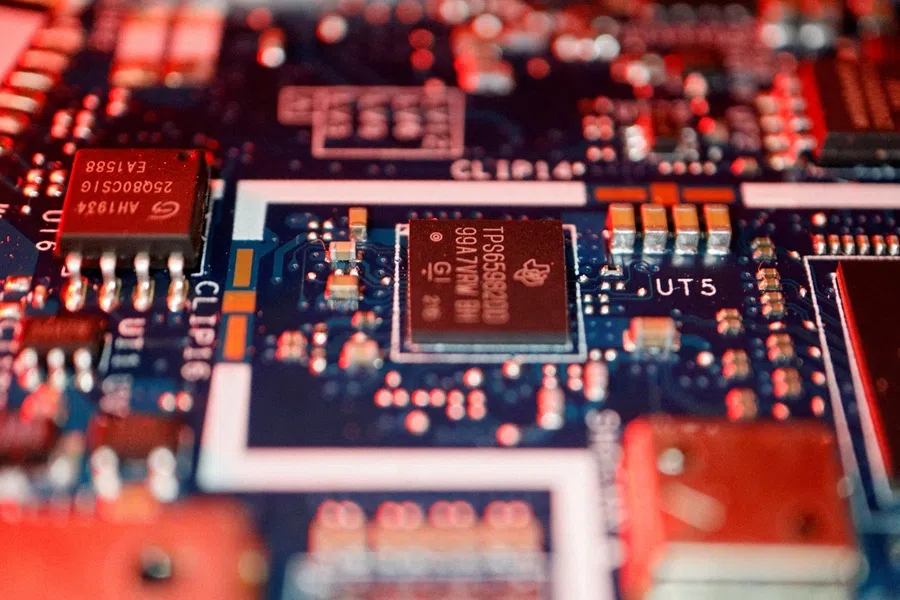

The AI boom runs on chips

Behind every viral chatbot and futuristic AI agent lies a brutal truth: none of it works without compute. And in China, compute means GPU chips — mostly made by Nvidia, mostly imported, and increasingly restricted. When DeepSeek’s R1 model stunned the world in January, it was not just the model’s fluency that drew attention, but its ruthless efficiency: squeezing peak performance out of every available GPU core.

That efficiency had two major consequences. It offered a lifeline to China’s AI sector amid a growing chip shortage and proved that large model deployment didn’t have to come with astronomical infrastructure costs. But for China’s largest tech firms, that only intensified the arms race to secure more compute.

Alibaba, Tencent and ByteDance are now stockpiling chips like gold bars. According to Guosen Securities, by the end of 2024, Alibaba Cloud had amassed more than 230,000 Nvidia AI chips and 450,000 domestic alternatives, with plans to purchase an additional 300,000 Nvidia chips and 450,000 Chinese chips this year. ByteDance, with similarly deep pockets, is reportedly planning to add over 380,000 Nvidia chips in 2025 alone. Tencent lags slightly in volume, but is accelerating fast.

Alibaba CEO Wu has said the company is preparing for “all policy scenarios” and has already ensured compatibility across multiple chip architectures. But reality hit hard in May, when Alibaba’s quarterly capital expenditures came in at just 24.6 billion RMB — far below analyst expectations of 35 billion. US restrictions on Nvidia’s H20 chip, intensified by the Trump administration in April, sent Alibaba’s stock down by more than 8% in a single morning.

China’s AI market saw massive GPU hoarding ahead of the US restrictions. Many smaller firms bought chips but lacked the technical chops to develop real models. Now, as they fall out of the race, unused compute is returning to the market.

Tencent is feeling the pinch too. In the fourth quarter, it rushed to buy chips before further US crackdowns, spiking its capital expenditures to 39 billion RMB. But deploying those chips takes time. As recently as March, new GPUs were still being installed at Tencent data centres, with inconsistent latency across cities and cable reconfigurations slowing rollout.

“In the long run, China’s AI chip field will consolidate to three or four major players... The winners will be those who make their chips the de facto standard — by combining technical muscle with practical applications.” — an executive at a cloud company

To keep pace, the company is supplementing with leased compute. In May, it paid 113 million RMB to Hangzhou-based Turing Engine for access to large-scale cluster resources. President Lau said Tencent is optimising inference efficiency, resizing models, and exploring domestic chips.

Almost all Chinese cloud firms are now developing their own chips. Huawei leads with its Ascend AI processors and Kunpeng CPUs, already powering 384-chip supernodes designed to rival Nvidia’s H100s. Alibaba’s in-house chipmaker, T-Head, has released the Hanguang 800 for inference workloads, while Tencent has backed chip startup Enflame and successfully tapped out its own “Zixiao” inference chip.

Still, maturity matters. “Clients often prefer the stability of Huawei’s ecosystem,” said an executive at a rival cloud provider. “So, we also build hybrid pools with chips from multiple vendors.”

But heterogeneity isn’t easy. Variations in performance, interface protocols, and numerical precision mean cloud providers now compete not just on hardware, but on their ability to build seamless heterogeneous compute clusters. The real prize? A unified PaaS interface that can abstract away the chip chaos and let developers build without friction.

“In the long run, China’s AI chip field will consolidate to three or four major players,” the executive said. “The winners will be those who make their chips the de facto standard — by combining technical muscle with practical applications.”

Alibaba and Tencent have not just built products — they have built empires. From fintech to e-commerce, gaming to cloud, the two giants have long been China’s most aggressive and influential strategic investors.

Owning the ecosystem

In every wave of internet innovation, Alibaba and Tencent have not just built products — they have built empires. From fintech to e-commerce, gaming to cloud, the two giants have long been China’s most aggressive and influential strategic investors. The AI boom is no exception. This time, their capital flows follow familiar patterns — but with a sharper focus on securing platform dominance.

For Alibaba, cloud is the foundation. Its AI ecosystem strategy starts with infrastructure and scales outward. During the rise of China’s so-called “Six Tigers” of AI startups, Alibaba Cloud invested early in five of them — Zhipu AI, MiniMax, Baichuan, 01.AI and Moonshot — offering not just cash but compute. Then in April, it launched a formal ecosystem partnership plan, covering six layers: infrastructure, models, data, tools, applications and delivery.

One of the first partners is SiliconFlow, which gained attention by offering third-party inference services for DeepSeek models. In June, SiliconFlow announced a multi-hundred-million RMB Series A round led by Alibaba Cloud, followed quickly by a deeper integration deal. Now, its inference platform is fully embedded into Alibaba’s Bailian model platform, operating directly on Alibaba’s compute stack.

Tencent’s strategy, by contrast, leans more heavily on traffic and platform lock-in. It has invested in four of the same AI startups — Zhipu, MiniMax, Baichuan and Moonshot — and was among the earliest backers of inference infrastructure firm Infinigence AI in 2023.

But Tencent’s greatest draw isn’t compute. It’s WeChat — and the massive gravity of its ecosystem. “A lot of enterprise clients are already building automation tools on top of WeChat Work and Docs,” said the founder of a B2B AI company. “Customer data, workflows — everything already lives there. It just makes sense to stay within the system.”

That’s the bet many are making. “If AI agents are going to become standard,” said Laiye CTO Hu Yichuan, “they’ll need to live inside the content and communications ecosystems people already use. And WeChat’s entrance is practically immovable. That’s where the agents will land.”

Tencent knows it. The company is already pivoting its enterprise AI pitch from raw tools to “content + agent” platforms. Its personal knowledge assistant ima has become a prototype for that strategy, while Tencent Cloud promotes ready-made AI knowledge bases for business clients.

Whether Alibaba’s open-source cloud or Tencent’s WeChat orbit wins the long game remains to be seen. But in China’s AI gold rush, platform power — compute, content or community — is proving to be the most valuable currency of all.

This article was first published by Caixin Global as “Cover Story: Alibaba Fights Tencent for Dominance Over AI in China”. Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)