Can Taiwan hold on to its lead in chip manufacturing?

Taiwan's semiconductor industry is booming, but its pole position is at risk. With the industry deemed of national security concern, China, the US and the EU are implementing restrictive measures, upping their investment and aiming for autonomy and self-sufficiency in the sector, which could cause Taiwan to lose its competitive edge.

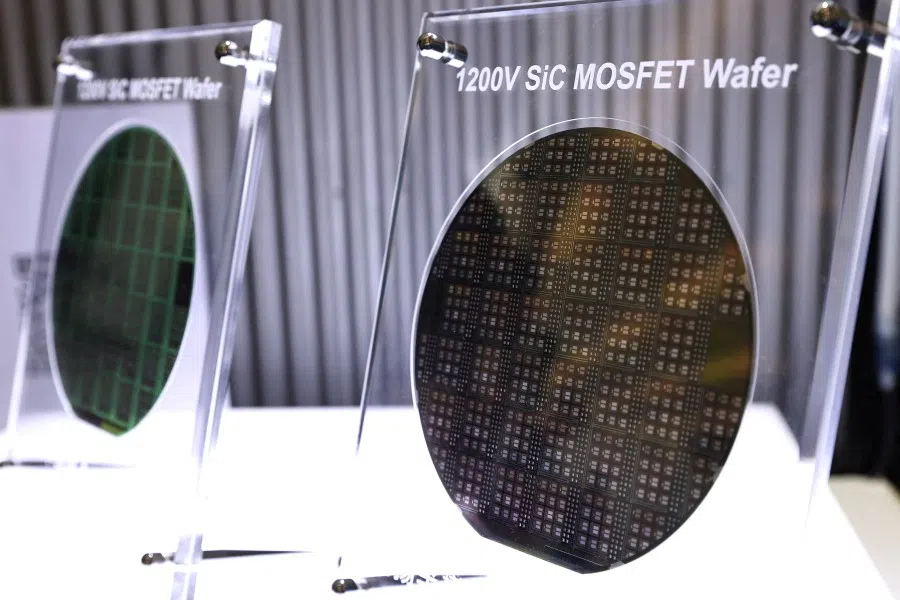

In 2021, Taiwan's semiconductor industry generated over US$120 billion in revenue for the first time, ranking second globally with a share of 19.8%. In addition, its contract manufacturers accounted for over 60% of global foundry revenue.

Semiconductor industry linked to national security

In his 2001 book Silicon Shield: Taiwan's Protection Against Chinese Attack, Australian journalist Craig Addison asserted that Taiwan's "silicon shield" - referring to its semiconductor industry - is its strongest defence against an attack from mainland China. Taiwan Semiconductor Manufacturing Co. (TSMC) accounts for over 50% of the global market share for chips and dominates advanced processes, earning itself the moniker of a "sacred mountain" protecting the island (护国神山).

... the global information and communications technology (ICT) industry's over-reliance on Taiwan is both a blessing and a curse for the island.

TSMC chair Mark Liu once said that many companies around the world need TSMC's technology to maintain their market share, and this is no exaggeration. In recent years, Advanced Micro Devices, Inc., TSMC's second largest customer, has relied on TSMC's 5-nanometre (nm) and 7 nm advanced processes to gain market share over Intel.

The global automotive chip shortage in late 2020 highlighted the importance of Taiwan's semiconductor industry. In early 2021, then German Federal Minister for Economic Affairs and Energy Peter Altmaier asked his Taiwanese counterpart Wang Mei-hua to push Taiwanese manufacturers to help ease the shortage of semiconductor chips in Germany's auto sector. Even though the former Merkel administration was friendly towards the mainland and avoided offending Beijing over Taiwan, it had to seek help from the Taiwanese government for the sake of its auto industry.

However, the global information and communications technology (ICT) industry's over-reliance on Taiwan is both a blessing and a curse for the island. In the same way that Taiwan considers TSMC a strategic "sacred mountain", developed countries in Europe and the US also understand that the semiconductor industry is closely linked to national security, and they hope to gain autonomy over advanced chips, which they see as an important strategic material.

During the automotive chip crisis, The Economist likened the world's dependence on Taiwan's and South Korea's semiconductor industry to a new Strait of Hormuz - an important global oil passageway that could be easily cut off.

... the US is forming a "non-red supply chain" that excludes China.

Forming a 'non-red supply chain'

The US has escalated its trade war with China into a tech war and is even heading towards a new Cold War. The US wants to avoid being overtaken by the mainland in high technology and aims to gain autonomy over crucial hi-tech strategic materials.

Amid a new Cold War, controlling cutting-edge chip technology ensures military and economic superiority, which equates to having dominance over the global economic and trade order. Hence, the US is strictly controlling its manufacturers' dealings with the mainland's military industry, as well as supercomputers, chipmaking and other sectors that could be used for military capabilities. At the same time, the US is forming a "non-red supply chain" that excludes China. To control the source of advanced chips, the US in 2020 urged semiconductor giant TSMC to set up a factory in the country for defence and security reasons.

In mid-2021, the White House proposed the rebuilding of the country's wafer manufacturing industry. In August this year, US President Joe Biden signed the CHIPS and Science Act of 2022 into law, paving the way for US$280 billion in funding for the US's wafer manufacturing industry.

In October, the Biden administration imposed additional chip export bans on China. The restrictions would prevent China from acquiring advanced artificial intelligence chips and US-made chip design software; and block China's access to the US's semiconductor manufacturing tools and equipment.

The US's tough measures are also hurting Taiwan's tech industry as mainland China is an important market for Taiwan's ICT sector.

More importantly, American citizens and green card holders are also banned from providing support for the development or production of chips at Chinese manufacturing facilities.

China's ICT sector will be dealt a heavy blow with Biden's chip ban, which is both a boon and a bane for Taiwan. The US's tough measures are also hurting Taiwan's tech industry as mainland China is an important market for Taiwan's ICT sector.

For example, TSMC announced that to comply with the US's ban, it will suspend production of advanced chips for Chinese start-up Biren Technology, which is focused on AI graphics. The US has also banned US tech company Nvidia, Biren's competitor, from exporting its advanced AI chips to China.

Furthermore, China's Phytium Technology - the main client for Taiwan's integrated circuit design company Alchip - was sanctioned by the US in 2021 for allegedly manufacturing missiles for the People's Liberation Army. AIchip halted its Phytium production and lost its biggest client. Its China businesses only contributed approximately 26% of revenue in the first three quarters of this year, down significantly from 71% last year.

On the bright side, mainland China's semiconductor industry poses less of a threat to Taiwan. After releasing its "Made in China 2025" plan in 2015, mainland China went all out to boost its semiconductor industry, and subsequently poached over 3,000 semiconductor engineers from Taiwan. The US's strong resistance to mainland China's tech industry reduced the competitive pressure on Taiwan and cemented its leading position in the semiconductor industry.

Semiconductor ecosystem is Taiwan's unique advantage

Another key consideration is whether the US will succeed in rebuilding the industry supply chain after cutting the "red supply chain", and what Taiwan's position will be thereafter.

If a new global ICT industry chain cannot be established, the US and Europe - regardless of economic efficiency - will produce their own semiconductors...

The US wants to build the "Chip 4" alliance with Taiwan, South Korea and Japan, but South Korea is reluctant for fear of losing the China market. Notably, when US House Speaker Nancy Pelosi visited Seoul in early August, South Korean President Yoon Sook-Yeul most likely wanted to avoid offending Beijing or make a stand on Chip 4, and gave the excuse of being on a break to not meet Pelosi.

If a new global ICT industry chain cannot be established, the US and Europe - regardless of economic efficiency - will produce their own semiconductors, which they deem as a national security resource. National security considerations have clearly taken precedence over economic benefits, as also evidenced by the US's US$280 billion CHIPS Act and the EU's 2020 announcement of a 145 billion euros (US$144 billion) investment to boost Europe's semiconductor industry.

With this policy direction, TSMC and Taiwan's semiconductor-related industries will lose their competitive edge, leading many people in Taiwan to worry that the global semiconductor industry will shift away from Taiwan.

Taiwan's tech engineers are described as "selling their liver" at work - such a high-pressure job with long hours would drive away any US tech persons.

However, Taiwan's semiconductor industry has unique advantages that other regions cannot replicate. In late 2021, TSMC founder Morris Chang said that there are many skilled and dedicated engineers, technicians and workers who are willing to join the industry, and they have more commitment than their US peers. In addition, Taiwan's semiconductor industry ecosystem is connected by its high-speed rail and expressways, so the thousands of engineers in TSMC's three manufacturing centres in Hsinchu, Tainan and Taichung do not have to relocate. Furthermore, Taiwan's tech engineers are described as "selling their liver" at work - such a high-pressure job with long hours would drive away any US tech persons.

Will Taiwan's "sacred mountain" be moved or levelled? Besides looking at whether Europe and the US will succeed in gaining autonomy in the semiconductor industry, we also have to look at whether Taiwan is able to stay innovative and maintain its ecosystem advantage, as described by Chang.

This article was first published in Lianhe Zaobao as "台湾"护国神山"会被夷平吗?".

Related: Taiwan lacks young passionate workers in semiconductor industry | Taiwan's booming semiconductor industry plays crucial role on world stage | China seeks Taiwan research talents in semiconductor industry | Why TSMC will stay rooted in Taiwan despite pressure to set up overseas chip factories | Has the US crushed China's hopes for self-sufficiency in the chip industry? | The end of the global chip shortage: Now, chips won't sell