Why TSMC will stay rooted in Taiwan despite pressure to set up overseas chip factories

While the US and Japan would like TSMC to "spread the risk" of global tech supply chains being hit in the event of cross-strait tensions, TSMC is quite firm on keeping its advanced technologies in Taiwan while going through the motions of setting up some overseas outposts as recommended by its allies. It is well aware of its strategic value and will want to hold on to its upper hand.

With an unprecedented global shortage of chips due to the Covid-19 pandemic, Taiwanese chipmaker Taiwan Semiconductor Manufacturing Company (TSMC) plans to invest US$44 billion (roughly S$59.2 billion) in expanding its capacity and pulling further ahead of closest rivals Samsung and Intel. But tense cross-strait and China-US relations will remain bugbears for TSMC.

TSMC controls key strategic materials for global technology and economic and trade development. According to Information industry and geopolitics experts, in the face of a worsening China-US tech war and mounting pressure to establish foreign factories and choose sides, TSMC will continue to stay rooted in Taiwan whilst fulfilling its chip orders.

In TSMC's revenue report and 2022 outlook announcement on 13 January, it said that its revenue increased by 24.9% year-on-year in 2021, and this figure is expected to increase by 25-29% in 2022.

But it is TSMC's envisaged significant increased investment expenditure that is attracting widespread attention. This year, the company is expected to raise its capital expenditure budget to US$44 billion, a 46.7% increase from last year's US$30 billion. Around 70-80% of the funds will be poured into industry-leading advanced process technologies in response to the urgent global demand for high-performance computing, automotive chips and 5G chips.

Market value surpassed US$700 billion

Following the revenue announcement, it was also reported that TSMC has received a huge order from Apple, its largest customer.

With all the good news announced about TSMC's high capital expenditure and the explosion of orders, TSMC's share price hit a record NT$688 (S$33.42) per share on 17 January, and its market value even surpassed US$700 billion. TSMC is now the world's ninth most valuable company by market capitalisation, which puts it far ahead of its nearest competitors Samsung (16th) and Intel (53rd).

Based on various reports, TSMC will begin commercial production of chips built on its 3nm process this year, accelerate progress to the 2nm process by 2024, and develop a more sophisticated angstrom era process.

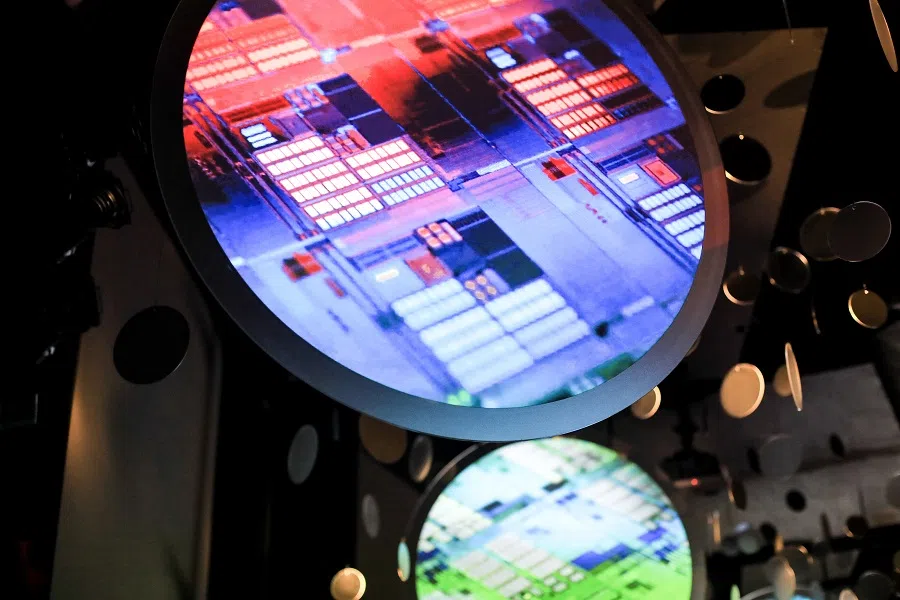

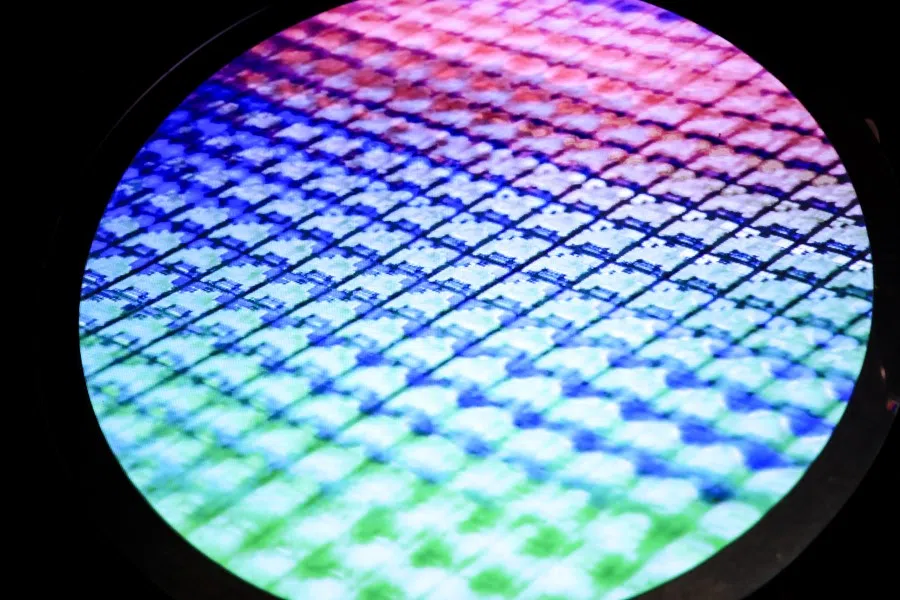

Made of semiconductor materials, chips are a core technology widely used in smartphones, computers, cars, fighter jets, 5G and artificial intelligence products.

TSMC currently produces 92% of the world's most advanced chips below 10nm. Chips the size of a fingernail contain tens of billions of transistors acting as microprocessors. The smaller and greater the number of transistors, the faster and more power-efficient it is. One nanometre (nm) is one-millionth of a millimetre (mm), while one angstrom is one-tenth of a nanometre.

TSMC continues to face calls by the US-Japan alliance to set up overseas factories to "spread the risk", as well as political pressure to choose sides between the China and US markets.

However, the battle between the three major semiconductor giants is not over yet, and Samsung and Intel are also catching up. Samsung is putting money into upgrading its production lines and plans to overtake TSMC by 2030, while Intel announced on 19 January that it has purchased the most advanced extreme ultraviolet lithography machine. On 20 January, Intel also declared that it would invest US$20 billion in a new chip manufacturing complex in Ohio, which are taken as signs that Intel plans to catch up with TSMC's advanced 2nm process by 2025.

Calls by US and Japan for TSMC to 'spread the risk' overseas

Looking ahead at this year, many analyses say the China-US trade war has evolved into a targeted war of tech decoupling. Washington has been "choking" Beijing with its restrictions on technology, and Taiwan with its comprehensive semiconductor industry is also facing the threat of armed reunification by mainland China - if war breaks out, that would hit the global trade and tech supply chains. And so, TSMC continues to face calls by the US-Japan alliance to set up overseas factories to "spread the risk", as well as political pressure to choose sides between the China and US markets.

John Chen Tzu-ang of the Market Intelligence & Consulting Institute at the Institute for Information Industry told Zaobao that TSMC owns semiconductor technology as a "strategic asset", and is looking at calls to set up factories in the US, Japan and other locations, while examining the need to secure local orders and operations. It is less political than it seems as subsidies from the US government is a factor to consider, and "if TSMC doesn't go in, the markets might be seized by Samsung and Intel."

Chen also said TSMC is expanding its factories in central and southern Taiwan, and will continue its strategy of staying locally rooted and retaining its most advanced production lines in Taiwan, as it is also cost-effective to expand production locally.

US integrated circuit designs dominate 66% of the global market, while Taiwan's foundry accounts for 65% of global volume, with a positive long-term outlook.

As for choosing sides between China and the US, Chen said TSMC has to choose sides for manufacturing advanced process chips 14nm and below, but there is no restriction on mature process technologies. He said that companies would "go where the orders are", preferring to stay low-profile and pragmatic. It explains why following the China-US trade war, Taiwan's electronic product exports to mainland China have repeatedly hit record volumes.

TSMC may be used as a pawn

Describing the semiconductor "co-opetition" between mainland China, the US and Taiwan, he said the US and Taiwan are a complementary "match made in heaven". US integrated circuit designs dominate 66% of the global market, while Taiwan's foundry accounts for 65% of global volume, with a positive long-term outlook.

Chen feels that after TSMC set up its US$12 billion fabrication plant in Phoenix, Arizona in the US, the semiconductor industry in the US and Taiwan would continue to rely on each other. "There are over 3,000 IC design companies in the US, and they would not just order chips from US companies, nor would they overtake TSMC's production capacity," he said.

As for the competition between TSMC, Samsung and Intel, he said Taiwan's key advantage is its talent pool, while the biggest challenge now is to take in and nurture talent from within and outside of Taiwan, to meet the future explosive demand for R&D and production.

"Because when the US gains a chip supply, if war breaks out across the Taiwan Strait, the economic and technological impact to the US will be much less, and Taiwan will be of less use." - Jieh Wen-chieh, retired Taiwan diplomat

Retired diplomat Jieh Wen-chieh, who was previously Taiwan's representative to New Zealand, observed that while TSMC has succumbed to US political pressure to set up the overseas factory, it has also rapidly expanded its factories in Taiwan in the past two years, in order to "establish a de facto reality". He said while TSMC is low-key and pragmatic and is hoping to have the best of both worlds, it has no influence on the situation in the Taiwan Strait, or the US policy on the issue, but is "just the affected party".

He added, "When TSMC's factory in Arizona goes into production in 2024, that will actually be bad for Taiwan. Because when the US gains a chip supply, if war breaks out across the Taiwan Strait, the economic and technological impact to the US will be much less, and Taiwan will be of less use."

Jieh said the mainland's determination for reunification cannot be underestimated, but the US wants to stop and cripple the process. Unless both sides of the Taiwan Strait establish a direct channel of communication to manage the risk, there remain concerns about the future of both TSMC and Taiwan.

Related: Taiwan's booming semiconductor industry plays crucial role on world stage | China seeks Taiwan research talents in semiconductor industry | Faced with a shortage of water, electricity and vaccines, can Taiwan still deliver the chips? | Chinese tech companies in chipmaking race to be self-reliant

![[Big read] Paying for pleasure: Chinese women indulge in handsome male hosts](https://cassette.sphdigital.com.sg/image/thinkchina/c2cf352c4d2ed7e9531e3525a2bd965a52dc4e85ccc026bc16515baab02389ab)

![[Big read] How UOB’s Wee Ee Cheong masters the long game](https://cassette.sphdigital.com.sg/image/thinkchina/1da0b19a41e4358790304b9f3e83f9596de84096a490ca05b36f58134ae9e8f1)