The next AI superpower? China’s quiet lead in the race for scale

As Huawei challenges Nvidia in AI hardware, China is quietly racing ahead in software scale. With 30 trillion tokens processed daily and AI now cushioning its economy against deflation, a new model of growth — and competition — is taking shape. Technology expert Yin Ruizhi examines the situation.

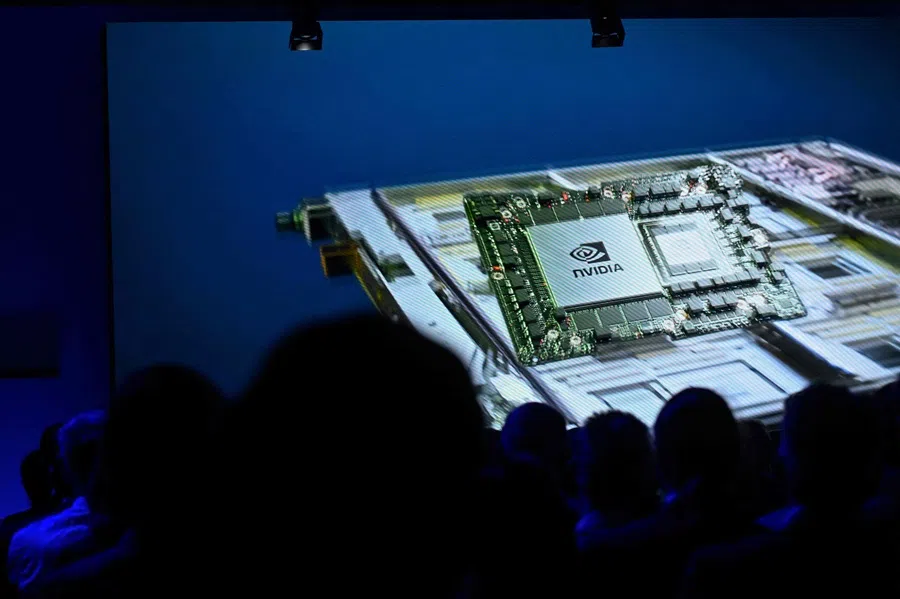

The most eye-catching technological development in China this September must be Huawei’s AI chips. At the Huawei Connect conference on 18 September, rotating chairman Eric Xu announced the latest updates to the Ascend chip line, including the upcoming Ascend 950 series.

Much advancement

The series features two chips — 950PR and 950DT — built with the same die design or internal architecture, and newly supporting low-precision data formats such as FP8 and MXFP8 — which allow for faster and more efficient processing, especially in AI and machine learning, without significantly hurting accuracy. Their computing power sees a major boost over the previous generation, delivering a 2 TB/s interconnect bandwidth. This high-speed data transfer capability reduces bottlenecks when moving large amounts of data, which is crucial for high-performance computing and AI workloads.

The 950PR is set for release in the first quarter of 2026, while the 950DT will be available in the fourth quarter of 2026. Looking ahead, the Ascend 960 is planned for the fourth quarter of 2027, while the Ascend 970 is planned for 2028.

Compared to Nvidia’s NVL144, due for release in the second half of 2026, the Atlas 950 SuperPoD is 56.8 times larger in scale, has 6.7 times the total computing power, and 15 times the memory capacity...

Huawei chasing Nvidia

Huawei’s impressive launch clearly marks another major step forward in its high-profile pursuit of US industry leader Nvidia. While individual Ascend chips still lag behind Nvidia’s equivalents in terms of performance, Huawei is able to compete with Nvidia in overall computing scale through its “supernode + cluster” architecture.

For the upcoming Ascend 950 series, Huawei’s Atlas 950 SuperPoD supernode supports up to 8,192 Ascend chips. Compared to Nvidia’s NVL144, due for release in the second half of 2026, the Atlas 950 SuperPoD is 56.8 times larger in scale, has 6.7 times the total computing power, and 15 times the memory capacity, reaching 1,152 TB; its interconnect bandwidth is 62 times higher, reaching 16.3 PB/s.

Meanwhile, the even more advanced Ascend 960 series will include the Atlas 960 SuperPoD, with 15,488 Ascend 960 chips and a compute power of 30 EFLOPS in FP8 — far exceeding anything Nvidia currently has planned.

While China has made a high-profile push to catch up in hardware, the country’s AI industry has quietly achieved a significant lead in software applications. According to official data released by the National Data Administration in August 2025, China’s daily AI token consumption was 100 billion at the start of 2024, soaring to over 30 trillion by June 2025 — a 300-fold increase in just 18 months. AI systems in China are handling vastly more text input and generating much more output, reflecting rapid growth in AI usage across applications like chatbots, automated writing, translation and more.

Tokens are the smallest unit of information processed by AI, and token usage is a strong reflection of the actual scale of large language model deployment within a country. Alongside traditional metrics such as steel output, oil production, electricity consumption and grain yield, token usage is emerging as a key quantitative measure in the broader competition between China and the US.

... there is a growing consensus within the AI communities of both China and the US that while the overall scale of AI applications in the two countries remains closely matched, China has clearly pulled ahead in terms of growth rate.

US brands gaining traction

Although the US lacks directly comparable statistics, at Google I/O, it was revealed that Google’s monthly token usage grew from 9.7 trillion in April 2024 to 480 trillion by April 2025 — a 50-fold increase. Meanwhile, Microsoft disclosed in its FY25 Q3 earnings call that Azure AI infrastructure processed over 100 trillion tokens in Q1 2025, a five-fold year-on-year increase, with 50 trillion tokens used in March alone.

Based on data from various sources, there is a growing consensus within the AI communities of both China and the US that while the overall scale of AI applications in the two countries remains closely matched, China has clearly pulled ahead in terms of growth rate.

As many AI application scenarios are still in the early stages of commercial deployment — and often kept under wraps by companies for confidentiality reasons, it is difficult to pinpoint exactly when China’s token usage growth began to outpace that of the US.

One key reason for this resilience is the growing role of AI applications across various sectors, which are helping reduce costs and enhance efficiency.

Costs down, efficiency up

China’s current inflation rate and the supply of goods and services also offer indirect evidence of the cost-reducing and efficiency-boosting impact of AI.

Under a traditional economic cycle, when a country experiences deflation and widespread price declines, production typically contracts as producing more often leads to greater losses. However, in today’s China, despite price deflation, many sectors — such as cultural tourism and manufacturing — have not seen a drop in supply. Moreover, despite a significant decline in employment within these industries, their output has remained relatively stable.

One key reason for this resilience is the growing role of AI applications across various sectors, which are helping reduce costs and enhance efficiency.

This signals a fundamental shift in how economies can sustain productivity during downturns — with AI enabling businesses to do more with less, and potentially redefining the traditional relationship between labour, output and economic cycles.

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)