The 'small yard, high fence' mirage: Why China-US tech competition will not be contained

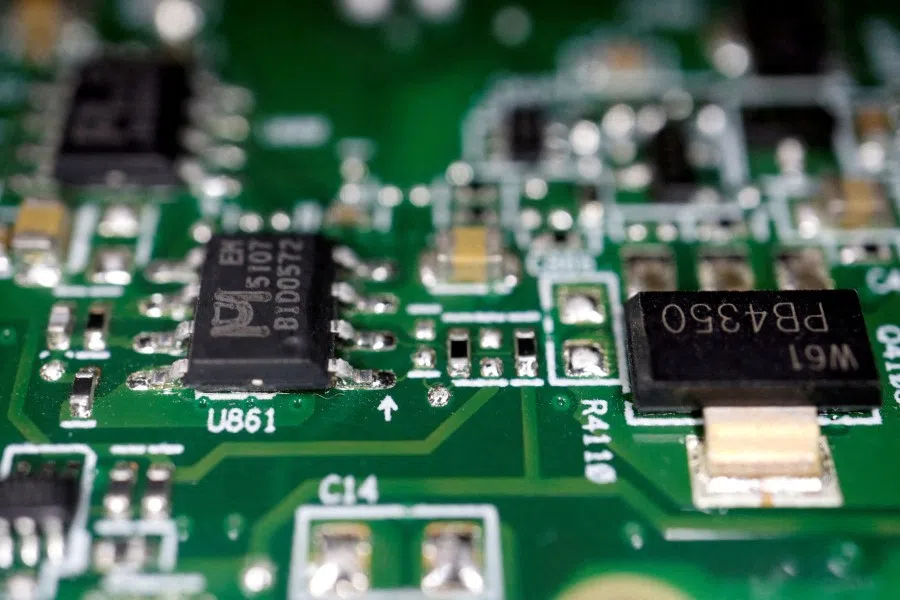

The US's "small yard, high fence" strategy of restricting key technologies from China would be difficult to effect in practice. The fact is that products such as semiconductor chips from China are essential in many downstream industries such as the automotive industry, and even security concerns would not stop their use.

More than half a decade since President Trump began a systematic policy of US trade and technology restrictions aimed at China, the Biden administration continues to expand the scope of these measures. They now include export controls, inward and outbound investment controls, and vendor monitoring and reporting obligations that cover a growing list of technologies.

Biden's national security adviser, Jake Sullivan, describes this as a "small yard, high fence" approach, controlling a small group of "strategic" technologies. It is not intended to effect a general "decoupling" from China's economy. Yet the course of events suggests that this distinction in policy goals will be impossible to maintain.

American controls like those targeting China's access to advanced semiconductors are justified on national security grounds, to maintain a military edge. But US measures continue expanding to cover a growing range of items and industries, and Washington is exerting growing pressure on third countries to toe its line. This trend will have unavoidable impacts worldwide. Most countries are heavily involved in trade with China, and this trade is steadily moving up the technological ladder.

A case in point is so-called "legacy chips": semiconductors manufactured using older technologies and employed in a wide range of uses, including in the automotive sector. When the US semiconductor controls targeting China were introduced, US officials declared it unnecessary to include such legacy chips, and that it was actually desirable that China continue making them.

The rapid rise of Chinese EV makers is itself now being framed as a national security issue by US officials and investigated by the EU.

Wider application of national security concerns

Yet the US Commerce Department is now undertaking a new survey of the global market for legacy chips to determine how US companies are sourcing for such chips. The relevant press release states that "non-market actions ... that threaten the US legacy chip supply chain is a matter of national security", and names China as the chief offender.

Likewise, a recent Congressional letter states that the focus on controlling advanced semiconductors has neglected the risk that China-made legacy chips pose to US economic security, such chips 'being the lifeblood of a modern economy and a modern military.' The letter calls on the Biden administration to respond with "all existing trade authorities... or explain what new authorities or mechanisms are needed to protect our supply chains and domestic producers."

This attention has been provoked by the surge in Chinese production capacity for legacy chips, driven by state-led industrial policy and skyrocketing global market demand. Much of that demand comes from the transition to electric vehicles, a trend also now dominated by Chinese companies. The rapid rise of Chinese EV makers is itself now being framed as a national security issue by US officials and investigated by the EU.

... many technologies like semiconductors are inherently dual-use. In this context, concerns about Chinese power shift easily from military uses of advanced computing to legacy chips in cars.

The pivot from advanced to legacy chips shows why the stated goal of keeping measures that target China's economy within a "small yard" will likely prove unsustainable. Modern economies sprawl across a vast range of technologies based on transnational supply chains, in which China is deeply integrated. And many technologies like semiconductors are inherently dual-use. In this context, concerns about Chinese power shift easily from military uses of advanced computing to legacy chips in cars.

US domestic politics will likely remain focused on reconcentrating economic and technological capacity at home, regardless who the next president is. Apart from Biden's flagship projects to "reshore" industrial and research activity, the US government is progressively articulating lists of "strategic technologies" under its export and investment controls regimes, without clear defining criteria. It is now looking at restricting Chinese use of US-provided cloud computing, including resale by foreign parties, and restricting Chinese vehicles and components entering the US through third countries.

Furthermore, the utility of a "high fence" to stop technological diffusion is dubious at best. Even for advanced chips, a large range of items must be restricted to stall Chinese technological advances, requiring compliance by companies in various countries.

China's continued demonstration of progress in advanced chipmaking likely explains why last year's update to the US chip export controls went further than the Dutch controls published just months before. This put a wider range of machines from Dutch equipment leader ASML under unilateral US restrictions. Likewise, US companies had export licenses to China suspended following news of Huawei's new chip.

The express expectation is that companies will comply not just with the letter of US controls, but with their "spirit" and "intention". Accordingly, the updated US chip controls require reporting to government of exports to China that are below the controlled thresholds.

Disadvantaging 'technology takers'

There is not even a solid precedent for such measures achieving their stated goals. The exploitation of supply chain "chokepoints" to prevent the spread of "strategic technologies" has yet to be proven in practice. The history of export controls suggests that their long-run effect is to promote diffusion and import substitution. Continued Chinese progress will likely compel the US to expand the breadth and depth of countermeasures, and their impact upon third countries.

Countries whose firms own the technologies to make such complex products have leverage to impose political goals on those "downstream" in the supply chain...

With international trade and technology flows increasingly securitised, power will increasingly be exerted by technology makers against technology takers. Not just the US and China, but the EU, Japan, South Korea and India all now have ambitious programmes to "onshore" a bigger slice of the semiconductor supply chain, seeking to capture a bigger share of revenues and reduce the leverage that others can wield against them. Countries whose firms own the technologies to make such complex products have leverage to impose political goals on those "downstream" in the supply chain, or which are wholly dependent on buying finished items from elsewhere.

This is a daunting problem for the nations of Southeast Asia, all of which are still largely "technology takers" and have economies heavily entwined with both the US and China. Chinese and US companies are growing their semiconductor design, manufacturing and packaging, cloud computing and AI operations in Southeast Asia, while Chinese EV makers are expanding their local market share and industrial operations. Navigating the growing vortex of competing foreign "onshoring" efforts and trade controls, and the retaliation that may be visited on non-compliance, is now among the greatest challenges facing leaders in Southeast Asia.

This article was first published in Fulcrum, ISEAS - Yusof Ishak Institute's blogsite.

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)