Why China's exports are in the doldrums

(By Caixin journalists Yang Jinxi, Li Rongqian and Kelsey Cheng)

In October, traffic on the highway leading to one of the world's largest ports by cargo throughput was unusually light.

In past years, the roads leading to the Ningbo-Zhoushan port in East China's Zhejiang province would have been packed in the week leading up to the 1 October National Day holiday, the peak season for shipping, said Wang Lei, executive vice-president at Safewell Group Holdings (China) Co. Ltd., a manufacturer and exporter of safes and telecom products. "Traffic jams were unavoidable," Wang told Caixin in October. "Now, there are barely any cars."

Wang has seen the change from Safewell's offices, which overlook the highway to the port. He has also seen it in the company's order book. "Since this April and May, we haven't been getting as many orders as in previous years," he said.

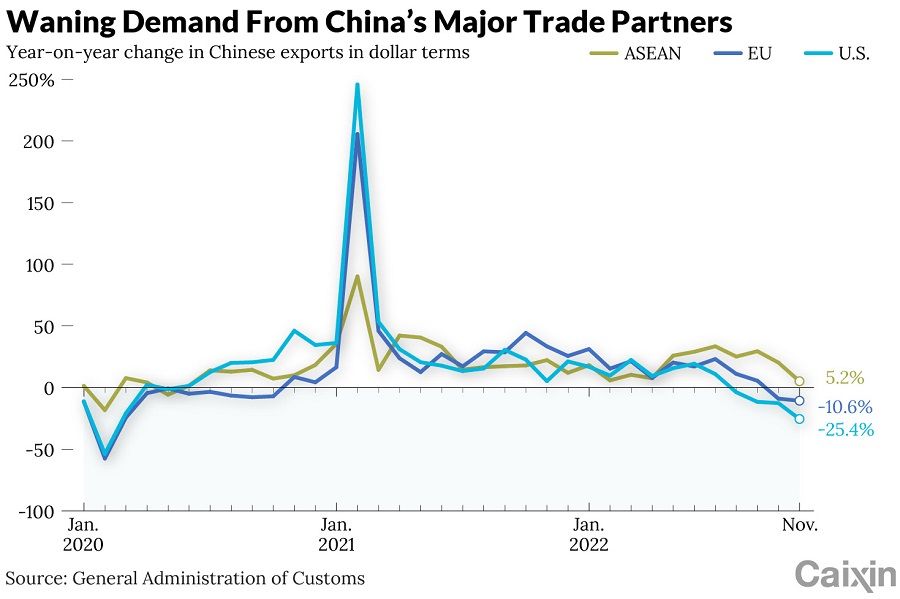

The main culprit is demand, which has fallen off in recent months in China's three biggest export markets - the US, the EU and the Association of Southeast Asian Nations (ASEAN).

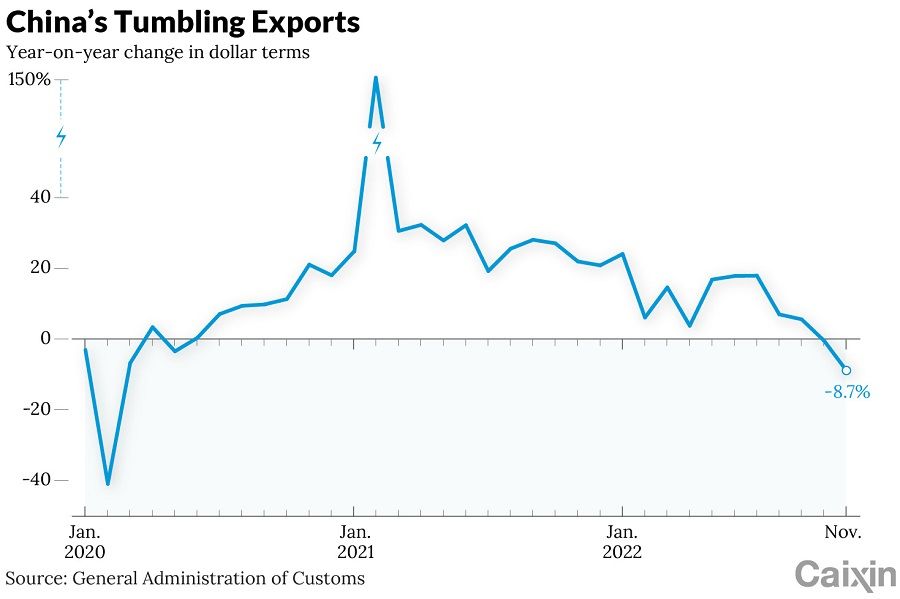

Safewell isn't the only Chinese exporter to take a hit. Chinese goods exports in dollar terms contracted 8.7% year-on-year in November after shrinking 0.3% in October, according to data released by the General Administration of Customs, well below the average 3.4% contraction estimated by economists surveyed by Caixin. It was also the largest drop since February 2020, when much of the world was caught up in the original coronavirus outbreak.

To make matters worse, this figure appears to be lagging. Since late 2021, the rising prices of imported raw materials and components had led to an increase in the prices of China's export products, resulting in apparent growth in trade value - when in fact, export container throughput of some products was already in decline, Cai Jiaxiang, a vice-president of the China Foreign Trade and Economic Co-operation Enterprises Association, told Caixin in October. It wasn't until August that the decline in export orders was gradually reflected in the overall trade value.

The China Containerized Freight Index, which tracks spot and contractual freight rates leaving major Chinese container ports on 12 shipping routes, had begun to fall in August. The index, released by the Shanghai Shipping Exchange, declined 13.6% month-on-month in November following a steeper 24.8% drop in October.

The main culprit is demand, which has fallen off in recent months in China's three biggest export markets - the US, the EU and the Association of Southeast Asian Nations (ASEAN).

However, the reason for slowdown has varied by region. In the US, high inflation cut into household purchasing power, while stuffed warehouses have forced retailers to cancel orders. In Europe, rocketing energy prices have spurred inflation that is keeping consumers' wallets closed - with one notable exception. Meanwhile, the same slump in global demand affecting Chinese exporters is hitting some of their downstream customers in Southeast Asia, encouraging them to cut back on orders for Chinese products.

All this bodes ill for China's economy, as the resilience of trade had kept the country's economy humming during the coronavirus pandemic as lockdowns left overseas consumers with few spending options other than buying goods.

... unsold goods have been piling up at many US businesses as sales have slowed.

High inventories and inflation

Year-on-year growth in exports to the US in dollar terms slowed in July and has remained in negative territory since August, customs data show. Exports to the major trade partner shrank 25.4% year-on-year in November, widening from a 12.6% contraction in October.

US demand has slowed this year as inflation has soared, pushing the Federal Reserve to increase interest rates seven times so far this year. The hikes appear to have stabilised inflation, with the consumer price index growing by 7.7% in October and 7.1% in November, with the latter being the smallest year-on-year increase since December 2021, according to the Bureau of Labor Statistics.

Yet, the repeated rate increases have had knock-on effects that have hurt parts of the economy that are big buyers of Chinese goods. Rates on 30-year fixed-rate mortgages in the US surged past 7% in late October, up from 3.14% a year earlier, according to Freddie Mac. New home construction has fallen and sales of previously owned homes have slumped, Wu Lili, a real estate agent in Houston, Texas told Caixin in October. This has led to a rapid reduction in demand for imported building materials and home improvement products, both of which were popular last year.

Inventories of furniture - a product imported in high volumes from China - have also been building up, leading to a drop in orders this year...

At the same time, unsold goods have been piling up at many US businesses as sales have slowed. Walmart's inventory levels in the US grew 26% year-on-year at the end of the second quarter this year, and while the figure was lower than the previous quarter's number, Chief financial officer John Rainey said on an 16 August earnings call that the company has "canceled billions of dollars in orders to help align inventory levels".

Inventories of furniture - a product imported in high volumes from China - have also been building up, leading to a drop in orders this year, according to Wang Huanan, general manager of the Xiamen branch of major freight forwarder Topocean Consolidation Service (China) Ltd. "Exports of other categories cannot quite make up for the shortfall in volume of furniture exports," he told Caixin in October.

The drop in demand has pushed down the cost of shipping goods from China to the US, with freight rates from Shanghai to Los Angeles tumbling to US$2,262 per 40-foot container as of 10 November, compared with US$9,947 in the same period last year.

Profits in the freight forwarding industry have rapidly deteriorated, one person in charge of a domestic freight forwarding company told Caixin in October.

"The growth in US import volume has run out of steam, especially for cargo from Asia," Ben Hackett, the founder of trade consultancy Hackett Associates, said in an 7 October press release. Hackett Associates produces a monthly Global Port Tracker report for the National Retail Federation.

Although the Chinese manufacturing industry's competitiveness may bolster exports, the year-on-year export growth rate in the next two months [November and December] may continue to decline. - Peng Wensheng, Chief Economist, China International Capital Corp. Ltd.

While the period of high inflation in the US has reached an inflection point, it's still running rampant, wrote China International Capital Corp. Ltd. chief economist Peng Wensheng in a research note analysing October trade data. It will provide some price support for growth of China's nominal exports, but it may also prompt the Fed to maintain its tightening policy, thereby suppressing demand for Chinese goods.

"Although the Chinese manufacturing industry's competitiveness may bolster exports, the year-on-year export growth rate in the next two months [November and December] may continue to decline," he said.

Rising EU energy prices

Exports to the 27-member EU also similarly slumped by 9% year-on-year in October and 10.6% in November, the latest customs data show. Headline consumer inflation in the 19-country eurozone came in at 10.6% in October, up from 9.9% in September and chiefly driven by energy prices, according to Eurostat, the EU statistics office.

This has prompted the European Central Bank to hike rates four times so far this year. The bank cited pressure from soaring energy and food prices, supply bottlenecks and a post-pandemic recovery in demand.

While exports of electric appliances to Europe fell by 9.3% year-on-year in dollar terms in the first seven months of the year, electric heaters and electric blankets surged 23% and 97% respectively...

Threats of an energy crunch loom as Europe heads deeper into winter, with Russia cutting natural gas supplies to Germany and other countries as relations sour following Russia's invasion of Ukraine in February. Average electricity prices for European households have surged nearly 50% year-on-year to 33 euro cents (35 US cents) per kilowatt-hour in November, while average gas prices rose 60% to 15 euro cents per kilowatt-hour, according to energy consultancy VaasaETT Ltd.

As a result, demand for Chinese heating gear has been on the rise. While exports of electric appliances to Europe fell by 9.3% year-on-year in dollar terms in the first seven months of the year, electric heaters and electric blankets surged 23% and 97% respectively, according to a 2 September report by the China Household Electrical Appliances Association. Globally, China's export value of air-source heat pumps, which offers an energy-efficient alternative to furnaces and air conditioners, jumped 63% over the first eight months of the year, according to calculations by analysts at Guosen Securities Co. Ltd. in a September report.

Cen Na, an inspector at the Cixi office of Ningbo customs, predicted in October that the high time for heater exports to the EU would last a month longer than in previous years. Cixi, a city in Zhejiang province, is home to more than 100 heater manufacturers, accounting for one-third of the country's total export volume for the appliance.

... export growth to ASEAN slowed to 25.1% year-on-year in August from 33.5% in July before rising 29.5% in September and then dropping to 20.3% in October.

Headwinds downstream

Following three straight monthly gains, export growth to ASEAN slowed to 25.1% year-on-year in August from 33.5% in July before rising 29.5% in September and then dropping to 20.3% in October. That figure then decelerated sharply to 5.2% in November. In September, the 10-member bloc overtook the US and the EU to become the world's largest importer of Chinese goods.

Yet, strong trade ties between the two parties haven't been enough to counter downward pressure brought about by the ongoing slump in global demand. Many goods exported from China to ASEAN are intermediate products that are usually reprocessed and then shipped elsewhere.

One major semiconductor exporter in Suzhou, East China's Jiangsu province, was only operating at about 50% capacity from August to September, one of its engineers told Caixin in October.

Guo Shaohai, a former vice-president at French shipping group CMA CGM SA's China operations, told Caixin in October that after deducting fuel surcharges, actual shipping rates from China to countries like Vietnam and Thailand were actually negative, as carriers had slashed their rates to hold onto customers as demand waned. In fact, freight rates along Southeast Asian routes have been negative since July, said a person in charge of such routes at a container line.

While China's October growth figures pointed to a grim start to the fourth quarter, some analysts believe Beijing's pivot on "zero-Covid" policy and rescue of ailing developers could boost domestic consumption and help lift the real estate sector, two other key drivers of growth. Exports, on the other hand, could still face headwinds.

"We expect exports to shrink at a similar pace in December and the export contraction to continue well into 2023, weighed on by a high base, a global slowdown, the post-Covid demand shift to services and a reversal of bullwhip effects," Nomura Holdings Inc. analysts led by Lu Ting said in a note on 7 December.

This article was first published by Caixin Global as "In Depth: Why China's Exports Are in the Doldrums". Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.