2024 will be about Western economic normalisation, China's deceleration and India's catch-up

Economist Alicia García Herrero gives an overview of the global economic outlook in 2024, highlighting that gains in real income, among other factors, should help with the soft landing in the US while the eurozone should grow faster than the year before, having left the energy crisis aside. China will continue to decelerate slowly but steadily while the rest of emerging Asia will do well.

The year 2023 was a difficult one in the West as major central banks tightened monetary policy much more than previously expected in light of rampant inflation. Notwithstanding the very high level of interest rates, both the US and the eurozone avoided recession.

In the case of the US, GDP growth in 2023 ended up being around potential (2.4% estimated), which is impressive also considering the banking problems experienced at the beginning of the year.

The EU did worse (0.5% estimated) but the shock it suffered from was bigger as it had to cope with huge energy costs as it reduced its dependence on Russian gas after Russia invaded Ukraine.

China and the rest of Asia

The Chinese economy, instead, underwhelmed in terms of growth compared to the bright expectations stemming from its exit from Covid.

At the same time, the rest of Asia did much better than expected, notwithstanding the increasingly large interlinkages with China.

Overperformance was not only about India's well-known growth and stock market performance but also about Japan, whose economy grew above potential as did most of Southeast Asia. The laggards were the exporters of ICT and semiconductors, especially South Korea, Taiwan and Vietnam, as the inventory cycle peaked.

Asia was also quite special on the inflation front as it remained much more in control. The extreme case was China, which ended the year with deflation on consumer and, much more so, wholesale prices. This, together with capital controls, has allowed the People's Bank of China (PBOC) to follow its own needs in terms of the monetary policy cycle, with small cuts, rather than hikes as the rest of the world.

The other exemption is also in Asia, namely Japan, but with a twist: with inflation over 3% but rather stagnant wages, the Bank of Japan (BOJ) has been dragging its feet to move out of negative rates, which has led to a record weak yen.

The reduction in funding costs should help avoid a hard landing in Western economies together with the restoration of households' purchasing power as inflation comes down and real disposable income rises.

Hard landing in Western economies likely be avoided

In 2024, the scenario will be very different as disinflationary forces in the West, already in place for a few months, continue. The expectation of a fast disinflation, with both the US and the eurozone reaching their inflation objectives by the end of 2023, should not change much even if the economy ends up being stronger than expected.

Disinflationary forces are strong and entrenched, stemming from a much calmer energy situation globally, notwithstanding the Gaza conflict, but also because China's export prices continue to grow negatively. This means that the Fed and the ECB should have the necessary room to cut interest rates quite rapidly, possibly 150 basis points for the first and 125 basis points for the second.

The reduction in funding costs should help avoid a hard landing in Western economies together with the restoration of households' purchasing power as inflation comes down and real disposable income rises.

China and Japan to decelerate

All in all, the US economy should still decelerate, possibly to half of its strong growth in 2023, to around 1.2%. In the case of the eurozone, growth should be faster than in 2023 and similar to that of the US.

The convergence of growth rates in the West will not be replicated in the rest of Asia as the Chinese economy continues to decelerate from slightly above 5% in 2023 to below 5% (4.5% according to our forecasts), on the back of limited fiscal and monetary support.

All in all, while China and Japan decelerate, the rest of Asia will do well. This points to Asia's divergent performance notwithstanding its strong integration.

India, instead, will continue to shine with 6.5% growth in 2024, an important election year for the country. The countries hit by the ICT/semiconductor cycle should also do better next year as the inventory cycle comes to an end.

Japan, though, will find it very hard to keep its growth rate in 2023 (1.6% estimated) as the BOJ exits from its long-standing ultra-lax monetary policy.

All in all, while China and Japan decelerate, the rest of Asia will do well. This points to Asia's divergent performance notwithstanding its strong integration.

Given much lower Fed rates and a decelerating US economy, the US dollar is set to weaken in 2024 at around 1.13 against the euro. That trend should be more extreme against the yen thanks to the BOJ's expected exit from negative interest rates by mid-2024.

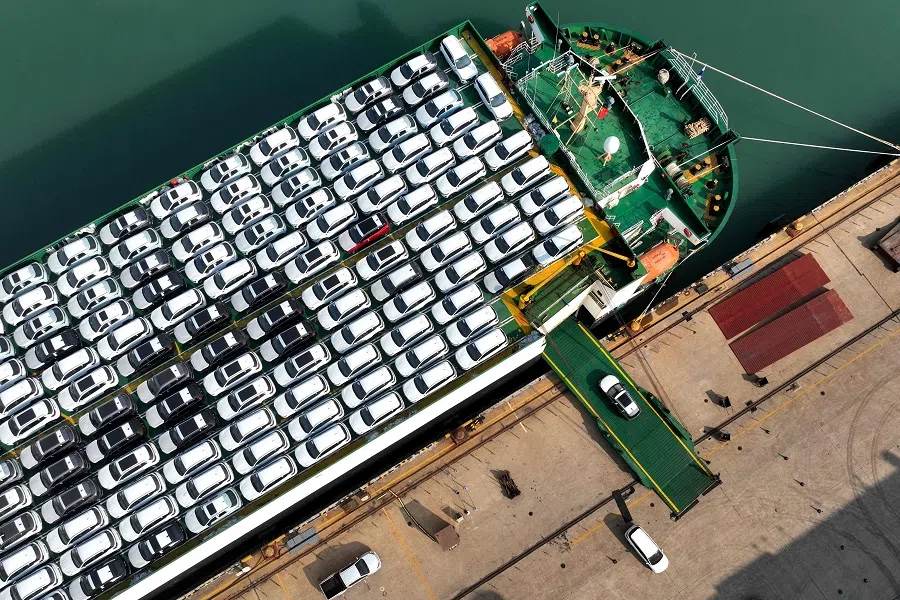

The RMB will find it hard to follow the euro in its appreciation and possibly that of other Asian currencies because the Chinese economy will need to continue to rely on external demand to grow. This also means that exports will need to be supported (as they barely grew in 2023 even with a rapid depreciation of the currency and negative export prices). For such support, it is hard to imagine that the RMB will be allowed to strengthen rapidly.

Emerging Asia set to do well

All in all, 2024 will be the year when Western central banks' key policy rates will start to subside thanks to the ongoing rapid disinflation process. Gains in real income, among other factors, should help with the soft landing in the US while the eurozone should grow faster than last year having left the energy crisis aside. China will continue to decelerate slowly but steadily while the rest of emerging Asia will do well.

In other words, the West will converge in terms of growth and inflation as it normalises monetary policy while Asia will diverge as other engines of growth appear in emerging Asia, led by India but also ASEAN.

This scenario is, no doubt, subject to several risks both in the West and in the East. The most obvious ones are geopolitical since 2023 has already piled up two wars (Ukraine and Gaza) which do not seem ready to end soon.

Asia, itself, could be the source of additional risks, whether stemming from the results of the elections in Taiwan or the South China Sea, with tensions between China and the Philippines being the most obvious example.

Beyond the geopolitics, the process of disinflation - while avoiding a recession - is not fully guaranteed, nor is China's continued management of risks from real estate-related issues or local governments' poor financial health.

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)