[Big read] Unseating China? The global race to make cheaper and better EVs

Car manufacturers from Europe, America, Japan, and South Korea not only have to contend with the intense competition from Chinese electric vehicles (EVs), but also with the fallout from the drop in global EV demand. We take a look at what various parties are doing to safeguard their market shares.

The story begins with Tesla, the American electric vehicle (EV) titan.

In 2011, in an interview with US media, Tesla CEO Elon Musk scoffed at Chinese EV maker BYD, saying its manufacturing was not up to the mark.

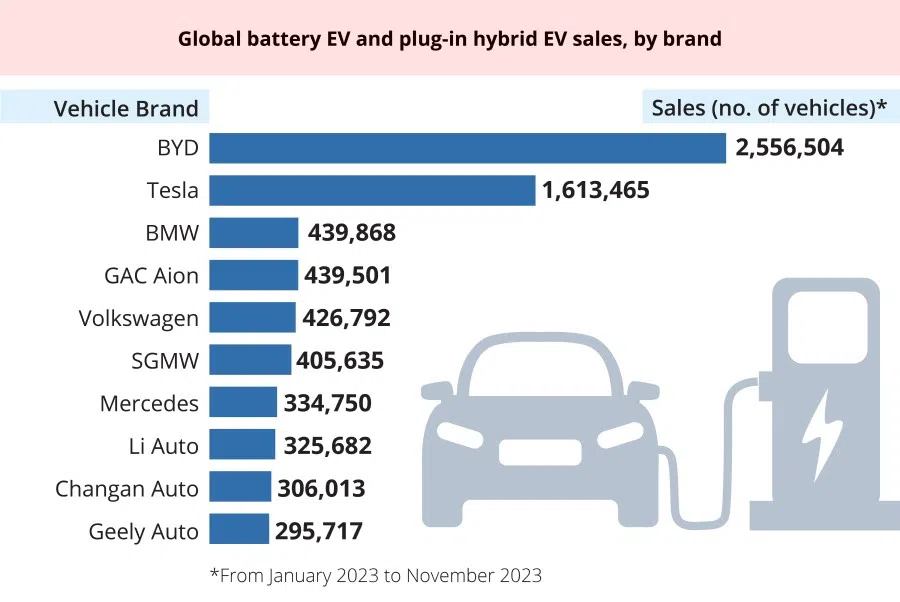

Twelve years on, Musk publicly admitted on X (formerly Twitter) that BYD's EVs are "highly competitive". Nonetheless, he remained full of confidence in his company; last year, he set a company target of selling two million EVs in 2023. However, Tesla only managed to record sales of 1.809 million units for the year.

... alarm bells ringing for automakers in Europe, the US, Japan, and South Korea that their greatest competitor is actually the entire Chinese EV manufacturing industry.

BYD hot on the heels of Tesla

What makes it more embarrassing for Musk is that BYD has caught up with Tesla. In the fourth quarter of 2023, BYD sold 526,409 pure EVs, 8.7% more than Tesla. For the whole of 2023, BYD sold around 1.6 million pure EVs, just behind Tesla by a nose.

Even with Tesla's leading industry position shaken, Musk was not to be outdone, as he posted on X, "Tesla is an AI/robotics company that appears to many to be a car company", underlining that his company harbours ambitions beyond car manufacturing.

What appears to be a contest between BYD and Tesla is enough to set the alarm bells ringing for automakers in Europe, the US, Japan, and South Korea that their greatest competitor is actually the entire Chinese EV manufacturing industry.

Figures published by the China Association of Automobile Manufacturers (CAAM) on 11 January indicate that the country produced nearly 9.59 million new energy vehicles (NEVs) last year, with sales approaching 9.5 million units, an increase of 35.8% and 37.9% year-on-year respectively. At the same time, Chinese NEV exports reached 1.2 million units, an increase of 77.6% year-on-year.

NEVs include pure EVs, hybrid EVs and plug-in hybrid EVs.

CAAM estimates that the sales of NEVs will reach 11.5 million units next year, with 5.5 million units being sold overseas.

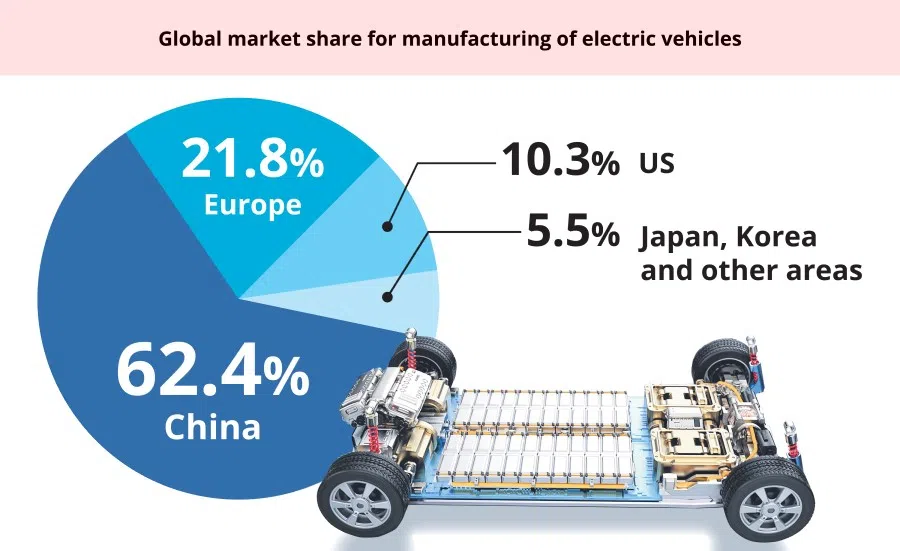

The latest research report published by the Korea Automobile and Mobility Association found that in the first three quarters of 2023, EVs made in China led the rest of the world in terms of sales, accounting for 62.4% of all units sold. Europe and the US were in second and third place, accounting for a further 21.8% and 10.3% respectively.

Chinese battery manufacturers are able to lower their manufacturing costs because the lithium and cobalt they use are produced in China.

Manufacturing cost biggest challenge

In an interview with Lianhe Zaobao, Professor Sharon Ng, head of the marketing division of the Nanyang Business School at the Nanyang Technological University, said that manufacturing cost was the greatest challenge for European, American, Japanese, and South Korean carmakers, and that was why their EVs were more expensive. Furthermore, the technology possessed by Chinese EV makers now matches those of foreign brands.

In Ng's view, European, American, Japanese, and South Korean carmakers would need to invest more in EV technology and batteries to safeguard their market standing.

"In addition, manufacturers also need a clear and unique market-positioning strategy to stand out. Manufacturers that can influence the decisions of consumers during the car-buying process are more likely to survive amid the intensifying competition. Government subsidies provided for the purchase of EVs will also encourage more consumers to switch to EVs."

As major EV brands start price wars to gain market share, European and American carmakers that have to deal with higher battery costs have lost this "war without gunfire".

Based on a research report by Belgian consulting firm PTOLEMUS, batteries account for 10-25% of the manufacturing cost of an EV. Chinese battery manufacturers are able to lower their manufacturing costs because the lithium and cobalt they use are produced in China.

Asian companies dominate battery production and assembly

PTOLEMUS analyst Vijay Govindaraju said, "Currently, 60-65% of the global EV battery production and assembly are dominated by Asian companies. The biggest battery manufacturers like LG and Samsung are headquartered in South Korea. The original equipment maker (OEM) that Tesla engaged to manufacture batteries is the only one that can go up against these Asian giants in the EV industry."

Susana Utama, a partner at consulting firm Ernst & Young, pointed out that Chinese EV makers mostly utilise lithium-iron phosphate batteries that have lower energy densities. While these batteries have a shorter range, they are cheaper to produce than the nickel-cobalt-aluminium oxide (NCA) and nickel-manganese-cobalt (NMC) ones favoured by European and American carmakers. She observed that some European and American automakers are starting to use lithium-iron phosphate batteries in their more compact EV models.

In many emerging markets, the market share of EVs manufactured in China is expected to rise following further price reductions, but the volume is expected to be lower than that exported by China to Europe. - Joshua Cobb, Senior Automobile Analyst, BMI

BMI, a research agency under information service provider Fitch Solutions, estimates that global EV sales will top 15.7 million this year, an increase of 14.8% from 2023. On the whole, EVs account for less than 1% of all vehicles sold worldwide, while EV sales in the ASEAN region is expected to reach 158,000 units in 2024.

Joshua Cobb, a senior automobile analyst with BMI said, "In many emerging markets, the market share of EVs manufactured in China is expected to rise following further price reductions, but the volume is expected to be lower than that exported by China to Europe. The export of Chinese EVs to Europe is also likely to face transport and trade risks over the next two years."

European and American carmakers developing mass market EV models

The key issue with European and American EVs is that they are too pricey. To compete with their Chinese counterparts, several European auto brands are developing mass market EV models.

An example is Citroën which introduced the e-C3 mass market pure EV last year. The new model which is assembled in Slovakia sells for around 23,300 euros (about US$25,260) in Europe, but is still unable to compete with the China-made Dacia Spring produced by eGT, a joint venture between the Renault-Nissan alliance and the Dongfeng Motor Group. Dacia Spring retails for 20,990 euros, or 10% lower than the e-C3, making it the cheapest EV in Europe currently.

This year, Renault is planning to introduce Legend, the electric version of its Twingo model, which is expected to sell for less than 20,000 euros. There is news that Renault is in talks with Volkswagen to discuss the possibility of jointly manufacturing Legend. It is estimated that 200,000 to 250,000 units of Legend would be produced annually.

Volkswagen has also not been idle. Last year, the company announced that it was investing 180 billion euros in EV development so that by 2025, one in five of its cars will be an EV. Two-thirds of the investment will be used for the manufacturing of batteries, the development of EV software, and procuring crucial raw ingredients.

Tesla slashed prices by more than 20% in 2023

In 2023, Tesla which narrowly retained its crown launched the Model Y SUV and lowered its product prices in many markets. In China, the selling price of locally-manufactured Tesla Model 3 cars was reduced by 5.9% to 245,900 RMB while that of Model Y cars was reduced by 2.8% to 258,900 RMB.

In Singapore, the drop in the retail price of the Model Y ranged from 15% to 18%, with the Rear Wheel Drive version and the Performance version selling for S$112,340 (US$83,786) and S$159,844 respectively.

According to CNBC, Tesla slashed prices by more than 20% in 2023.

... hybrid EVs account for 40% of new car sales in Japan, while very few pure EVs are sold in the country.

Popularity of hybrid EVs in Japan

Japan, which has been soundly beaten in the "battle of pure EVs", is actively developing more sophisticated batteries and EV technology.

Japanese carmakers like Toyota, Honda, and Nissan are committed to introducing more hybrid EV models that run on both battery and petrol. These carmakers are reluctant to develop pure EVs due to the inconvenience of recharging and high selling prices.

Satoru Aoyama, senior director for APAC corporates at Fitch Ratings, said that hybrid EVs account for 40% of new car sales in Japan, while very few pure EVs are sold in the country.

"The higher cost of electricity, shortage of charging facilities, and the high penetration rate and massive popularity of hybrid EVs are the main impediments to the growth of pure EV sales in Japan," he said.

Toyota, which rolled out its first Prius hybrid EV unit in 1997, was once regarded as the frontrunner in green automotive technology. In order to retain its crown as the biggest car manufacturer globally, Toyota announced in 2021 that it was investing US$35 billion to develop EVs, and expects to introduce 30 new EV models by 2030.

The company has also made breakthroughs in battery research. Recently, it announced plans to mass produce EVs that utilise solid-state batteries within a year or two. EVs fitted with such batteries can travel 1,200 kilometres after just 10 minutes of charging.

Heavyweight battery makers back South Korean carmakers

South Korea fares better than Japan in EV development due to support from several large EV battery manufacturers, such as LG Energy Solution, SK On, and Samsung SDI. These companies supply their batteries worldwide and possess advanced battery-making expertise. Their backing will enable South Korean carmakers like Hyundai and Kia to develop EVs with superior performance.

Pak Jeong Min, senior director for APCA corporates at Fitch Ratings, said these companies invest huge sums to develop highly efficient batteries and charging facilities, and highly competitive EVs.

"We feel South Korean carmakers can compete in the EV market. Unlike other manufacturers, they have dedicated production platforms for EVs, clear transformation goals, and product launch plans. However, sales of the country's EVs lag behind those of European or Chinese automakers, because South Korean automakers have less presence in markets with high EV sales."

Hyundai's main markets overseas are in North America, Europe, and India, while its market share in China is below 2%. Pak predicts that an increase in the export of Chinese EVs will further threaten South Korean carmakers.

Rising protectionism in Europe and America

As competitively priced Chinese EVs are exported to the West, protectionism rears its head in Europe and America.

Currently, Chinese cars imported into the US are subjected to a tariff of 25%. The Wall Street Journal reported that the US government is thinking about raising import tariffs on Chinese goods, including EVs. However, this may be detrimental to American automakers like Tesla that produces its EVs in Chinese factories.

At the same time, the EU has also started investigations to determine whether subsidies from the Chinese government give EVs produced by BYD, Geely, and SAIC Motor unfair advantages.

Ernst & Young's Utama feels that the findings of the investigation may prompt the EU to raise import tariffs on Chinese EVs, but manufacturers and suppliers from China, Europe, and other regions buy and sell products and raw materials from each other, so trade balance is vital.

"Thirty to 40% of the cars sold by European automakers are made in China, so European EV makers are expected to continue relying on batteries produced in China until they can procure them from other countries."

Last year, Tesla established its regional headquarters in Malaysia, and the Malaysian government hopes that this would encourage other manufacturers to follow suit.

Southeast Asia to benefit from EV industry development

As the global EV industry continues to expand, Southeast Asian countries that are part of the supply chain stand to benefit.

The latest report from CIB Research found that the total value of the EV market in ASEAN countries was US$10 billion in 2021. Between 2022 and 2026, this figure is expected to increase with an estimated compound annual growth rate (CAGR) of 10% to reach US$18 billion in 2027.

Indonesia and Thailand stand to gain the most from this because of the large-scale car production and assembly facilities in both countries that are being quickly converted into plants for manufacturing EV parts. Indonesia and the Philippines also have large nickel deposits, and could become major battery producers in time to come.

Malaysia is also preparing to expand its semiconductor industry to supply more EV parts, as it aims to attract EV carmakers to manufacture automobiles. Last year, Tesla established its regional headquarters in Malaysia, and the Malaysian government hopes that this would encourage other manufacturers to follow suit.

As for Singapore, Hyundai has set up an EV assembly plant in Jurong. The company plans to procure parts from local suppliers and intends to increase its annual production in Singapore to 30,000 EVs by 2025.

ST Engineering, AEM Holdings, and Frencken Group are among a handful of publicly listed companies in Singapore that provide EV parts or services.

In addition, TES is a Singaporean electronic waste recycler that provides mobile phone and mobile computer battery recycling services. The company is currently building facilities to recycle EV batteries.

This article was first published in Lianhe Zaobao as "拼技术压价格 欧美日韩争杆位 与中国电动车抢赛道".