De-risking from China easier said than done for German companies

In theory, the Germans are supportive of the government's call for greater economic independence from China. In practice, this is hard to implement. A roadmap and a better explanation to companies of how this will work and who will pay the price is needed, says The Berlin Pulse editor Jonathan Lehrer.

German-Chinese relations have deteriorated in recent years - the mood in Germany has become more critical of China. This is partly because China's economic rise has led to a more assertive China in foreign policy, especially in the Indo-Pacific region.

This is clearly reflected in the findings of Körber-Stiftung's representative survey, The Berlin Pulse: 62% of Germans have a negative view of China's influence in the world - the highest figure since our annual survey began in 2017. Especially since the outbreak of Covid-19 and China's ambivalent attitude towards Russia's war of aggression against Ukraine, the German population's perception of China's role in the world has gone down.

In parallel with the growing scepticism towards China, Chancellor Olaf Scholz's coalition (consisting of the Social Democrats, Greens and Liberals) has broken with the China-friendly years under Chancellor Angela Merkel. The German government's China strategy not only describes China as an economic competitor, partner and systemic rival, but emphasises the element of systemic rivalry in its relations with Beijing.

This new focus is consistent with our survey results: only 13% of Germans see China as a partner, while 84% see China as an economic threat.

60% of Germans said that they are in favour of reducing economic dependence on China, even if it means economic losses and job losses.

Approval for de-risking

This begs the question: should Germany and China continue to be as closely intertwined economically as they are now, given the deterioration in opinion in Germany? The German government's China strategy answers this question with yes and no. The paper argues that economic relations with China should not be decoupled but diversified in certain sectors.

The aim is to achieve greater economic independence from China, particularly in critical sectors such as the pharmaceutical industry, the extraction of raw materials (rare earths) and electronics. It seems that the decisive criterion for economic relations with China should no longer be the price, but the security of goods and supply chains.

But this paradigm shift comes at a price. Economics Minister Robert Habeck recognises this. He asked in October: "You don't get economic security, new markets and a diversified trade or raw materials chain without a price. And the question is: are we prepared to pay this price?"

In our survey, The Berlin Pulse, we asked whether Germans were prepared to pay the price. 60% of Germans said that they are in favour of reducing economic dependence on China, even if it means economic losses and job losses.

German companies are failing to reduce their one-sided dependence on China.

De-risking fails to take off

However, a look at the latest study from the German Institute for Economic Research (IW) shows that there has been no significant progress in reducing critical dependencies in the first half of 2023. According to the IW report, German companies are failing to reduce their one-sided dependence on China. "De-risking is underway, but we should not be under any illusions: Too little is happening, even though time is pressing," says trade expert Jürgen Matthes.

The study also shows that 40% of the 400 companies surveyed in the western German federal state of North Rhine-Westphalia are dependent on products from China. Of these, around a third say that this will not change in the future, and more than half even expect the importance of business with China to increase.

German companies in China

The difference between theory from Berlin and practice on the ground is illustrated by large German companies such as BASF or Volkswagen, which often seem to have more leverage than small and medium-sized enterprises. The chemical company BASF announced that it would invest billions in China. The reason: while Greater China accounts for roughly 50% of the global chemical market, BASF generates less than 15% of its total sales in China. From this perspective, the long-established company from southern Germany is still underinvested in China.

The same applies for Germany's automakers. Volkswagen generates 40% of its annual sales in China. Much of this comes from internal combustion engines, as the German car industry has missed out on the Chinese electric car market. Nevertheless, for companies like Volkswagen, China is a fitness centre to challenge themselves to do more: if you can compete in the Chinese market, you can compete everywhere in the world.

And what about geopolitics? Many companies expect or just hope that there will be no escalation in the Indo-Pacific. And if there were, the costs would be so enormous that even minimising the risk would not change much. Says BASF CEO Martin Brudermüller: "I am not saying that investing there is without risk. But the opportunities we see outweigh the risks."

The call for greater economic independence from China needs a roadmap and a better explanation to companies of how this will work and who will pay the price.

Challenges for 2024

This shows that even if the German government has popular support for its China policy, it faces challenges in implementing the policy. The call for greater economic independence from China needs a roadmap and a better explanation to companies of how this will work and who will pay the price.

It is good that the federal government uses investment guarantees to encourage diversification of investments. But the German government must also face the reality that not all companies are interested in reducing their investments in China, and it will not be possible to force them to give up attractive investment opportunities.

Given Germany's economic downturn, it is crucial to understand that mitigating risks should not be limited to geopolitics and economic strategies alone. Prioritising secure suppliers over cheaper options requires backing from social investment and effective communication.

When weighing the desire to lessen dependency against significantly higher costs, it is vital to consider the ramifications. An Ifo Institute study revealed that disconnecting from the Chinese economy would impose a sixfold greater cost on Germany than Brexit.

Opportunities for 2024

However, 2024 also promises opportunities for Germany's China policy. Reducing critical dependencies involves relocating production and supply chains to other countries. We asked Germans about their attitude towards emerging middle powers in Asia, Africa and South America - countries such as India with strong growth or large markets. 51% of our respondents are positive about the growing international influence of such countries. This can give the federal government a tailwind in implementing their policy.

...it is good that it will soon be easier for Germans to travel to China, so that not only business people, but also citizens can once again explore the country that has become so foreign to us in the past two years.

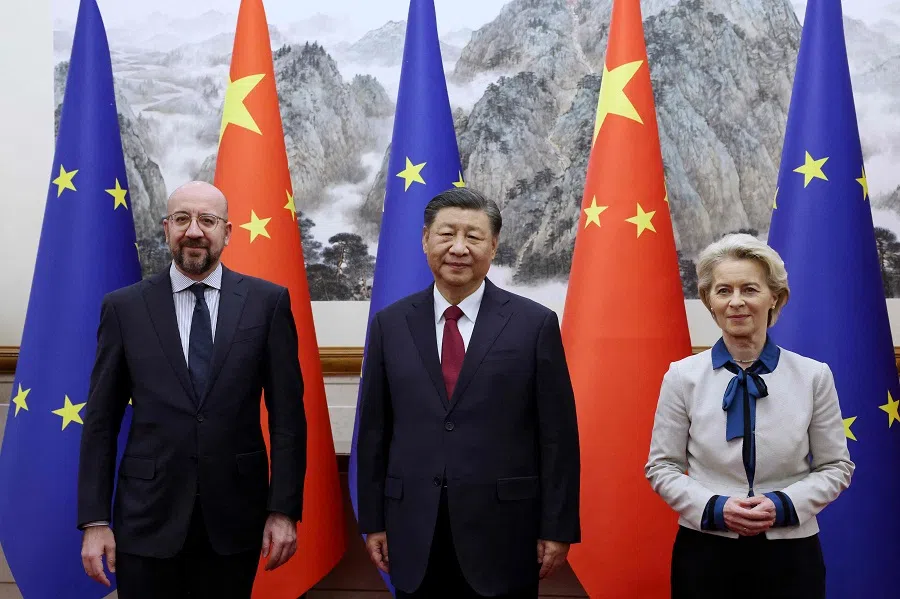

And even if the EU-China summit in early December did not produce any breakthroughs, communication between Germany and China seems to be getting more constructive again after the 7th German-Chinese government consultations and Scholz's visit to Beijing in 2022.

This is crucial because only regular dialogue allows both sides to explain themselves and avoid misunderstandings. And avoiding misunderstandings is still the best way to avoid geopolitical crises. Therefore, it is good that it will soon be easier for Germans to travel to China, so that not only business people, but also citizens can once again explore the country that has become so foreign to us in the past two years.

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)