[Big read] Chinese games rake in 100 billion RMB from overseas users

Lianhe Zaobao journalist Zeng Shi looks at the Chinese gaming industry and the hit games it has exported overseas in the last decade, including the recent popular title Black Myth: Wukong. While intense competition makes it difficult for gaming companies to survive, heading overseas might be the way to go.

In September, Chinese mobile game Whiteout Survival extended its reign as the Chinese game with the highest overseas revenue as its monthly earnings from foreign markets grew by 7% month-on-month.

The game was developed by Century Games, a Zhejiang Century Huatong Group subsidiary that focuses on foreign markets. Following its official launch abroad in February 2023, Whiteout Survival’s revenue grew rapidly. In April, it was introduced in China and found its footing there quickly too.

According to a WeChat report published in October by mobile games market intelligence agency Sensor Tower, Whiteout Survival’s cumulative global revenue has exceeded US$1.3 billion as of the end of September.

Overseas market gaining importance

Head overseas or be eliminated — this has been the collective anxiety of Chinese game makers over the past couple of years. Chinese gaming titans like Tencent, NetEase, and MiHoYo have stepped up their efforts to expand into overseas markets. At the same time, a large group of small to medium-sized game makers are following suit as they calibrate their market positions and differentiate themselves from the competition.

For Chinese game companies, takings from foreign markets are becoming more important. For example, at Century Huatong Group, overseas revenue reached 54.11% of its total earnings in the first half of this year, a significant increase from the 38.54% during the corresponding period in 2023.

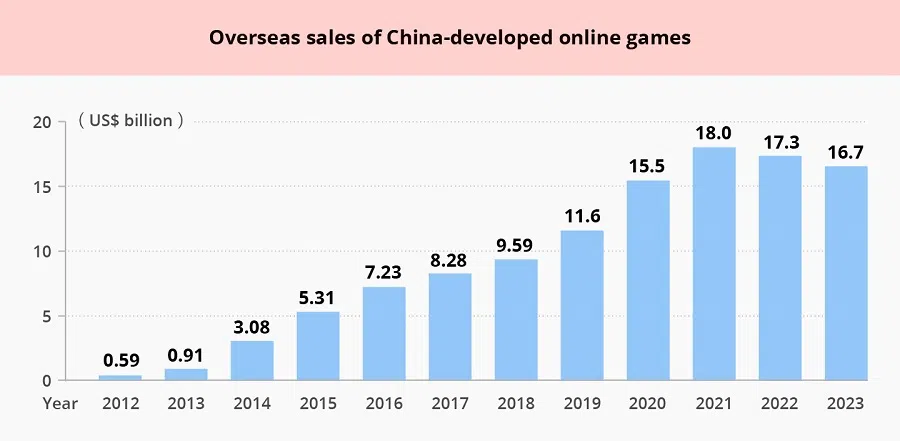

As one of China’s most successful cultural exports, the route overseas for Chinese games began from around 2012, as some major Chinese game studios started promoting their products to overseas gamers and found some initial success. Since 2015, Chinese games have rapidly expanded overseas, with great improvements in the standards of games developed by Chinese companies, as well-produced mobile games replaced browser games as the main offering to attract overseas gamers.

... Chinese game makers earned US$16.37 billion from overseas markets during the year, surpassing 100 billion RMB for four consecutive years, growing by over four times in ten years as compared to US$3.08 billion in 2014.

Overseas revenue exceeds 100 billion RMB four years in a row

The tightening of regulatory controls by Chinese authorities in recent years had a profound impact on the development of its gaming industry, forcing Chinese game companies to adapt and seek growth in foreign markets. In 2021, the Chinese authorities suspended issuing new video game licenses for eight months, forcing a group of flailing game companies to exit the market while numerous others set their sights on overseas markets as heading overseas became the trend for industry development.

According to the 2023 Chinese Gaming Industry Report (《2023年中国游戏产业报告》) published by the China Audio-video and Digital Publishing Association (CADPA), Chinese game makers earned US$16.37 billion from overseas markets during the year, surpassing 100 billion RMB for four consecutive years, growing by over four times in ten years as compared to US$3.08 billion in 2014.

Chinese game developers have evolved from their basic approach in the early years, and are now using more sophisticated strategies for foreign markets. Guangzhou-headquartered Chinese game company 37 Interactive Entertainment expanded overseas in 2012.

Peng Mei, the vice-president of 37Games, its game development studio focusing on foreign markets, told Lianhe Zaobao that initially, it was mainly using its existing products to break into overseas markets. While successful in Southeast Asia’s culturally similar markets, the company faced challenges in regions like Europe, the US, Japan and South Korea due to cultural differences, leading to some games underperforming.

Peng said Southeast Asian gamers prefer massively multiplayer online (MMO) games, while South Korean gamers are into fantasy titles and less interested in wuxia games; anime, comics, games and novels (ACGN) titles are very popular among Japanese gamers, but they have little interest in simulation games. As for gamers in Europe and America, the gaming experience is crucial. Depending on the characteristic preferences of gamers from different regions, there are corresponding marketing strategies.

As for marketing, different materials are prepared for different countries and regions to best draw the attention of local gamers.

Peng added that after years of research and implementation, in 2018 her company decided to adopt a localised business strategy for foreign markets, tailoring game types based on the requirements of local gamers and customising the same title to satisfy local differences. As for marketing, different materials are prepared for different countries and regions to best draw the attention of local gamers. Peng said this localised approach has helped them to perform well in many overseas markets.

After more than a decade of exploring overseas markets, this listed company now does business in more than 200 countries and regions globally. It has also published more than 120 titles and seen its overseas takings grow more than fivefold within five years, from 1.05 billion RMB in 2019 to 5.8 billion RMB in 2023.

Chinese game companies battle it out in Southeast Asia

While the US, Japan, and South Korea are important regions for which Chinese game developers are competing, Southeast Asia — the primary destination of their initial overseas expansion — has always been a battleground. As for the Middle East and Latin America, they are seen as emerging markets with tremendous growth potential.

Game livestreaming is the core business of Chinese livestreaming platform Huya Inc, which launched its overseas arm Nimo in 2018. Zhang Yi, Nimo’s head of marketing and communications, told Lianhe Zaobao that there are more than 320 million gamers in Southeast Asia presently. The youthful demographic means a huge appetite for livestreaming, e-sports, and interactive entertainment, especially in countries like Vietnam, Thailand, and Indonesia where e-sports is ingrained.

... the differences in barriers to entry, laws and regulations, and payment systems across Southeast Asian countries also pose difficulties for Chinese game companies. — Zhang Yi, Head of Marketing and Communication, Nimo

Currently, Nimo is building up its presence in many regions, such as Southeast Asia, the Middle East, and Latin America, while assisting Chinese game companies to enter these markets. Zhang highlighted that Southeast Asia is an important market for Chinese game developers, and local gamers there are receptive towards Chinese games, so the technical expertise, content creativity, and business experience of Chinese companies give them the competitive edge. However, they also face numerous obstacles in adapting to local market conditions.

He said games are a mass consumption cultural good, and game makers face the competing needs of global operations and localisation when entering new markets. To adapt to and penetrate new markets, companies need to understand the cultural, language, and entertainment needs of local users. Furthermore, the differences in barriers to entry, laws and regulations, and payment systems across Southeast Asian countries also pose difficulties for Chinese game companies.

Traditional Chinese cultural elements in games

In August, Black Myth: Wukong, the first AAA game title produced in China, was launched. It took less than five days for this game based on the ancient Chinese classic Journey to the West to break the record for most online players on the Steam gaming platform. The red-hot popularity of the game has boosted the confidence of Chinese game companies in their overseas expansion, and drawn more attention to cultural dissemination through digital games.

More and more games developed in China for foreign markets incorporate traditional cultural elements, as game developers use Chinese culture to set their products apart from others. For instance, the globally popular online game Genshin Impact is full of Chinese elements in the form of architectural styles, paper-cutting, calligraphy and traditional festivals; the scene design of the period-style mobile game Call Me Shopkeeper (叫我大掌柜) is based on the painting Along the River during the Qingming Festival by Northern Song artist Zhang Zeduan, and it also incorporates unique activities such as couplet creation (对对子), pitch-pot, and cuju (蹴鞠, an ancient Chinese form of football), to showcase Song dynasty culture.

Li Chenyu, a 23-year-old gamer from Guangzhou, told Lianhe Zaobao that during traditional Chinese festivals like Mid-autumn Festival and Spring Festival, popular mobile games often roll out festive events. Other than giving the game a festive look, there are also special missions related to the festivals for players to experience traditional customs like letting off fireworks, looking at the moon and viewing lanterns.

Li said these Chinese cultural elements make the gaming experience more immersive and novel, so that he often finds the in-game holiday atmosphere more festive than in reality.

Exporting culture through games?

Games play an increasingly important role in the export of culture. The overseas edition of the People’s Daily carried a piece on the worldwide presence of mainstream American cultural symbols like McDonald’s and Hollywood, and argued that similar to the film industry, the gaming industry also has many structural dividends and has an advantage in exporting culture.

... showcases traditional Chinese culture through various aspects ranging from the world setup, scene composition, story and plot, character image and dialogue, and costume and props. — Peng Mei, 37 Interactive Entertainment

For game companies, “telling China’s story well” is also an option to make products more attractive. Peng Mei of 37 Interactive Entertainment said games are a form of cultural expression and novel cultural entity with global traits, which makes them suitable for cross-border exchanges. Even as it promotes its games overseas, Peng’s company is working hard to innovate new forms of cultural expression.

She said during game development, her company builds up in-depth knowledge of history and context before extracting tales, historical figures and cultural elements from traditional culture. It then showcases traditional Chinese culture through various aspects ranging from the world setup, scene composition, story and plot, character image and dialogue, and costume and props.

Giving the example of its popular overseas-distributed game Puzzles & Survival, Peng said her company introduces new elements of Chinese culture into it every year. For instance, a Chinese culture theme involving a collector of curios from a mysterious oriental family was launched in September. For this theme, a Kwon-glazed porcelain artisan was invited to create porcelain pieces based on game characters to show global users the allure of the art form.

... greater competition drives up advertising costs, and smaller companies with limited budgets face significantly higher costs and greater challenges in promoting their games overseas. — Silvia Zeng, Head of Research for South China, Jones Lang Lasalle

Greater challenge for Chinese games amid keener competition abroad

As competition among local developers in overseas markets intensifies, the cost of attracting new users rises, and Chinese game companies face all sorts of new challenges in their overseas expansion.

Silvia Zeng, head of research for south China at Jones Lang Lasalle (JLL), has been studying the country’s gaming industry for a long time. She shared her analysis with Lianhe Zaobao that Chinese gaming giants like Tencent, NetEase and 37 Interactive Entertainment, and numerous small to medium-sized Chinese game companies have stepped up their overseas expansion in recent years. Along with a plethora of new local game companies in overseas markets, this has caused rising competition abroad. On the other hand, greater competition drives up advertising costs, and smaller companies with limited budgets face significantly higher costs and greater challenges in promoting their games overseas.

According to the 2023 Overseas Performance of Chinese Games Research Report (《2023年中国游戏出海研究报告》) jointly published by CADPA, China Gaming Industry Research Institute (中国游戏产业研究院), and Gamma Data, actual overseas revenue for Chinese games peaked at US$18.01 billion in 2021 before sliding for the first time in many years of overseas expansion by 3.7% to US$17.35 billion in 2022. In 2023, the downtrend continued as overseas revenue slipped to US$16.67 billion.

Deeper understanding of what gamers want

Peng Mei said while Chinese games continue to enjoy relatively high sales revenue from foreign markets, the year-on-year drops indicate that their growth is under pressure. As such, Chinese companies expanding overseas need to work hard to refine content and long-term operations to excel overseas.

To Peng, a key hurdle to doing so lies in understanding and respecting local cultures. As such, companies need to strike a balance between local cultures and traditional Chinese culture, and have a deep understanding of local operations and user needs. Game developers need to put in effort if they hope to integrate local cultures through localisation, and make gamers accept the game language.

Sylvia Zeng noted that given the diversity abroad, Chinese game developers need to go beyond comprehensive localisation research in various aspects like game development and distribution channels. At the same time, they have to improve game mechanisms, produce more innovative and playable games, and create new income-generation models to boost profitability to avoid getting caught in the dilemma of homogenous competition.

She also feels that on the whole, while China’s gaming industry is affected by cyclical fluctuations, given how the industry quickly adapts to the public’s spending habits, it remains innovative and active, and there is still room for it to grow.

Guangzhou is a major node in the Chinese gaming industry. The presence of many game producers there have brought about the coordinated development of both upstream and downstream companies, to form a complete ecosystem. — Zeng

Industry centred around major cities

After years of continued development, Chinese game companies are now mainly found in major Chinese cities. Besides first-tier Chinese cities, they also concentrate in Chengdu, Hangzhou, Wuhan and Xiamen.

Sylvia Zeng assessed that Beijing has a first-mover position in China’s digital industry, and the country’s first game company and electronic game were both born there. During the PC games and browser games eras, the capital leveraged its advanced software industry and pipeline of graduates to rapidly develop its gaming sector.

In the era of mobile games, while constrained by factors such as urban planning and industry roadmaps, Beijing’s wealth of television and movie production resources provide game companies with plenty of relevant intellectual property to promote inter-industry collaboration. At the same time, the concentration of internet traffic giants there also provides a convenient channel for game development.

Zeng said Shanghai is a high ground for the development of China’s gaming industry that has produced a steady stream of well-known game makers. With an excellent environment for companies to develop, it continues to attract both local and foreign game companies. On the other hand, Guangzhou is a major node in the Chinese gaming industry. The presence of many game producers there have brought about the coordinated development of both upstream and downstream companies, to form a complete ecosystem.

Based on the office rental market, there is a growing demand for office space from the game companies in Guangzhou in recent years, pointing to the continued expansion of the industry. Zeng said since 2019, the gaming industry has accounted for a rising share of the total office rental transactions in Guangzhou to nearly 10% in the first quarter of this year, in line with the industry’s actual revenue growth trend.

Figures show that there are more than 3,000 game companies in Guangzhou currently, and 15 of them are publicly listed. In 2023, these companies earned 105.8 billion RMB as revenue grew around 8.6%. Altogether, they accounted for 35% of the Chinese gaming industry’s total earnings.

This article was first published in Lianhe Zaobao as “中国游戏出海抢滩 虏获玩家千亿入袋”.