China’s balancing act to keep its social security system afloat

China’s employees are dependent on its social security system to keep them going, especially in terms of pensions and funds for those of retirement age. However, amid struggles with salaries and manpower, how are companies to take care of employees?

(By Caixin journalists Zhou Xinda, Tang Hanyu, Chen Yiying and Han Wei.)

The Chinese government is caught in a dilemma: there is a pressing need to boost contributions to what is the world’s largest social security system to better support the country’s ageing population, while simultaneously address growing calls to reduce the financial burden amid a wobbly economy and the slowest wages growth in up to 40 years.

Contributions made by Chinese residents and companies to government insurance plans have continued to rise in recent years, correlating with the steady increase in average wages. Every summer, a hike in the baselines for social security contributions has become the norm after the central government’s statistics department unveils the latest wage data.

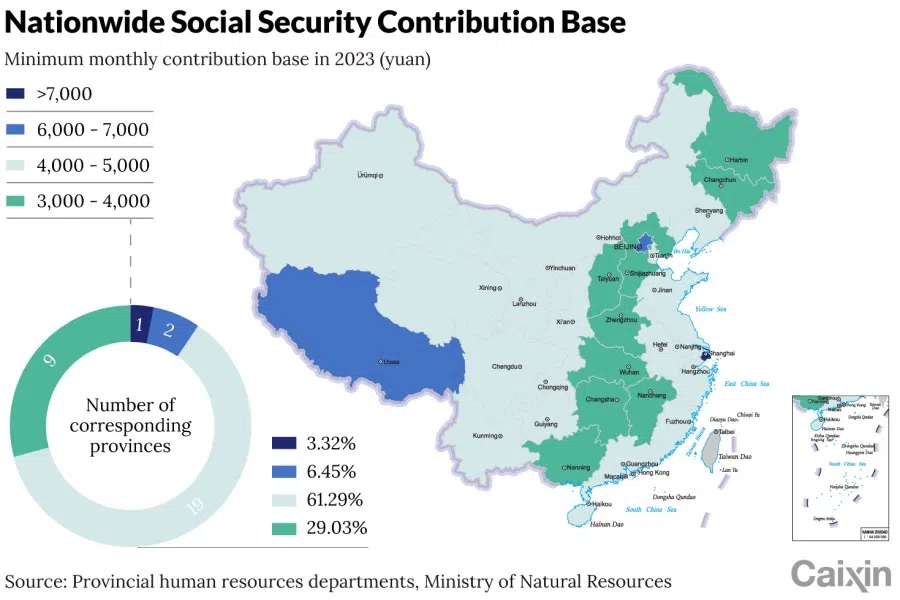

According to incomplete statistics collated by Caixin, the overall increase in the minimum payment base across provinces nationwide for 2023 ranges from 4% to 12%, with a median of about 7% to 8%. For instance, the minimum social security payment base for enterprise employees in Beijing and Jilin has increased by 7.8%, with the extreme ends of the adjustments being Guangxi at 3.9% and Shanghai at 12.12%.

But as the world’s second-largest economy grapples with sluggish growth, complaints have mounted that the rising social security contributions have become a major burden for businesses.

A survey by human resource service provider 51shebao found that 37.4% of companies interviewed in 2023 said labour costs accounted for 30% to 50% of their total business costs, while 11.4% of the respondents indicated a share higher than 50%.

Despite positive signs, with strong exports and manufacturing investment fueling first-quarter GDP to beat expectations at 5.3%, China’s economy still faces persistent challenges. These include a weak job market, insufficient demand, and sluggish price levels, indicating the need for continued stimulus, said Wang Zhe, senior economist at Caixin Insight.

Against this backdrop, businesses are seeking to lighten their burden and reducing social security contributions remains a key strategy in the policy toolkits of local governments to support growth, especially for small and medium-sized enterprises, Wang said.

A survey by human resource service provider 51shebao found that 37.4% of companies interviewed in 2023 said labour costs accounted for 30% to 50% of their total business costs, while 11.4% of the respondents indicated a share higher than 50%.

However, for some it’s even higher. A human resources manager from a small tech company in Shanghai told Caixin Wages and social security obligations comprise more than two-thirds of their business costs. That strict adherence to social security payment rules has pushed the company’s labour costs to 70% of total business expenses, marking a 9% increase since 2021, said the manager.

The scale of the system these contributions support cannot be understated: By the end of 2023, about 1.07 billion people were paying into or receiving payments from its national basic pension, according to the Ministry of Human Resources and Social Security (MHRSS). That makes it the world’s largest, according to government estimates.

Overall, the massive social security system covers five different types of insurance and a mandatory housing fund. Namely, retirement pension, unemployment, medical insurance, work-related injury cover, and maternity support.

Both employees and employers are required to make contributions. According to regulations, the contributions base is tied to the previous year’s average wage, rising as wages increase.

A 2006 policy capped the contribution base at 300% of the average local salary of the preceding year and the minimum is 60% of that. If an employee’s average monthly income from the previous year is within this range, the actual salary is used as the base. If outside this range, contributions are adjusted to the upper or lower limit accordingly.

That is, if a worker’s salary is higher than 300% of the average salary, the contribution will be calculated based on 300% of average salary at most. Meanwhile, earning less than the lower limit of the range — 60% of the average salary — the contribution will be calculated at that rate.

But while insurance payments continue to rise, many Chinese workers have experienced slowing salary growth.

Average wages for urban non-private and private sector employees nationwide increased by 6.7% and 3.7% respectively in 2022, compared to the previous year, according to the National Bureau of Statistics (NBS). This represents a slowdown in growth rates of 2.98 percentage points and 5.2 percentage points, respectively, from 2021, marking the lowest increases since 1984 for the non-private sector and 2008 for the private sector.

The share of China’s state sector among the country’s 100 largest listed companies, measured by aggregate market capitalisation, rose to 61% in the first half of 2023 from 57.2% at end-2022, according to independent nonprofit research organisation the Peterson Institute for International Economics.

Meanwhile, actual salary growth in China was 4.9% in 2023, a decrease of 0.4 percentage points from 5.3% in the same period of 2022, according to a survey of 4,000 companies by leading human resource consulting firm Mercer.

By 2035, people older than 60 will account for 30% of the population, reaching 400 million...

Despite weaker affordability of higher social security obligations for businesses and individuals, policymakers are facing a more pressing issue: ensuring that the system is capable of providing for its rapidly expanding group of elderly and falling birthrate.

The number of people aged 60 and over reached 296.97 million in 2023, about 21.1% of its total population, up from 280.04 million in 2022, NBS data showed. By 2035, people older than 60 will account for 30% of the population, reaching 400 million, the MHRSS projected.

China’s population declined for a second straight year in 2023 as its birthrate hit a new low, with 1.41 billion people recorded at the end of last year, down 2.08 million from 2022, when it logged its first population drop in 60 years, according to the NBS.

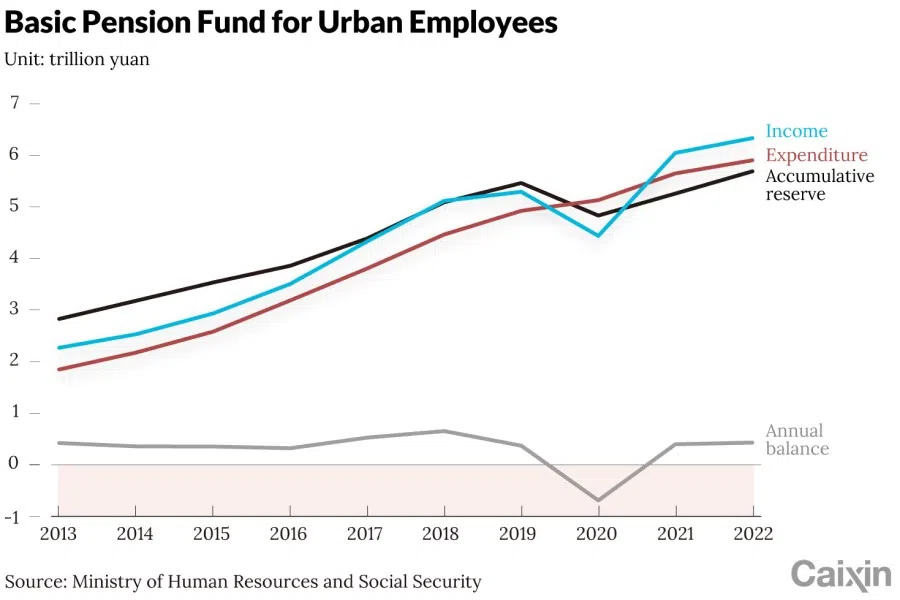

China is in a race against time to supplement its pension system, which has already run into shortfalls in many parts of the country. The Chinese Academy of Social Sciences (CASS) has estimated in 2019 that the country’s basic pension funds that cover urban employees will dry up by 2035 after its accumulative savings peak in 2027 at 6.99 trillion RMB (US$0.96 trillion).

Rising payments

Provincial authorities are set to unveil the new annual social security contribution base around mid-year, and another hike this year — as in previous years — is almost certain.

In 2023, the per capita annual income from wages and salaries of residents nationwide was 22,053 RMB, an increase of 7.1% over the previous year, according to NBS data.

Consequently, provinces including Hunan and Shandong have made a preliminary decision to increase this year’s contribution base by around 7%.

In Shanghai, China’s highest-paid city, the contribution base reached 7,310 RMB in 2023 after a 12% hike from the previous year. That compares with the city’s minimum wage of 2,690 RMB.

Nearly half of the 11 million urban employees in the city have a pre-tax income of less than 7,000 RMB per month, meaning the additional social security burden will be felt heaviest by middle and low-income groups, estimated Nie Riming, a researcher at the Shanghai Institute of Finance and Law.

Caixin’s calculations based on government data showed that in 2023 at least five municipalities and provinces, including Beijing, Tianjin, Liaoning, Jilin and Shanghai, increased their local social security contribution base at a pace higher than average salary growth.

The faster pace reflects local authorities’ urgency to supplement social security funds to meet the central government’s requirements, especially after contributions fell during the pandemic.

Even in the capital Beijing, fully implementing the collection rules has been challenging. In 2019, the municipal government set a goal to increase the minimum contribution from 40% to 60% of the average wage by 2021.

China in January 2022 kicked off a key reform that started nationwide pooling of pension funds for disbursement by the central government. The move was aimed at allowing pension funds to be transferred from regions with a surplus to regions in deficit, according to the International Labor Organization.

Under the reform, localities are required to strictly adhere to the unified standards for the contribution base and ensure its collection. However, significant economic disparities across regions pose challenges to this being carried out.

Even in the capital Beijing, fully implementing the collection rules has been challenging. In 2019, the municipal government set a goal to increase the minimum contribution from 40% to 60% of the average wage by 2021.

However, by 2023, the city’s actual collection of the minimum payment still lagged at 56% of the average wage. This already represented a 75% increase in the minimum contribution over a four-year period to 6,326 RMB per month.

The rapid growth has squeezed companies across all sectors, prompting the envisioning of a scenario that all parties dread: escalating labour costs compelling many businesses, particularly small and micro enterprises, to shift the burden onto workers by cutting jobs, lowering wages, and underreporting the contribution base.

This would result in a decline in actual contributions, not to mention a further drag on the economy.

Indeed, only 28.9% of companies across the nation were fully compliant with social security base regulations in 2023, lower than the pre-pandemic level, according to the 51shebao report. Data from Shanghai’s Human Resources and Social Security Bureau showed that by the first half of 2023, participation in the urban employee’s basic pension plan had dropped to 15.3 million, a decrease of over 70,000 from the end of 2022.

Those most severely affected by rising social security obligations are the over 200 million gig workers who must shoulder the entirety of the contributions by themselves. Many struggling to make ends meet are increasingly opting out of insurance, creating a significant loophole in the system.

“After deducting rent, food and money sent back home, there’s hardly anything left to save, so why worry about anything else?” said Wang Gang, a migrant worker from Guizhou who earns a maximum monthly salary of 5,600 RMB in Shanghai as a security guard.

Reducing burden

Central and local governments have made various efforts to address companies’ concerns over the rising social security burden.

In 2019, the State Council cut the share of pension contributions by employers to 16% from 20%, while reducing rates for work-related injuries and unemployment insurance. In 2020, temporary exemptions or reductions in social security payments were offered to companies encountering difficulties caused by the pandemic.

By the end of November 2022, the relief policies reduced social security payments for enterprises by more than 270 billion RMB, according to the MHRSS.

However, as pressures from the economic downturn have intensified in the aftermath of the pandemic, the relief measures have been insufficient to counteract the impact of consecutive increases in the contribution base.

Local governments have more motivation to attract investment and stimulate their regional economies by reducing the social security burden on enterprises. And as pension contributions are subject to rigid central government requirements and national coordination, local authorities have turned to cutting other insurance categories under their management.

... for many enterprises, the periodic reduction of medical insurance contributions is not sufficient to offset the burden of rising pension insurance payments.

For example, this year, several cities, including financial and economic behemoths Shanghai, Guangzhou, Foshan and Shenzhen have issued policies to temporarily reduce medical insurance payments.

However, for many enterprises, the periodic reduction of medical insurance contributions is not sufficient to offset the burden of rising pension insurance payments.

In Shenzhen, the nation’s tech capital, the minimum contribution base for employee pension insurance was raised to 3,523 RMB from 2,360 RMB this year. The city is set to further increase the base to in July to match provincial requirements, meaning employers and individuals will have to spend an additional minimum of 274.5 RMB and 146.4 RMB per month, respectively, compared to the same period in 2023.

Statistical bias

Experts note that the growing pressure on businesses and individuals from social security contributions is partly due to an imbalance within the statistics used to determine the contribution base.

China’s system for tracking labour wages, traditionally skewed towards the better-paid non-private sectors, has undergone multiple reforms. Despite this, data from NBS reveal that while employees in private enterprises make up 70% to 90% of the permanent population in most cities, the calculation of the average social wage still predominantly reflects the situation in non-private sectors.

A 2019 reform was aimed at better capturing the general wage landscape, but non-private sectors — including state-owned, collectively-owned, and foreign-owned businesses — continue to disproportionately influence the statistics, pushing the results higher.

According to 2022 NBS data, the average annual wage of urban employees in private enterprises was only 57.2% of that in non-private units, growing 3 percentage points slower.

This article was first published by Caixin Global as “Cover Story: China’s Balancing Act to Keep Its Social Security System Afloat”. Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)