China’s stimulus bomb sparks optimism, but economy may still struggle

The Chinese government has just announced a slew of aggressive stimulus measures to prop up the economy. But some analysts question the long-term impact of the measures and whether they go far enough.

(By Caixin journalists Wang Shiyu, Wu Xiaomeng, Chen Bo, Liu Ran, Wang Liwei and Denise Jia)

What a difference a week can make. As millions across China prepared to head off on vacation in the days leading up to the National Day break, the announcement of a slew of aggressive stimulus measures and an unusual Politburo meeting addressing economic challenges propelled the benchmark CSI 300 Index to its biggest weekly gain in nearly 16 years.

Despite the initial positivity, some analysts question the long-term impact of the measures and whether they go far enough. While the jury may still be out on their effectiveness, the policy announcements themselves and the manner in which they were deliberated underscored the gravity of the situation facing the nation’s top leadership.

This was evidenced in the 26 September meeting of the Politburo, led by Chairman Xi Jinping, as it took the unusual step of tabling macroeconomic matters ahead of schedule, suggesting a heightened urgency to stabilise the economy. Concerns have been fuelled by weaker-than-expected second-quarter GDP growth of 4.7% as the protracted property slump, coupled with weak consumption and investment, has weighed on China’s post-Covid recovery.

Macroeconomic discussions at the monthly Politburo sessions are typically scheduled for April, July and December. Moving the topic up to September emphasised the leadership’s concern and commitment to reviving growth.

According to a post-meeting statement, the Communist Party’s top decision-making body emphasised the need to “face difficulties and strengthen confidence” and “intensify countercyclical adjustments”, which was in stark contrast to the more reserved tone of prior meetings.

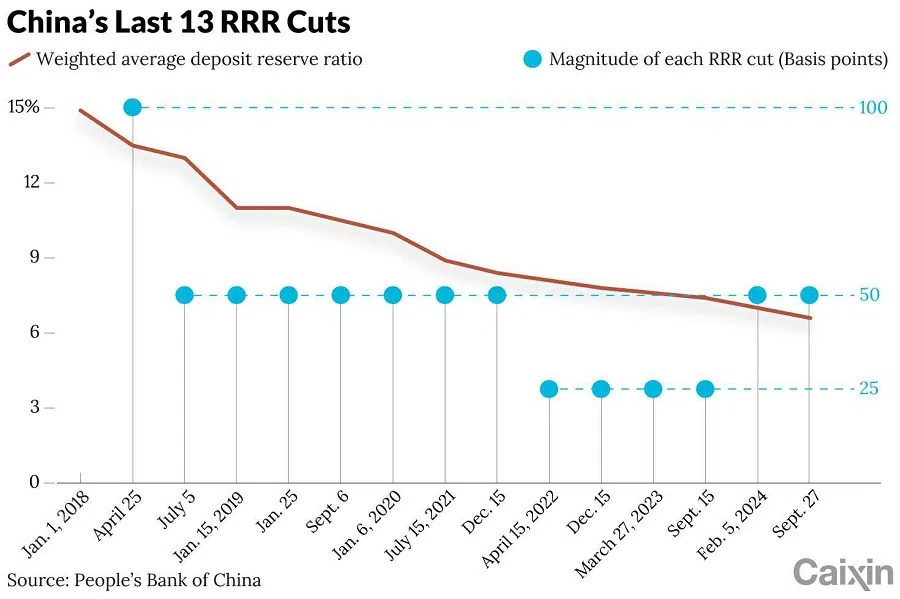

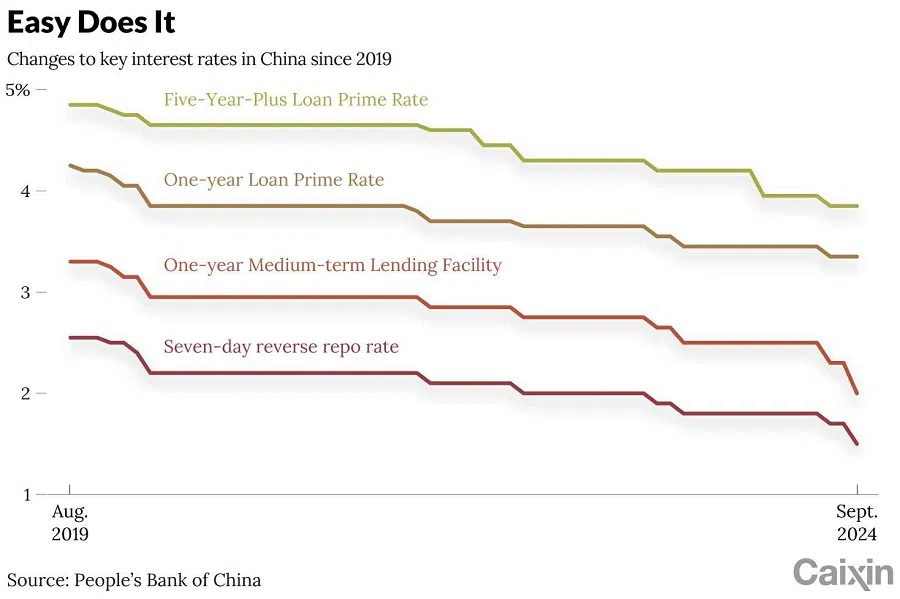

It was then the turn of the People’s Bank of China (PBOC) to get in on the action. After signalling its intentions to cut its main policy rate and the reserve requirement ratio (RRR) for banks before the meeting, the PBOC on 27 September slashed the 7-day reverse repo rate from 1.7% to 1.5%, alongside a 0.5 percentage point reduction in the RRR for most financial institutions. Officials also hinted at further RRR cuts before the end of the year.

In addition, the central bank will create two new tools to encourage financial institutions and listed companies to increase their stock holdings, also a first. Market watchers said these measures demonstrated a comprehensive effort to balance both monetary policy and financial sector stability.

The central bank’s monetary policy surpassed market expectations, while real estate policies aligned with forecasts, and liquidity support for the capital market was stronger than anticipated, said Nie Yixiang, co-head of investment at Fidelity International, in a report.

The immediate market response to these announcements was striking. The CSI 300 Index... began its surge on 24 September, eventually rising over 15% for the week, the biggest since 2008...

A report from Standard Chartered Bank called the recent central bank measures a “bold action”, signalling a potential shift towards a more aggressive monetary policy approach.

“We expect the PBoC to maintain the easing momentum in the next few quarters amid likely further Fed rate cuts,” said Standard Chartered. “We now expect a 25-basis-point RRR cut in Q4, in addition to our previous forecast of a 25-basis-point cut in both Q1 and Q3 2025.”

The bank also predicted a 10-basis-point policy rate cut in Q2 2025, on top of its previous forecast for a 10-basis-point cut in both Q4 2024 and Q1 2025.

The National Financial Regulatory Administration (NFRA) added to the barrage of monetary policy announcements by unveiling key measures targeting the banking sector. These included plans to bolster the core capital of major commercial banks and expand support for small and micro-enterprises.

Markets soar

The immediate market response to these announcements was striking. The CSI 300 Index, which tracks the top 300 stocks on the Shanghai and Shenzhen exchanges, began its surge on 24 September, eventually rising over 15% for the week, the biggest since 2008, while the Chinese RMB strengthened to a 16-month high against the dollar.

However, Morgan Stanley’s chief China economist Xing Ziqiang cautioned that while policymakers are seriously addressing deflationary pressures, China isn’t yet in “at all costs” mode.

Indeed others, like Nomura’s Chief China economist Lu Ting, warned that the real challenge lies in the long-term effects of these policies. While the current stimulus package provides immediate support, particularly for real estate and stocks, there are growing calls for additional fiscal measures, said Lu.

And as discussions around a potential 10 trillion-RMB (US$1.4 trillion) stimulus package intensify, after Liu Shijin, former deputy head of the Development Research Center at the State Council, proposed the plan at a forum on 21 September, experts agree that sustained economic recovery will most likely require more robust government action beyond the current measures.

As Liu is a former member of the Monetary Policy Committee of the PBOC, his comments made news headlines and sparked speculation about a possible stimulus package.

Monetary action

The interest rate cut is the second for 2024. Speaking on the day of the announcements, PBOC governor Pan Gongsheng said that these adjustments are aimed at driving down loan and deposit rates, fostering lending and bolstering economic activity. So far, the 7-day reverse repo rate has been slashed by 30 basis points, matching the combined cuts made from 2020 to 2023.

... the Politburo only for the first time emphasised the urgency to “stop the decline and stabilise” the real estate sector, reflecting the high level of concern over the sector’s drag on the overall economy.

The rate cut was long anticipated as China’s economy faces mounting pressure to hit its official GDP growth target of roughly 5%. Recent data underscores the challenges: RMB loans grew by 1.04 trillion RMB in August, yet long-term loans to businesses and residents remained weak. Broader monetary indicators, such as M2 and M1 reflected slower growth, pointing to reduced liquidity in the market.

In addition to rate cuts, the central bank injected 300 billion RMB into the financial system through the medium-term lending facility (MLF) at a reduced rate of 2% on 25 September. Pan estimated that the latest RRR cut would release roughly 1 trillion RMB into the economy, with room for further reductions of 0.25 to 0.5 percentage points by the end of the year.

Analysts expect the total RRR cut for 2024 could reach 1.5 percentage points, making it one of the most aggressive liquidity expansions since 2019.

These moves align with shifts in global monetary policy, particularly the US Federal Reserve’s rate cuts, which have reduced external constraints on China’s monetary policy, providing the PBOC more flexibility to navigate its own economic challenges, a person close to the central bank told Caixin.

Property incentives

Despite the years-long slump in the property market, the Politburo only for the first time emphasised the urgency to “stop the decline and stabilise” the real estate sector, reflecting the high level of concern over the sector’s drag on the overall economy.

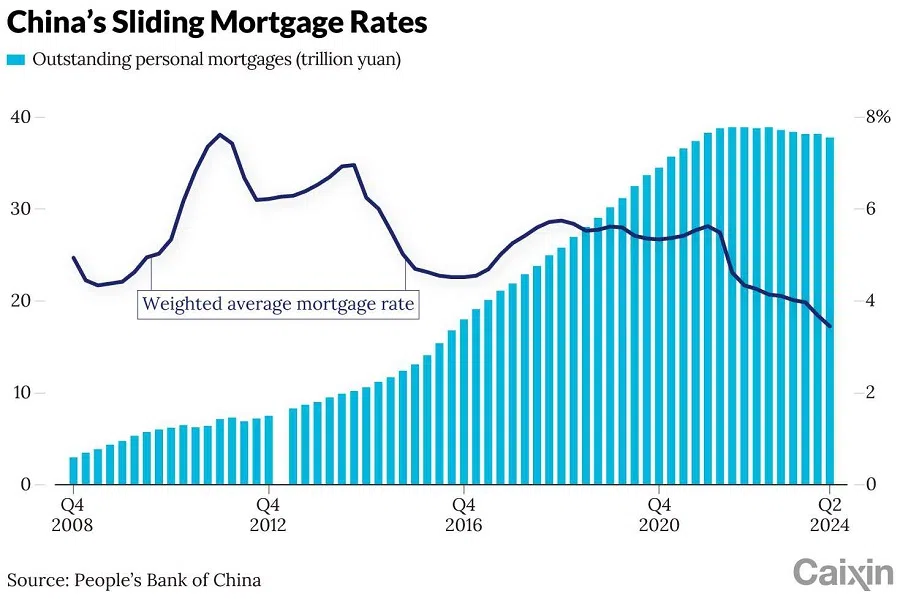

At a State Council press conference on 24 September, the PBOC and the NFRA introduced a series of policies aimed at addressing both demand and supply issues in the property market, including lower mortgage rates and reducing down-payment requirements for first and second homes.

... market insiders argue that these measures may not be enough to stimulate demand, as many potential buyers are hesitant to take on new debt given their pessimism about the broader economy.

The real estate sector’s primary challenge is weak demand. With property prices still falling and no signs of recovery, many companies are now focused on cutting debt to survive, said one executive at a developer.

Banks are expected to cut mortgage rates by 0.5 percentage points, benefiting around 50 million households. Additionally, the minimum down payment for second homes will now match the 15% requirement for first homes.

On the supply side, developers face severe funding shortages due to declining sales. Despite support measures introduced in 2022 and early 2024, many are set to expire by the end of the year. Pan announced that key support policies, such as operational property loans and stock financing extensions, will now be extended through 2026, offering temporary relief.

However, market insiders argue that these measures may not be enough to stimulate demand, as many potential buyers are hesitant to take on new debt given their pessimism about the broader economy. In addition, some developers complain that negotiating loan extensions with banks remains difficult, with banks hesitant to offer further debt relief, especially for highly leveraged companies, even with the policy extensions in place.

To offer further assistance, the central government is urging local authorities to buy houses and land from struggling developers, while state-owned enterprises have been encouraged to purchase unsold commercial housing or recover idle residential land. But progress has been slow, with developers resisting offers well below market value.

Developers with large inventories of unsold land, particularly in lower-tier cities, are unwilling to sell when it would result in significant losses, according to an executive from a listed developer.

On top of this, local governments are already struggling under the burden of surging debt. Bai Chongen, dean of Tsinghua University’s School of Economics and Management, estimated that local governments accumulated an additional 6.79 trillion RMB in debt during the pandemic. He suggested that repaying these debts should be a top priority of any new stimulus.

The PBOC has also pledged further financial support, including the possibility of re-lending programmes if necessary. The government has also rolled out a project financing mechanism to ensure that under-construction projects are completed. So far, 5,700 projects have been approved, with 1.43 trillion RMB in commercial bank financing ensuring over 4 million housing units are delivered.

Despite these efforts, industry experts remain cautious. Once current projects are completed, developers may face shrinking opportunities as land reserves dwindle, raising concerns about the sector’s longer-term prospects, an executive at a developer told Caixin.

Boosting capital

The PBOC’s latest policy adjustments are set to challenge the banking sector, as declining interest rates squeeze profit margins and strain capital adequacy.

Lower Loan Prime Rates (LPR) and mortgage rates are tightening the interest spread, reducing banks’ yields. In the first half of 2024, major banks, including Industrial and Commercial Bank of China, China Construction Bank, Bank of China and Agricultural Bank of China, reported net interest margin drops of over 20 basis points compared with 2023.

Governor Pan emphasised that in adjusting its monetary tools, the central bank aims to balance support for real economic growth with the health of the banking sector. He expects the impact on bank income to be neutral, with net interest margins stabilised by symmetrical adjustments in lending and deposit rates.

As deposit rates fall alongside lending rates, savings become less attractive, sparking concerns about reduced liquidity in the banking system, the person close to the central bank told Caixin.

Experts argue that the recovery of banks’ interest spreads hinges on a revival of financing demand in the real economy.

“Interest spreads are driven by macroeconomics, not just monetary policy,” an economist familiar with monetary policymaking told Caixin. “Low inflation and sluggish growth are narrowing spreads, but a growing economy could reverse this trend.”

In recent years, large banks have seen their profitability eroded due to fee-reduction policies, while state-owned banks struggle to maintain dividends, further straining capital reserves. To address these challenges, the government plans to boost the core tier-1 capital of six major state-owned banks through phased initiatives.

Currently, the core tier-1 capital adequacy ratios of these banks surpass regulatory minimums, ranging from 9.28% to 14.01%. However, pressure from declining profits, the economic slowdown, and state-mandated roles in rescuing smaller financial institutions could stretch these reserves, warned by Zeng Gang, deputy director of National Finance and Development Laboratory.

While details of the capital injection remain undisclosed, market speculation suggests potential direct injections by major state shareholders, such as the Ministry of Finance and China Investment Corp. Some predict it could be similar to the 1998 capital injection, when the government issued US$270 billion special bonds to recapitalise the big four state-owned banks.

Other experts caution that injecting capital into large banks could crowd out smaller players, further consolidating the power of state-owned banks and creating structural imbalances in the financial system.

Unlike monetary policies, expanding fiscal measures like issuance of government bonds and special bonds, requires approval from the National People’s Congress. So all eyes will be on the upcoming session of the NPC Standing Committee in late October...

Stimulus speculation

Separately, former deputy head of the Development Research Center at the State Council Liu has advocated for a 10 trillion-RMB stimulus package over the next one to two years, funded by ultra-long-term special bonds. His plan focuses on enhancing public services for migrant workers and low-income families, aiming to boost consumption and investment.

Liu emphasised that the stimulus plan should differ from the 2008 infrastructure-heavy approach. Instead, he advocated investing in “human capital” — education and healthcare — to improve productivity and fuel long-term growth.

But monetary policy alone will not be enough, said Xu Qiyuan, deputy director of the Institute of World Economics and Politics of Chinese Academy of Social Sciences, calling for “fiscal stimulus to take the lead”. He and other experts argue that while monetary tools still have room to manoeuvre, fiscal intervention is key to driving economic recovery.

Luo Zhiheng, chief economist at Yuekai Securities, recommended expanding fiscal policies by increasing government bond issuances to cover lost revenue from declining land sales, speeding up special bond issuance, and refining local government debt policies.

Unlike monetary policies, expanding fiscal measures like issuance of government bonds and special bonds, requires approval from the National People’s Congress. So all eyes will be on the upcoming session of the NPC Standing Committee in late October, which may provide a crucial window for greenlighting any new fiscal initiatives.

An earlier version of this story mistakenly reported that banks including Goldman Sachs and J.P. Morgan had raised their GDP forecasts for China in response to Beijing’s recent economic stimulus measures. Neither had. The story also incorrectly reported Goldman’s forecast for the Chinese economy this year. The bank’s 2024 China GDP forecast has remained at 4.7% since 15 September.

This article was first published by Caixin Global as “Update: Cover Story: China’s Stimulus Bomb Sparks Optimism, but Economy May Still Struggle”. Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.