Even more European airlines drop China routes

Facing higher operating costs due to Russia closing its airspace to them, weaker demand for travel between China and Europe, and fierce competition from Chinese airlines, many European airlines are either scaling back or suspending their China routes.

(By Caixin journalists Zou Xiaotong and Kelsey Cheng)

On 9 November, Scandinavian Airlines (SAS) concluded its final direct flight from Shanghai to Copenhagen, marking the end of a longstanding route that even managed to keep running during the Covid pandemic.

By the time the flight had taken off, SAS had already deactivated its official account on China’s ubiquitous WeChat social media platform. This leaves Air China as the only airline offering direct flights between the Chinese mainland and Denmark.

SAS is following in the footsteps of several of its European peers. Since the start of this year, Virgin Atlantic, British Airways, Lufthansa and LOT Polish Airlines have all either scaled back or suspended their China routes.

Air France-KLM is also reducing flights. From next month onwards, KLM will reduce the number of flights it runs per week from Amsterdam to both Beijing and Shanghai, according to a check on aviation analytics provider Circum.

Only seven European carriers remain on China-Europe routes, down from 14 in 2019.

Russia barred airlines from the EU and a host of other countries from its airspace in February 2022 in retaliation to sanctions imposed on it following its invasion of Ukraine. Chinese airlines can still fly over Russia.

European carriers have been battered by higher operating costs due to Russia closing its airspace to them, weaker demand for travel between China and Europe, and fierce competition from Chinese airlines.

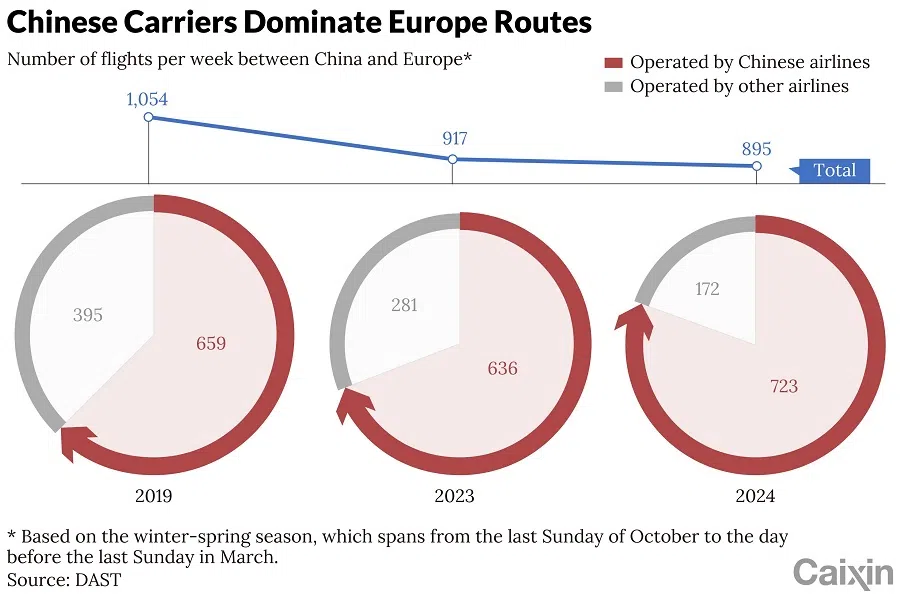

Between 27 November and 3 December, there were 855 flights between China and Europe, a 21.6% year-on-year increase, according to aviation data site DAST. Over 84% of those flights were operated by Chinese carriers, compared to about 60% in 2019.

... these reroutes add 10% to 15% to European airlines’ costs, largely due to higher fuel costs.

Russia’s shadow on costs

Russia barred airlines from the EU and a host of other countries from its airspace in February 2022 in retaliation to sanctions imposed on it following its invasion of Ukraine. Chinese airlines can still fly over Russia.

This means European carriers’ flights to Asia now require costly detours. For example, SAS’s pre-invasion Shanghai-Copenhagen flight took roughly 11 hours. The carrier’s final flight, however, took over 15 hours.

Industry insiders estimate these reroutes add 10% to 15% to European airlines’ costs, largely due to higher fuel costs. European airlines’ high fuel costs are set to get even higher in the coming years, as the EU has mandated that all flights taking off from its airports must use an increasing proportion of more-costly sustainable aviation fuel from next year onwards. Lufthansa in June introduced an environmental surcharge of up to 72 euros (US$76) per ticket to offset these costs.

Yet European airlines have been careful to frame their decisions as “suspensions” rather than permanent withdrawals.

While citing “current market conditions” as the reason for ceasing its Shanghai- Copenhagen route, Scandinavian Airlines said in a statement that “China remains an important market for SAS and we will actively monitor the situation to see if there are future opportunities to restore our presence”.

Lufthansa paused its Beijing-Frankfurt routes in late October but continues to operate flights from Munich to Beijing and Shanghai. British Airways said in a statement to Caixin in August that it has suspended its London-Beijing route until November 2025. It maintains flights to Shanghai and Hong Kong, albeit at reduced frequencies.

In some cases, airlines are using codeshare agreements with Chinese carriers to maintain a presence in the market. For instance, Lufthansa’s tickets for the Beijing-Frankfurt route are now operated by Air China under a codeshare arrangement. Similarly, China Eastern Airlines and Air France-KLM share revenue on certain routes.

Air France-KLM remains committed to the Chinese market, said Wouter Vermeulen, general manager for greater China at the Franco-Dutch airline. Vermeulen told Caixin in May that the carrier aims to restore its flight routes and capacity to pre-pandemic levels in the long run.

“Compared to Japan and South Korea, demand for China is weaker. While capacity on China-Europe routes has exceeded pre-pandemic levels, demand has only recovered to about 70%.” — Eric Zhu, Associate, Bloomberg Equity Research

Shifting focus away from China

European airlines are also reallocating resources to routes with stronger demand and profitability, where passenger volumes have already surpassed pre-pandemic levels.

“European airlines are prioritising deploying capacity to routes with higher demand and better returns,” said Yu Zhanfu, a senior independent aviation consultant.

North American and European capacity deployment to Japan and South Korea has already surpassed 2019 levels, said Bloomberg equity research associate Eric Zhu. “Compared to Japan and South Korea, demand for China is weaker. While capacity on China-Europe routes has exceeded pre-pandemic levels, demand has only recovered to about 70%,” he said.

The sluggish recovery in China-Europe travel is partly due to weakened trade ties, according to a person from the China Air Transport Association (CATA). Bilateral trade between China and the EU declined by 3.3% in the first nine months of 2024, according to EU data.

Tourism has not fully rebounded, and visa restrictions remain a bottleneck for Chinese tourists traveling to Europe, said Vermeulen. For example, Schengen visa issuances in China have only reached 40% of 2019 levels.

Despite this, Chinese airlines have aggressively expanded their capacity on such routes. In the first half of 2024, China’s Big Three airlines — Air China Ltd., China Eastern Airlines Corp. Ltd., and China Southern Airlines Co. Ltd. — offered approximately 4.67 million seats on China-Europe routes, a 21.25% increase compared to 2019 and more than double the volume year-on-year.

However, according to their earnings reports, the average revenue from international routes for the trio declined by about 30% year-on-year.

Wang Changshun, chairman at CATA, stated at a public event in October that global airfares dropped in 2024, with ticket prices in China hitting historic lows.

European governments are reluctant to escalate the issue, as market, political and economic considerations remain in flux.

Unfair competition?

The growing dominance of Chinese airlines on China-Europe routes has fuelled calls for government intervention.

In October, KLM CEO Marjan Rintel publicly urged European governments to take action against what she described as “unfair” competition from Chinese carriers. Lufthansa CEO Carsten Spohr suggested that European carriers should lobby for a level playing field by ensuring any airline landing in Europe avoids Russian airspace.

However, no concrete measures have been enacted. According to Wang Zhan, a Fitch Ratings aviation analyst, European governments are reluctant to escalate the issue, as market, political and economic considerations remain in flux. The International Air Transport Association has also taken a neutral stance, emphasising that “airspace should not be used for political purposes.”

The ultimate problem to end is the Russia-Ukraine war, said Geoffrey Jackson, executive director of the US-China Aviation Cooperation Program. The detour issue was not caused by China, he told Caixin.

“Chinese airlines use less fuel, take less time, and naturally have lower ticket prices,” he said.

For now, European airlines might still be constrained in regaining their foothold in the Chinese market.

Unless there is a significant shift in China-Europe relations, European governments are unlikely to adopt a hardline approach toward Chinese airlines in the short term, said Bloomberg’s Zhu. The future of China-Europe routes hinges on the recovery of demand, he said.

... these resumptions are primarily for US airlines’ West Coast flights, which are less affected by the need to bypass Russian airspace.

North American airlines more aggressive

While their European counterparts are scaling back, some North American airlines are restoring routes that have been out of action since the pandemic, or even launching new ones.

In early December, United Airlines applied to the US Department of Transportation (DOT) to launch a new Los Angeles-Beijing route starting in May 2025, with three weekly flights. Delta Air Lines announced in October it is resuming its Shanghai-Los Angeles service next June.

“This route has been suspended for more than four years, and we hope to see more growth in both flights and passenger volumes,” one Delta Air Lines representative told Caixin. She also noted that Delta remains confident about the Chinese market in the long term.

But these resumptions are primarily for US airlines’ West Coast flights, which are less affected by the need to bypass Russian airspace.

As of now, US airlines have not yet utilised their full quota of 50 roundtrip flights per week as permitted by the DOT. Including the three additional weekly Shanghai-Los Angeles flights Delta plans to launch in June, US carriers will operate a total of 45 flights, whereas Chinese airlines are already utilising their 50 per week quota.

In late October, Canada also eased restrictions on Chinese airlines, boosting China-Canada routes that had previously operated at less than 10% of 2019 capacity. Between 27 November and 3 December, China-Canada flights recovered to 11.2% of pre-pandemic levels, with Chinese carriers operating 81.4% of these flights.

This article was first published by Caixin Global as “In Depth: Even More European Airlines Drop China Routes”. Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.