Key challenges China’s next Five-Year Plan needs to tackle

As China maps out its 15th Five-Year Plan, the nation confronts global turbulence and domestic shifts with bold strategies. Aiming for socialist modernisation by 2035, the plan focuses on boosting domestic consumption, fostering innovation-led growth and addressing demographic changes.

(By Caixin journalist Yu Hairong)

Against the backdrop of an increasingly volatile and uncertain environment abroad and sluggish demand at home, Chinese academics, economic planners and other experts are busy working on the next national Five-Year Plan (FYP) that will guide the country’s economic and social development through 2030.

Key themes... include pursuing high-quality development, the dual circulation strategy and becoming a technological powerhouse and an innovation-led economy.

The plan will need to address both domestic and international risks and challenges, while setting reasonable goals for specific industries, sectors and society that will help meet the broader aim of basically achieving “socialist modernisation” by 2035, an objective agreed at the plenum of the ruling Communist Party’s central committee in October 2020. Key themes under this overarching goal include pursuing high-quality development, the dual circulation strategy and becoming a technological powerhouse and an innovation-led economy.

Caixin collected the views of five prominent policy experts and government advisers about the challenges and priorities the government will need to address.

Yang Weimin (杨伟民): a former deputy director of the economic committee of the national committee of the Chinese People’s Political Consultative Conference, who was involved in drafting six consecutive FYPs and plays a significant role in shaping China’s economic policies and strategies. He also served as a deputy head of the general office of the Central Leading Group for Financial and Economic Affairs.

Huang Qunhui (黄群慧): a respected academic economist and a researcher at the Institute of Economics of the Chinese Academy of Social Sciences (CASS), one of China’s most influential think tanks. His work primarily focuses on industrial economics, economic development and structural reform.

Xu Lin (徐林): a former director of the development planning department at the National Development and Reform Commission (NDRC), China’s top economic planning agency. He is now chairman of the China-US Green Fund, a private equity fund that promotes sustainable development through green investment in energy efficiency, clean tech and smart cities.

A key challenge facing China over the next five years is the increasingly complex and uncertain external environment.

Wang Dehua (汪德华): a researcher at the National Academy of Economic Strategy, under CASS. His work focuses on fiscal and tax theories and policies.

Wang Yiming (王一鸣): a vice-chairman of the China Center for International Economic Exchanges, a major government-affiliated think tank, advising on international economic affairs and policy coordination. He previously worked at the NDRC and played a key role in drafting FYPs. His expertise includes technology and innovation policies, industrial development policies and regional economic policies.

Uncertain international environment

A key challenge facing China over the next five years is the increasingly complex and uncertain external environment. Wang Yiming pointed in particular to three trends: a new wave of scientific and technological revolution is fuelling increasingly intense global competition for technological leadership; the reshaping of global industrial and supply chains is accelerating, with the focus shifting from cost and efficiency to safety and stability; the overhaul of the global governance system is gathering pace, as traditional multilateral mechanisms struggle to reform and new multilateral frameworks and regional free trade agreements emerge.

Given these challenges, expanding domestic demand to achieve growth, especially boosting household consumption, needs to be a core task. But achieving this will require increasing the share of household income in national income, which can be done through reforms to income distribution and allocating more fiscal spending to public services and livelihood programs.

Domestic structural shifts

Another key challenge is addressing some major structural changes that emerged during the 14th FYP period (2021-2025), including a shift in growth drivers and demographic changes.

Since 2021, traditional drivers of economic growth, exemplified by the real estate sector, have lost momentum, placing downward pressure on the economy. Although emerging industries such as new-energy vehicles, lithium batteries, and photovoltaic equipment have expanded strongly, it remains a long-term challenge to cultivate new quality productive forces, a term coined by President Xi Jinping that refers to advanced, innovation-driven productivity.

If the economy is to achieve an average annual growth rate of 5% during the 15th FYP period, this would require an increase of 38 trillion RMB in total demand...

China’s population has been falling since 2022, according to official data, a drop that is expected to continue for the foreseeable future. The working-age population will also decline, resulting in significant changes in the supply-demand relationship for labour and a continued rise in labour costs, according to Wang Yiming.

The ageing population will increase the burden of elder care on society and families, decrease consumer spending among the working-age population, and make weak demand a persistent constraint on economic growth.

Boosting domestic demand

At the end of 2021, the Central Economic Work Conference identified “weakening demand” as a key issue, which has persisted and is of increasing concern to the government.

Previous FYPs did not put sufficient emphasis on the demand side of the economy, and paid more attention to production, supply and investment, because in the past, many sectors were primarily confronted with supply shortages, said Yang Weimin. However, the main contradiction now is insufficient domestic demand. If the economy is to achieve an average annual growth rate of 5% during the 15th FYP period, this would require an increase of 38 trillion RMB in total demand, he said. Where can this additional demand come from?

Exports have been a strong driver of growth in the last few years — the contribution of net exports of goods and services to economic growth reached 30.3% in 2023. However, many said that given the more uncertain external environment, further sustained rapid export growth will be unrealistic and China’s economy will need to rely more on the domestic market.

Fixed-asset investment, a traditional growth engine, has slowed significantly in recent years, and it is increasingly difficult for infrastructure spending to deliver the boost that it once did. As a result, government efforts to expand domestic demand must focus on expanding consumption, said Wang Dehua.

China’s household consumption as a percentage of GDP fell to 39.1% in 2023 from 45.5% in 2001. That compares with 67.9% in the US, 49.9% in Germany and 55.6% in Japan in 2023.

Consumption, particularly household consumption, has long been considered a weak link. Huang Qunhui cited data showing that, in 2023, China’s manufacturing value added accounted for nearly 30% of the global total, yet household consumption only made up 11.4%. China’s household consumption as a percentage of GDP fell to 39.1% in 2023 from 45.5% in 2001. That compares with 67.9% in the US, 49.9% in Germany and 55.6% in Japan in 2023.

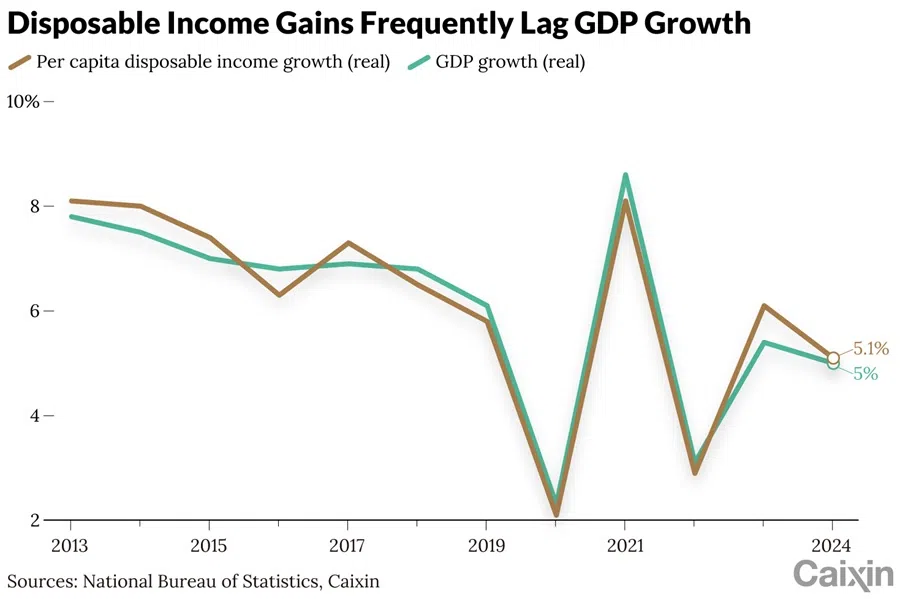

Although incomes have been growing in recent years, the share of wages in the economy’s primary income distribution is still small, according to Wang Dehua, who refers to the way income is divided among workers, businesses, and owners before taxes and transfers. Household incomes remain a relatively small part of national income, and low earners’ wages are rising more slowly, he said. Although fixing income inequality largely depends on a stronger market and a more dynamic economy, the government also needs to play a bigger role through redistribution policies, he noted.

Boosting the incomes of low- and middle-income groups and reducing their burden has already been identified as a key strategy to stimulate consumption. Huang said that over the next five years, efforts should be made to achieve two “slightly higher” targets: household income growth should slightly outpace overall economic growth, and the growth rate of wages should slightly exceed gains in labour productivity.

Fiscal policy should be used to increase investment in critical areas such as education, sports, elder care, childcare and affordable housing, Huang said. A higher proportion of spending should go to social security and healthcare, with increased subsidies for urban and rural residents’ pension funds, he added.

China should continue to pursue its goal of becoming a manufacturing powerhouse, but at the same time, the government should use the 15th FYP to set the objective of becoming a major nation focused on people’s livelihood, said Yang.

During the 15th FYP period, China also needs to accelerate the equalisation of public services between urban and rural areas as well as among regions, according to Xu Lin. This is key to genuinely raising the per capita disposable income and consumption capacity of low- and middle-income residents. But implementing these changes will be complex and difficult, he warned.

Services now account for 56% of China’s final consumption, but this figure remains low when compared with developed countries such as the US, according to Wang Dehua. Efforts to boost consumption should focus more on the services sector where supply has not kept up with demand and prices remain too high or quality is subpar, which means consumer demand is not being effectively met, he said.

China should continue to pursue its goal of becoming a manufacturing powerhouse, but at the same time, the government should use the 15th FYP to set the objective of becoming a major nation focused on people’s livelihood, said Yang. If household consumption as a percentage of GDP can be raised to above 50% by 2035, China’s economic fundamentals will become much more stable.

Adapting supply-side structural reform

Supply-side structural reform (SSSR) (供给侧结构性改革) has been high on policymakers’ agenda since the 13th FYP period (2016-2020) and aims to improve the quality of China’s economy by addressing structural imbalances and promoting more sustainable growth. The initial focus was on cutting overcapacity, reducing inventory, deleveraging, lowering corporate costs, and strengthening weak links. Building on these efforts, the 14th FYP refined SSSR’s objectives to “drive innovation and provide high-quality supply to lead and create new demand, and enhance the resilience and adaptability of the supply system to domestic demand”.

Excess supply has driven severe “involution-style”(内卷式) competition, a phenomenon that refers to excessive, disordered competition that includes rampant price wars, heavy losses and low profit margins.

The 14th FYP put particular emphasis on self-reliance and strength in science and technology. As China will soon be entering late-stage industrialisation with a shift in the structure of the economy toward services, an industry researcher said that the 15th FYP will need to focus on increasing total factor productivity, the portion of economic growth generated by the indirect inputs of technological progress and gains in efficiency, rather than by the direct inputs of labour and capital.

The next stage of advancing technological self-reliance and strength should draw from what’s been termed a “new whole-nation system” (新型举国体制). The phrase builds on an older concept of the whole-nation system, which includes state mobilisation, that has been a hallmark of China’s approach to major national projects for decades. The idea behind the updated system is to maintain centralised leadership of key strategic goals while also drawing on market mechanisms and fostering collaboration between the state, the private sector and research institutions to achieve those goals, particularly in areas like technological self-reliance, innovation and critical infrastructure.

Xu said the new whole-nation system should place greater emphasis on the role of market mechanisms and incentive structures in resource allocation and focus on harnessing the advantages market players can offer in organising R&D projects around the diversified needs of the market.

The next FYP should also seek to address one of the major supply-side issues currently facing China’s economy — overcapacity. Excess supply has driven severe “involution-style”(内卷式) competition, a phenomenon that refers to excessive, disordered competition that includes rampant price wars, heavy losses and low profit margins. This has already hit industries such as solar panels and is now creating havoc in the auto industry after electric-vehicle giant BYD Co. Ltd. slashed prices in May.

“If demand-side policies aim to expand household consumption, then supply-side policies also need necessary adjustments to give greater priority to the development of consumption-oriented industries,” said Yang.

The first step is to develop consumer-oriented industries that currently rely heavily on imports to satisfy demand, including pharmaceuticals, cosmetics, culture and tourism, he said. Second, sectors like education, health care, sports, elder care and culture must be more actively developed to better satisfy the needs of various consumer groups. Third, priority should be given to developing mid- and high-end consumer goods and services, such as luxury products, high-quality housing, premium sports and cultural offerings, that cater to high-income groups, he said.

Without pursuing supply-side structural reform to improve the efficiency of resource allocation, efforts to expand domestic demand through short-term fiscal and monetary measures will be unsustainable, said Xu. There is even a risk of falling into the trap of relying on stimulus policies to drive demand growth, he said.

This article was first published by Caixin Global as “In Depth: Key Challenges China’s Next Five-Year Plan Needs to Tackle”. Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)