Luckin challenger pushes China's coffee price war towards boiling point

Cotti appears to be struggling to sustain its rapid expansion, having already faced operational issues with franchisees and suffering a spate of store closures, as Luckin fights back. Meanwhile, as the two Chinese coffee chains duke it out at the cheap end of the market, China's largest international player, Starbucks Corp., is distancing itself from the competition and focusing instead on growing its foothold in the country's smaller cities.

(By Caixin journalists Feng Yiming, Sun Yanran and Wang Xintong)

China's coffee market is in the midst of a price war, and it is showing no sign of abating as the country's leading affordable brand Luckin Coffee Inc. faces down challenger Cotti Coffee, the upstart launched by Luckin's disgraced co-founders Lu Zhengyao and Qian Zhiya.

Forced out of Luckin for their role in perpetrating a US$300 million fraud, Lu and Qian returned in late 2022 with a new venture and promptly went to battle with their former brainchild. They adopted the same low-price strategy, at one point undercutting Luckin's best discount.

But Cotti - named after the Italian biscuit biscotti - appears to be struggling to sustain its rapid expansion, having already faced operational issues with franchisees and suffering a spate of store closures, as Luckin fights back.

Meanwhile, as the two Chinese brands duke it out at the cheap end of the market, China's largest international player, Starbucks Corp., which offers brews at comparatively premium prices, is distancing itself from the competition and focusing instead on growing its foothold in the country's smaller cities.

This divergence in strategies is being seen as coffee brands of all sizes vie for a bigger share of China's fast-growing market. The Asian nation has overtaken the US as the world's largest branded coffee shop market by number of outlets, expanding 58% over the last year to nearly 50,000 locations, according to a report published in December by industry media World Coffee Portal.

With Xiamen-based Luckin beginning to scale back its offers recently and Beijing-based Cotti kicking off new promotions despite many of its stores facing a raft of problems, the direction of the price war and the coffee market landscape are in flux.

"Growth was led by the rapid expansion of small store format and delivery focused Luckin Coffee and Cotti Coffee," the report said. Starbucks, which once reigned supreme in China, now ranks as the second largest branded coffee operator in the country by outlets, the report added.

As of early March, Luckin had opened over 17,800 stores in China - significantly outstripping Starbucks' 7,770 locations and Cotti's close to 6,800, according to food and beverage industry information provider Canyan Data.

The rise of Luckin reflects a broader trend among Chinese consumers who increasingly favour cheaper products amid low confidence and a sluggish economy. However, a more-than year-long struggle with Cotti has taken a toll on Luckin's expansion momentum and bottom line, as the company booked a drop in its profitability in the fourth quarter of 2023.

With Xiamen-based Luckin beginning to scale back its offers recently and Beijing-based Cotti kicking off new promotions despite many of its stores facing a raft of problems, the direction of the price war and the coffee market landscape are in flux.

[Cotti] launched a promotion that offered coffee for as low as 9.90 RMB (US$1.37) per cup. Soon after, it launched a weekly 8.80-RMB promotion and a limited-time 1-RMB discount for new customers.

Cotti challenges Luckin

Luckin's co-founders Qian and Lu made their comeback in the coffee industry in October 2022, founding Cotti with a more aggressive franchise model that eschewed traditional franchise fees in favour of an approach that allows the company to share profits and risk with its franchisees.

But the pair used the low-price, subsidy-driven strategy that they had employed to fuel Luckin's rapid rise. In February 2023, the newcomer launched a promotion that offered coffee for as low as 9.90 RMB (US$1.37) per cup. Soon after, it launched a weekly 8.80-RMB promotion and a limited-time 1-RMB discount for new customers.

The chain is still in a phase of breakneck expansion as it tries to grab market share. To this end, the headquarters is subsidising its franchisees to ensure their stores are profitable, chief strategy officer Li Yingbo told Caixin, adding that this subsidy policy will last until the end of this year.

Not to be outdone, Luckin launched a weekly 9.90-RMB coupon campaign in June 2023. Two months later, its CEO announced that the campaign would be extended for at least two more years.

The decision came at a time when Luckin desperately needed to stabilise its market position, after it opened its 10,000th store in China in June, becoming the first coffee chain in the country to reach that threshold, a company executive told Caixin.

While Cotti has fewer stores than Luckin, the former reaches more cities.

"Many of Cotti's franchise partners were those rejected by Luckin." - a coffee industry analyst

Cotti has expanded its footprint to more than 330 of the country's nearly 400 county-level cities, Li said. As of Monday, Cotti already had 80 stores in Xinjiang and ten in neighbouring Xizang, while Luckin has yet to enter either of the two autonomous regions, according to GeoHey, a Beijing-based company that tracks the locations of more than 1,000 chain brands nationwide.

Cotti could not have kept up the pace of its expansion had it not been for its initial efforts to aggressively attract franchisees, including offering a number of incentives, a coffee industry analyst told Caixin. In addition, Luckin has restrictions on franchise partners' age, assets and how they work together, while Cotti has none of those requirements, he said. "Many of Cotti's franchise partners were those rejected by Luckin."

Cotti has also taken to locating its stores tactically. One franchisee told Caixin that by choosing a location next to a Luckin store, franchisees are more likely to pass the vetting process by headquarters staff, who believe that Luckin's reputation will bring them more customer traffic.

While Li stopped short of revealing Cotti's financing information, a company source said that the coffee chain had benefited from government preferential policies and has its own capital.

Luckin counterattacks

Cotti's tactics worked well initially, with many of its partners tasting success. Wang Zhensheng, a franchisee with 20 Cotti stores in Linyi, East China's Shandong province, told Caixin that his average daily sales per store in the first half of 2023 ranged from 350 to 450 cups, with a monthly net profit of between 30,000 RMB and 40,000 RMB.

However, things changed as Luckin reacted and diversified its franchise business. In May, the company launched a new franchise model that encourages existing shop operators in more than 100 cities to become its partners. The coffee chain then experienced a marked expansion, opening more than 5,800 new stores from July through December, more than double the 2,244 shops in the first half of 2023 and a staggering 280% increase on openings in the second half of 2022, GeoHey data show.

The surge in Luckin shops has disrupted Cotti's plans. Several Cotti franchisees from different regions said their monthly profit per store has dropped to around 10,000 RMB in recent months.

"The data we monitored shows that about 20% to 30% of Cotti's franchisees are profitable, about 20% to 30% break even, and the rest are losing money," an investor told Caixin. "Cotti has already closed more than 1,000 stores."

These closures have cast a shadow over the future of Cotti, which relies heavily on the franchise model. One Cotti employee told Caixin that many of his colleagues are now pessimistic about the company's growth prospects because "many franchisees have reached the end of their patience".

He predicted that if Cotti is not able to launch a blockbuster product soon, a more severe wave of store closures could hit before the year is out.

"The picture is very clear now," said one Luckin investor - it will be hard to find another team in the market that can outperform Luckin, she said, adding that the dominant player still has the potential to double its store count in lower-tier cities.

Meanwhile, well-known venture capitalists and private equity funds are generally wary of investments related to Luckin's founding team due to their integrity issues, a coffee industry consultant told Caixin. Some investors are willing to "secretly" back Cotti because they trust Lu, but more are shunning the startup, the consultant said.

Luckin's supporters expect the chain's operating margins will rebound as Cotti keeps closing stores.

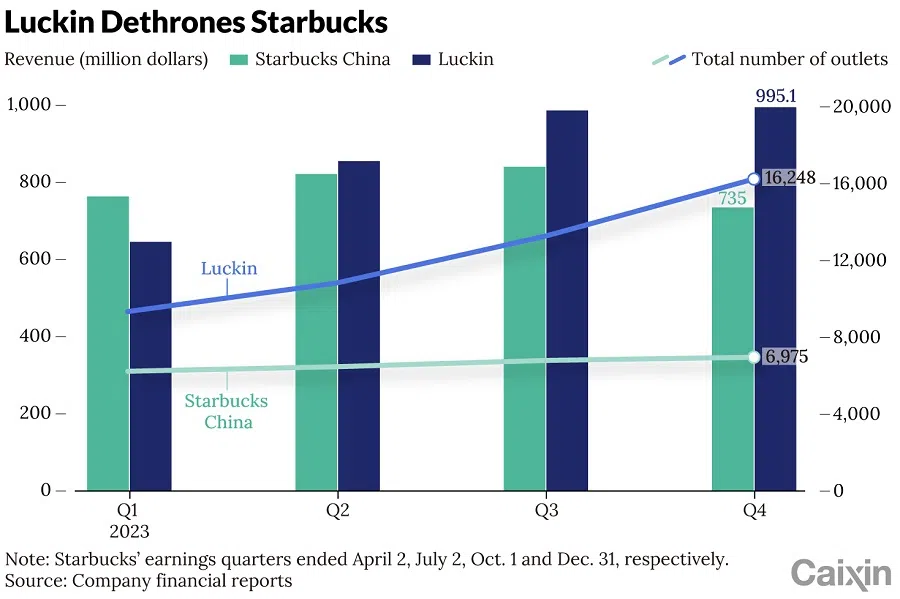

Luckin generated net revenue of 7 billion RMB in the fourth quarter of 2023, up 91.2% on the year, according to its annual financial report published in February. For the whole year, it turned over 24.9 billion RMB, or US$3.44 billion, of net revenue, up 87.3% from 2022, surpassing Starbucks' comparable annual sales of US$3.16 billion in China to become the country's biggest coffee chain. Luckin's sales include those from its small overseas operations including Singapore.

However, the price war did hurt Luckin's profit margins. "Our reported overall operating margin in the fourth quarter of 2023 was 3%, compared to 8.5% in the same period (of 2022)," chief financial officer An Jing said on an earnings call in February.

The drop was "mainly driven by the decrease in average selling price as we continued our '10,000th store celebration event' campaign as well as the weak traffic in the winter season," An said.

But Luckin's supporters expect the chain's operating margins will rebound as Cotti keeps closing stores.

Some industry insiders are worried that the price war will end in a lose-lose situation. Cotti partner Wang told Caixin that if it continues this year, he expects both Cotti and Luckin will have trouble surviving.

But Cotti appears to have no intention of pulling out of the price war, announcing a new three-month 9.90-RMB unlimited offer on 26 February. Luckin, however, recently reduced the variety of drinks that can be bought with the 9.90-RMB coupon on its app.

Starbucks' expansion

Despite the tens of thousands of stores and 1,000-plus chains operating in China, the country's coffee market is still budding and not yet fully tiered, said Belinda Wong, chair and co-CEO of Starbucks China, during an earnings call in January. Wong believes that the current situation, where many competitors are focusing on "fast store expansion and low-price tactics" will "shake out over time".

"We are not interested in entering the price war," Wong said. "We are focusing on capturing high quality but profitable, sustainable growth."

During the call, Wong also announced that the company would expand into new county-level cities. The opportunities are abundant, she said, citing figures that Starbucks had entered only 857 of China's nearly 3,000 cities at or above the county level as of the end of December.

Starbucks founder Howard Schultz echoed Wong's sentiment at a forum in Shanghai last month. The US firm, which entered the Chinese mainland in 1999, must "recognise that competition is happening", said Schultz, but "I'm not spending one minute of my time worrying about it" and will strictly focus on the business itself.

Acknowledging that customer preferences are changing, Schultz, former CEO of the company, said "we will adjust [our strategy] accordingly," but the adjustments will not be "dramatic".

... many consumers have tightened their belts following the pandemic, as a weak economy, real estate slump and high unemployment rattle confidence. All of these factors drove the premium brand [Starbucks] to revamp its strategy.

Customers will upgrade their preferences from low-end and discount coffee over time, so what Starbucks needs to do is "continue to earn the respect of the marketplace," he said.

The US giant's expansion into smaller cities comes as it is looking for new growth points in China. Its China strategy had long been centred on the first-tier market, offering relatively expensive coffee and expanding mainly into big cities as it tapped the middle class and businesspeople. About 66% of its stores are in the mainland's first-tier cities of Beijing, Shanghai, Guangzhou and Shenzhen and so-called new first-tier cities such as Hangzhou, Chengdu and Suzhou, according to GeoHey's data.

However, many consumers have tightened their belts following the pandemic, as a weak economy, real estate slump and high unemployment rattle confidence. All of these factors drove the premium brand to revamp its strategy.

A source close to Starbucks told Caixin that the opening of the first store of a brand like Starbucks in a lower-tier city usually ushers in a large amount of traffic, as local coffee drinkers see this as an upgrade.

But some industry insiders are concerned that Starbucks may not be able to sustain growth in smaller cities after the initial boom fades.

One caterer from a lower-tier city told Caixin that demand for coffee in their area has been insufficient recently, and as a result they are considering expanding into the milk tea business.

A coffee equipment franchisee in Chongqing echoed this sentiment. "Many stores have closed down within a year of opening," the person said. "Demand for coffee in lower-tier markets is actually not that high."

Qu Yunxu contributed to this story.

This article was first published by Caixin Global as "In Depth: Luckin Challenger Pushes China's Coffee Price War Toward Boiling Point". Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.