Meituan hopes Middle East expansion will deliver growth

Meituan has taken its sister food delivery platform Keeta to the Middle East for its first foray outside China. While Meituan’s growth in the Chinese food delivery market has slowed, Persian Gulf states offer a fast-growing customer base as governments accelerate urbanisation. In particular, Saudi Arabia’s food delivery market is expected to grow at an annual growth rate of no less than 20% in the coming years.

(By Caixin journalists Sun Yanran and Ding Yi)

Among the delivery drivers that crisscross streets and zip between buildings in Riyadh, there is a growing consort of riders and e-bikes donning Meituan’s characteristic black and yellow. Soon, drones clad with the same colours could take to the skies over the Saudi Arabian capital.

After pulling off a rapid takeover of the Hong Kong market, Meituan has taken its sister food delivery platform Keeta to the Middle East for its first foray outside China.

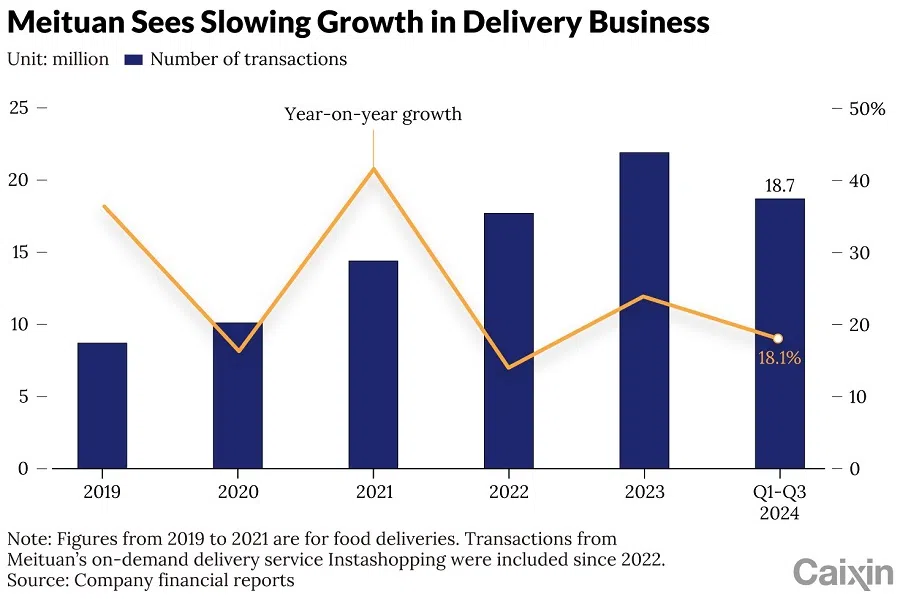

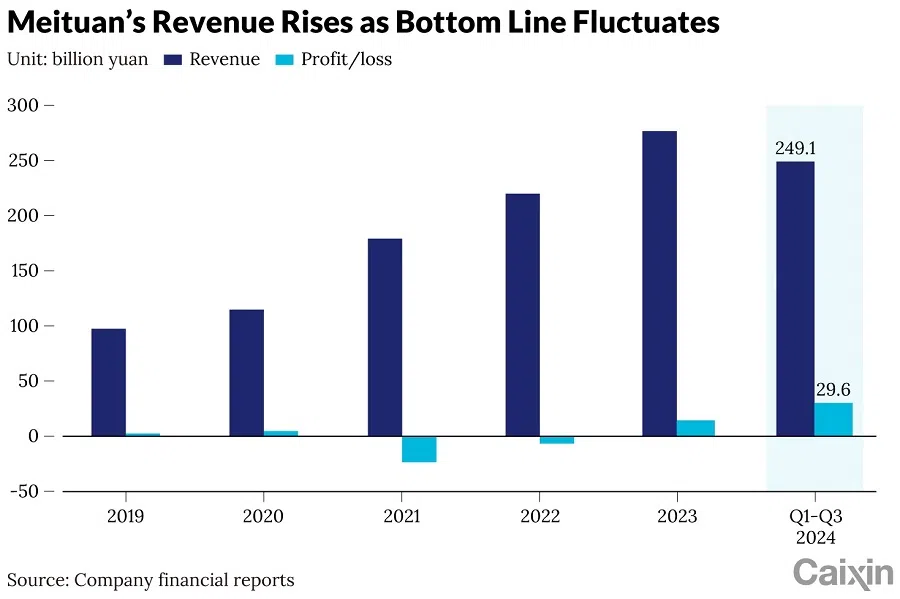

The push into the region has been spearheaded by Meituan’s CEO Wang Xing, who took direct oversight of the overseas and drone delivery businesses following a management overhaul in February last year, as the company tried to counter a slowdown amid intense competition at home.

Seven months later, Keeta began testing the waters in Al-Kharj in east-central Saudi Arabia. It expanded into Riyadh in October and Jeddah and Mecca in January.

“If all goes smoothly, users in every Saudi city will be able to enjoy Keeta” by the end of 2025, Tony Qiu, vice-president of Meituan’s international business, told local Saudi media in November. He also said that the company would invest 1 billion riyals (US$266.4 million) in the kingdom and prioritise the recruitment of local talent across operations, marketing, sales and technology.

Keeta will also continue to explore the potential of its drone food delivery business in first-tier cities in Gulf nations including Saudi Arabia, the United Arab Emirates, Qatar, Bahrain, Kuwait and Oman, said Mao Yinian, head of Meituan’s drone delivery unit. Mao expected orders delivered by drones to account for up to 20% of total orders by 2029, with the proportion likely to be higher in the Middle East than in China.

While Meituan’s growth in the Chinese food delivery market has slowed, Persian Gulf states offer a fast-growing customer base as governments accelerate urbanisation. The urban population across the Gulf region is projected to increase by 30% from 2020 to 2030, with 90% of the region’s population expected to live in cities by 2050, according to a recent report by US-based management consulting firm Arthur D. Little Inc., citing the Brussels International Center.

Keeta captured 44% of Hong Kong’s food delivery orders in March 2024, surpassing rival Foodpanda’s 35% to become the top player in the city, according to local market analytics firm Measurable AI...

Hong Kong trial

Beijing-based Meituan launched Keeta in Hong Kong in May 2023 as the food delivery giant’s first major venture outside the Chinese mainland. Its service was initially limited to the densely populated Mong Kok and Tai Kok Tsui districts. In October that year, Keeta completed full coverage of the city, igniting a full-fledged competition with rivals Deliveroo Plc and Foodpanda GmbH.

Keeta captured 44% of Hong Kong’s food delivery orders in March 2024, surpassing rival Foodpanda’s 35% to become the top player in the city, according to local market analytics firm Measurable AI, which attributed the success to Keeta’s average order value (AOV) being over 40% lower than its rivals.

The lower AOV is a result of Keeta’s strategy to offer splashy subsidies, promotions and free deliveries, which other delivery apps were not offering.

As of March 2024, more than 2 million people in Hong Kong had downloaded the Keeta app, over a quarter of its 7.4 million residents, according to company data.

However, Hong Kong’s market is limited. A 2021 survey by Japan-based market research firm Rakuten Insight showed that about 46% of Hong Kong respondents ordered food delivery less than once a month and that about 18% of them had never bought meals through food delivery apps.

“Hong Kong lacks the potential to become a big food delivery market,” one market analyst said, explaining that it is convenient for people to dine out in Hong Kong and that the cost for hiring a courier is as high as HK$40 (US$5.13) per order. The low AOV will make it hard for Keeta to turn a profit in Hong Kong, the analyst added.

Expanding into the Middle East

Since early 2024, Meituan sent Qiu and several other key figures who contributed to Keeta’s success in Hong Kong to Saudi Arabia to prepare for the launch of the app in the kingdom.

Saudi Arabia’s food delivery market is expected to grow at an annual growth rate of no less than 20% in the coming years, helped by its accelerating urbanisation and expanding young population considered to be more open to ordering food on apps — Tony Qiu, Vice-President, International Business, Meituan

Saudi Arabia was chosen as Keeta’s first stop in its international expansion because of the country’s strong market growth potential and its policies for economic diversity, according to Qiu.

Saudi Arabia’s food delivery market is expected to grow at an annual growth rate of no less than 20% in the coming years, helped by its accelerating urbanisation and expanding young population considered to be more open to ordering food on apps, Qiu said.

The Saudi Arabian government is implementing Vision 2030 to reduce the country’s dependence on oil, diversify the economy, develop services sectors and attract foreign investment with favourable policies including tax reductions. Qiu said the framework provides a golden opportunity for food delivery companies to develop in the country.

According to a report by GF Securities Co. Ltd., the value of Saudi Arabia’s catering industry reached US$25.9 billion in 2023, making up one fifth of the Middle East’s total. As of January, there were 13,000 restaurants available on Keeta in Saudi Arabia, including major brands KFC, Starbucks and Dominos, according to local media outlet Arab News.

Unlike in China where individual consumers are a major source of orders, success in Saudi Arabia hinges on family orders, Qiu said.

A typical Saudi Arabian family with four or five children tends to order as much as twice the food they actually need for a given meal, and Saudi Arabians are relatively less price-sensitive, which means they’ll likely spend more money per transaction on average than families in China, said Raymond Zhu, CEO of Dubai-based investment firm Dhow Holding.

However, Keeta faces significant local competition. According to the GF Securities report, about 70% of Saudi Arabia’s food delivery market was controlled by local players HungerStation and Jahez in 2023.

To win over customers from local players, many of which offer membership services, Keeta is providing free delivery for more than 90% of restaurants doing business on its platform and compensating customers for late orders, according to Qiu.

Delivery via drones is an ideal solution in the Middle East, the market analyst said, as the region’s extreme heat and numerous areas inaccessible to cars make human delivery challenging.

Empowered by drones

In December, Keeta Drone, a subsidiary of Meituan, obtained the UAE’s first commercial license to offer drone-enabled food and medicine delivery services in the Dubai Silicon Oasis — part of the Dubai Horizons project, which aims to formulate standards for drone routes in low-altitude airspace and landing zones in designated airport locations.

Delivery via drones is an ideal solution in the Middle East, the market analyst said, as the region’s extreme heat and numerous areas inaccessible to cars make human delivery challenging. Whereas in China, drones don’t get as much use due to an abundance of labour supply and local regulatory restrictions on drone use.

Currently, Keeta is working with fast food chains KFC and Pizza Hut to conduct trial operation of several aerial delivery routes in Dubai, with its drones used to deliver meals to specialised lockers in designated locations for customers to collect. The company is also exploring using drones to transport prescription medicines and test samples for local hospitals.

Meituan’s drone delivery head Mao is aiming higher with plans to launch Keeta’s drone delivery service in multiple Middle East countries “at scale” in the near future.

Meituan is also preparing to upgrade its drones to cater to the special demand in the Middle East market. People in the region normally eat dinner around 8 pm to 9 pm, which requires drones to have stronger capabilities for flying in the dark. Moreover, their carrying load should also be enhanced as people there are accustomed to buying many items per transaction, according to Mao.

But Mao’s primary task is to automate the operation of delivery drones to reduce costs as the business has yet to turn a profit, he said, predicting that Meituan’s drone delivery service will achieve commercialisation by 2030. The cost per drone delivery is expected to be a little bit higher than that of traditional human delivery services, Mao added.

Bao Yunhong contributed to this story.

This article was first published by Caixin Global as “In Depth: Meituan Hopes Middle East Expansion Will Deliver Growth”. Caixin Global is one of the most respected sources for macroeconomic, financial and business news and information about China.