Malaysia's Melaka Gateway project: Scaled-down ambitions

Melaka Gateway, earlier touted as a mega project that would generate substantial economic benefits, fresh foreign direct investment and access to technical know-how from China, is now a shadow of its former self. There remains, however, significant challenges for the envisioned cruise terminal.

The ambitious Melaka Gateway (MG) project was first conceived in 2014 as a grand project that would generate substantial economic benefits in terms of 45,000 new jobs, a projected 2.5 million tourists, fresh foreign direct investment (FDI) and access to technical know-how from China. Due to a slew of obstacles, however, the project has now been reduced to that of a cruise terminal. Even with the scaled-down ambitions, however, challenges remain as to whether the new entity will be viable.

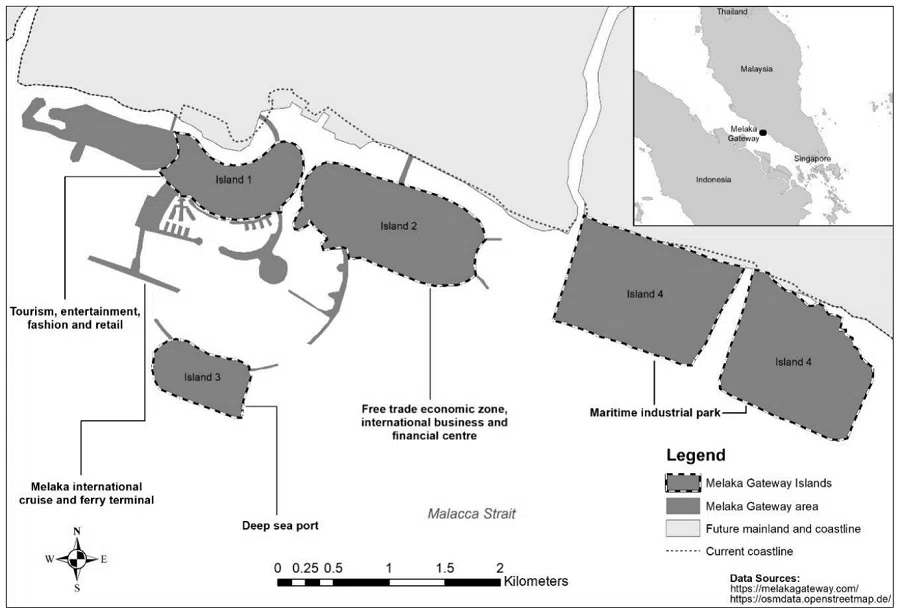

Initially conceived, the project comprised the development of four islands, of which three are reclaimed. They are supposed to host respectively a cruise terminal, a maritime industrial park, a container and bulk terminal and a deep-water port (Figure 1).

Earlier projection of China's major role

It generated considerable controversy when it was launched in 2014; then, China was aggressively investing in ports outside China as part of its Belt and Road Initiative (BRI). Thus it was not surprising that the MG's initial proposed partnerships with Powerchina International, Shenzhen Yantian Port Group Co., Ltd and Rizhao Port Group Ltd. led to the project being labelled as a BRI project by observers.

Two media statements from MG in 2016 indicated that the initial timeline for the completion of the deep-water port was 2019 or even earlier. The entire project was supposed to be completed by 2025. It has become clear by now that the MG would not be able to keep to the proposed timelines due to delays brought about by the termination of its operating license by the federal and state authorities. The operating licence for the port is granted by the former while land reclamation is governed by the state authorities.

... as of June 2022, all the equity of KAJD is held by Malaysians, including the Sultan of Johor, who is also the current King (with a one-third share). The role of China has been reduced to the use of Sinohydro for land reclamation.

In 2018, its operating license was revoked by the Ministry of Transportation (MOT) for lack of progress but this was subsequently reinstated in 2020 after a legal tussle between the master concessionaire of the project, Kaj Development Sdn Bhd (KAJD) and MOT.

However, the state authorities terminated its land reclamation agreement with KAJD in 2020, for its failure to meet its timelines. This led to another round of legal disputes between KAJD and the state government, which was subsequently reported to have been settled out of court in February 2023.

In September 2023, MG announced the revival of the project on its revamped website. The scaled-down project comes with federal and state approval, with new investors, shareholders, and leadership.

Official records at the Companies Commission of Malaysia show that as of June 2022, all the equity of KAJD is held by Malaysians, including the Sultan of Johor, who is also the current king (with a one-third share). The role of China has been reduced to the use of Sinohydro for land reclamation. The latter, which is listed as a subsidiary company of Power Construction Corporation of China, is a state-owned engineering and construction company. There is also a charge of RM70 million (US$14.65 million) to Sinohydro for the reclaimed land.

KAJD is banking on Melaka's UNESCO heritage status and its recently announced collaboration with Global Ports PLC (GPH) to bring in seven million tourists annually.

Downscaling and domestic competition

The envisioned mega project has been downsized to the development of a cruise terminal named the Melaka International Cruise Terminal (MICT). The terminal was part of the original development plan for the first island.

The resized project is now valued at RM682 million, which is considerably smaller than the reported RM40 billion for the entire development of all four islands. This may be more manageable for KAJD, given that it is a small private company with limited exposure to large international projects. The cruise terminal is expected to be completed by 2026.

KAJD is banking on Melaka's UNESCO heritage status and its recently announced collaboration with Global Ports PLC (GPH) to bring in seven million tourists annually. The latter is an independent cruise port operator which operates mainly in the Caribbean and the Mediterranean. In East Asia, it has a presence only in Singapore and Vietnam. The targeted number seems optimistic, given that Penang hosted a mere half a million international cruise tourists in 2023.

Even then, the project is not without challenges. Global growth is forecast to be sluggish while global investment is expected to be weak, which will make it difficult to attract investors to invest in projects which can attract more cruise tourists.

There is also considerable competition for cruise tourism on the west coast of peninsular Malaysia. Penang, for example, is also a heritage city. It is bigger than Melaka and has well-developed tourist products. Unsurprisingly, Penang has more domestic and foreign tourists than Melaka. It has also forged a collaboration with Royal Caribbean Cruises which upgraded the Swettenham Pier Cruise Terminal (SPCT) in 2021. SPCT now allows two mega-sized cruise ships to dock and can handle 12,000 passengers at the same time. There are also reported plans to make Port Klang on the west coast as Malaysia's homeport for international cruises.

As in the case of Penang, will Melaka be able to balance tourism with the preservation of its precious heritage status, which is the cornerstone of its attraction?

To bring in cruise tourists, there is a need to develop attractive tourism products such as cultural shows, museums and handicraft activities. This requires cooperation with tour operators and the state. In addition, there are sustainability challenges when large numbers of cruise tourists disembark in a small city like Melaka. As in the case of Penang, will Melaka be able to balance tourism with the preservation of its precious heritage status, which is the cornerstone of its attraction?

Hence while the revived MG project is now centred on cruise tourism alone, success in bringing in cruise tourists to Melaka extends beyond the mere construction of a cruise terminal and collaboration with cruise port operators. It remains uncertain whether the projected number of cruise tourists can be achieved in the short term and sustained in the long term.

This article was first published in Fulcrum, ISEAS - Yusof Ishak Institute's blogsite.

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)