Why Singapore’s retailers feel the squeeze from Chinese brands

Figures show that Chinese retailers account for 3% of the Singapore market, as compared to just about 90% local businesses. If so, then why is the sense on the ground so different, and why are Singapore retailers feeling squeezed? Lianhe Zaobao journalist Li Yaning explores the question.

Despite a robust macroeconomic backdrop, many small and medium-sized retail enterprises (MSMEs) in Singapore are struggling to survive. Frequent reports of shop closures point to intense competitive pressures, with powerful overseas brands — particularly from China — emerging as a major challenge. Market observers felt that competition from Chinese brands will persist and that the new business models they bring are forcing local SMEs to transform.

Public concern over overseas brands, especially Chinese brand

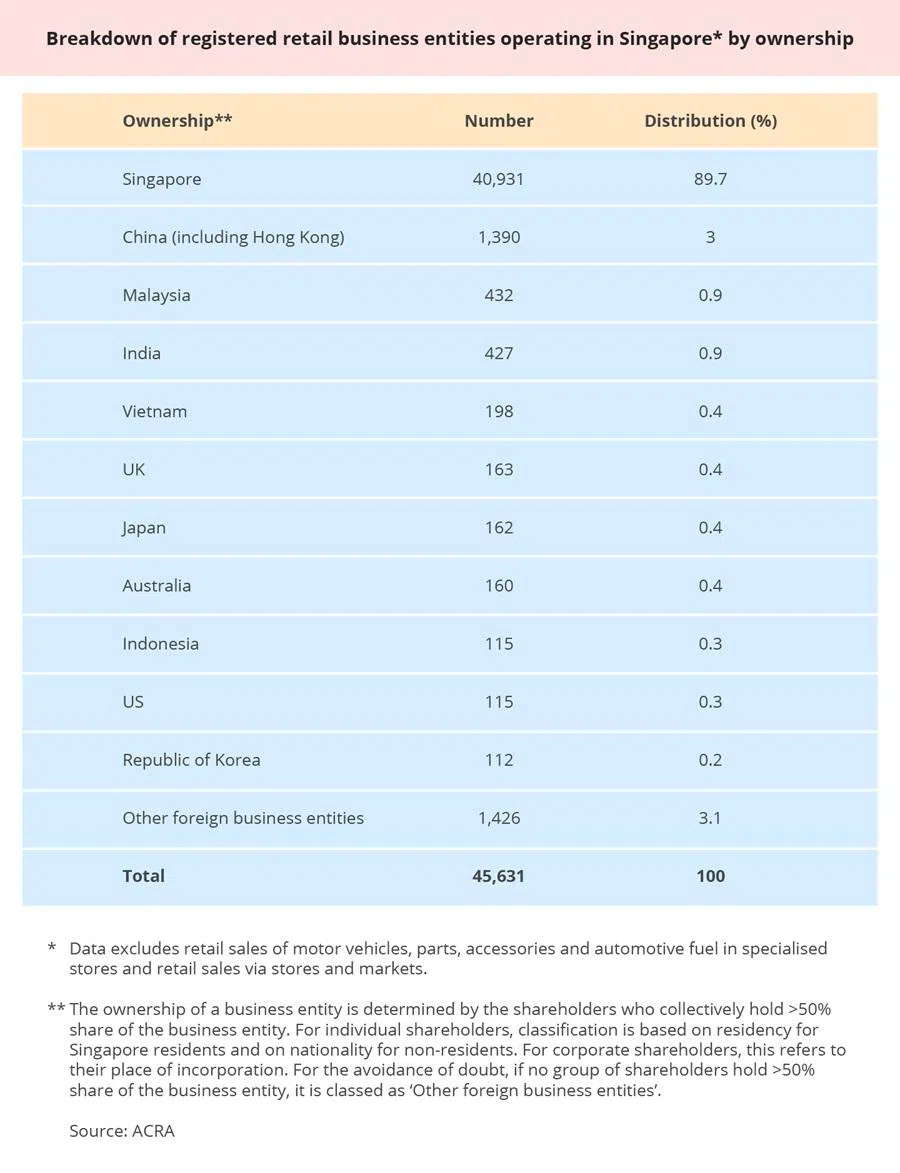

Singaporean Deputy Prime Minister and Minister for Trade and Industry Gan Kim Yong previously disclosed in parliament the ownership distribution of registered retail business entities operating in Singapore.

Data show that 89.7% of retail business owners are from Singapore, 3% from China and the remaining regions account for less than 1%. However, public concern over overseas brands, especially Chinese brands, driving up rents and costs and squeezing SMEs, clearly exceeds the level of threat suggested by these figures.

Some overseas brands leverage their scale to open a large number of chain stores, so their actual presence and influence in shopping centres are far greater than their share of business entities would suggest. — Professor Sing Tien Foo, Provost’s Chair Professor, Department of Real Estate, NUS Business School

In addition to the rapidly expanding F&B sector, Chinese brands are also quickly entering various retail segments such as lifestyle, trendy toys, technology, electrical appliances and fashion. For instance, fashion brand Edition and beauty brand Judydoll entered Singapore for the first time last year.

Figures cover only entities, not outlets

Commenting on the obvious gap between public perception and the figures, Professor Sing Tien Foo, Provost’s Chair Professor at the Department of Real Estate at NUS Business School, told Lianhe Zaobao when interviewed that these figures are compiled according to registered business entities, not by the number of outlets. Some overseas brands leverage their scale to open a large number of chain stores, so their actual presence and influence in shopping centres are far greater than their share of business entities would suggest.

Moreover, they can use economies of scale to lower supply chain and raw material costs, and enhance market penetration through diversified sales channels, further amplifying their impact on the retail market.

... many brands seek local partners when entering a new market, meaning the registered owner may be a Singaporean individual or company. This partly explains the gap between official statistics and their actual market impact. — Jianggan Li, CEO, Momentum Works

Momentum Works CEO Jianggan Li noted in an interview that many brands seek local partners when entering a new market, meaning the registered owner may be a Singaporean individual or company. This partly explains the gap between official statistics and their actual market impact.

Foreign firms bring new ‘strategies’ and strong capital

A recent OCBC Bank survey found that market competition is the biggest challenge facing local SMEs, with 36% of respondents citing it as their primary concern. Elaine Heng, OCBC’s head of Global Commercial Banking, said the real challenge does not lie in the number of foreign brands, but in the completely new “strategies” they bring. Backed by strong capital, they enter the market with highly digitised membership schemes and different ecosystems, fundamentally changing the competitive landscape.

In an interview, the Association of Small & Medium Enterprises (ASME) observed a distinct “two-speed economy” among local retail SMEs. Many are caught in a “perfect storm” of structural pressures that persist regardless of macroeconomic optimism, leaving them with little room to break out of their predicament.

High operating costs remain the most pressing challenge. Rising manpower expenses — driven by wage increases under the Progressive Wage Model and chronic retention difficulties — are consistently cited as top concerns. These pressures are compounded by high rents and weak domestic demand, as reflected in contractions across consumer-facing sectors.

... local SMEs lack economies of scale, whereas foreign brands such as Chagee and Luckin Coffee have vast resources and support networks, giving them a dominant advantage that is unlikely to change in the short term.

Chinese brands may expand slower, but competition remains

Professor Sing opined that after the last wave of rapid growth, the expansion of Chinese brands could begin to slow.

However, he pointed out that local SMEs lack economies of scale, whereas foreign brands such as Chagee and Luckin Coffee have vast resources and support networks, giving them a dominant advantage that is unlikely to change in the short term.

On the pressure Chinese brands exert on local SMEs, Li is more optimistic. He commented that “the trend of Chinese brands expanding overseas will continue. In the process, Chinese brands, their local partners and competitors, as well as some start-ups that take lessons from the Chinese experience, are all learning from one another. Not every brand will be successful in their overseas venture, but those that do will accumulate experience and spur local firms to compete with more advanced models, which benefits the whole ecosystem. I do not believe that a country’s retail sector will be wholly controlled by foreign companies.”

“We anticipate more MSMEs exploring mergers, alliances or consortiums to gain the scale needed to bid for larger contracts and remain relevant in an ecosystem increasingly dominated by larger firms”. — The Association of Small & Medium Enterprises (ASME)

ASME also noted that intensifying competition is accelerating the evolution of local SMEs. As value creation becomes a key survival factor, retailers are tapping government support schemes to pursue digital transformation and strategic differentiation through innovation. Those slow to adapt, however, risk a steady erosion of competitiveness and, ultimately, exit from the market.

ASME also observed that regional expansion and corporate consolidation are increasingly becoming competitive necessities. “We anticipate more MSMEs exploring mergers, alliances or consortiums to gain the scale needed to bid for larger contracts and remain relevant in an ecosystem increasingly dominated by larger firms”.

This article was first published in Lianhe Zaobao as “中资零售商新加坡仅占3% 本土企业“内卷”压力为何大?”.