Domino effect in West Africa: Niger coup destabilises China's expanding economic footprint

The recent Niger coup and conflicts from Mali to Burkina Faso, Chad and Sudan have cast uncertainty on the future of Chinese economic diplomacy in the Sahel and other parts of Africa. Academic Alessandro Arduino explains.

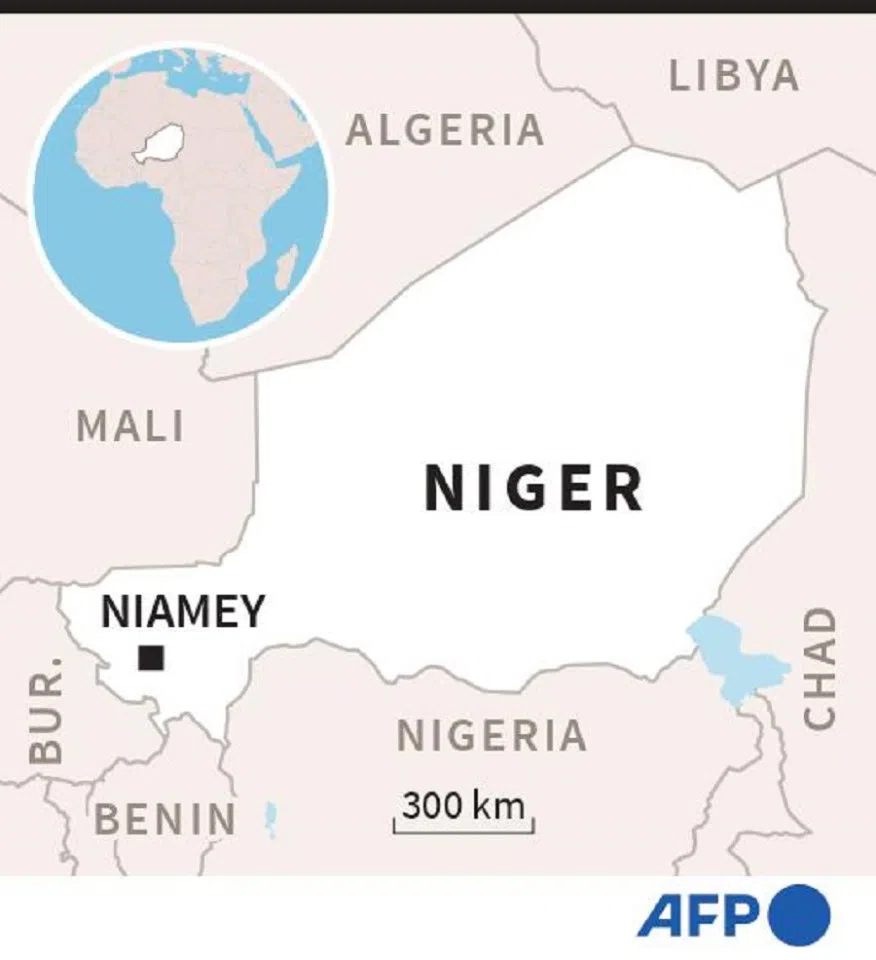

On the morning of 26 July, the presidential guard stormed the palace, supposedly a secure venue, detaining the democratically elected President Mohamed Bazoum of Niger. The echoes of UN condemnation resounded severely, reminiscent of the statements made merely three months prior, when Sudan, too, fell victim to the clutches of an attempted military coup, which fanned the flames of civil war.

Promptly, the Chinese embassy invited all overseas Chinese in Niger to be vigilant, strengthen protection, avoid going out, and take security precautions. Already in March 2021, just before Bazoum got elected, there was a thwarted coup attempt in Niger's capital Niamey. Although the situation on the ground is still very fluid, this time, it seems that the army is not confronting the insurgents, casting a shadow over a rapid solution.

Bastion for Western security interests

While the US and the European Union (EU) have expressed concerns similar to those previously voiced in Sudan, they view the situation in Niger with greater concern. Being a cornerstone of the Western security architecture in Western Africa, the country received financial and security support to keep its fragile economy afloat.

Niger's role as a bastion for Western security interests revolves around three core issues: the first is a bulwark against the expansion of Islamist insurgencies in the Lake Chad region and near the borders with Burkina Faso and Mali. The second sees the country as a key ally of the EU in limiting irregular migration flows from sub-Saharan Africa. Lastly, Niger is one of the few countries in the area that was not looking at the Russian Wagner model to protect its interest.

Also, from Beijing's standpoint, the stakes are high, as China's investment in Niger and in the Sahel relies on stability. Additional uncertainty stemming from Niger spells disaster for the Belt and Road Initiative (BRI) in the region. Since 2000, China's appetite for investments in Niger has grown, with it signalling its intention to develop a crude oil pipeline project and to tap the local uranium deposits that account for 5% of the world's high-grade uranium ore resources. Recently, at the China-Niger Investment Forum held in Niamey in April 2023, it was mentioned that Beijing would be willing to build an industrial park to develop agricultural products, manufacturing, mining and real estate.

Nevertheless, the unrest in Niger marks the latest in a string of coups in Africa in recent years, following those in Mali, Burkina Faso, Guinea, Chad and Sudan, in what is grimly known as "Africa's coup belt".

The increasing uncertainty in West Africa, a region already grappling with the nefarious effects of climate change and the spike of staple prices since the Russian invasion of Ukraine, is a recipe for disaster. In 2022, Niger faced an unprecedented food crisis, with an estimated 4.4 million people out of the total population of 26 million facing acute food insecurity.

... the Chinese mining sector is bearing the brunt of rising violence in Africa.

If instability in Niger persists, it may create conditions conducive to a more significant influx of Russian mercenaries, stationed into neighbouring Mali and Burkina Faso, to support the prevailing faction. Additionally, Niger might be tempted by the appeal of free grain offered to the other six African nations by Russian President Vladimir Putin during the recent Russia-Africa forum in St Petersburg.

China's BRI under threat

These factors complicate China's long-term infrastructure development, including the US$4.5 billion approximately 2,000 km-long China National Petroleum Corporation (CNPC) Niger-Benin oil pipeline and the upgrade of the uranium ore mining facilities in the northern part of the country.

While the Chinese energy sector has already been inoculated against operating in a complex environment, the Chinese mining sector is bearing the brunt of rising violence in Africa. In this respect, China is at a crossroads in terms of the need to re-ignite the economy in the mainland and to keep the BRI on track.

Nevertheless, Beijing cannot count on the financial largesse that was at its disposal during the inception of the BRI. Based on Chinese official data, the economy's annual growth rate plummeted to slightly over 3% in the spring, significantly below the government's target. While an economic stimulus could be imminent, the BRI will not witness new macro projects in high-risk areas.

... the rapid worsening of the security situation, especially in the Sahel, is pushing Beijing to reconsider the viability of several infrastructural projects and to shift new endeavours in safer areas.

Russia finds an opportunity?

According to Chinese pundits, most of the overseas investment activity on the BRI will be mainly related to revitalising the remaining projects unaffected by the deterioration of the security environment. Albeit the fact that the BRI is now inscribed in the Chinese constitution and Beijing is looking to consolidate its expanding footprint in Africa, the rapid worsening of the security situation, especially in the Sahel, is pushing Beijing to reconsider the viability of several infrastructural projects and to shift new endeavours in safer areas.

While new projects totalling US$36 and US$8 billion in the North African countries of Algeria and Egypt respectively, received the green light from Beijing, the unfolding events from Niger to Sudan cast uncertainty upon the future of Chinese economic diplomacy in the Sahel. In its place, all eyes turn to the pledges of "armed stability" offered by the Wagner Group and the provisions of essential goods by Moscow as Russia tries to elbow its way in as a potential substitute.

![[Video] George Yeo: America’s deep pain — and why China won’t colonise](https://cassette.sphdigital.com.sg/image/thinkchina/15083e45d96c12390bdea6af2daf19fd9fcd875aa44a0f92796f34e3dad561cc)

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)