Trump 2.0: What’s in store for Southeast Asia?

Southeast Asia is unlikely to be a priority in Trump’s foreign policy agenda, but the region will need to strategise its response to the president-elect’s trade and security stances, and his transactional approach.

The world is bracing for a wild ride with the second Trump presidency — one that promises to be even more volatile and disruptive than his first. Trump’s standing in American politics is now more powerful than ever with what he calls an “unprecedented and powerful mandate” from the American people. He secured a decisive victory in the presidential election, winning 312 electoral college votes compared to Harris’ 226 and becoming the first Republican to win the popular vote since George W. Bush in 2004.

An era of intensified Trumpism

How radically Trump will push his agenda will depend a great deal on whether there would be effective checks and balances in the American political system and among his own advisers. With a Republican majority in the Senate and potentially in the House of Representatives, alongside a conservative-bending Supreme Court, he may have a freer hand, at least until the mid-term elections in 2026.

As for the personnel, Trump was reportedly constrained by mainstream Republicans during his first term; this time round, he could pursue his goals more assertively and pack his inner circle with Trumpist loyalists first, and policy practitioners second. The coming years could herald an era of intensified Trumpism. His officials could possibly provide some restraint on him, but it is reasonable to expect that Trump will act with greater compulsion and fewer restraints on signalled priorities, alongside abiding unpredictability.

Trump 2.0 will be preoccupied with the challenge of delivering his campaign promises to swiftly end the Russia-Ukraine war and the conflict in the Middle East.

Southeast Asia is a critical hub in global supply chains, a major player in international trade, the world’s second-largest destination of foreign investments, as well as a focal point in the US-China strategic rivalry. Consequently, the region faces high stakes with the expected policy shifts during Trump’s second term.

Trump’s first presidency provides insights into what may lie ahead. His first term was marked by a disdain for the liberal internationalist principles that have shaped US foreign policy since World War II — particularly regarding multilateral institutions, alliances and trade. This, along with Trump’s impulsive style, bombastic rhetoric and “America First” transactionalism will continue or even intensify.

Against this backdrop, what does the future hold for Southeast Asia?

Southeast Asia is unlikely to be a priority in Trump’s foreign policy agenda. During his first term, Trump’s attendance at ASEAN and APEC summits — especially the high-profile Trump-Kim meetings in Singapore and Vietnam — appeared driven more by specific circumstances than a dedicated interest in the region itself, as seen under Obama, or the strategic focus on Southeast Asia’s role in US-China competition under Biden.

Trump 2.0 will be preoccupied with the challenge of delivering his campaign promises to swiftly end the Russia-Ukraine war and the conflict in the Middle East. Given Trump’s personal disinterest in the region as well as his scepticism towards multilateralism, the region may face another four years of Trump’s absence at ASEAN summits and minimal direct engagement with Southeast Asian leaders. During his first term, Trump attended only the 2017 ASEAN summit meetings, failed to send a cabinet-level official to subsequent summits in 2019 and 2020, and failed to appoint US ambassadors to ASEAN and Singapore.

Southeast Asian countries may see a reduction in American development assistance.

Trump’s return will also mark a retreat of US global leadership on shared challenges. Under Biden, addressing global issues like climate change and pandemics was elevated as one of the two pillars of its national security strategy, alongside great power competition. His administration launched various initiatives supporting Southeast Asia in areas like climate resilience, smart cities, environmental protection, public health, education, youth leadership and women’s empowerment.

Trump 2.0 may deprioritise these initiatives, given his track record of attempting to reduce American foreign aid and his scepticism towards climate change, green transition, public health and gender equality. As a result, Southeast Asian countries may see a reduction in American development assistance. The future of significant programmes like the Just Energy Transition Partnerships (JETP) — the financing scheme strongly backed by the Biden administration to help Vietnam and Indonesia transition to cleaner energy sources — now hangs in the balance.

Trade risks to Southeast Asia

Trade is where the risks to Southeast Asia’s economic well-being are most apparent under Trump 2.0. The Indo-Pacific Economic Framework (IPEF) involving seven Southeast Asian states was Biden’s initiative to keep America engaged in regional economic rule-making, without offering a traditional free trade agreement with market access. Trump, who coined it “TPP Two”, may axe it on his first day in office. Although the impact of an IPEF cancellation will be much less profound than the shock of his 2017 withdrawal from the Trans-Pacific Partnership, it would further weaken the US’s commitment to sustain its economic engagement in Southeast Asia.

Trump’s proposed tariffs could result in a 3% decline in exports from Asia (excluding China) to the US, and an 8% drop in US exports to those Asian economies.

More critically, Trump’s enthusiasm for tariffs, which he called “the most beautiful word in the dictionary”, will spell great trouble ahead for the region. His threats to impose sweeping tariffs — 10-20% on all imports and 60% on imports from China – would trigger disruptions in global trade and growth, severely undercutting the rules-based international trading system that has underpinned Southeast Asia’s economic growth for decades. Oxford Economics projects that Trump’s proposed tariffs could result in a 3% decline in exports from Asia (excluding China) to the US, and an 8% drop in US exports to those Asian economies.

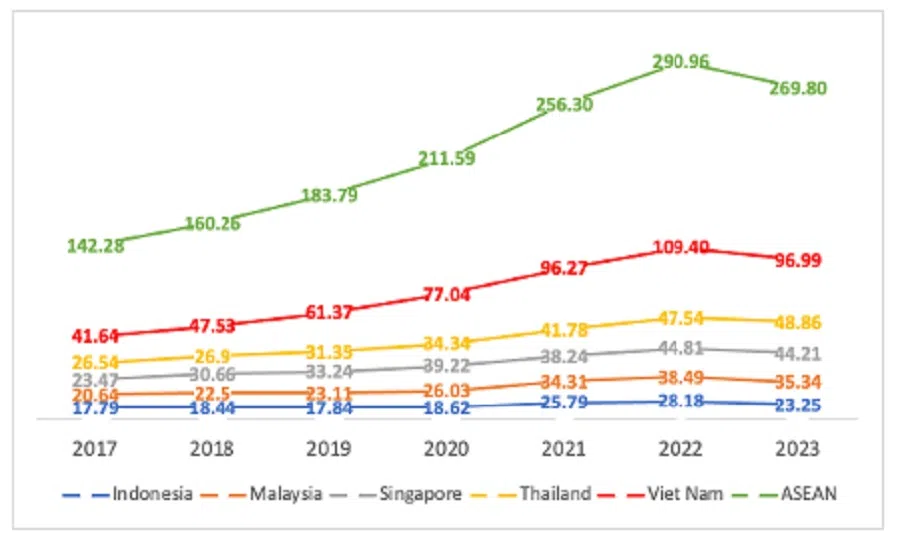

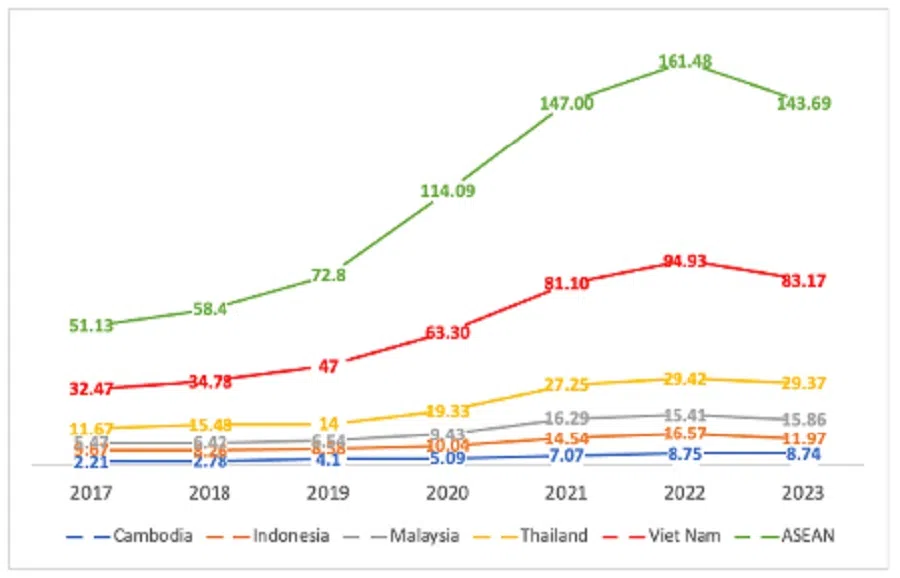

Ironically, Southeast Asian countries have largely benefited from the US-China trade war waged by Trump 1.0, which spurred companies to shift supply chains to the region to avoid Trump’s tariff hikes on Chinese goods. US-Southeast Asia trade has grown steadily throughout the Trump 1.0 and Biden administrations, with Vietnam, Thailand, and Malaysia’s exports to the US almost or more than doubling between 2017 and 2023. These countries, which have large trade surpluses with the US, will come under heightened scrutiny. His first administration labelled Malaysia, Vietnam and Singapore as “currency manipulators”. They are off the list under Biden but remain under monitoring.

Under the Biden administration, the de-risking of global supply chains due to US-China tensions primarily impacted the semiconductor industry and the green sectors of electric vehicles and solar panels. This left Southeast Asian economies — deeply integrated into the supply chains linking China and the US — largely unscathed in most other industries. However, Trump’s proposed tariff hikes on Chinese imports — and products with significant Chinese components — combined with the threat of Chinese retaliation, would significantly heighten the risk that the world’s two largest economies may decouple. ASEAN economies, of which China and the US are the largest trading partners, would be caught in the middle.

ASEAN exports to the US rely heavily on Chinese intermediate goods (not to mention the re-routing and relabelling of Chinese goods going to the US via Southeast Asia) and Chinese exports to the US also use raw materials and intermediate goods from ASEAN. A sharp decline in Chinese exports to the US would also negatively impact Southeast Asian exports to China, which in turn would affect overall regional economic performance. In sum, the globalisation model that Southeast Asia has long depended on for growth faces an increasingly uncertain future.

(2017-2023, US$ billion) (Source: ASEANstats)

(2017-2023, US$ billion) (Source: ASEANstats)

Defence and security: all about China

On the security front, discerning Trump’s approach and potential implications is more complex. On one hand, Trump is deeply sceptical of alliances, often accusing US allies of “free riding” on America’s defence commitments. This approach threatens the sustainability of the expanded network of US alliances and minilateral coalitions in Asia that Biden has spent years cultivating.

Manila may need to recalibrate its hardline stance towards China or establish more safeguards to avoid a conflict outbreak, because Trump 2.0 will be less inclined to come to Manila’s rescue in such an event.

The Philippines, in particular, stands to be most impacted. In recent years, it has significantly strengthened its alliance with the US and joined multiple plurilateral arrangements involving the US and other allies such as Japan and Australia. Manila may need to recalibrate its hardline stance towards China or establish more safeguards to avoid a conflict outbreak, because Trump 2.0 will be less inclined to come to Manila’s rescue in such an event.

On the other hand, balance of power has been central to the US’s strategic competition with China. Recognising this reality, Trump 1.0 invested in building security-defence ties with key Southeast Asian nations. For instance, it transferred two Coast Guard cutters to help bolster Vietnam’s maritime capabilities.

In 2018, the USS Carl Vinson became the first American aircraft carrier to visit Vietnam since the Vietnam War, followed by the USS Theodore Roosevelt in 2020. The US also renewed crucial defence agreements with Singapore, including the 2019 memorandum of understanding to extend the use of the island’s air and naval bases by 15 years.

The first Trump administration also raised its stakes in the South China Sea (SCS) by significantly increasing US freedom of navigation operations in SCS to challenge excessive maritime claims. In 2020, the US State Department issued an important policy statement regarding maritime claims in the SCS, aligning US policy with the 2016 ruling by the Permanent Court of Arbitration (PCA) in favour of the Philippines against China.

The hard-line approach focused on balancing against China will likely intensify in Trump 2.0, given the China hawks potentially forming his national security team, including Vice-President-elect JD Vance, incoming national security adviser Mike Waltz, and figures like Robert O’Brien, Marco Rubio or Bill Hagerty. It bears reminding that the paradigm shift in the US’s China policy from engagement to strategic competition started under Trump 1.0, and has now become an organising principle of US foreign policy.

That said, Trump could inject significant uncertainty into this dynamic. His penchant for “deal-making” raises concerns that he might strike deals with China on issues like Taiwan or the SCS, bypassing regional countries’ interests. Southeast Asia, therefore, continues to oscillate between potentially being drawn into the escalating US-China tensions or potentially being left in the lurch by Trump’s isolationist and unilateralist instincts.

Singapore supports 270,000 “high-quality jobs” in the US and is a key gateway for 6,000 American firms in Southeast Asia. Often unsaid but critically, Singapore plays a crucial role in the projection of US power in the region.

The three ‘Ts’ of managing Trump: trade, transactionalism and team America

Ultimately, no one can be certain as to what Trump would do, given his mercurial nature. But a reasonable assessment is that his approach towards Southeast Asia countries could boil down to a Trumpian triumvirate of “Ts”: their trade relations with the US, transactionalism (how Trump assesses a partner country pays its fair share for American defence guarantees), and how far they can align with Team America in its objectives vis-à-vis China.

South Korea is a good example. Given its growing trade surplus with the US, Seoul is considering increasing energy imports from the US. In October, Trump labelled South Korea a “money machine” which could pay US$10 billion annually for hosting US troops. To pre-empt Trump, Seoul recently agreed to raise the figure by 8.3% to US$1.13 billion in 2026 — though still well below Trump’s figure.

Going by the three “Ts”, Southeast Asian countries could see varying fortunes. Non-US allies or those with trade deficits or small surpluses with the US may fly under the radar. Singapore could be well-positioned: it ran a US$40 billion trade deficit with the US in 2022, and is the third-largest Asian investor in the US. As Prime Minister Lawrence Wong noted in his congratulatory message to Trump, Singapore supports 270,000 “high-quality jobs” in the US and is a key gateway for 6,000 American firms in Southeast Asia. Often unsaid but critically, Singapore plays a crucial role in the projection of US power in the region.

The cases of the Philippines and Vietnam will be more intriguing. The Biden administration’s planned US$500 million to boost Manila’s military capabilities, on top of US$1.14 billion of US military assistance from 2015-2022, may not sit well with Trump. Meanwhile, Vietnam had the third-largest trade surplus with the US last year, after China and Mexico. Yet, both countries are on the frontlines of the SCS disputes, hence their value to the US’ strategic competition with China. Will they receive a pass due to their geopolitical importance?

Southeast Asian countries navigated Trump 1.0 relatively well and hope they can do the same with Trump 2.0. However, the region should guard against complacency because Trump 2.0 will be far more emboldened and unrestrained. Southeast Asian leaders should leverage their pragmatism, build a good rapport with Trump, and avoid ideological posturing or virtue signalling, as European counterparts often do. While no preparation can fully account for what’s ahead, resilience, adaptability and a cool head will be key to weathering the Trumpian storm.

This article was first published in Fulcrum, ISEAS – Yusof Ishak Institute’s blogsite.

![[Big read] When the Arctic opens, what happens to Singapore?](https://cassette.sphdigital.com.sg/image/thinkchina/da65edebca34645c711c55e83e9877109b3c53847ebb1305573974651df1d13a)